It promises to be the most far-reaching advance in mobility since the invention of the automobile itself, but its biggest impact won’t be felt on the highway. Cities are where self-driving vehicles (SDVs, which are also known as autonomous vehicles) are most likely to fundamentally change—for the better—how people live, work, and, of course, get around. Far fewer accidents and much lower costs, as well as higher traffic efficiency, improved productivity, and lower pollution are just some of the anticipated benefits. Our research indicates, for example, that widespread urban adoption of SDVs and “robo-taxis” (and, especially, shared self-driving taxis) could result in a 60% drop in the number of cars on city streets, an 80% or greater decrease in tailpipe emissions, and 90% fewer road accidents.

The impact of SDVs in cities will be outsize, because cities are both our biggest and our fastest-growing population centers. Half of humanity—3.5 billion people—live in urban areas today, and by 2030, two-thirds of the global population will reside in urban locations. Cities account for 60% to 80% of energy consumption and 70% of worldwide greenhouse-gas emissions. But there is also broad recognition, in the words of the United Nations, that “the high density of cities can bring efficiency gains and technological innovation while reducing resource and energy consumption.” Goal number 11 of the UN’s Sustainable Development Goals: 17 Goals to Transform Our World is to “make cities inclusive, safe, resilient and sustainable.” SDVs, along with other technology-enabled advances, such as intelligent traffic management, are essential.

As BCG reported in April 2015, it is no longer a question of if but when SDVs will hit the road. (See Revolution in the Driver’s Seat: The Road to Autonomous Vehicles, BCG report, April 2015.) Multiple parties are already at work developing autonomous-driving technologies, and the trend toward putting SDVs on the road is rapidly gaining momentum across a broad front that encompasses OEMs, suppliers, mobility providers, technology companies, academic institutions, governments, and regulatory bodies. At international auto and consumer technology shows, increasing numbers of automakers and technology companies are showing off their SDV visions, and the number of players working on autonomous driving is rising rapidly. (See, for example, “Connected Trends: CES 2016 Observations and Questions from the Floor,” BCG article, January 2016.) New experiments, trials, and goals are announced almost daily. Dubai, for example, recently stated its ambition to have 25% of all trips driverless by 2030.

While technological development continues apace, SDV stakeholders are also addressing the societal, legal, and regulatory issues that will arise as these vehicles come to market. Urbanites—policymakers, planners, companies, and ordinary residents who have a stake in the world’s cities—will want to be involved as the city of the future, which might be very different from the cities we know now, takes shape around SDV technology and other advances in mobility.

Many public policymakers are already focusing their attention on autonomous transportation and on understanding its potential impact. The US Department of Transportation mounted a Smart City Challenge, funding up to $40 million to “one mid-sized city that puts forward bold, data-driven ideas to improve lives by making transportation safer, easier, and more reliable.” Sweden’s government has launched Drive Sweden, a “strategic innovation program” that focuses on new mobility models, including automated transportation. Modifications to Swedish legislation, if enacted, will make SDV testing easier. Germany has already loosened legal barriers to SDV testing, so long as the driver can override autonomous control. In Finland, the Ministry of Transport and Communications is preparing a legal framework for SDV testing and has named a working group to prepare the necessary actions. Many other jurisdictions—including Austria, France, the Netherlands, the UK, and the US—are also in the process of adopting SDV legislation or have already done so.

This report is the result of a collaboration between BCG and the World Economic Forum. (See “About this Report.”) The terms self-driving, autonomous, and SDV, which we use interchangeably, refer to fully self-driving vehicles unless stated otherwise. The term robo-taxi means a sequentially or simultaneously shared SDV with any number of occupants.

About This Report

The Boston Consulting Group and the World Economic Forum have been collaborating on a project dedicated to shaping new urban mobility with self-driving vehicles. The early stages of this project involved substantial research with consumers, urban officials, and policymakers worldwide. Their opinions and views form the basis of this report.

The qualitative research—which encompassed focus groups with a total of 56 participants in Berlin, London, and Singapore—was designed to uncover unprompted attitudes, attractions, and concerns related to SDVs and to use the findings to inform the quantitative research. The survey—the largest to date dedicated to SDVs—involved 5,500 consumers in 27 cities in ten countries: China, France, Germany, India, Japan, the Netherlands, Singapore, the United Arab Emirates, the UK, and the US.

We also considered urban priorities and challenges and the potential role of SDVs and related mobility models, discussing these topics with 25 policymakers, including mayors, heads of traffic departments, and members of traffic innovation teams in 12 cities: Amsterdam, Dubai, Düsseldorf, Gothenburg, Graz, Helsinki, Miami, Milton Keynes, New York, Pittsburgh, Singapore, and Toronto.

In the following chapters, we present the current views of consumers and policymakers on SDVs in an urban context. We also analyze four possible scenarios that illustrate SDVs’ impact on urban areas on the basis of varying adoption dynamics and city policies. How each of these scenarios plays out—and the extent to which cities will be able to reap the benefits that autonomous transportation promises—depends substantially on the extent and pace of cooperation and collaboration among multiple players in the public and private sectors over the next decade or two.

A Consumer Perspective: Excited and Ready to Try SDVs

A potentially big barrier to self-driving vehicles—consumers’ acceptance of a car that drives itself—turns out to be a shrinking obstacle and one that will likely dwindle with experience and familiarity over time. As part of our work, in 2015, The Boston Consulting Group and the World Economic Forum (the Forum) conducted qualitative and quantitative research among more than 5,500 consumers in 27 cities in ten countries—to date, the largest survey fully dedicated to autonomous driving. From New York to Kolkata, Berlin to Beijing, consumers are surprisingly and remarkably knowledgeable about SDVs and their potential benefits, and, by and large, they are more than willing to give them a try.

