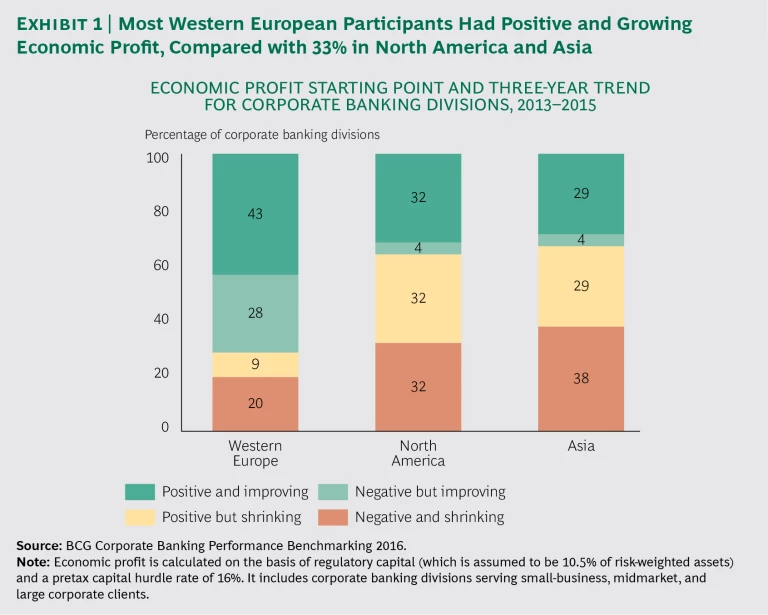

Corporate banking is a tough business. Players everywhere are facing increasing competition, declining revenues, surging regulatory costs, spiking loan losses, and rising capital requirements. But not everyone is being dragged down. In fact, BCG’s most recent Corporate Banking Performance Benchmarking survey—of 300 corporate banking divisions around the world serving the small, midmarket, and large business segments—found a dramatic split between the best and the rest. More than 70% of Western European participants improved their economic profit from 2013 to 2015, generating value for their shareholders, compared with just one-third in North America and Asia. Despite these regional differences, it is noteworthy that top-performing corporate banking divisions delivered shareholder value in every segment and region, from small businesses in Asia to large corporations in Europe.

The corporate banking sector encompasses diverse segments within and across regions, each with varying business and economic dynamics. Nevertheless, this year’s survey revealed a few themes that cut across all those segments. First, nearly all participants in the study reported increased loan volume but falling margins. With interest rates low—even negative, in some markets—and an increasingly heated search for assets, downward margin pressure is likely to remain a fixture. Second, despite efforts to streamline operations and other expenses, operating costs remain stubbornly high for most banks, fueled by significant cost increases in compliance and risk. Embedded inefficiencies in traditional working practices add to the challenge, making it harder to extract savings, improve pricing, and manage risk. Third, while lower loan losses boosted performance for banks in some regions, firms in several Asian markets—as well as in economies such as the US that are affected by the volatility in oil prices—experienced a marked rise in loan losses.

What’s more, the corporate banking sector is in the throes of profound disruption—and it’s happening whether or not banks are fully ready.

The impact will only grow more sweeping as digitally enabled business models redefine the movement of data and money and change the economics of corporate banking business models.

Banking leaders face an urgent need to radically optimize performance and commit to a continuous digital transformation. Our benchmark data confirms the hazards of clinging to traditional credit-centric revenue models and static, inflexible operating practices. Incumbent banks must embrace deep, systemic digitization to stay relevant, open up new paths to sustained economic profit generation, and overhaul all key levers.

The time for this radical shift is now. Top players are already using digital approaches to boost corporate banking value creation and generate the profits needed to support far-reaching digital transformation—including next-generation corporate bank models, such as industry-specific ecosystems.

The trouble, of course, is that such evolution takes significant investment and, right now, banks are straining to keep up with current demands. To reshape their business and operating models and meet the challenges and opportunities presented by the postcrisis environment, corporate banking divisions must move swiftly to do the following:

- Define a vision and determine the digital capabilities necessary to improve the performance of all the classic levers of corporate banking, including salesforce effectiveness, end-to-end operations, risk, and capital and liquidity management.

- Invest in new digital offerings and business models.

- Fund the journey, starting with pricing and other near-term actions, such as procurement and organizational redesign, until digitally accelerated processes start to generate funds.

- Launch an effort, led by the corporate banking CEO and his or her C-suite executives, to change the culture and manage the transformation program successfully.

