This article is an excerpt from Global Leaders, Challengers, and Champions: The Engines of Emerging Markets (BCG report, June 2016).

2016 BCG Global Challengers

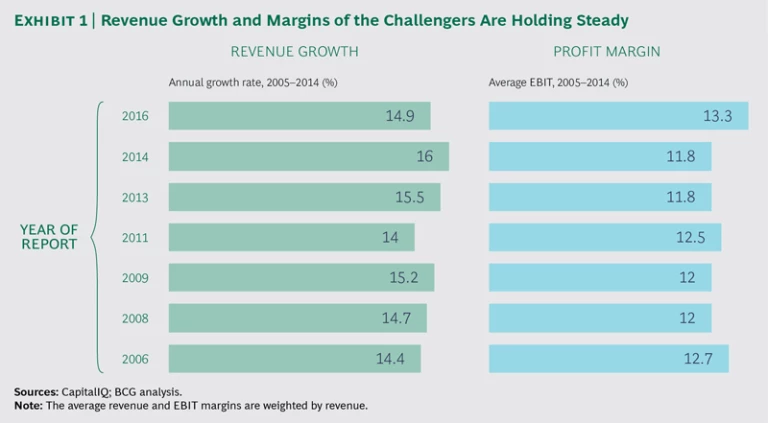

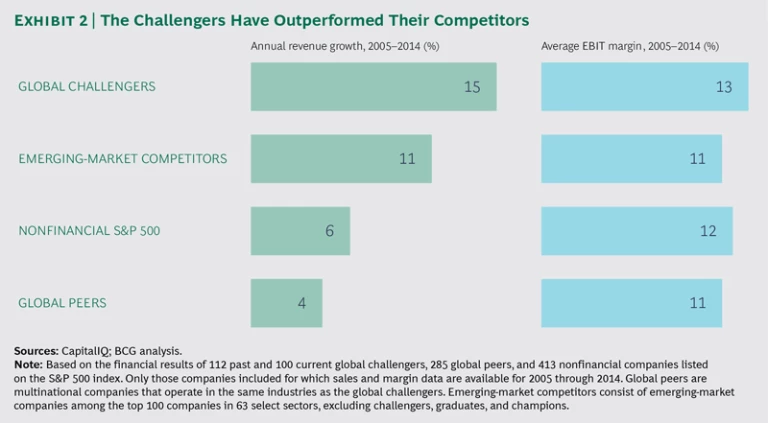

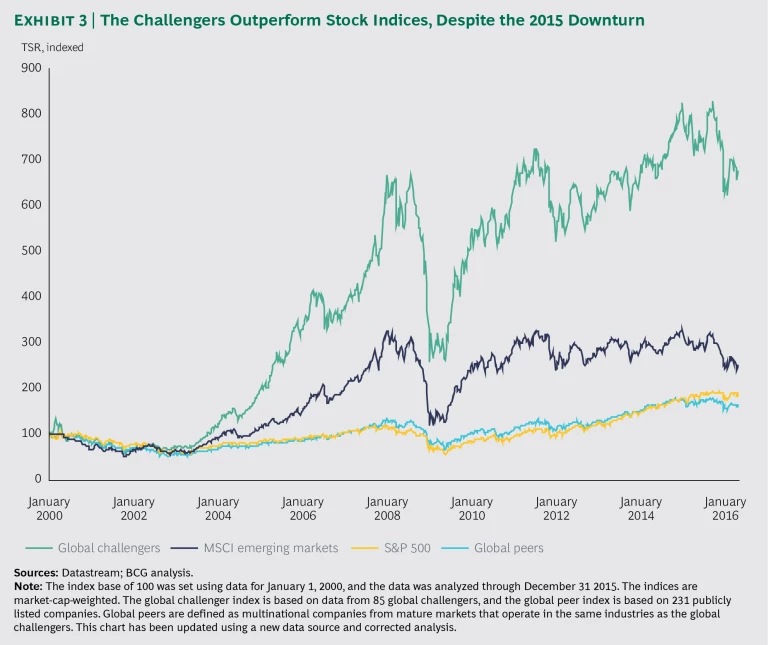

Despite economic turmoil in emerging markets , the latest global challengers have maintained both their growth rates and profit margins. (See Exhibits 1 and 2.) The global challengers nearly quintupled their share of overseas revenue from 2005 through 2014. Not surprisingly, this performance has translated into strong total shareholder returns, even with the downturn in 2015. (See Exhibit 3.)