(Mostly) Ready to Ride

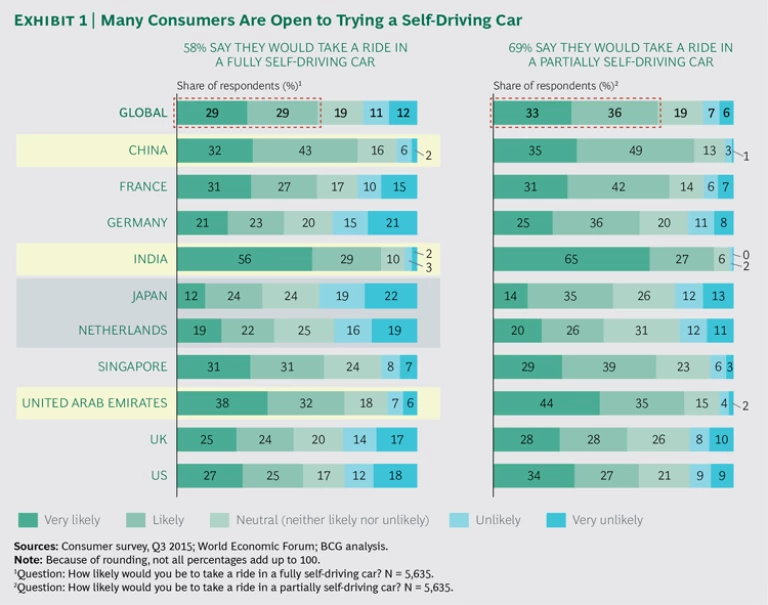

Overall, 58% of respondents said they would take a ride in an SDV, and 69% said that they would take a ride in a partially self-driving car. (See Exhibit 1.) Willingness is highest among younger consumers—63% of those aged 29 or younger are willing to ride in an SDV compared with 46% of consumers aged 51 or older. This is one reason why we expect acceptance of SDVs to increase over time. Consumers in Asia—home to half of the world’s 100 largest cities—are among the most ready. Willingness among Indian and Chinese consumers, for example, is high: 85% and 75%, respectively, are prepared to ride in SDVs. This might be because currently high levels of traffic congestion, less-developed traffic infrastructure, and high accident rates lead urban consumers in these countries to hope for significant benefits from SDVs. Consumers in Japanese, Dutch, and German cities are the most reluctant (36%, 41%, and 44%, respectively).

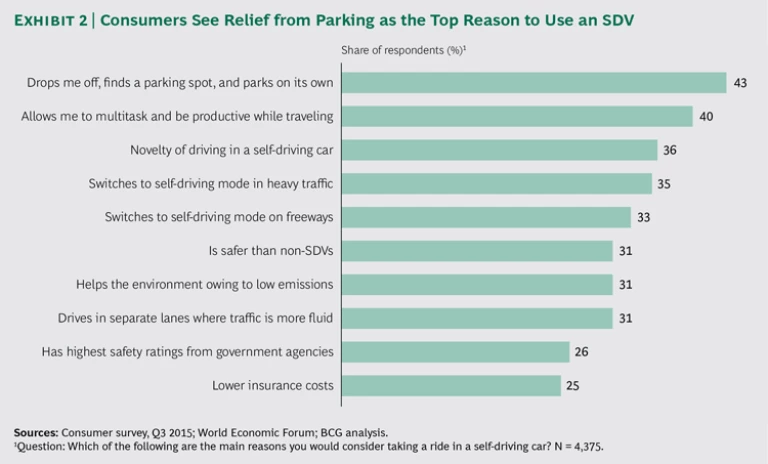

Consumers like convenience, and the biggest single attraction of SDVs is not having to find a parking place. More than four in ten consumers said that the number one reason for using an SDV is that it “drops me off, finds a parking spot, and parks on its own.” (See Exhibit 2.) Other attractions include being able to multitask or be more productive while traveling, the sheer novelty of SDVs, and the ability of the car to switch to self-driving mode in heavy traffic.

Consumers are quick to identify several possible uses for SDVs, among them, providing mobility for the elderly and others who cannot drive, functioning as a mobile office, enabling longer commutes, and taking over or facilitating daily tasks such as transporting children to school or running errands.

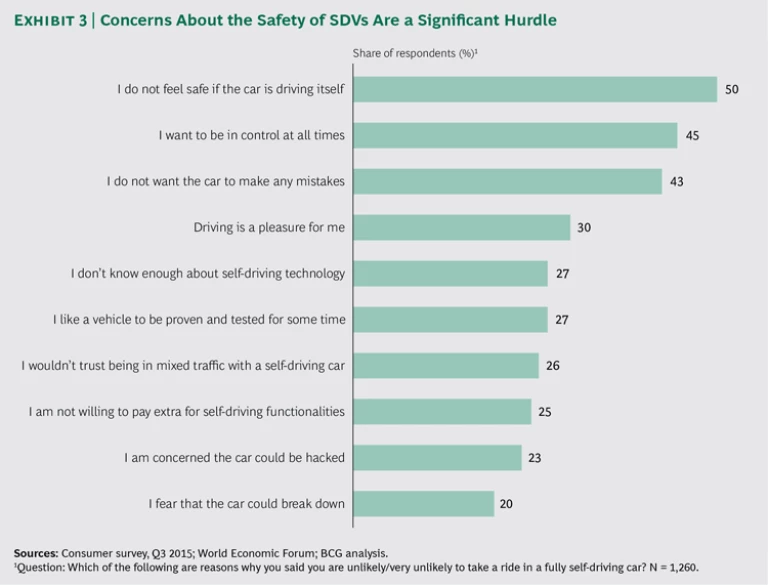

To be sure, consumers also have concerns, and safety tops the list. Recent news of accidents involving autonomous cars, such as the first fatality resulting from a failure of highway autopilot, could strengthen this concern futher. Half of all consumers said that they “do not feel safe if the car is driving itself.” (See Exhibit 3.) Only 35% of parents would let their child ride in a self-driving car alone, a figure that drops to 12% in the Netherlands, 17% in the UK, and 21% in Singapore. Some 45% of drivers want to be “in control at all times,” and 30% would not want to give up driving, an activity that they enjoy.

Consumers Look to Automakers for Electric or Hybrid SDVs

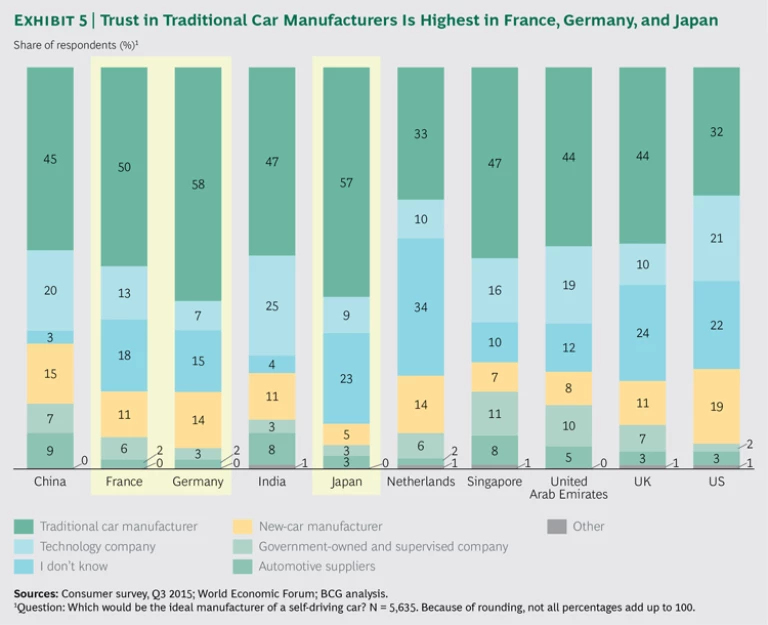

Our findings include good news for the auto industry. Consumers are looking to established car manufacturers rather than tech companies and others to manufacture SDVs. (See Exhibit 4.) Almost 50% of survey respondents cited automakers as the ideal manufacturers of SDVs, although almost 70% of them think that automakers should work in collaboration with tech companies.

While consumers expect car companies to produce reliable, high-quality, and safe vehicles, they also believe that tech companies should bring in their expertise. Apple and Google are top-of-mind possibilities; a number of tech startups were also mentioned.