The State of the Corporate Banking Industry

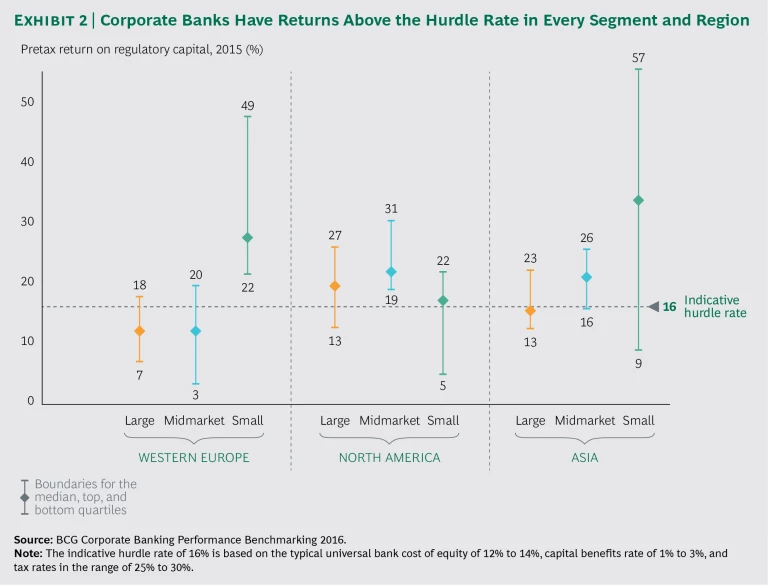

Our benchmark study found that relatively few participants reported positive and growing economic profit from 2013 through 2015; less than one-third in North America and Asia and less than half in Western Europe, for instance. (See Exhibit 1.) In addition, while top players achieved returns on capital above our hurdle rate, bottom-quartile players performed below the hurdle rate in almost every region and

For example, the economic profit of around 70% of corporate banking divisions in Western Europe improved despite ongoing economic challenges. That’s a marked contrast to our 2011–2013 study, when economic profit improved for just one-third of Western European divisions. Conversely, the economic profit of close to two-thirds of North American corporate banking divisions shrank during that period, a worrying trend that has been somewhat camouflaged by the fact that many divisions in the region still post relatively high returns on capital. In Asia, two-thirds of the corporate banking divisions in our benchmark also reported shrinking economic profit, which eroded shareholder value.

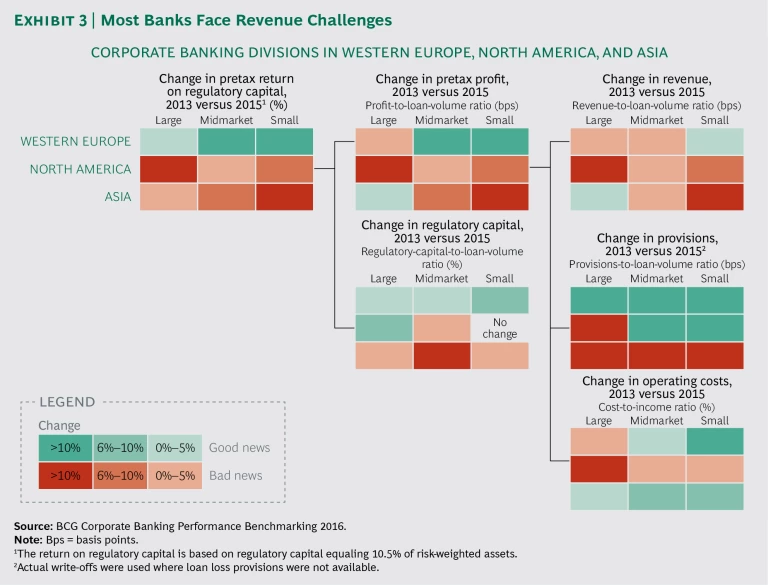

Looking across regions and segments, it’s clear that margin declines are endemic. (See Exhibit 3.) Improving loan losses gave a lift to most segments in Europe and North America, but large corporate divisions in North America were battered by energy-related credit issues. European small-business and midmarket divisions benefited from substantial improvement in their cost-to-income ratios on average. The same was not true in North America, where stubborn cost pressures overpowered revenues.

Our benchmark study found that European players succeeded in reducing their capital consumption, as evidenced by declining regulatory-capital-to-loan-volume ratios in all segments. Some North American banks had similar results, specifically in the large-cap segment. In Asia, by contrast, rising capital figures, combined with higher loan losses, overcame improvements in cost-to-income ratios to weigh down returns on capital.

Notably, the benchmark data revealed a wide gap between top-performing firms in the industry and the rest. Our analysis shows that leading corporate banking divisions excel in the following four ways.

