The high-risk, high-reward world of biopharma and medtech has generated a great deal of optimism on Wall Street—and behind-the-scenes financial engineering in the C suite. Shareholders have been rewarded handsomely with strong returns in the sector, but it is unclear how long such high valuations can last. Stock prices may be rising, but the businesses themselves have slowed in terms of growth.

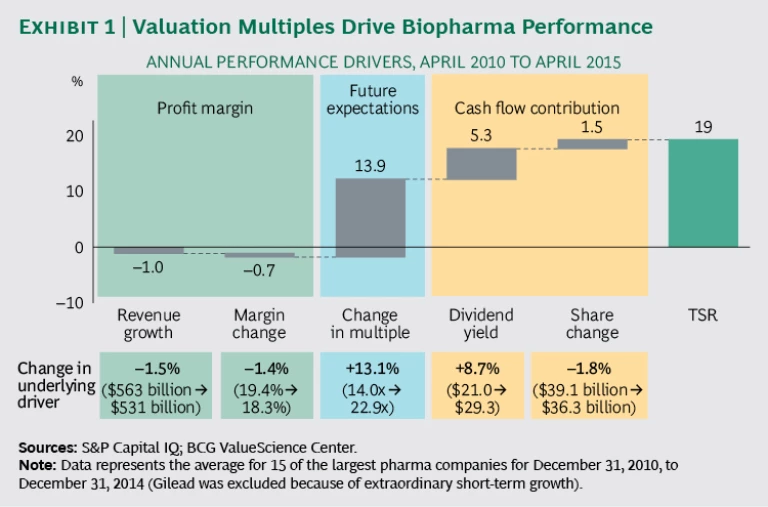

Consider the top 15 biopharma companies. Between 2010 and 2015, they collectively generated a TSR of 19% per year—more than doubling their investors’ money in four years. (See Exhibit 1.) This creation of wealth took place despite negative growth (the growth rate of these 15 companies actually declined by 1.5%). There are several explanations for the sector’s strong market performance. Companies were able to mitigate the impact of patent cliffs better than expected, to rationalize their cost base in order to address eroding operating margins, and to redistribute cash through predictable and growing dividends and massive common-stock repurchases. In addition, many management teams consolidated smaller players or acquired products to cut costs and offset revenue lost to generics.

At the same time, eroding revenue and lack of profitability had a slightly negative impact on shareholder value between 2010 and 2015, resulting in a decrease of 1.7% per year, while cash redistribution added 6.8% per year. The major bump, however, came from rising valuation multiples, which added 13.9% in value per year. Not all of this multiple expansion can be accounted for by projected future growth and concrete pipeline projects.

Analysis of the top medtech companies during this period reveals a similar, though slightly less stark pattern, with 16.1% TSR and revenue growth of 4.7%. Other industry sectors also showed tremendous value creation, but it was typically driven by revenue growth. For example, revenue growth contributed 14% per year in TSR across the S&P 500 during this five-year period.

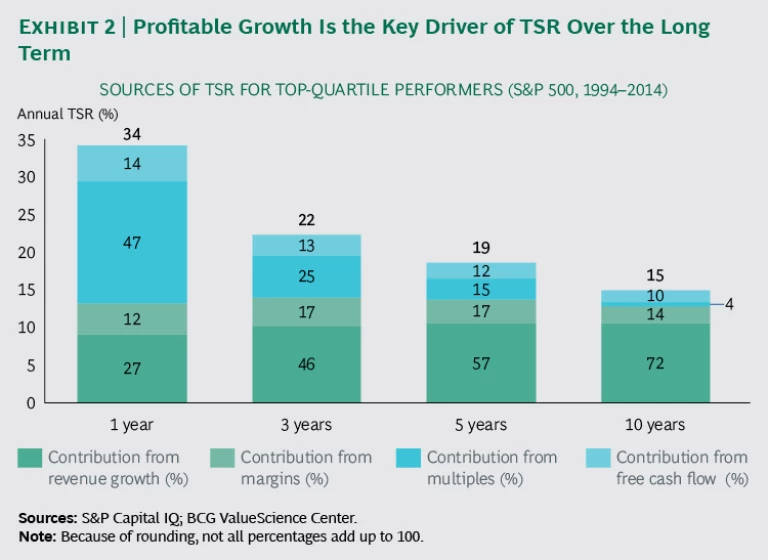

Generating TSR through cash distributions and positive market sentiment cannot work forever. Sustainable growth and value creation ultimately require top-line growth. It is an inescapable empirical truth, as illustrated by the fact that 72 cents per dollar of value creation by the S&P 500 over a ten-year period can be attributed to growth. (See Exhibit 2.)

