In the two years since The Boston Consulting Group conducted its last Treasury Benchmarking Survey, banks have remained locked in a Sisyphean struggle. Once an issue like liquidity coverage ratio (LCR) is dealt with, other challenges and new regulations appear. Low—and, in some cases, negative—interest rates are a major part of this struggle and have dominated the economic environment for banks. (See Time for Rebalancing: Insights from BCG’s Treasury Benchmarking Survey 2014 , BCG Focus, December 2014.)

Our 2016 survey found that most banks are still in the stabilization phase. Slow growth, very low interest margins, and heightened regulatory demands require banks to reinforce their fundamentals, reduce noncore assets, and improve their capital allocation. Pressure is also on banks to refine their steering, IT, and analytics approaches to eke out basis points of margin, improve their operating efficiency, and enhance their insight-generating capabilities. Those changes can open up critical avenues for growth and support the development of new offerings and partnerships.

Our 2016 Treasury Benchmarking Survey analyzed how treasury departments are approaching these imperatives. A total of 33 leading banks across Europe and North America participated in our study.

Low Interest Rates and Subdued Interbank Lending Persist

Since 2014, balance sheet composition in the Eurozone and North America has stabilized. Still, the economic environment remains challenging—especially when coupled with new uncertainty over the impact of the UK’s departure from the European Union on financial markets.

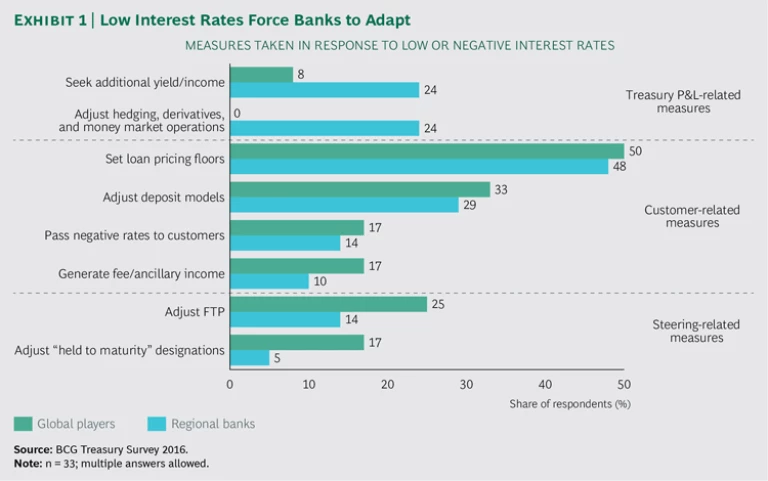

One challenge is that interest rates are low. Continued rate hike delays in major markets have prompted banks to take a number of measures to help P&L performance and generate additional yield and income. Banks are revisiting the asset allocation and investment strategy of their liquidity buffers and investment portfolios—in some cases downgrading credit quality to improve returns. Banks are also making adjustments to their hedging, derivatives, and money market operations. On the customer front, some banks are passing negative interest rates on and introducing loan pricing floors to prevent variable lending rates from falling below zero. In addition, they are fine-tuning their funds transfer pricing (FTP), deposit modeling, and risk appetite frameworks in order to sharpen and align business unit incentives for asset and liability origination. Some banks are also revisiting accounting designations, such as “held to maturity.” (See Exhibit 1.)

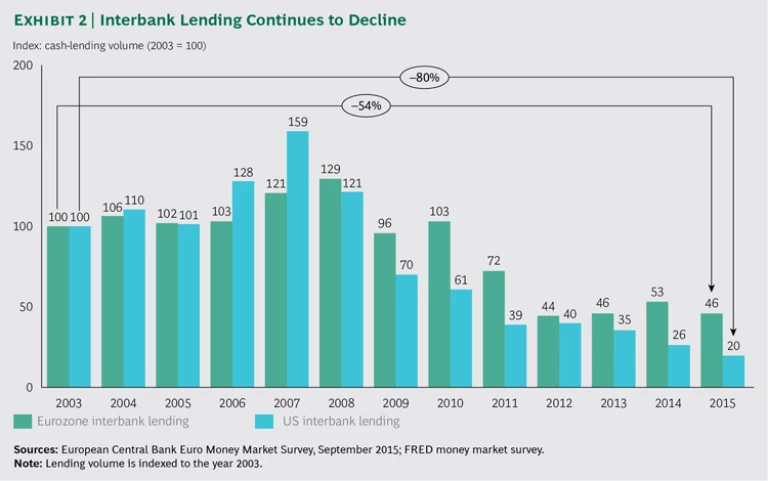

Interbank lending and borrowing remain low. (See Exhibit 2.) In Europe, interbank lending (in absolute numbers) has largely plateaued since hitting historical lows in 2012. Given lingering questions about Brexit, we expect that interbank lending in the Eurozone will remain cautious and that the European Central Bank will continue to play an important funding role.