Top Players Are Dramatically Less Credit-Centric

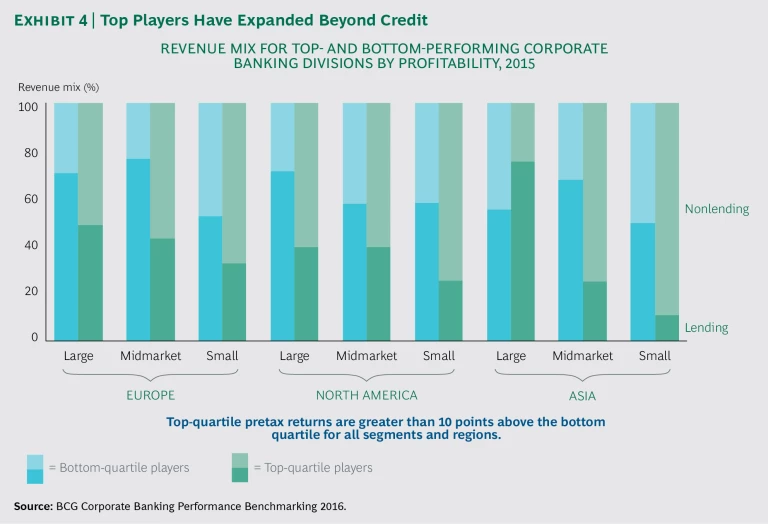

The best-performing banks have broadened their revenue models to serve a greater share of the client wallet. (See Exhibit 4.) They are able to use solid product capabilities as well as strong top-down strategic direction to steer the sales force toward capital-light products and clients. Targeting attractive client segments—often those with a healthy mix of noncredit revenues and lower risk and capital consumption—has been a priority for top players. This gives them a broader base from which to push capital-light banking services, particularly transaction banking, deposit products, and investment banking. As a result, top-quartile banks are earning a pretax return on regulatory capital that is more than 10 percentage points higher than that of bottom-quartile players in every segment and region.

They Deliver Substantially Higher Risk-Adjusted Lending Margins

Aided by superior sales force management practices, client targeting, and tools that often include sales and underwriting capabilities tailored for the industry, corporate banking leaders are doing a better job of identifying which clients and prospects represent lower risk. This allows them to grow their customer base accordingly and to price higher-risk clients appropriately.

They Excel in Managing Operating Costs

Top-quartile banks in even the most challenging regions and segments are stretching their budgets further. A comparison of operating leverage performance (calculated by subtracting cost growth from revenue growth) among banks in Western Europe revealed gaps of 11 percentage points between the top and bottom quartiles of the large corporate divisions, 10 percentage points in the midmarket band, and 4 percentage points in the small-business segment. This means that some divisions in every region and segment have found a way to manage the inherent tension between growing revenues faster than operating costs while managing capital consumption.

Others will need to do the same. But after headcount and other surface-level fixes have been made, the only way to improve is by addressing entrenched costs. Paper-based processes, fragmented systems, a heavy reliance on physical channels, and limited data transparency are among the many embedded inefficiencies. As we know from BCG’s Corporate Banking Operational Excellence benchmarking studies, many corporate banks struggle to report even basic end-to-end metrics, such as loan application turnaround and cash management onboarding times. This makes it hard for managers to gauge performance. BCG’s work on “smart compliance” shows that new technologies and innovative compliance processes are the only way to offset the bottom-line impact of major increases in compliance and risk management costs. Entrenched costs add millions in annual expenses—depleting resources that banks sorely need in order to fund process and service innovation.

They Have Highly Capable Sales Forces

Corporate banking sales forces are generally benchmarked on the basis of metrics such as volume and revenue per relationship manager (RM), but we wanted to understand how much value RMs are generating when credit risk and capital charges are factored in, especially considering RMs’ first-line-of-defense role in managing risk. Looking at our metric for value contribution per RM, we see wide variation among corporate banks around the

Some of this variation is explained by cross-selling—an area in which bottom-quartile players perform especially poorly. In addition, banks with top-performing RMs are stronger at loan pricing, transaction-banking pricing, and bringing on capital-light products. Furthermore, top players in low-interest-rate environments tend to be better at adjusting pricing structures in order to pass on to clients the burden of low rates.

Digitize Foundational Capabilities or Be Left Behind

Corporate banks are being disrupted by digitization whether or not they are fully ready—and most are not. With the contours of the next-generation banking environment already taking shape, the only way that corporate banks will be able to stay relevant is by adapting their operating model swiftly and aggressively.