If top-line growth continues to stagnate, investors will increasingly question management teams about their growth plans and require solid answers. This is just one of the many reasons that growth should now be a central concern for boards and executive management teams alike.

Companies need different sets of priorities in planning their growth agenda for different time horizons. In the short term, they should focus on maximizing their core business. In the medium term, they should focus on accelerating growth in core platforms. In the long term, they should map out how to reshape the company for future growth opportunities.

Competing in a Fishbowl

With so much pressure in the health care industry to contain costs, biopharma and medtech companies are looking for new ways to thrive and grow. The environment is transitioning from an ocean to a fishbowl—that is, from one in which spending is relatively unconstrained to a future where spending (and therefore growth) is strictly limited.

For decades, demand was driven by patient needs and product availability—and spending was merely a consequence. Doctors and patients weren’t directly footing the bill, so the formula for success was relatively simple: identify a patient need, develop a product or service that meets that need, and drive demand while fending off competition. In that universe, even “me too” products could generate significant revenues when coupled with aggressive efforts to drive demand.

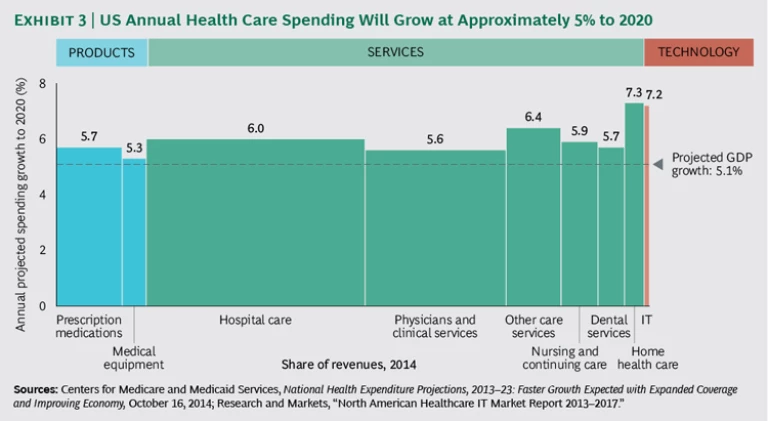

Today, market dynamics have changed dramatically. Public and private payers worldwide have become more proactive and powerful, and they are actively attempting to control spending and reduce health care costs. They are putting downward pressure on both pricing and volume for biopharma and medtech companies. Over the past five years, single-payer systems in the EU5 have contained health care expenditures at a compound annual growth rate of 1.9%. And the Centers for Medicare & Medicaid Services (an agency within the US Department of Health) estimate that most health care sectors in the US will grow at about 5% per year, with limited variation among sectors. (See Exhibit 3.)

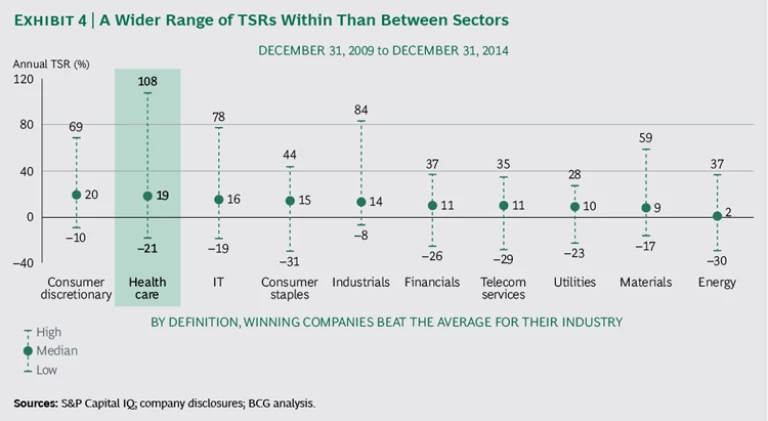

BCG analysis shows that 9% growth is necessary to achieve median S&P 500 shareholder value creation. Is it possible for biopharma and medtech companies to achieve this rate of growth (or higher) in an industry that is growing at a much slower pace? Fortunately, the average growth in a market does not determine the fate of every company. Our research shows that growth among players in a single sector varies more than average growth across sectors. (See Exhibit 4.) Similarly, the range of TSR within health care subsectors (for example, biopharma, medtech, and health care services) is wider than the range of TSR across these subsectors.