Consumer trust in traditional automakers with respect to SDVs is highest in France, Germany, and Japan. (See Exhibit 5.) Consumers in India, the US, and China, are most likely to see a tech company as an ideal manufacturer of the entire SDV. One reason may be the importance and visibility of the tech industry in these economies. US consumers, for example, have been exposed to countless media and company reports on Google’s ongoing testing in Austin, Texas, and Mountain View, California.

Although very few consumers have even seen an SDV, their expectations for how SDVs will differ from traditional cars are quite specific. Take engine types. More than 35% of consumers expect SDVs to be hybrid vehicles, and another 29% anticipate that they will be electric. (See Exhibit 6.) Only 9% expect self-driving cars to have a conventional internal-combustion engine. These expectations are substantially consistent across countries.

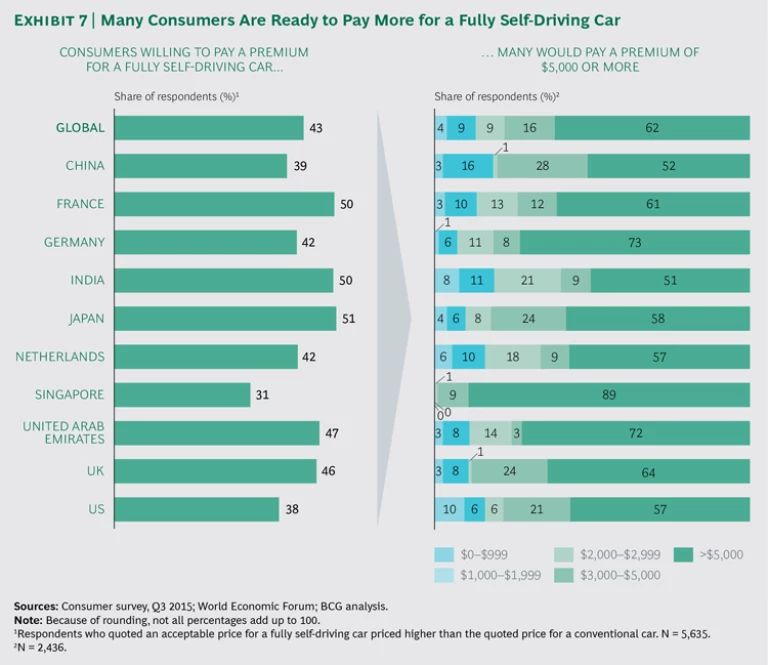

Majorities—more often than not, substantial majorities—are willing to pay a premium of $5,000 or more for an SDV. (See Exhibit 7.) In fact, consumers justify the price premium with a rational business case: If I use an SDV, I can live farther from the city. That means that I will save in other areas such as rent, parking fees (since the car can park itself far from where I need to be), and insurance premiums (since an SDV is less risky to drive). It bears noting that consumers’ $5,000 threshold is not far from our bottom-up estimate of the $6,500 premium that automakers would need to charge, at least initially, to cover the cost of manufacturing an SDV.

Mixed Feelings About Ride Sharing

The one-driver-one-car issue has bedeviled urban policymakers for years, and while various solutions—high-occupancy-vehicle lanes and congestion and peak-period pricing, for example—have made modest progress, their overall impact has been muted. If SDVs are to affect urban life significantly, ride sharing almost certainly has to be part of the deal. With fewer vehicles on city streets traveling fewer overall vehicle miles, emissions will be lower and space will be freed for alternative uses.

Although people in many cities already share taxi rides—and services such as uberPOOL and Lyft Line successfully offer shared rides as a way to save money—consumers, especially women, remain much less than enthusiastic about the idea than they do about SDVs generally. In our survey, 37% of consumers said that they are likely to share a ride in a self-driving taxi with strangers. For women, the figure was 33%. Ride sharing encounters the least resistance in Asian markets (China, India, and Singapore), where informal and impromptu taxi sharing is relatively common, and the most in Europe (the UK, Germany, and France). As with views of SDVs generally, however, there is a generational divide—45% of those under 30 are willing to share their taxi, compared with only 22% of those over 50—a split that is roughly also seen among users of Uber. Reluctance does not, however, mean refusal. Willingness to share rises dramatically with price. The percentage of respondents who prefer sharing a robo-taxi to paying $20 for a solo ride in a traditional taxi is only 11% when the price is the same. Willingness rises to 37% for the robo-taxi at $10—a 50% discount off the original taxi fare—and to 52% at $5, a discount of 75%. Furthermore, design attributes such as glass partitions, cameras, and other security features could help alleviate safety and privacy concerns and further increase willingness to share rides.

A Policymaker Perspective: Open to SDVs in Cities

When it comes to urban environments and SDVs, there are two major questions: How disruptive will these vehicles actually be in transforming the city of today? And how can city governments take advantage of autonomous technology to achieve broader goals with respect to urban mobility and livability?

It is reasonable to believe that SDVs—especially if there is widespread ride sharing—will have a far-reaching impact on all manner of travel within cities and on consumers’ lives. Our research with urban policymakers indicates that many are aware of the potential societal benefits, but they have yet to factor these into their transportation plans in many practical ways.

Policy Goals for Urban Transportation

Urban policymakers want city inhabitants to have ready access to safe and affordable mobility. This goal can be elusive. Pedestrian and cyclist safety presents considerable challenges in many cities, and the most common accident- and fatality-reduction measures—stronger laws, awareness campaigns, tighter enforcement, and improved infrastructure—are far from universally effective. Compared with such measures, advanced driver-assistance systems—and in the long run, SDVs—provide much more effective ways of improving road safety.

Policymakers are making substantial efforts to promote sustainable modes of transportation. Most of the city officials we interviewed spoke of plans to dedicate more road space to walking, cycling, and public transportation, for example, and to encourage new mobility models, such as car sharing, e-mobility, and bike sharing. London’s network of Cycle Superhighways is one example of this kind of thinking at work. Most cities still don’t actively discourage private cars (although some have implemented congestion- or peak-pricing schemes), but neither do they encourage them. As one European traffic director put it, “We are not trying to outlaw cars in the city. Rather, we are trying to make all other transport modes, such as cycling and public transport, equal in terms of convenience.” Some 60% of the urban policymakers we interviewed expect that by 2025, at least one city will have banned traditional-car ownership, partly as a result of emerging shared-autonomous-mobility models. Another 24% believe that this will happen by 2030. Some cities are more aggressive: Oslo recently announced its ambition to ban private cars from the city center by 2020, thereby cutting greenhouse gas emissions in half.

City policymakers want to provide equitable access to affordable transportation for all sociodemographic segments, wherever they live and work. To achieve this goal it might be necessary to extend more transportation services to less densely populated areas. Policymakers talk of solving the “last-mile problem” for citizens—getting them from their home or office to the closest public-transit point (and back). The last mile can be a particular challenge for people living on the outskirts of a city, where access to public transportation can be distant. Addressing this issue by expanding public-transportation networks—adding lines and capacity to improve the passenger experience with greater frequency and convenience—is, in many cases, difficult to support financially because utilization rates are often low.