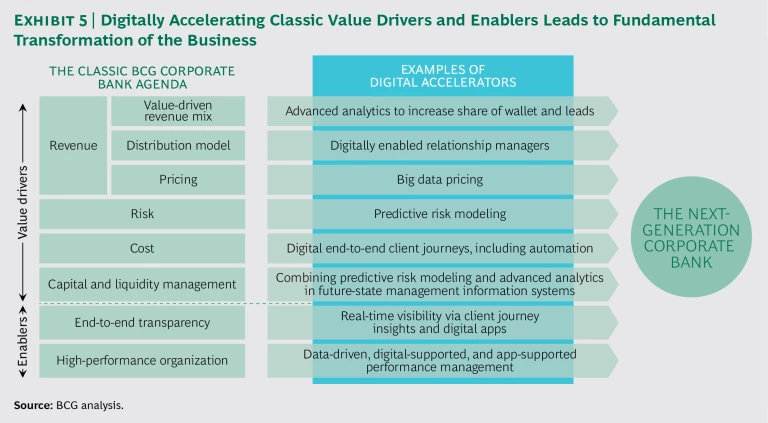

The clock is ticking. Corporate banks have a narrow window of time in which to free up needed resources and develop the basic capabilities necessary for the sweeping transformation that is required. If they can’t manage to do so, they will be eclipsed. Leading banks are already well on their way to digitizing the traditional enablers of value. (See Exhibit 5.) In the process, they are overhauling their client strategies, revenue models, cost performance, risk, and capital and liquidity management. In this environment of razor-thin margins, that approach is game changing. Other banks must likewise move decisively to accelerate the rate of digitization in their core businesses. If they don’t, they will not be able to meet shareholders’ expectations for returns or carve out the investment resources needed to prosper amid the more significant disruptions looming over the horizon, such as Industry 4.0, next-generation banking ecosystems, and banking networks with the Internet of Things. Breakaway banks that gain a two- or three-year head start may create a nearly insurmountable competitive barrier for laggards.

Banks must start by addressing pricing—usually the single biggest source of untapped funding for digital investment. A focus on the client journey and client-centric innovation is also critical. In addition, banks must modernize their IT infrastructures and embrace agile ways of working. And they need to develop more effective and collaborative sales force practices. One key change will affect the role of the RM. The digital approaches we describe below will enable all RMs to spend more one-on-one time serving as strategic advisors to high-value clients and to use digitally enabled tools and channels to streamline service and expand client reach. Some clients may ultimately opt for an entirely digital self-service model.

Revenue Levers

In the near term, banks can gain significant improvement by digitizing three areas that our research and client work show to be core revenue drivers.

Apply advanced analytics to increase share of wallet and generate leads. Our casework with corporate banks has shown that RM-centric advanced analytics can dramatically accelerate cross-selling and improve prospecting. RMs can see which products the bank’s clients are using, whether consumption is going up or down, and how buying behavior compares with that of similar clients. Transaction and external data feeds can be integrated to generate extra insight. When integrated with customer relationship management (CRM) and other enterprise systems, these analytics can help RMs refine their targeting—by flagging clients with notable product gaps relative to their peers—and give RMs concrete benefits to share with prospects.

Many banks have been working on share-of-wallet analyses using familiar spreadsheet tools for years, often struggling to convince sales forces that the insights are worth the effort. Feedback from RMs about the next generation of analytical support, however, is much more positive because the platforms are easier to use and clearly help them reach their goals. A central European bank, for example, developed such a platform and achieved startling improvements in performance during the first year; revenues were up 10% to 15% in its corporate segment, and new client volumes were up more than 30% in its small-and-midmarket-enterprises segment.

Digitally enable RMs. To support RMs in increasing share of wallet and acquiring new clients, a bank in Southeast Asia created an analytics engine that scanned hundreds of internal and external data sources for specific client, market, and industry trends. RMs could log on to this platform, punch in a client or prospect’s name, and receive a comprehensive profile including such data as the company’s buying history, business and financial background, and risk indicators. The system cut RM prep time from hours to minutes. In addition, by pulling in data from a bank’s CRM system and from online sources, such as social networks, RMs and product specialists using this system can determine who in the bank might be able to help facilitate introductions to a new account.

Similarly, an Indian bank developed a pipeline management tool to provide RMs with “next best offer” insights and integrated share-of-wallet information. The tool pulled information from across the bank’s client base, including client buying preferences, interaction history, and significant events in a company’s life cycle, such as a major acquisition, divestiture, or product launch. The tool provides RMs with real-time alerts on their tablets and mobile devices—such as a notification whenever limit utilization falls below a predefined threshold. Those insights allow RMs to have richer and more comprehensive conversations with clients. The result has been a 20% to 30% jump in productivity for the bank.

Banks are also digitally enabling work processes and collaboration among RMs, product specialists, and risk colleagues. Digital apps can improve collaboration in account planning and sales execution between RMs and product specialists, and they can improve the end-to-end credit process through the use of updates and alerts that facilitate communication and the sharing of data.

Client analytics can help banks identify which clients are the most profitable and which are the least so that RMs can apportion their time accordingly. At one European bank, for instance, priority clients are assigned a dedicated RM and receive specialized lending and investment offerings as well as fast-track credit and transaction approvals; meanwhile, those in the middle and basic tiers receive incentives to access lower-cost, streamlined product portfolios through phone, mobile, and online channels. The moves have proved to be a win-win, lowering the cost to serve while raising overall satisfaction across client tiers.

