Asset managers today face a fundamental and indisputable fact: the world they are analyzing in order to make and execute investment decisions is increasingly complex and rich in data. For some managers, this is a tremendous opportunity: more complex strategies can be supported.

However, for most firms, the ability to keep up, from an investment and trading standpoint, will require significant investment and material changes to almost all elements of the target operating model, the blueprint that governs nearly every component of the business. The alternative to adapting that model is to risk becoming less competitive in the ability to generate alpha.

Keeping up in this context requires significant investment in developing and maintaining advanced, digital data and analytics capabilities in support of the front office. Doing so isn’t just a matter of technology. It requires a step change increase in capabilities related to process flows, work structure, roles, metrics, and talent.

Read More On This Topic

Global Asset Management 2016

- Doubling Down on Data

- Asset Managers Get Real with Risk

- An Asset Manager's Guide to Data and Digital Disruption

Advanced Analytics and Data Are Going Mainstream

Historically the realm of a small subset of esoteric strategies, investment in advanced analytics, machine learning, big data, and other capabilities is on the verge of becoming mainstream. The enablement of investment decisions with any or all of these tools cannot be confined to just a few managers, nor can it be just something that IT can figure out on the firm’s behalf.

Embracing these capabilities will be central to the way many large investors make decisions—even those that have traditionally relied on human judgment—and go to market. It is therefore critical for all asset managers to reconsider their operating model to ensure that they are set up to deliver on these capabilities in the near term.

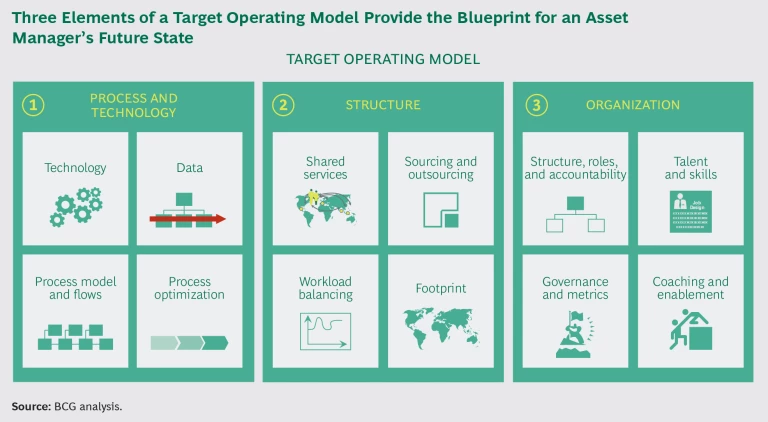

A target operating model, in BCG’s view, is a framework with three primary components: process and technology, structure, and organization. (See the exhibit “Three Elements of a Target Operating Model Provide the Blueprint for an Asset Manager’s Future State.”) These three elements provide a blueprint for an asset manager’s future state and translate into a series of business questions and decisions for front-, middle-, and back-office operations.

In recent years, many leading asset managers have pushed to better align their target operating model with their core business strategy. They are, for example, creating centers of operational excellence, evaluating alternative sourcing models, and adapting operational and technological skill sets to the structure of their business.

Such changes have helped firms scale their businesses more effectively, accelerate new-product speed to market, trade in new asset classes and markets, and operate more efficiently.

The Boston Consulting Group's 2016 Global Asset Management Benchmarking Survey uncovered a number of significant operating model changes that originate directly in the front office and that are impelled by the analytical and data-driven challenges described above. Some forward-thinking firms are adapting their target operating model in ways we believe are relevant to all asset managers. Their efforts focus in particular on adapting technology and data infrastructure to handle these changes by building excellence in data management and honing capabilities to use a rapidly expanding set of technology tools.

Front-Office Trends That Drive Operating Model Changes

An evolving data landscape is not a new phenomenon for asset managers, but the pace of change today and the breadth of opportunity it has created represents a significant step forward. The scope of change increasingly touches multiple elements of the target operating model.

We believe that of all the changes, advanced analytics, portfolio order and execution management capabilities, innovation in trading, and data in the front office have the greatest potential for profound impact.

Advanced Analytics. There is rapidly rising interest in the potential of advanced digital technologies and techniques to provide competitive advantage in investment management processes and elsewhere. Technologies that push the boundaries of traditional analytics—such as machine learning, data visualization, artificial intelligence, natural-language processing, and predictive reasoning—were once the province of a small set of alternative managers. Now they are becoming mainstream, sometimes yielding highly targeted investment insights with unprecedented speed.

Portfolio Order and Execution Management Capabilities. Managers looking to take on more-complicated investment strategies, trade at higher volumes, and execute more efficiently are adopting technology tools that can help them. The technology providers of these products are building progressively more sophisticated tools across asset classes.

The most frequently integrated new tools fall into three front-office functions:

- Portfolio management tools can help portfolio managers and analysts view their positions and exposures, develop and test strategies, construct model portfolios, and perform scenario analysis.

- Order management and compliance tools can help firms enter orders for execution, check for compliance or rule violations, and route orders to trading.

- Execution management tools can help traders route trades, access pools of liquidity, and execute market transactions more effectively.

The reevaluation of front-office tools requires significant work operationally, as well as the technology and data to handle that complexity. As tools have evolved, vendors have begun to look for opportunities to integrate them across functions and asset classes. Most managers, however, focus on developing or procuring best-of-breed solutions.

Innovation in Trading. A number of factors now disrupt the trading space: near-real-time technology, access to liquidity, strategic ability to pick a trade’s timing and exchange market, cost minimization, and ability to obfuscate trades. At high-frequency-trading firms, much in-house technology focuses on the ability to beat the market. Other pressures for change include the sometimes-disruptive financial-technology innovations of fintech firms, as well as constantly changing regulation.