Improving traffic efficiency, reducing congestion, and lowering air pollution from auto engine emissions are also high priorities for city governments. SDVs, and especially robo-taxi fleets, could enable cities to meet these objectives in the long run.

High Hopes and Some Concerns for SDVs

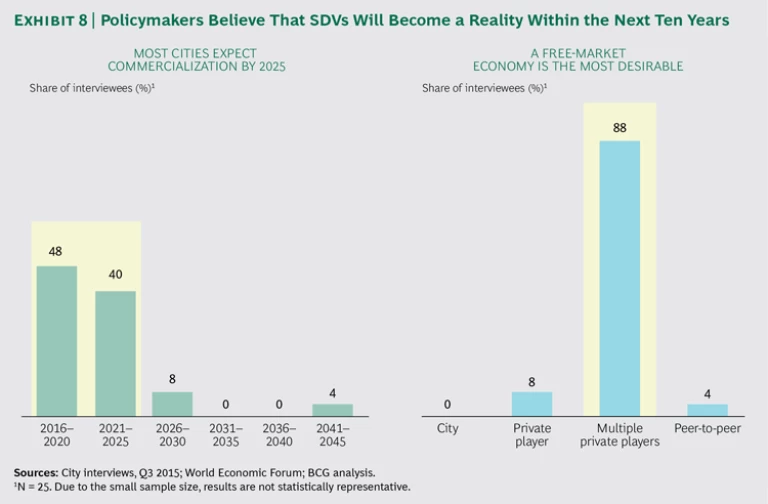

Many urban policymakers see significant benefits in SDVs and are positively disposed toward them. Of the 25 policymakers we interviewed, only 2 had not given thought to the potential benefits and concerns related to SDVs. Almost 90% said that they expect the first urban shared-SDV fleet to be operating by 2025, but few cities have taken concrete steps to integrate SDVs into their mobility plans.

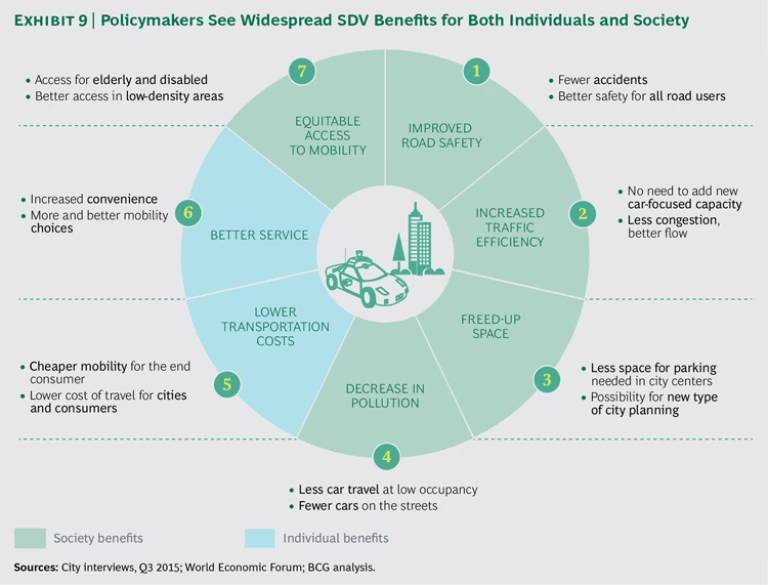

Policymakers anticipate a wide range of benefits for individuals and society from widespread adoption of SDVs, robo-taxis, and, particularly, shared-SDV fleets. These benefits include many of the priorities cited above, including improved road safety, equitable availability of and accessibility to mobility, better traffic efficiency, and reductions in costs and pollution. Many policymakers are particularly excited about the prospect of improving the accessibility of transportation. They believe that SDVs (including cars, multipassenger “pods,” and minibuses) offer a tailor-made solution for the last mile—especially for inhabitants of less densely populated areas—and expand public-transit options. Robo-taxi fleets could also provide the elderly, children, and the disabled with better access to transportation.

Policymakers voiced their concerns about mobility concepts based on SDVs:

- Impact on Public Transportation. While policymakers would like to see robo-taxis solve the last-mile problem, they also worry that SDVs and their convenience might come to be regarded as a superior mode of transportation for the entire commute, thereby undermining the use of existing public transportation. This concern looms large in cities with large and costly public-transportation infrastructure that needs to be maintained.

- Urban Sprawl. Policymakers are also concerned about the risk of increased urban sprawl. With SDVs offering a more convenient, and potentially cheaper, means of transportation, people might move further from their city-center workplaces, with significant consequences for current urban plans and the distances traveled by individual vehicles.

- Revenues at Risk. Many cities generate revenues from fuel taxes, parking tickets, and other vehicle-related fees and charges. SDVs will eat into these revenue streams unless cities find ways to produce revenues from robo-taxi fleets and their related infrastructure, such as charging stations.

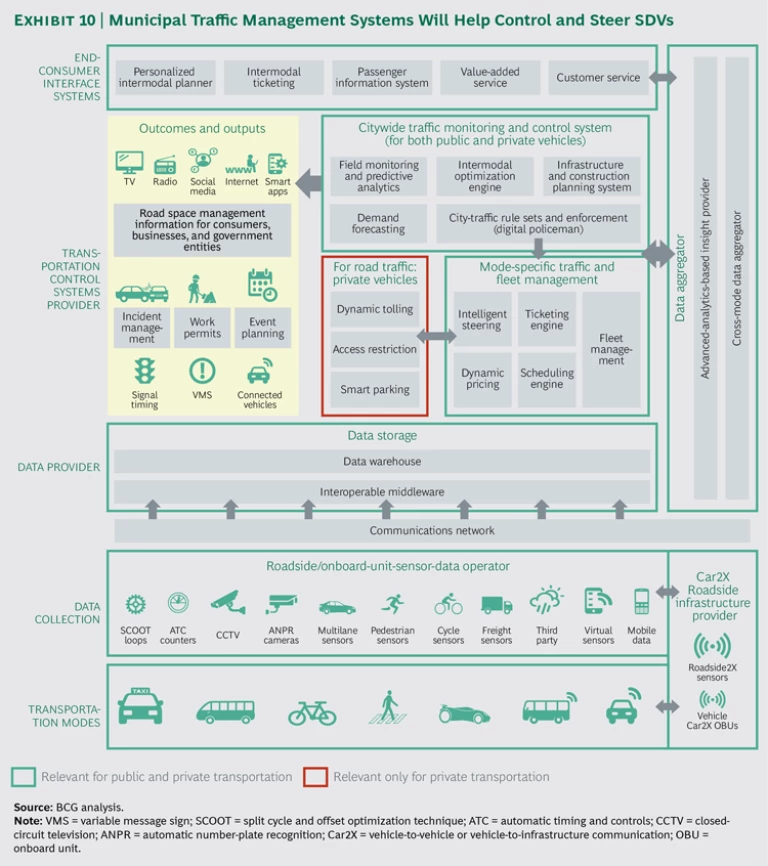

- Funding. Who is going to pay for the virtual and physical infrastructure a city may need to install to make SDV transportation a safe and reliable reality and to maximize societal benefits? Governments, various components of private industry, and consumers will have to reach consensus on new fee and taxation models, as well as new public-private funding structures to cover such expenses. In a previous report, we estimated that to equip a city of 10 million inhabitants with intelligent traffic management systems, the required infrastructure investment could be as much as $5 billion. (See Connected World: Hyperconnected Travel and Transportation in Action, a World Economic Form report produced in collaboration with BCG, May 2014.)