Adjust pricing to fund the journey. Greater discounting discipline and related pricing improvements deliver significant returns for very little investment in the near term. Leading banks are pushing pricing excellence to new levels with digital platforms and pricing tools that RMs can use in the field. Such tools let RMs obtain input regarding the client’s parameters from the bank’s treasury and risk groups, as well as guidelines for target prices and exception management. RMs can also access pricing comparisons from similar deals, along with training modules and negotiation tips and scripts.

Data-enabled dashboards and league tables increase transparency and friendly competition. An RM negotiating a $10 million loan with a food-processing company can see the rates and discounting offered to other clients with similar needs and profiles and understand the client’s price sensitivity at a glance. If it turns out that the loan pricing is too low, the RM receives a list of strategies and incentives to help migrate the client to a higher pricing band. That way, RMs can increase high-value volume and minimize low- and no-margin deals.

Other Value Drivers

Digitization can also accelerate performance and generate measurable short-term gains in other areas critical to unlocking value.

Use predictive modeling and automated account management to lower risk and cost. Corporate banking credit processes tend to rely on paper and manually intensive processes. Staff can spend inordinate amounts of time gathering information at great cost to the bank—and materials such as financial statements can often be months old. Meanwhile, the cash management department is sitting on customer transaction data containing a trove of insights about credit risk. Mining that data could improve risk performance considerably. One North American bank with more than 50,000 commercial customers, for example, used transaction data to refocus its annual reviews—and shaved 25% off the cost of that process while improving the detection of bad loans as a result. The bank also learned that about 80% of its bad loans could have been detected at least a year earlier if the predictive-risk modeling engine had been in place. The bank now expects to reduce credit losses by up to 10%, and as its ability to refine the accuracy of risk-weighted asset calculations improves, it could release up to 30% of capital.

Risk insights gathered from customer transaction data can allow banks to enter new but unproven markets. Partnering with an online marketplace, for example, allowed one Indian bank to gain financial performance data—such as sales volume, returns, and customer satisfaction—about the internet merchants that bought and sold goods over the platform. The bank’s credit risk modeling system integrated the data, which allowed the bank to expand the number of internet merchants it served and render better credit decisions.

Finally, predictive-modeling techniques can help to fast-track approvals for routine requests, such as credit line increases for existing clients, and better identify small-ticket credit up-selling opportunities. This frees up RMs to spend more time with clients and to evaluate complex situations that require greater professional judgment and advice.

Dramatically improve end-to-end client journeys. Corporate banking clients often complain about product silos, black-box processes, and endless requests to resubmit information. A surprisingly large amount of resources are consumed by providing basic information to clients, such as the status of their payments and loans. Banks haven’t been blind to the difference between their customers’ experience of banking interactions and the streamlined digital interactions that those customers enjoy in other areas of their professional and personal lives. The most adept organizations are investing in the end-to-end digital redesign of critical customer journeys, such as onboarding, loan origination, and payments tracking and reconciliation.

This can have multiple benefits. A clean process makes customers happy and reduces attrition—a critical outcome as the battle for clients intensifies. Cleaner processes are also less expensive, sometimes by as much as 30% to 50%, because they require less staff time all along the value chain. Finally, optimized client journeys consume less sales force time and allow RMs to focus on client relationship development or increase the client coverage ratio and thus reduce operational costs.

At one European bank, for instance, half of all calls to customer service involved payments. Tracking down digital payments, scanning confirmations, and managing exceptions required hundreds of staff members and thousands of hours. The bank halted that waste by bringing a customer-centric mindset to the entire payments experience. The result was a digitized client self-service function that provided needed information quickly and saved millions of euros for the bank.

Embed capital and liquidity management into sales force and executive level management. Despite the dollars that have been funneled into capital and liquidity management initiatives following the 2007–2008 global financial crisis, it’s not uncommon to see RMs pricing deals with inadequate or misaligned risk, liquidity, and capital data, or to find business unit CEOs who are offered incentives based purely on volume and revenue. Leading players manage differently. Not only are they using predictive-risk modeling techniques to improve credit risk assessment, fulfillment, and risk-weighted asset calculations, but they’re also using those methods to reduce the conservatism built into some models to compensate for weaknesses in data availability and quality.

Enablers

Digital tools and processes can help shape corporate culture and promote desired employee behaviors. Simply deploying RM league tables, for example, can change behaviors in subtle but powerful ways. Insights from the client journey help banks address a slew of trickle-down issues, such as turnaround times and costs per loan, which allow managers to make more accurate decisions.