In the US, interbank lending has been on a steeper downward trend, with a compound annual decline of 23% since 2007. That has forced banks in the US to rely more heavily on deposit funding and secured short-term funding, such as repurchase agreements.

Governance Centralizes

Steering-oriented governance models, in which treasury decisions inform activities within the business and not just interactions with financial markets, continue to dominate. The survey found that both global and regional banks (those with balance sheets of greater or less than €500 billion, respectively) are embracing an expanded role for treasury and combining traditional liquidity management with broader banking-book management.

The steering-oriented approach is especially common in North America, where all treasurers in the survey report to the CFO.

The study found that, in addition to classic steering functions like banking-book and liquidity management, global players are increasingly integrating execution activities, such as money market and swap or derivatives desks, into their group treasury departments to create a stronger link between steering and execution. New leverage ratio, LCR, and the fundamental review of the trading book (FRTB) rules are accelerating this integration. Respondents from larger banks stated that the asset and liability committee is playing a more central role and giving treasurers a seat at the table in banks’ strategic steering discussions.

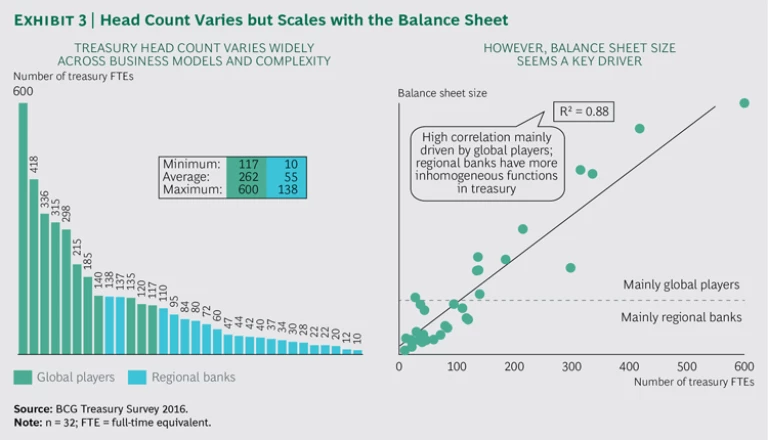

In general, most treasury departments have been able to keep their head count relatively steady even while centralizing and coping with an increased regulatory load. The survey shows that in 2016 the number of treasury full-time equivalents (FTEs) as a percentage of total bank FTEs ranged from 0.06% to 1.17% for regional banks and from 0.10% to 0.37% for global players. That compares with 0.06% to 0.99% for regional banks and 0.01% to 0.37% for global players in 2014. Absolute numbers vary widely, however, with some regional banks having as few as 10 FTEs or as many as 138. Among global banks, the largest staffs had about 500 more FTEs than the smallest. (See Exhibit 3.)

Income Contribution and Stabilization Dominates

Net interest income (NII) stabilization is a major task for all banks, regardless of size or location. Treasuries will need to manage overall NII more closely and steer the banking book effectively. Intriguingly, the survey found wide variance in treasuries’ contributions to total NII, with some bank treasuries contributing 40% of total NII and others zero. Smaller banks tend to be on the higher end of the contribution range in general.

Liquidity maturity transformation (where banks lend over long-term horizons using funding from deposit accounts and other short-term liquidity sources) is an important element of NII. In the period following the financial crisis, however, banks had to pull back on maturity transformation to curb their liquidity exposure. Looking ahead, banks may need to rethink that posture in light of current margin pressures. That will require changes in risk appetite and careful discussion with a variety of stakeholders, most particularly regulators.