While there is ample opportunity for individual companies to achieve substantial growth, the constraints on total health care spending mean that every company cannot grow at the same time—there will be winners and losers. Management teams therefore need to ask: What choices will make the difference between winning and losing? Which opportunities for growth can we seize? As the sources of growth become scarce, competition will be more intense, and sharp strategic differentiation will be vital.

Where Are the Growth Opportunities?

Finding new sources of revenue will be hard—but not impossible. Health care is a $6.5 trillion industry, and while industry growth will likely remain in the low single digits, the drive toward greater efficiency and value will lead to new opportunities.

Fundamentally, there are two paths to growth: innovation and consolidation. In the past, innovation was almost entirely focused on clinical advances, but we believe that with the increasing drive toward greater value and efficiency, there will be opportunities to innovate in a variety of ways. In the long run, innovation is the driver of growth, but in the short and medium terms, consolidation and cost rationalization can increase revenue and earnings per share. In practice, successful growth models will require a mix of organic and inorganic growth.

We anticipate that new health care products could create up to $1 trillion in market opportunity over the next five years. Funding for new products and services will come both from additional resources directed toward health care, including out-of-pocket spending, and from the redirection of existing spending (with new products and services replacing existing ones).

In the current and future health care environment, there are four types of opportunities that will enable companies to boost top-line growth: breakthrough therapies, patient-focused offerings, tailored offerings for new health care systems, and health care efficiency and value solutions.

Breakthrough Therapies. Patient needs are vast, and medical science and technology continue to progress rapidly, paving the way for new treatment options. Novel therapies that offer significant benefits to patients will always find a market, particularly if they offer significantly improved outcomes.

Although R&D productivity declined across the board from 2001 to 2010, it has since turned around significantly. A subset of biopharma companies have shown that it is possible to generate growth and a good return on investment in spite of staggering R&D costs. Several biotechs, for example, have achieved top-line growth, and their P/E multiples show that the market clearly values innovation, despite the fall in the value of the Nasdaq biotech index since September 2015.

To be clear, breakthrough innovation does not mean simply churning out a large number of new molecular entities, and it certainly does not mean racking up me-too-product approvals. With increased pressure on pricing and stronger competition across many therapeutic areas, biopharma cannot fall back on the old model of incremental innovation supported by major marketing efforts.

Instead, companies need to innovate with their eyes wide open. The bar for new products is very high, and breakthrough innovation is expensive and risky. The winners will demonstrate a superior ability to identify innovations that can significantly improve patient outcomes beyond the current standard of care, correctly assess which innovations can succeed, and develop or acquire innovations at the right time.

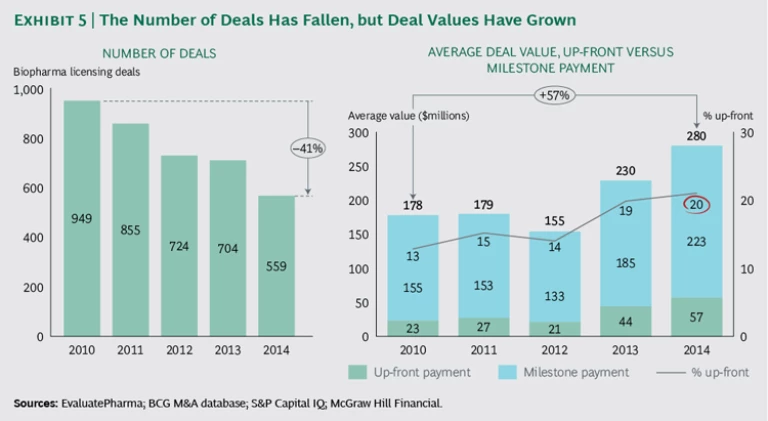

This requires both internal capabilities and high-performing business development engines. Large companies should focus their R&D in therapeutic areas and medical conditions where they can invest, build, and expand their capabilities, and they should acquire innovative products from other, often smaller biotech players once the scientific concept has been proven. Business development capabilities are a critical differentiator, and large companies need to position themselves as the partner of choice for smaller biotech companies. With many suitors vying for their products, biotech companies can extract ever-sweeter financial terms from big companies. The number of overall business development deals has fallen, but average deal value has grown because of increased competition. (See Exhibit 5.)