- Protection of Privacy and Data Ownership. A big part of the robo-taxi revolution involves the collection and use of consumers’ mobility-related data. Who, for example, owns the data? How does the city ensure that this data is safeguarded from cyberattacks? How can the city safeguard citizens’ privacy while using the data to improve transportation demand management?

On balance, in the eyes of city policymakers, the potential benefits of SDVs outweigh the risks and concerns. And policymakers recognize that in order to reap the benefits, new business and urban transportation models will be needed.

Laying the Groundwork for Mobility Ecosystems

A number of public- and private-sector players are already laying the groundwork for intermodal transportation systems of which SDVs and robo-taxis could be integral elements. One private-sector example is Moovel, a subsidiary of Daimler. Moovel is available in five regions of Germany, including the Stuttgart, Munich, and Ruhr areas. The travel planning app integrates user options, including walking, private cars, car sharing, taxis, and public transportation. In addition to planning their trips and selecting options, users can also pay through the platform.

In Helsinki, public- and private-sector partners have been collaborating since 2015 to develop and implement an end-to-end mobility as a service (MaaS) concept. At the core of MaaS are personalized mobility service plans. MaaS acts as an operator that integrates various transportation providers and offers a single mobile application to users on a “single-ticket principle.” Rather than purchase a bus ticket or pay a taxi fare, users purchase a mobility ticket with the actual usage plan tailored to their individual needs. So, for example, for a monthly fee of €100, a user could have unlimited access to public transportation, limited access to taxi rides, and use of a rental car for a specified distance or amount of time.

Most city policymakers see themselves in an enabling role in the deployment of autonomous transportation, the private sector taking the lead in actual development. They expect that a private-sector marketplace of competitive robo-taxi fleets offering different kinds of mobility services will evolve, and they recognize that they, as policymakers, are unlikely to manage such a marketplace efficiently. For one thing, their decision-making processes move too slowly for fast-advancing technology, and for another, they can play a more productive role in SDV development by facilitating the establishment of the relevant infrastructure (charging stations, for example, and traffic flow protocols and systems), paving the way for testing the technology and helping to gain public acceptance. And since SDVs will ultimately be one component of a larger, integrated mobility ecosystem, these policymakers also see that they will have an important role in the regulation of robo-taxis and the collection, analysis, and use of mobility data for planning purposes.

Nobody thinks that private-car ownership will fully disappear. Policymakers expect to encourage the adoption of shared SDVs, but they will not want to force it. They anticipate using a range of instruments to make private-car use less attractive—for example, by increasing the expense of parking or imposing more-aggressive congestion-pricing schemes. Plenty of officials are cautious about the role of SDVs in their cities. “We need to better understand the impact this is going to have on our city before we take a position,” one said. And another said, “We would like to see it work in other cities first before we try it out for ourselves.”

Impact Scenarios: How Big Will the Revolution Be?

No one can predict the future, of course. But autonomous technology is advancing fast. Its impact is far-reaching, complex, and multifaceted. It affects many parties, including consumers, the auto and technology industries, governments, policymakers, and urban planners. Some looking into the future is necessary, if only to begin to understand and plan for the ways in which things could pan out and for the ramifications for urban life and policy.

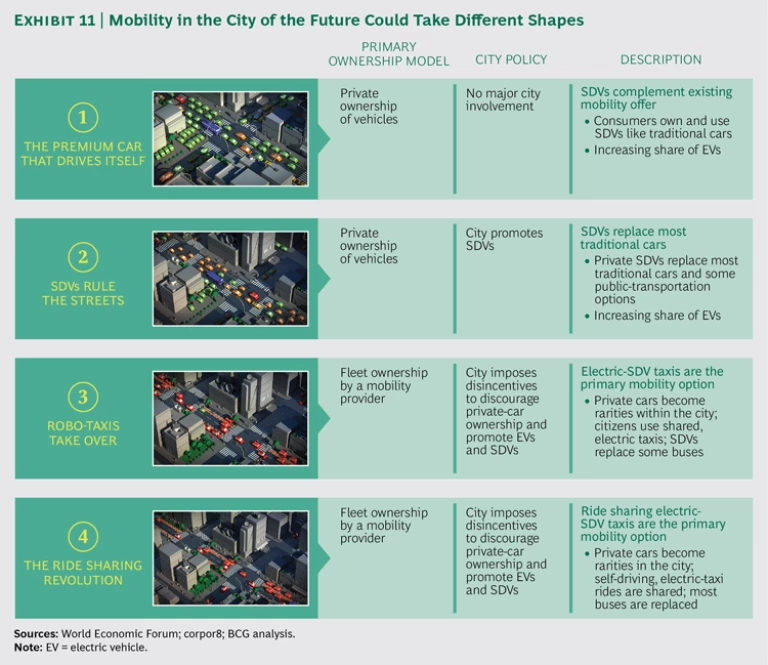

As part of our research into the impact of SDVs, BCG and the Forum developed four scenarios for what the city of the future might look like. These are clearly what-if hypotheses. Our goal was not so much to predict what the future will hold as to provide some insight into the possible impact of different mobility models on cities and their inhabitants. We hope that the possibilities that we project will help inform relevant aspects of policymaking as leaders design the mobility models of the future. (Please see the video that describes the city scenarios.)

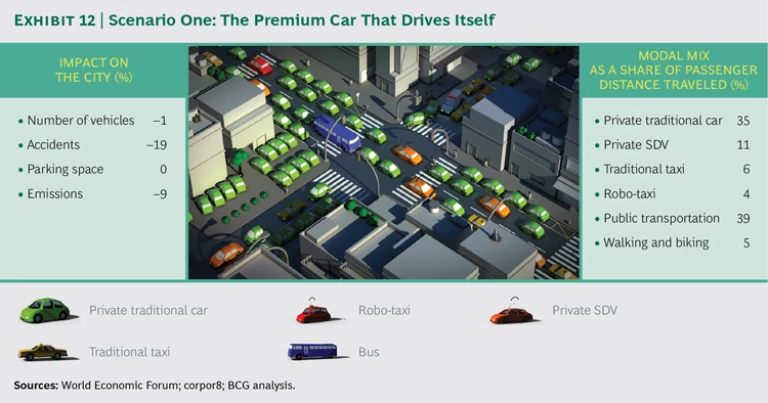

Scenario One: The Premium Car That Drives Itself

Imagine a city similar to any major city of today. It’s 2030, and people are still using cars, taxis, bikes, motorbikes, and their feet, as well as public transportation to get around. The city is busy, congestion is commonplace, and a lot of space is dedicated to both on- and off-street parking. In addition to using traditional transportation, a growing number of people now own premium-segment SDVs. Indeed, every fourth new vehicle sold in the city is a self-driving car; price is a barrier to wider adoption. One in ten SDVs is shared privately, meaning, for example, that a family that in the past used two vehicles now has only one, which, because of its self-driving capabilities, fulfills all of the family’s mobility needs. Other automotive technologies have advanced as well. Every third private vehicle sold is now electric. The share of new sales of electric vehicles (EVs) used as taxis is even higher. The city offers incentives that encourage the use of battery-powered vehicles as taxis, and some 90% of the new taxis sold every year are electric.

