In the wake of the recent financial crisis, the global fashion and luxury industry established a solid record of extremely strong value creation. More recently, however, the industry’s performance declined somewhat—a trend that has continued into 2016. The exceptions have been companies that have turned to digitization, consolidation, and “casualization”—trends that will remain relevant to many companies for the near term.

In 2016, as in past years, BCG conducted its annual study of

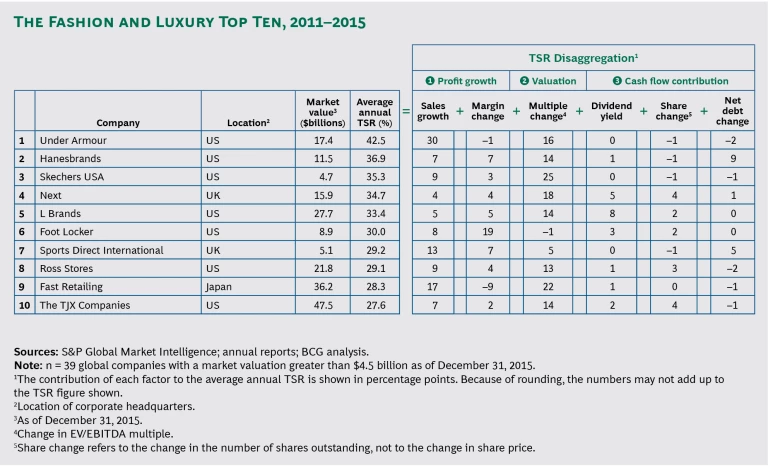

Thirty-nine of those companies are in fashion and luxury. (See Creating Value Through Active Portfolio Management , the 2016 BCG Value Creators report, October 2016.) From 2011 through 2015, the fashion and luxury companies returned an annualized TSR of 15%. The industry ranked tenth overall and last among the five consumer industries in the study. Travel and tourism, consumer durables, consumer nondurables, and retail were the other four, and all five consumer industries finished in the top ten of the 28 industries we analyzed.

A Shift from Sales Growth to Valuation Multiples

During the five-year period of our analysis, each of the top ten companies in the fashion and luxury industry generated significant value through expansion in valuation multiples—in general, more than 14 percentage points of TSR. (See the exhibit below.) This is a departure from what we’ve seen in previous analyses, in which companies created more value from sales growth. The shift to multiples reflects the slow but steady increase—stronger in some countries than others—in consumer confidence since the depths of the financial crisis. As confidence rises, consumers become more willing to splurge on expensive products. Moreover, the TSR performance of the industry has fallen below historical averages in the past one or two years, so investors may be expecting a rebound. Sales growth was still the second-biggest contributor to value creation, adding, on average, 11 percentage points of TSR. For the most part, the remaining factors were not significant contributors.

Four Factors That Led to Top Performance

In our review of the performance of this year’s top ten, we identified several noteworthy aspects. One, the majority of the best performers (seven out of ten) are US-based companies, reflecting the relative strength of the US economy over the past five years (in contrast, for example, to the European economy) and the confidence of investors in the future of this market. In addition, unlike previous years’ assessments, there are no emerging-market companies among the top ten. The notable absence of Chinese companies reflects Asian markets’ relatively disappointing performance over the past few years.

A number of US companies have appeared on the list for several years. Ross Stores finished eighth this year and tenth in the 2015 analysis. And Under Armour, the top performer, has finished in the top ten for three consecutive years and outperformed the market in seven of the last ten.

Two, all the top-performing companies are mass-market players: fast-fashion apparel companies, discount chains, and mass brands. There are no high-end luxury players among this year’s top ten, most likely because of slowing growth in China, which represents roughly 30% of luxury consumption worldwide. (In China, the central government’s prolonged measures aimed at reducing extravagant gifting, as well as the rising popularity of niche, individualistic brands among the younger generations, have also affected the performance of some fashion and luxury companies.)

The mass fashion market has always been highly fragmented, with many players and new entrants enjoying strong growth and gaining share and other companies declining or exiting the market. However, this market is starting to see consolidation, with larger brands gaining share over smaller and local brands. For example, Fast Retailing, a Japanese company that finished ninth in this year’s ranking and features Uniqlo as its main brand, is expanding in China and other parts of Asia. Fast Retailing generated 17 percentage points of TSR from sales growth, more than all but one company—Under Armour—among the top ten. Inditex and Primark are two other rapidly growing fast-fashion companies (though neither made it into the top ten this year).

Three, rather than selling through wholesalers, most of the top ten have their own retail distribution systems and branded stores, a model that is favored by younger consumers—including millennials—who are less likely to shop at department stores than than their counterparts in previous generations. (Some of the companies, however, have a hybrid model.)

Four, footwear and sportswear companies—including Under Armour, Skechers USA (third), Foot Locker (sixth), and Sports Direct International (seventh)—dominate the rankings. Consumers—particularly men and young shoppers—are moving toward more casual wear. Given the size of the millennial population relative to older demographic segments such as Generation X, such shifts will likely continue over the next several years at least, to the benefit of companies that sell casual clothes and athletic footwear.

Three Trends That Will Boost Performance

We expect that three trends in the fashion and luxury industry will continue to spur value creation for the foreseeable future. Of course, such predictions do not apply universally. Like all other consumer industries, fashion and luxury includes companies with various business models and core strengths. Still, we believe that these trends will remain relevant to most fashion and luxury companies.

The Growing Importance of Digital. Consumers are purchasing more and more goods online—increasingly through mobile platforms—and digital sales are growing at double-digit rates across all industry categories. To capitalize on e-commerce, companies will need to invest in agile digital architectures, but the rewards are there for those that get it right. For example, top-ten performer Sports Direct makes more sales through digital channels than do its competitors.

Consolidation of the Apparel Industry. Led by fast-fashion giants such as Uniqlo, Inditex, H&M, and Primark, the industry is starting to consolidate. Through their efficient, optimized models, these companies are gaining share over smaller and more traditional brands and networks. These global brands can easily expand into new markets, and, as they grow, scale matters. The risk is that some companies may increase their operational costs and head count without ensuring that revenues grow proportionally. The industry has seen this happen many times, resulting, ultimately, in the demise of some companies. In addition, companies need to develop the right operating model, maintaining an optimal balance of employees at the central corporate level relative to those at the level of portfolio brands.

The Continuing Dominance of Casual Clothes and Footwear. Consumers are wearing less formal clothing, preferring instead casual apparel, shoes, and accessories—even in the workplace. This trend is not new, but it has gained momentum recently. And there is a related trend: consumers are less inclined to splurge on personal goods such as luxury clothing. They are instead opting to spend their money on experiences, especially in categories such as health and wellness, leisure travel (notably, baby boomers), and consumer services.

The shift from personal goods to experiences will benefit some fashion and luxury companies, provided they are positioned correctly. For example, the rise of health and wellness experiences benefits companies that make activewear, athletic footwear, and other apparel for exercising, hiking, and spending time outdoors. The rise in leisure travel will mean higher sales of layering clothes, luggage, and travel accessories. And consumer service companies whose business models feature subscriptions and customization may benefit, particularly if they have ties to beauty and skin care. At the same time, some personal-goods categories, such as high-end accessories, may face slower growth. To respond, companies will need to reposition themselves—at the levels of the portfolio and individual brands—by orienting products around specific experiences.

The value creation performance of fashion and luxury companies has, for the past five years, been average, and there’s no silver bullet to change the industry’s performance. What’s most important is that companies understand the factors that are most relevant to their situation and that will allow them to capitalize on a recovering economy and return greater value to their investors.