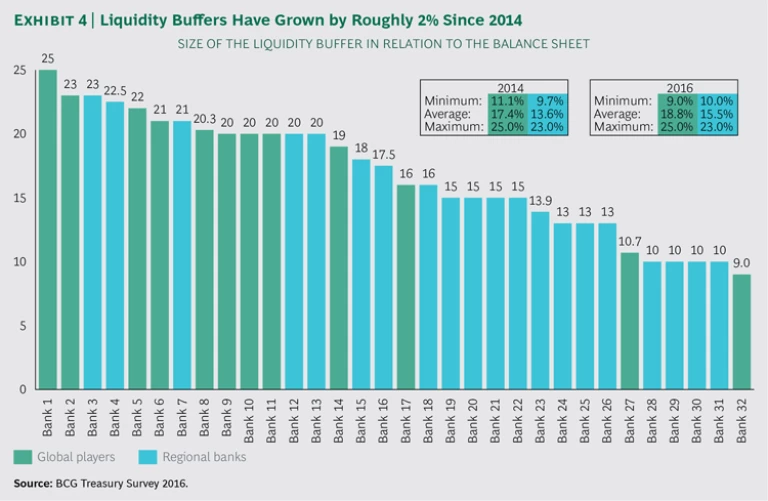

Liquidity buffers, which usually carry a negative spread, also affect NII. Following the financial crisis, most banks established large buffers to meet stiffer regulatory requirements and protect against the risk of future funding freezes. Our 2016 survey data found, however, that these buffers continue to grow. The average liquidity buffer size for global players rose by more than 1% in the past two years (from 17.4% of assets in 2014 to 18.8% in 2016). Regional banks saw theirs grow from 13.6% to 15.5%. (See Exhibit 4.)

For more than a third of participating banks, liquidity buffers now represent more than 20% of their balance sheets. Much of that growth is fueled by LCR requirements and the results of internal stress scenarios. The low-interest-rate environment—and the types of refinancing and tenors used—is helping to temper some of the cost of maintaining large buffers. As a result, banks have been more active in reducing their refinancing tenors over the past two years than they were during 2010 through 2014, the time frame that comprises the two periods covered in BCG’s prior treasury surveys.

More than 90% of the global players reported having some kind of NII optimization model in place. The same was true for only 60% of the regional banks. NII volatility (occasionally in combination with the economic value of equity [EVE]) remains the most common metric, used by 82% of global players and 78% of regional banks.

The new interest rate risk management in the banking book (IRRBB) regulation will force banks to manage interest rate risk using both fair value and earnings views. That will affect regional banks in particular given that half of those surveyed primarily rely on an earnings view and just over one-third (38%) primarily use present value. Global banks are more likely to use both methods already.

Regulatory Compliance Remains Focused on LCR

Today, treasurers face a more demanding regulatory environment. Several rules that were in the proposal stage when our 2014 survey was released have now come into force, and several others are due to be finalized over the next two years. Rules in five domains dominate the agenda: liquidity, bail-in-able debt, separation, IRRBB, and FRTB.

Survey participants were focused on the technical implementation of LCR two years ago, and now they are concerned about applying LCR as a steering metric in practice. Global players must ensure regulatory compliance across all their operating regions. As a result, they rely more heavily on local liquidity ratios than do regional players, which favor group-wide liquidity gap profiles and associated limits. Net stable funding ratio (NSFR) use remains low at present, but uptake will likely increase dramatically once rules concerning the ratio are finalized and take effect as expected in 2018.

In response to new regulations addressing total loss absorbing capacity (TLAC) for global systemically important banks and minimum requirements for own funds and eligible liabilities (MREL), global banks are revisiting their funding structures to ensure sufficient resources in the event of a bail-in. This is a greater concern for global players than regional ones, with 42% of global players issuing TLAC/MREL-eligible instruments compared with 29% of their regional counterparts. Some banks are also deleveraging in order to reduce their funding and capital needs. Others are simply waiting for the final announcement of the MREL rules, with about a third of participants believing that TLAC/MREL will have little impact on their balance sheet composition (either because the rules do not apply or because their funding structures are already in line with the requirements). Canadian domestically important banks are not yet affected, pending the finalization of their bail-in regime.

Europe has different regulations on bank separation that involve separating higher-risk activities such as investment banking from customer-related activities like retail banking. These have not had a major effect on funding and liquidity management, although 25% of global players and 10% of regional banks reported that they have reorganized their processes and governance structures to manage liquidity centrally and to create separate liquidity buffers.

IRRBB, published in its final form in April 2016, requires banks to take the Basel Capital Framework’s Pillar 2 treatment into account when forming economic capital calculations. Banks must also develop specific shock and stress scenarios. They must enhance disclosure—for example, reporting the effect of shock and stress scenarios on the EVE and on NII. The regulation will become effective in 2018, which makes it a high priority for banks.