Although the changes to urban life in this scenario are more limited than in the others, there are some measureable benefits from SDVs, alternative power trains, and sharing. Because a small percentage of the new SDVs are shared, there is a very small (about 1%) reduction in the number of vehicles in the city. Emissions drop by 9%, thanks to a higher share of zero-emission EVs. In addition, those SDVs that have internal-combustion engines are assumed to consume 20% less fuel than traditional cars with drivers. We assume SDVs will realize that fuel efficiency by maintaining continuous speeds, taking better routes, and accelerating and braking more smoothly. Even though there are slightly fewer vehicles in the system, there is no gain of parking space that can be repurposed, because the space that is freed up is now used for EV charging stations.

The most positive benefit for the city is a reduction in accidents. Automated driving, especially in combination with connectivity, has the potential to significantly reduce the number of accidents, injuries, and fatalities. Since 90% of accidents today occur because of human error, even the moderate uptake of SDVs foreseen in this scenario could lead to a drop in accidents of almost 20%.

Scenario Two: SDVs Rule the Streets

In this scenario, the city takes a more active role in designing its urban mobility structure. It offers incentives for use of SDVs as well as electric powertrains. Within ten years, the percentage of SDVs in use rises to almost 60% of the private-vehicle and taxi fleet total. One in ten SDVs is shared by multiple individuals, and the total number of cars in the city falls by 8%.

The city’s more aggressive policy results in greater societal benefits. Tailpipe emissions drop by almost 25%, and space dedicated to parking can be reduced by 5%. The high share of SDVs means there are 55% fewer accidents—an improvement that leads to further, indirect savings in such areas as hospital care.

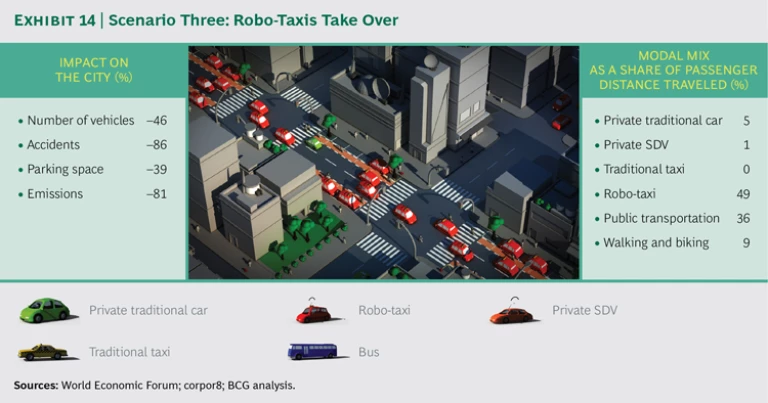

Scenario Three: Robo-Taxis Take Over

Now let’s suppose that the city imposes disincentives for private-car ownership (a prohibitive tax on private vehicles, for example, or even an outright ban), with the specific goal of making the self-driving taxi (and traditional public transportation) the main means of motorized transportation. The biggest change is the nearly 50% drop in the number of cars, the result of people traveling mostly in shared cars rather than in privately owned vehicles. Because most of the taxis are electric, emissions decrease drastically (by about 80%). Furthermore, there are almost 90% fewer accidents, nearly 40% of parking space is freed up, and the city can use that space for other modes of personal mobility (for example, more and bigger bicycle lanes) and freight transportation—or simply for public leisure space.

There is a trade-off, however: overall vehicle distance traveled rises. This, we assume, is partly because some people switch from using large-capacity buses to low-occupancy SDVs, owing to increased convenience and the better end-to-end service that SDVs can provide. In addition, SDVs travel more distance empty than individually used cars. (Like a taxi today, a shared SDV will drive empty to pick up a passenger, drop him or her off, and drive empty to the next passenger. An SDV might also drive empty to search for a parking spot outside the city center.)

We have assumed that the aggregate additional distance traveled could rise by as much as 50%. (Empty-vehicle taxi travel in New York City today is estimated to consume about 40% of drivers’ time.) If the shared SDV fleet in this city of the future is not electric, overall tailpipe emissions will likely increase despite SDVs’ having better fuel economy than conventional cars.

These assumptions do not yet account for the additional vehicle miles traveled that could result from greater use of SDVs than of conventional vehicles. Improved convenience might lead plenty of people to choose SDVs over walking or biking for running errands, such as picking up their dry cleaning a few blocks away, or other purposes. Furthermore, the availability of the shared-SDV fleet might trigger demand from new segments: children, the elderly, and people with disabilities might see SDV travel as an attractive alternative to the public-transit system and more feasible than driving a car. If the price is sufficiently attractive, low-income citizens might use SDVs extensively as well.

All in all, while fleets of shared SDVs may reduce the total number of vehicles in the city, they may not necessarily reduce the number of cars on the road at peak hours. We expect the net impact on congestion to be positive in most cities, although the changes—for example, higher throughput, fewer bottlenecks, and a reduction in traffic incidents—may come mostly from road efficiency improvements rather than the simple reduction in the number of vehicles or kilometers traveled on the city’s streets.

Scenario Four: The Ride Sharing Revolution

This scenario, which is the most transformative relative to the status quo, anticipates the most benefits and the biggest changes in consumer behavior and urban policy. The city could provide incentives for ride sharing as well as for using SDVs, reducing the number of traditional cars even further. Every self-driving taxi now averages two passengers instead of the 1.2 assumed in scenario three (the current average occupancy we used as the base figure for a traditional taxi). The potential payoff is enormous. In addition to the emissions reduction and the road safety improvement achieved in scenario three, the aggregate vehicle distance driven in the city falls dramatically, since almost every trip is now shared. (See Exhibit 15.) In addition to the parking space already gained, ride sharing frees up a lot of space on the streets at any given time and further lowers the number of cars needed to provide the same level of mobility to the population. Traffic efficiency improves, and there are nearly 60% fewer vehicles than today. In addition, the cost to the consumer of ride sharing mobility is likely a lot cheaper. The city of the future starts to take shape.

Multiple Scenarios, Considerable Implications

Our analysis makes it clear that the potential benefits for society are huge if SDVs are combined with ride sharing and electrification. A power train shift from internal combustion to electric engines is essential if cities want to cut tailpipe emissions, and ride sharing in urban areas is required to reduce the number of vehicles. Autonomous capabilities are the key to big improvements in road safety.