Data in the Front Office. Some investment managers still view advanced analytical tools and sophisticated front-office IT as secondary to sound investment process and are, therefore, not adding resources in those areas. Still, despite a range of views, almost every investment manager we have encountered has identified improvements to the governance, quality, availability, and breadth of data as priorities for the front office and the risk management organization.

Data initiatives are being launched in three areas, each of which creates very specific business value for managers:

- A Single Source of Truth. Maintaining the flow of consistent and accurate data throughout the organization is critical, especially as portfolio management systems become more common and strategies grow more complex. A single source of truth is vital for risk organizations as they take a more active role in monitoring areas such as liquidity and counterparty exposure.

- Real-Time or Near-Real-Time Data in the Front Office. For some investment strategies, having start-of-day positions is adequate. Increasingly, however, investment managers want the ability to look at positions, cash, and open orders in near-real time. The ability to do this while maintaining data accuracy (for example, recording details of corporate activity) is behind the concept of providing an investment book of record (IBOR), which has become the North Star of data for many managers.

- Focus on Data Quality and Governance. Managers seek to achieve excellent data quality and effective governance in various ways but almost always with significant implications for the operating model.

Implications for the Operating Model and Investment Process

Every trend affecting the front office affects one or more of the target operating model’s three elements. There are implications for each element, and we see leading firms making some changes as they invest in the front office.

Process and Technology. Technology and data, in our experience, receive the most investment and will continue to attract the keenest focus of managers’ time and resources. Firms are emphasizing investments in core platforms and related workflows and building two-speed technology platforms for experimenting and learning in more agile ways:

- Core Platform Technology. Investments in core platform technology include implementing new front-office backbones, such as portfolio or order management systems, and new data infrastructure. Many of these investments are multiyear programs that require significant commitment. But they do improve the alignment of technology with firm-wide investment goals, such as the ability to operate in a truly multiasset class environment. Alternatively, some managers focus efforts on incremental standardization of investment tools to mitigate risk and improve scalability across the front office. Another area of increasing opportunity is the development of portfolio management collaboration tools and technology that allow managers to work together across traditionally siloed investment activities.

- Delivery Model Technology. The premise of a two-speed technology is critical for firms experimenting with advanced analytics and machine learning tools. The most innovative firms are investing in building “sandbox” environments for testing tools and evaluating potential technology partners more quickly than otherwise possible. Highly innovative firms are creating joint business and technology teams that operate in an agile way, disconnected from the broader workflow and operations.

- Data Architecture and Big Data. To support advanced analytics and promote evolution of the investment process, it is critical to obtain the right high-quality data in a timely way. Leading asset managers’ efforts to modernize data architecture have taken different forms. For many firms, the right first step along a data modernization path is to evaluate and rethink their data-warehousing strategy, creating a more cohesive architecture for delivering data in a more consistent and timely way. Other firms have invested in building big data architecture, bringing in new tool sets that allow them to maximize value derived from the structured and unstructured data that they bring into the firm and that they create.

In many cases, investments in data are made in conjunction with a broader front-office effort, such as portfolio management and order management replatforming:

- Data Sources. The breadth of both traditional quantitative structured data, as well as unstructured data that many investment professionals want to capture, is rapidly growing. Social data, such as Twitter feeds, can provide insight but only if it is made available to investment professionals in a timely and digestible way. Leading technology organizations are partnering with investment professionals to enhance their understanding of current and future data needs and the architecture required to import that data.

- Data and the Investment Book of Record. Historically, a firm’s portfolio management system and models were fed data in an overnight batch process that reflected the day’s transaction activity, any corporate actions that happened over the course of the day, and updated cash positions. For many firms, however, a more systematic IBOR solution is now required to track those changes throughout the day—owing to the high volume of transactions, frequent changes in cash, the breadth of their positions, or complicated trading strategies. These tools pull data from order management and trading systems, as well as accounting systems, to give full intraday views of a manager’s positions and to help support ever-advancing analytical activities.

Work Structure. Shared services, organization structure, and resourcing are all areas in which the evolving dynamics in the front office affect the operating model:

- Shared Services. One critical first step in building an organization that is proactively able to meet front-office analytical and data needs is the identification and prioritization of the right use cases. Relying on inadequately trained and focused people to do this work has been a stumbling block for many firms. Many innovative firms are creating a dedicated organization to build capabilities for data and analytics. These groups are centralized to allow access by all investment groups and to keep them focused and prepared in deploying and developing their analytical and technical skills, as well as to keep them in touch with the rapidly evolving vendor landscape.

- Sourcing and Outsourcing. The landscape of new vendors offering fresh data and analytical capabilities is evolving rapidly and has the potential to disrupt many parts of the investment process. Some managers are focusing on building partnership models to evaluate different potentially disruptive technology partners. For a few leading firms, this has meant creating investment vehicles, using firm assets to take venture stakes in exciting technologies. For others, it has been far simpler: staying abreast of new ventures and bringing them in for proof-of-concept assessment when new analytical questions arise. Either way, firms that are pulling ahead are highly reliant on partners to help deliver capabilities. They are building their organization and processes to fully support that model.

Organization. The ability to tackle and deal effectively with any and all of these trends can place significant stress on the organization. Processes and tools change, creating the need for significant change management. It is crucial to identify and hire new talent, and that requires competing in a variety of talent pools. Competition is steep for data scientists, architects, and governance professionals—and not just with other buy-side institutions but also with the sell side and leading technology companies. Bringing new people into the investment group and into IT requires viable career paths and career development expectations.