In light of the more heavily regulated environment, banks should review their treasury and trading operating models and revisit how they transfer risks from the banking book to the trading book.

Enhanced FTP Is Needed

In the current economic environment, adequate steering instruments are crucial because they ensure that limited capital, funding, and liquidity resources are optimally deployed. For treasurers, the FTP methodology is the central steering tool. Treasurers cite the inclusion of negative interest rates, LCR and NSFR costs, improvements in liquidity buffer cost calculation, and enhanced behavioral modeling of loans and deposits as the most significant changes to FTP over the last two years.

To succeed in the present environment, banks may need to adopt a more client-centric approach to FTP and take a wider portfolio view. One prerequisite for such an approach is high granularity in the FTP model to ensure that costs can be allocated at a client level, ideally as part of the pricing process (that is, ex ante). One example of this is the refinement of the calculation and allocation of liquid asset buffer costs—these have more commonly been allocated at the profit center level, instead of a more granular desk or individual-ticket level. Survey data found that this remains the current practice for 75% of global players and 57% of regional banks.

Too Many Systems, Too Little Data

The 2014 survey found that many banks use multiple front- and back-office systems, largely as a result of acquisitions. This has not changed. While a varied architecture mitigates overreliance on any one vendor, it also dramatically increases IT complexity. Updating and maintaining multiple systems and databases increases costs and operational risk.

Participants also struggle with data availability. For example, more than half of all respondents said that when performing their intraday collateral management (that is, ensuring that sufficient collateral is available to cover obligations), getting needed data quickly and efficiently is their biggest challenge.

Behavioral Modeling Is Well Established but Other Simulations Lag

Treasury models that approximate behavioral cash flows of nondeterministic assets and liabilities, such as mortgages with prepayment options or assets whose cash flow is variable, are widely used by global players, but less so by regional banks. Every global bank in the survey stated that it uses behavioral models to oversee loans with optionalities, but that was true for only 71% of regional banks.

All global players and 79% of regional banks also use behavioral models for nonmaturing deposits. The sophistication of these models varies significantly, however. Whereas most banks use total deposit balances for deposit modeling, fewer use individual customer balances or transaction level information, which provide a more accurate analytical base. Also, few track the reasons for balance changes (such as shifts from deposits to investment funds).

Deposit modeling is typically a two-step process. In the first step, banks identify homogeneous clusters—for example, products, client types, or account balance ranges. Then, in the second step, they develop interest rate and liquidity models using a variety of targets and constraints—minimizing margins or volatility, for example, or maximizing returns. Our survey found that while many banks put considerable effort into the second step, most have yet to employ big data or advanced analytics to refine their segmentation analyses. As a result, many banks are relying on less-than-precise modeling groups.

Advanced analytics can also help banks perform better and develop more-integrated balance sheet, profitability, and regulatory ratio simulations. While some banks are starting to use such integrated simulations, overall adoption remains low. Barriers include inadequate data quality and availability and the difficulty of determining the appropriate level of granularity for the input parameters, such as profit center, business unit, or bank level.

Taking Action

Since the 2014 Treasury Survey, the regulatory and operating environment has grown more complex. Treasurers can sometimes feel their role is a Sisyphean task: as soon as they address one issue, other, more challenging ones appear. To help treasurers anticipate issues more nimbly, we recommend the following steps:

- Revisit the operating model to ensure adequate governance, functional design, and head count.

- Review and optimize the operating model from the perspective of the IRRBB and FRTB regimes.

- Optimize the balance sheet structure and management with respect to LCR/NSFR and TLAC/MREL.

- Use FTP to set the right incentives and support a shift from product to client profitability in the business lines.

- Streamline the IT platform to reduce system cost, complexity, and associated risk by trimming the number of interfaces and integrating core processes.

- Enhance modeling skills to adopt ex-ante simulations for overall balance sheet optimization.

- Proactively investigate ideas and technologies (such as digital funding platforms) that can help treasurers support growth.

High-performing treasuries can play a pivotal role in helping banks return to growth—or at least minimize the suffering caused by the ongoing low-interest-rate environment. By managing steering tasks in conjunction with overall bank economics, treasurers can provide crucial insight, stability, and governance as well as economic impact.

Acknowledgments

This report and the underlying BCG Treasury Benchmarking Survey would not have been possible without the cooperation of the banks, as well as the support of the firm’s Financial Institutions practice. The authors would especially like to thank Michael Widowitz and Benedikt Ruprecht, as well as all the participating treasurers.