Some banks are deploying digital tools to help staff improve their skills. This effort could include setting up digital learning academies that offer instruction on things such as loan structuring and price negotiation as well as soft skills, including leadership, sales force effectiveness, and teaming. BCG has helped clients develop apps that staff can use to set and track their progress toward performance goals. For example, a bank might define a set of goals for salespeople, such as making a certain number of client calls, learning about a new product, involving risk managers early on in complex deals, or reaching out to a more experienced colleague for tips and coaching. Such an app would let employees track their own behavior and help them get constructive feedback from their peers. Deploying these tools on smartphones can be dramatically more effective than traditional classroom training or episodic employee reviews. (See “A Future Day in the Life of a Digibank Relationship Manager.”)

A Future Day in the Life of a DigiBank Relationship Manager

It’s Monday morning, and Sara leaves her apartment. “The usual,” she says to her smartwatch, which orders her daily beverage—an extra-hot latte with 1% milk, honey, and extra foam—and summons a cab to collect her at the coffee shop a minute after the latte is ready.

Her car app anticipates that it’s taking her to the first meeting on her calendar. She taps “yes” to acknowledge, then opens the Digibank RM app on her smartphone. She’s off to meet with Client 9, one of her biggest health care clients, which wants to finance a major expansion. She’s already viewed the latest financials shared by the client on the bank’s credit platform and run them by the risk team and health care experts, so she feels ready.

Tapping the “client radar” tab, Sara checks on her other clients. She sees that the risk system has just approved Client 12 for a larger operating line of credit on the basis of its cash management transaction behavior, and that the CFO of the company has already clicked to execute the offer on his client portal. She creates a reminder to call him that afternoon and smiles as she remembers her uncle telling stories about the paper applications that clients had to file when they wanted a higher credit limit years ago.

Sara runs through client questions from the e-learning refresher she took last week. Her gut tells her that there may be bigger opportunities with Client 12, which is on her yellow list of clients she hasn’t spoken to in a while. (Sara prides herself on never having a client on the red list and enjoys being number one when the weekly “client connection” rankings show up on her colleagues’ phones on Friday afternoon.)

She clicks through her other reminders, okays a request from the office’s foreign-exchange specialist to call one of her clients, checks on the status of her new loan applications (Client 14’s loan has gone orange in Loan Operations, and she pings the department for an update), and scans her e-mail for recent messages.

Traffic is bad, so she checks out her prospecting app while she waits. The client acquisition indicator glows green, indicating that an updated “know your customer” baseline is available from the industry utility. The social network function shows that Prospect 3 is in the same industrial park as two existing clients and that the company’s CFO has a relationship with one of them. It shouldn’t be hard to get an introduction.

She remembers the Industry 4.0 experts’ lunch-and-learn talk about specialty medical device companies investing in 3D printers and moving away from old-fashioned warehouse inventories. This requires different financing options, and Digibank’s B2B payments platform integrates well with company websites and order management systems. It might be another chance to steal a client from Paperbank. She pings the health care expert, sends him the prospect report, and asks when she can call him so she can sharpen her skills with regard to 3D-printing business models.

Her cab pulls up at Client 9’s office. She glances at the CRM profile one more time, puts away her phone, and heads into the building to help the client finalize the biggest investments of his career.

The Next-Generation Corporate Bank

We don’t know precisely what corporate banking will look like in 20 years, but we’re getting clear indications of where the industry is heading. These indications come from every region of the world and all kinds of players, including aggressive incumbents, financial technology companies (fintechs), and fast-growing Asian banks that are in many ways leapfrogging brand-name Western corporate banks.

There are a number of possible scenarios. We envision three here that have strong potential to emerge, whether individually or collectively: Industry 4.0, ecosystem banking, and banking with the Internet of Things.

Industry 4.0: An Example of Industry Specialization

The rise of Industry 4.0 shows how technology can change both the business ecosystems of specific industries and the financial services that they use. Industry 4.0 will connect buildings, vehicles, sensors, and machines. These connected systems and networks make it possible to gather and analyze data, predict failure, and adapt to changes, enabling faster, more flexible, and more efficient processes that can generate significant increases in productivity. These capabilities will fundamentally change relationships among banks, suppliers, producers, and customers, and introduce radical new business models.

Consider the example of a crane manufacturer that specializes in shipping and cargo. Typically, the manufacturer would build a small number of cranes and sell them—a business model that needs substantial amounts of working capital and involves a relatively small number of payments each year. With Industry 4.0, the cranes are digitally enabled and integrated into the business system, where they can continuously weigh containers and interact with shipload management systems. In fact, the crane company can move from selling cranes to selling services related to loading and unloading ships, paid on a per-container basis, in addition to other value-added services. Now the company has a much bigger balance sheet. It’s also making millions of transactions per year and needs a more sophisticated and scalable cash management service.

Banks that have developed the industry-specific capabilities to service such companies and advise their clients on how to adapt financially will have an advantage.

Ecosystem Banking

It’s no accident that digital leaders in many industries are often also platform leaders; think Amazon, for example. In the future, many parts of the economy will be marked by industry-specific value chain platforms. This will allow corporate banks to serve the platform, whether it is a large anchor company or a more diffuse network of companies linked by a common industry-specific platform.