Large companies are also under pressure to specialize in particular therapeutic areas and medtech domains. Companies with a deep understanding of a specific field are more likely to assess new science correctly and leverage this scientific knowledge to address unmet patient needs in their areas of expertise. In addition, focused companies are more likely to be seen by key decision makers as a credible and desirable partner that can successfully bring new products to market and drive the adoption of new therapies. Most licensing deals’ terms are contingent upon the financial performance of the product after launch, so biotech companies are looking for licensing partners that are well equipped to maximize the economic value of their intellectual property.

While there is a lively ongoing debate about the pricing of new therapeutics, we would argue that society is willing to pay a premium for truly innovative therapies that improve patient outcomes above and beyond the existing standard of care. To value the size of the breakthrough therapy opportunity, it is important to consider both the new “space” created by products going off patent and the projected rate of overall health care spending (5% growth per year). We expect growth in spending on drugs to keep pace with the rest of health care spending. Taken together, these two trends are expected to yield an available spending pool for new patent-protected medicines of $280 billion by 2020.

Patient-Focused Offerings. What if the traditional patient-prescriber-payer triangle no longer served as the cornerstone of the health care industry? What if, instead, patients paid for a growing share of their health care costs and had more control over which products they used? As patients spend more out of pocket—both by choice and as payers shift costs onto them—we expect consumer-driven health care spending to grow faster than the traditional, slow-growing, payer-reimbursed segment. This is good news for companies looking to grow. As consumers take on greater responsibility for health care spending, new product categories emerge and greater opportunities for differentiation arise.

Patients are already taking responsibility for health care expenditures in a number of segments. In developed economies, many patients rely on over-the-counter pharmaceutical products for conditions such as seasonal allergies and pain relief. Many other health care segments, such as dental, vision care, medical aesthetics, and hearing aids, are also mostly self-pay. And self-pay is at the core of many emerging-market health care systems. In Brazil, one-third of all health care costs is borne by patients. The World Health Organization estimates that patients in China pay one-half of total costs out of pocket.

A number of innovative products and companies have successfully tapped into consumers’ willingness to spend on health care products. Fitbit, the maker of wearable fitness trackers, has a valuation that grew to $8 billion in just three years. Similarly, 23andMe created a novel direct-to-consumer market around genomic testing to help patients understand their genetic risk of developing certain diseases. In addition, we are seeing the consumerization of traditional health care products, such as insulin pumps, which are now marketed in a variety of styles and colors. And smartphones are placing health care data directly into the hands of consumers, empowering them to become more active in health care decision making.

Self-pay markets present several attractive features: the opportunity for patient-focused innovation (beyond purely clinical features), greater variation in product offerings, and branding that provides additional protection against competition. Furthermore, the patient-driven segment is constrained only by patients’ willingness to pay—rather than by government or insurer spending caps. Thus, the patient-focused opportunity gives companies the chance to grow in the health care fishbowl by essentially jumping into a new and bigger pool. To win in the self-pay market, companies will need to develop consumer-oriented capabilities, such as fast product innovation cycles, agile marketing, strong branding, and creative advertising.

The rapid growth of patient-driven markets will create a sizeable opportunity. Given the current base of patient out-of-pocket spending and a growth rate of 4.5% to 6.3%, we estimate new spending in the patient-driven market at

Tailored Offerings for New Health Care Systems. Economic growth in many parts of the world is providing access to health care for millions of new patients. Recognizing this opportunity, global companies have attempted for many years to serve these markets. However, few Western companies have successfully penetrated beyond the richest layer of the population to address the needs of the growing middle class. And pharmaceutical sales in emerging markets come largely from promoting established products.

In many emerging economies, government policies can create favorable conditions for economic growth, but governments tend to make decisions with local interests in mind. Faced with the growing expectation of greater access to health care, policy makers are understandably cautious about investing heavily in products from multinational players. Indeed, governments often seek to protect and foster local businesses; therefore, growth in government spending primarily benefits local players and providers of cost-efficient products and services, rather than large global players and providers of premium-priced offerings.