These three factors—sharing, autonomous driving, and electrification—reinforce each other to facilitate fast adoption. Autonomous driving makes it much easier to share vehicles, and because their utilization rates are higher than those of private cars, shared vehicles are well suited to electric engines. Indeed, it will likely be easier to convince consumers to use EVs as part of a shared-mobility fleet than to get them to buy them—especially until there is widespread high-speed electric-charging infrastructure in place (which expanding use of SDVs in cities would facilitate). And, as our research suggests, consumers already expect SDVs to be electric.

A few things are certain. One is that no single scenario will play out exactly as described above. Another is that each city will experiment with its own course, and, as a result, there will be many different trials (and probably a few errors), which will put varying demands on consumers, industry, and city leaders.

Shaping the Future of Urban Mobility

The deployment of SDVs in cities—along with the development and commercialization of robo-taxis and the promotion of ride sharing—requires collaboration among, and experimentation involving, multiple stakeholders. A prerequisite of progress is that each participant in the urban transport ecosystem—including policymakers, private industry, and consumers—must be willing to accept and try out new ideas.

Building an Integrated City Roadmap

We believe that, from an urban perspective, the overall benefits of SDVs outweigh the costs. Cities need to start working on how to reap the benefits, simultaneously addressing the challenges to the development of integrated transportation plans that include autonomous transportation. An initial list of questions and issues, which focuses on such topics as the transportation ecosystem, urban policymaking, societal acceptance, and financing, includes the following:

The Transportation Ecosystem

- What role should autonomous transportation play as part of a city’s broader transportation plan?

- What is the ideal operating model and ownership structure for SDVs in an urban environment?

- How should SDVs connect with other means of transportation, in particular public transit?

- How should cities use mobility data for transportation planning and management?

Urban Policymaking

- What are the right policy measures and other tools for encouraging the population’s adoption of SDVs—at the desired pace?

- Should cities mandate electric-only SDVs to limit emissions?

- How do cities provide incentives to encourage (or mandate) ride sharing and shared fleets to obtain the maximum benefits of SDVs?

Societal Acceptance

- How do cities manage the widespread disruption of traditional transportation models, such as taxis, and the associated impact on employment and labor?

- How do cities collect, share, and protect the mobility data of their citizens?

- How can cities help get the general public accustomed to SDVs?

Financing

- How do cities finance, manage, and provide incentives for the development and deployment of new mobility models and the necessary (nonautomotive) SDV infrastructure?

- How do cities adapt their revenue models and decrease their dependence on vehicle-related taxes and fees?

Each city will have to optimize its own mobility model and make tradeoffs to best address its specific challenges and pain points. In general, to provide superior mobility to citizens, transportation plans should be multimodal and combine the best of all available solutions. Policymakers may also find that they need to rethink the process of transportation planning and the length of investment cycles. It is no longer feasible—or advisable—to plan 30 years in advance. Game-changing technology advances come too quickly today. Cities need to adopt a more entrepreneurial mentality and combine it with a test-and-learn approach—trying out new mobility ideas, adding those that show promise to the mix, and discarding those that do not.

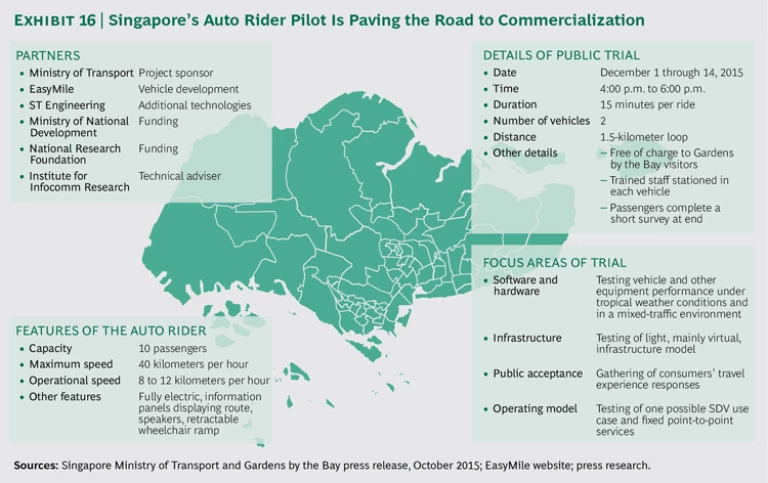

Singapore is an example of continual experimentation and adoption. For years, the city-state’s government has experimented with, and adopted, monetary and nonmonetary disincentives for private-car ownership, including requiring a quota license (a “certificate of entitlement”), charging for vehicle access, and controlling parking availability and pricing. As Singapore’s growing population and economy continued to increase the demands on its transportation system, the city moved early to develop a long-term vision of how SDVs and new mobility would complement its already multimodal land transportation system. Singapore has a wide array of goals: to reduce congestion, especially during peak hours; improve convenience, particularly with respect to the last mile; help alleviate a labor shortage by reducing the need for professional drivers; further reduce reliance on private cars; improve safety; and provide more transport options, particularly for the less mobile.

The centerpiece of Singapore’s transportation system is public transportation, and the city intends that SDVs complement rather than replace it. Singapore’s ambition is that by 2025, 75% of all peak-hour journeys will be undertaken using some form of public transportation.

In August 2014, the government established the Committee on Autonomous Road Transport for Singapore (CARTS) to guide SDV development efforts along four paths, each with a distinct role in the city’s trans-port ecosystem:

- Fixed Routes. Mass transport for intra- and intercity travel on fixed routes and schedules

- Point-to-Point Travel. On-demand shared-mobility services for point-to-point and first- and last-mile travel

- Freight. Autonomous truck platooning for last-mile delivery

- Utility Operations. Utility vehicles for cleaning roads, collecting rubbish, and watering plants

Four trial activities are already underway or planned. These will help shape mobility concepts that can meet the city’s requirements, also providing insights into how the urban environment might be redesigned to better use this technology:

- Private sector-led development of SDV prototypes, including vehicle-to-infrastructure cooperative systems in the One-North district

- Testing of self-driving shuttle buses in the Gardens by the Bay district

- Three-year testing of autonomous trucks, including a ten-kilometer route between two port terminals along the West Coast Highway

- A two-year trial in Sentosa of on-demand point-to-point self-driving shuttles that can be summoned with a smartphone

Like Singapore, other cities will need to develop their own roadmaps for integration of new technologies and mobility solutions.

Flexibility and Collaboration in the Private Sector

The road to widespread adoption of SDVs is likely to take twists and turns. While the pervasive use of shared driverless vehicles might mean that fewer cars will be required to provide the same amount of mobility, those cars will likely be used more intensively, shortening replacement cycles and potentially fueling the continued sales of new vehicles. Moreover, every city will take its distinct path, which will mean various opportunities and requirements for OEMs, tech companies, and infrastructure companies.