Here’s how it might work. In a traditional setting, the large corporate division might own the relationship with the anchor company, providing loans, cash management, and other services. The midmarket division might work with the anchor’s various credit-centric suppliers and distributors. And local branches might serve some of the small businesses in the network. Each relationship exists in isolation. Credit decisions are based on financial statements and collateral. Payments on the bank’s cash management system are mirrored by a parallel flow of purchase orders, invoices, and so on.

Now consider how a digital leader would serve this ecosystem with banking and nonbanking services. A shared platform would enable all entities to exchange information, initiate and close transactions, pass on—or even discount—invoices, and make payments. A bank that participated in this system would have access to a wealth of data about each company’s transactions and accompanying information; it would be able, for example, to identify certain small businesses as excellent credit risks because of the steady volume of revenue it received from blue-chip companies.

This is not a new idea. Various banks and nonbanks have been experimenting with financial supply chain solutions for years. Advances in digital technologies and the growing readiness and ability of companies of all sizes to participate in such an ecosystem, however, will soon usher in a significant increase in adoption as firms learn about the ability of such platforms to improve the operational performance of each ecosystem participant.

The draw is the nearly unbounded potential for growth, which is continually expanding as partners add their own services and innovations and as more clients and vendors engage. With highly automated, scalable, software-based services, ecosystem operators will gain an unprecedented advantage. Over time, this will lead to a few (if not just one) dominant players per industry-specific ecosystem. Corporate banks that don’t participate will find themselves excluded from large portions of the revenue pools of such industry-specific ecosystems.

Having identified a significant opportunity to reposition itself in the agribusiness market, one large Asian bank, for example, is creating digital ecosystems to serve the specific needs of farmers, fleet owners, food processors, distributors, and other agents. The offering is differentiated by fruits and vegetables, dairy, poultry, and other subsectors, because each has a different value chain and industry dynamic. Through partnerships with large agribusiness-based companies, the bank will provide information and business solutions to each player in the value chain to continuously optimize each participant’s business model and operations, as well as offer tailored financial services, such as cattle loans for dairy farmers, fleet financing for logistics providers, and cash management solutions for dairy processors. The bank gains unprecedented visibility across the value chain, enabling it to offer end-to-end banking products. For example, the bank has built a digital lending offering that mines the transaction data captured across the ecosystem. When complete, the ecosystem model could generate significant new revenue streams for the bank while lowering operating expenses and risk.

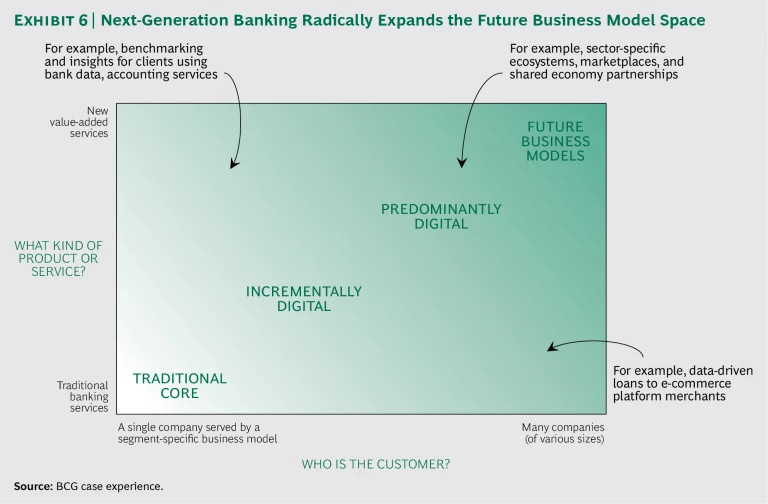

If they get as big as some predict, ecosystem models will transform the way corporate customers do business and how banks serve them. The solution space will expand dramatically—and allow banks to move from a one-to-one model based on traditional products to a one-to-many approach featuring new digital products and services, many of which will be easily customized at scale. (See Exhibit 6).

Leading banks are already thinking in these terms and asking themselves strategic questions: Should we invest to be the first movers in our country in ecosystem banking? If so, which ecosystems should we choose, what should we offer ourselves, and where should we partner with fintechs or other platform players? If not—because this will expose us to the risk of being commoditized and played off against other banks, industry conglomerates, or technology leaders—should we push to own the ecosystem platforms?

Banking with the Internet of Things

A more ambitious future could be built on the Internet of Things. For instance, think of a world in which trucks are not only self-driving but also autonomous business units. A truck could be programmed to join an Uber-style system for shipping containers. When empty, it would log on to the platform and sign up for whichever shipping-container journey was identified as optimal by its profit-maximizing algorithm. The container might pay the truck on a per-kilometer basis, using a blockchain-enabled smart contract. The truck might similarly pay its own tolls and refueling charges as it goes along.