For this reason, emerging markets pose strategic and operational challenges to large biopharma and medtech players. Because most global companies enjoy high-single-digit or even low-double-digit growth rates, they often fail to realize that they are losing ground to local competitors. For example, from 2010 to 2014, in the Chinese hospital channel, the top 10 multinational biopharma companies grew, on average, 11% per year, while the

To be successful in emerging economies over the long term, global players must develop segmented, customized offerings that fit local conditions and present clear advantages for governments. The most successful companies will be those that can actively shape national health care systems by partnering with governments and other local players. Using this approach, Siemens has developed customized health care offerings in Brazil, Russia, India, and China and increased top-line growth in these markets by

Partnering, too, is critical for the next wave of growth in smaller and less advanced emerging markets, such as those in Africa. These markets do not have the luxury of growing slowly over time, as mature markets did decades ago. Nor can they afford to replicate some of the pitfalls that are prevalent in primary- and secondary-care systems in mature markets (such as focusing on treatment rather than prevention).

Partnerships can be invaluable. North Star Alliance, for example, a public-private partnership, runs roadside drop-in clinics across Africa using converted shipping containers. The alliance provides quality health services to truck drivers and sex workers who don’t usually have access to health care and who play a critical role in spreading diseases such as HIV. Companies that can develop such innovative, high-impact programs can help build their own future markets.

Like the patient-driven opportunity, emerging markets represent a new pool of opportunity for biopharma and medtech companies. We expect demand for health care products in emerging markets to generate $200 billion in new spending by 2020, driven by the rapid expansion of access to health care.

Health Care Efficiency and Value Solutions. Health care systems worldwide are far from efficient. Many analyses show a poor correlation between costs and clinical outcomes, and productivity gains in health care lag far behind gains in other economic sectors. To thrive in the health care fishbowl, companies need to replace existing treatments, products, and processes with more cost-effective alternatives that eliminate waste and better deploy resources.

For decades, generic drugs have been replacing patented products. The process is now spreading to biologics and medical devices. However, replacing high-priced products with lower-cost comparable products can address only a small percentage of total costs, since labor accounts for 56% of overall health care spending. The opportunity to lower labor costs while increasing efficiency and improving outcomes is significant. Industries such as retail and banking have seen gains of 2% per year in labor productivity over the last ten years, while labor productivity rates in health care have been stagnant. What would happen if they caught up with those of other industries? Productivity gains of 1% to 2% could yield a $170 to $360 billion opportunity if companies were able to capture 80% of those gains. Health care systems have much to gain from the use of labor-saving technologies—and companies that can innovate in this area will make important strides toward top-line growth.

Many technologies—such as telemedicine, automated anesthesia, robotic endoscopic surgery, advanced imaging, and 3-D printing—have the potential to increase efficiency by replacing labor or decreasing the amount of labor required. Many labor-saving technologies that are adopted in order to reduce costs often also lead to improved outcomes. For example, self-injection devices, remote-monitoring technologies, and connected-care systems have already enabled the rise of home care, moving treatment out of high-cost hospital settings. In fact, home care has been the fastest-growing segment in the health care industry, and its growth rate is expected to continue, outpacing prescriptions and overall health care.

The biopharma and medtech industries have tried to help payers and providers better assess the true costs and value of their products for more than a decade, with limited success. One barrier has been the challenge of demonstrating overall cost reduction when a new device or drug costs more than the current standard of care. Some costs that patients bear—such as those related to lost productivity, comorbidities, or clinical depression resulting from a poorly controlled condition—are very difficult to track. Others, like reduced days in the hospital, are easier to measure and, increasingly, can be tracked and presented to payers as evidence of the total value of a new therapy or device.

Companies that can improve the standard of care while lowering costs—and that can quantify the benefits of labor-saving technologies—may well be the true health care innovators and growth engines of the next decade. To be successful, they will need a deep understanding of inefficiency, waste, and pain points in the patient journey, as well as the ability to develop cutting-edge technologies that can address these problems.

The Role of Acquisitions

In the first half of 2015, biopharma deals worth $220 billion were announced, triple the amount during the same period in 2014. Furthermore, the number of large deals has grown. Generally, capital market reactions have been positive when deals are announced with guided disclosure on postmerger plans. While growth overall is necessary to create shareholder value, smart inorganic growth can create as much value as organic growth.