Standards and rules for how vehicles communicate with each other and with the surrounding environment (buildings, roadways, traffic signals, bridges, and tunnels, for example) need to be developed, and the various stakeholders need to reach agreement. The benefits of vehicle-to-vehicle and vehicle-to-infrastructure communication to complement SDV technology need to be further evaluated and tested. New vehicle types will emerge to meet the needs of shared-SDV fleets. These could be electric and more robust and, potentially, vary in size, interior design, and occupancy capacity. Car makers are already investing in new-mobility providers in order to be part of this development. General Motors and Lyft recently announced plans to test a fleet of self-driving Chevrolet Bolt electric taxis on public roads in 2017. Toyota has invested in Uber. In Singapore, nuTonomy, a startup spun off from MIT, is planning to start trials of autonomous taxis in late 2016.

Cities will look to the auto and tech industries, among others, for support in redefining their mobility landscape. Car manufacturers, tech companies, infrastructure builders, and insurance and finance players will all have opportunities to contribute relevant expertise and invest in solutions. Almost all will need to develop products and services that do not exist today. This will be hard, if not impossible, to do in isolation or with only the end-user in mind. Companies will need to partner with each other, across industries, and with the public sector if they want to be at the forefront of this development. Established car manufacturers in particular will need to move fast, as new players are emerging and pushing into automakers’ core business.

Each party can learn from the others. Agility based on a test-and-learn approach will likely be essential. This is something the tech industry does well—but less so more traditional industries. At the same time, the investment and payback cycles are likely to be long, and traditional manufacturers are much more familiar with these cycles than are most tech players.

Will Consumers Lead or Follow?

Consumers’ views of SDVs vary considerably: plenty of consumers are excited; others will be hard to extract from their current driver’s seat. Consumers’ needs and requirements will differ widely depending on location, the type of city in which they live, and other contextual factors. An SDV in Mumbai will be quite different in both design and use from an SDV in Berlin. How well cities plan and private-sector companies design may have a lot to do with consumers’ eagerness to adopt SDVs.

In cities, the biggest benefits of SDVs are associated with widespread ride sharing, yet for the majority of urbanites, this concept will take some getting used to. How much of an incentive—or push (such as a ban on traditional cars)—will it take? The success of services such as Uber, Drivy, and DriveNow indicates that many consumers value the convenience of shared on-demand transportation. Millennial consumers are more flexible in their approach to car ownership and use than are their parents and grandparents. Still, change is likely to come slowly—unless it is pushed along. And the safety and security issue looms large in the background. As with the “technical” safety of SDVs themselves, the impact of early personal-security problems in ride sharing will be magnified. Persuading consumers to change their current behavior and accept different ways of moving around will be key for the long-term success of new mobility models based on autonomy, sharing, and EVs.

City Initiatives: A Tour d’Horizon of Global Experimentation

When it comes to cars—and especially SDVs—a trial-and-error approach might seem like a bad idea. But controlled experimentation is exactly what will move SDVs forward in a pragmatic but timely fashion. Always keeping safety front of mind, policymakers, industry, and consumers need to figure out what works. In addition to the examples of Helsinki and Singapore, numerous trials are already underway:

- Milton Keynes is conducting trials with autonomous pod cars on public pedestrian roads as part of the UK Autodrive project.

- The City of Toronto is collaborating with the University of Toronto on developing a better understanding of the impact of SDVs on cities.

- In April 2016, Amsterdam conducted small-scale SDV demonstrations as part of the Netherlands’ EU presidency.

- In Pittsburgh, Uber and researchers from Carnegie Mellon University are developing self-driving taxis.

- In the Greenwich area of London, GATEway is testing zero-emission autonomous pod cars that are intended to provide shuttle service to and from public transit.

- Gothenburg is currently planning trials of 100 SDVs on its ring road. The trials will commence in 2017 as part of an autonomous-driving pilot project, Drive Me, with Volvo, which is endorsed by the Swedish government.

The Drive Me pilot is part of Drive Sweden, one of the largest and most ambitious programs of experimentation. A public-private undertaking, Drive Sweden involves some 30 partners that include the Swedish national and city governments, companies from several industries, and universities. Its ambition is to develop a new approach to mobility that includes automated transportation systems but also encompasses all other modes of transportation—personal, public, and freight.

Launched in 2015, Drive Sweden already has multiple projects underway that are notable for the complexity and breadth of the issues they seek to address. Cooperation and collaboration are cornerstones. The program seeks to combine data from all sorts of connected vehicles and traffic management systems “to allow industry and research partners to collaborate on both a national and international level.”

Within the Drive Sweden framework, the Drive Me project focuses on studying the potential benefits of large-scale SDV use. Test vehicles will be put into real traffic environments to collect data for analysis, modeling, and quantification. The trial will be conducted on some of Gothenburg’s most heavily traveled roads at average speeds of 70 kilometers per hour. In addition to gathering data, the trials are intended to help build consumer confidence in SDVs.

Drive Sweden is only one ambitious undertaking. But like the experiments underway in Helsinki and Singapore, it provides a model for others through its bold vision, multi-stakeholder composition, and collaborative approach.

There is a compelling case to be made for SDVs—especially in cities. The potential benefits are significant and easy to see, even if some will be difficult to realize in the short term. The major players in the private sector—industry and consumers—are excited and engaged. The public sector is moving too, albeit a bit more cautiously.

Technologies and new business models already under development can substantially transform and improve urban transportation—and by direct extension, livability—while providing new opportunities for the private sector. It is a powerful and exciting starting point for a truly transformative revolution on our city streets.

Acknowledgments

This report, which is based on an exclusive collaboration with the World Economic Forum in 2015, focuses on understanding the impact of self-driving vehicles in an urban context. The authors want to express their deepest gratitude to the mobility team at the World Economic Forum, in particular:

John Moavenzadeh

Head of Mobility Industries

World Economic Forum USA

Alex Mitchell

Head of Automotive Industry

World Economic Forum USA

Andrey Berdichevskiy

Community Lead, Automotive Industry

World Economic Forum

The authors would also like to extend their deep gratitude to all of the companies, organizations, and government bodies that have been involved in this initiative.

OEMS and Suppliers:

Audi

Delphi Automotive

General Motors

Hyundai Motor Company

PSA Peugeot Citroën

Renault-Nissan Alliance

Toyota

Volkswagen

Volvo Group

Mobility and Logistics Companies

Deutsche Bahn

Uber Technologies

United Parcel Service

Technology Companies

HERE

Qualcomm Technologies

Infrastructure Companies

ChargePoint

Siemens

Government Authorities and Initiatives

Drive Sweden

Government of Dubai, Road and Transport Authority

Singapore Land Transport Authority

Singapore Ministry of Transport

Transport for London

United Arab Emirates Ministry of Cabinet Affairs

Cities and Counties

Amsterdam

Dubai

Düsseldorf

Gothenburg

Graz

Helsinki

London

Miami-Dade County

Milton Keynes

New York City

Pittsburgh

Singapore

Toronto

The authors are grateful to corpor8 for the urban-mobility visuals used in the report.