Banking in this business system would be completely different. Today, a bank might lend money to a trucking company to finance a truck, then process the checks and electronic payments made from customers to the company and from the company to fuel card providers and maintenance shops based on paper or e-mail invoices to the company’s finance department. In the future, there will be exponentially more payments that will all be fully digital. The bank will increasingly be seen as a trusted provider and fraud risk manager, generating new service opportunities and revenue streams.

How to Begin the Transformation

Although all corporate banks have taken at least tentative steps on the path to digitization, launching a long-term strategic transformation can be daunting, especially since it is extremely difficult to predict where the market will be in a few years.

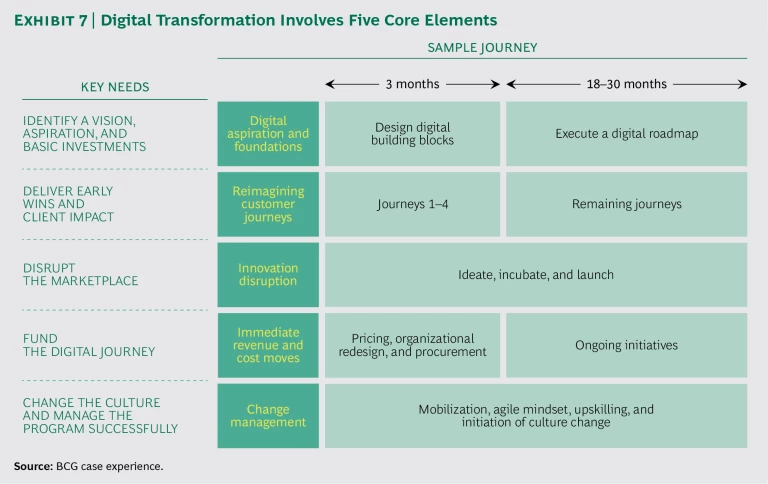

Rather than focusing on specific projects or products, it is important to identify a transformation path that keeps options open while building digital capabilities and generating near-term cash to fund the ongoing journey. In our experience, this path comprises five key elements. (See Exhibit 7.)

First, determine the bank’s digital aspirations and future strategy. This includes assessing its current capabilities and constraints. Once this vision has been outlined, the required foundational investments become clear. Those investments will cover things like IT, big data, agile expertise, and process changes to digitally enable the bank’s broader organization and facilitate the digital culture shift needed.

Second, the bank needs to inventory its clients’ journeys and redesign the most important set, usually starting with no more than four and adding others over the next several months. This will provide some early client-facing wins and momentum inside the bank.

Third, the bank should consider which potentially game-changing disruptive businesses to invest in and at what level. These high-risk, high-return digital business ventures are very different from the traditional business of corporate banks. Yet staying away and leaving the field open to fintechs, more aggressive banks, and competitors from other B2B industries could be very damaging. Catching up may be extremely difficult, if not impossible.

Fourth, the bank will need to develop a comprehensive plan to fund the journey. It will likely start with near-term, high-impact levers, such as pricing, procurement, and organizational redesign programs aimed at eliminating costly complexities and low-value activities and redeploying resources to the future agenda.

Fifth, the bank must commit to a rigorously executed change management program. The digital investments will affect clients and large numbers of staff, potentially cannibalizing existing businesses. Change management starts with the CEO and the C-suite team, who must back the digital vision and demonstrate their support to the organization. Staff at all levels must gain expertise and become increasingly knowledgeable in digital topics. After that, digital ways of thinking, partnering, and agile working must be embedded into the organization. And because the number, scale, and budget of the individual projects involved in such a program today may be an order of magnitude greater than the project agenda of a corporate bank some years ago, investing in governance and program management capabilities so that senior executives can keep such a program on track is critical.

Corporate banking divisions have emerged from the financial crisis only to be hit by a massive digital disruption. To stay viable, they need to understand the client journeys that matter most, invest in continual client-centric innovation, adopt agile ways of working, and create more effective and collaborative cultures. The example of early movers makes clear that the next-generation bank is around the corner. The only question is, which banks will be among them?

Acknowledgments

The authors would particularly like to thank the following colleagues for their valuable contributions to the conception and development of this report: Pallavi Agarwal, Shreya Aggarwal, Ankit Gupta, Anubhav Jain, Aditya Jandial, Liliya Maliauka, Brad Mayer, and Francois Orain.

The authors would also like to thank Marie Glenn for her assistance in writing the report, and Philip Crawford for helping to coordinate its preparation and distribution. Finally, they thank Katherine Andrews, Gary Callahan, Lilith Fondulas, Kim Friedman, Abby Garland, and Sara Strassenreiter for their contributions to its editing, design, and production.