The most recent wave of acquisitions in biopharma and medtech has been driven by low interest rates, adequate cash flow available to invest, and the opportunity to leverage differential tax rates. What underlies this activity is largely the pursuit of long-term growth. In some cases, it is based on a desire to obtain breakthrough therapies and deepen a company’s presence in specific therapeutic areas; one example is Celgene’s recent acquisition of Receptos. In other cases, such as Pfizer’s acquisition of Hospira, companies pursue M&A to strengthen their value and efficiency offerings. Acquisitions can also help companies build their core or expand into adjacent therapeutic areas.

The ideal acquisition target is a company that offers opportunities for cost synergies in the short term and growth potential over the long term. Naturally, these gems are becoming rare. In many recent deals, a significant share of the acquiring companies viewed the merger as a cost-saving measure, although savings could have been realized without the transaction. For example, an acquiring company may be looking to reduce its own R&D spending in favor of the newly acquired pipeline. In practice, investors do not penalize acquirers as long as the synergies are delivered.

Financial markets have also been fairly tolerant of high acquisition premiums. Many recent deals may appear to challenge the net present value approach because uplift to the acquirer is factored in by investors, who reward acquirers with higher stock prices. This tolerance could reflect more wisdom than is apparent at first glance, because a lack of growth indicates a mature market and is probably a harbinger of margin pressure, risk to dividend streams, and a general decline in the business environment. In this scenario, short of returning cash to investors, maturing companies have few options beyond M&A to create value in the long term. Investors value growth much more than short-term margin expansion or cash on the balance sheet. A BCG analysis shows that 1 point of growth is worth up to ten times more than 1 point of EBITDA in the pharmaceutical world. However, that means an acquisitive strategy cannot rely on cost savings alone, so consolidators, too, need to demonstrate that they can create organic top-line growth.

The Future Starts Today

Companies need to ask themselves questions for the short, medium, and long terms and pursue an agenda specific to each.

In the short term, what more can we do to maximize our core business? Biopharma and medtech companies need to ensure that their core business provides a firm foundation for growth. This can best be achieved by shifting investments away from low-value pursuits and directing them instead toward high-potential opportunities.

- Review market opportunities with a fine-toothed comb, and focus resources and investment on the highest-potential opportunities to capture all pockets of profitable growth.

- Activate all possible pricing levers (including contracting) with a long-term view of how market dynamics will evolve.

- Systematically free up resources by eliminating low-value activities and spending.

- Challenge the decline of products facing competition from generics wherever possible—for example, by offering unique, value-added services that give physicians and payers a reason to continue using the original product.

In the medium term, how can we accelerate growth in our core platforms? Once high-potential growth opportunities have been identified, it is important to move quickly. Companies will need to prioritize innovation and deepen their expertise in the most promising therapeutic areas.

- Pursue launch excellence and maximize commercialization of new assets.

- Accelerate the most promising projects in the pipeline.

- Prune low-value assets and programs to make room for future products.

- Divest low-growth businesses where there are opportunities to sell these at attractive valuations in order to generate additional funds for reinvestment in high-growth areas.

- Step up external innovation or make strategic acquisitions to deepen existing areas of focus.

- Prepare the organization and its assets for value-based health care—for example, by ensuring that clinical studies assess not only basic efficacy endpoints but also cost effectiveness and value.

In the long term, how should we reshape our company for future growth opportunities? To achieve sustainable growth, companies need to continually scan the horizon for new, transformative opportunities. By focusing R&D in therapeutic areas with high growth potential, companies can continually build up their capabilities, invest in innovation, and establish a leadership position in a given sector.

- Align innovation spending with pools of future growth.

- Make clear choices about where to play—and where not to play—and stake out a leadership position in your chosen areas.

- Reshape capabilities for greater competitiveness and differentiation in your chosen areas of focus and establish partnerships to expand in-house capabilities.

- Seek transformative, large-scale transactions to expedite your strategy.

Investors expect growth, and growth will be hard to come by in the health care fishbowl. High multiples won’t be sustainable if they are not supported by top-line growth. A successful long-term growth strategy maps a course toward future sources of value (where to play) and articulates how the business raises competitive barriers (how to win). Sustainable growth is as much about great execution as it is about smart strategy—and execution starts today.