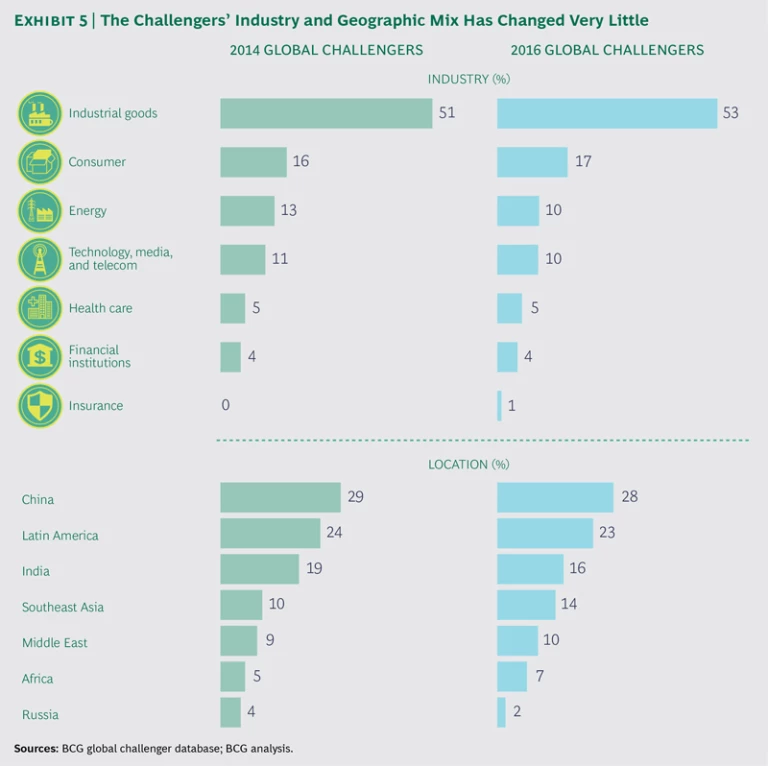

But the numbers tell only part of the story. What are these companies exactly, and where do they come from? (See Exhibit 4.) Outwardly, there has been little shift in the industry or geographic mix of the global challengers. Industrial goods is still the sector with the largest number of challengers; among countries, China and India come out on top. (See Exhibit 5.) This high-level view, however, does not capture many of the undercurrents that are starting to ripple to the surface.

One shift is that resource and commodity companies may have passed their high-water mark. These companies have always made up a healthy share of the global challengers. And they do so in this year’s report as well, accounting for 24% of companies on the list. But between 2014 and 2016, the number of challenger energy companies declined from 13 to 10. And none of the new challengers is solely in the resource or commodity business. (The new challenger Grupo México is also active in railroads.) Moreover, as noted earlier, the effect of the drop in commodity prices that occurred in 2015 is not reflected in the composition of this year’s list.

Another trend is the rise of a new breed of consumer companies. The consumer-oriented challengers on this year’s list are moving beyond advantages based on cost and access to raw materials such as palm oil. They include Dalian Wanda, a luxury hotel and resort developer from China, and Discovery, a financial services firm from South Africa.

The new challengers are also appealing to the digital needs of the expanding middle class in emerging markets. Two prime examples are Axiata, a leading regional telecom operator, and Xiaomi, a maker of smartphones. Remarkably, the revenues of device makers from emerging markets grew eightfold from 2005 through 2014, reaching $211 billion. While many device makers are winning with low-cost products, others are increasingly investing in innovation and R&D.

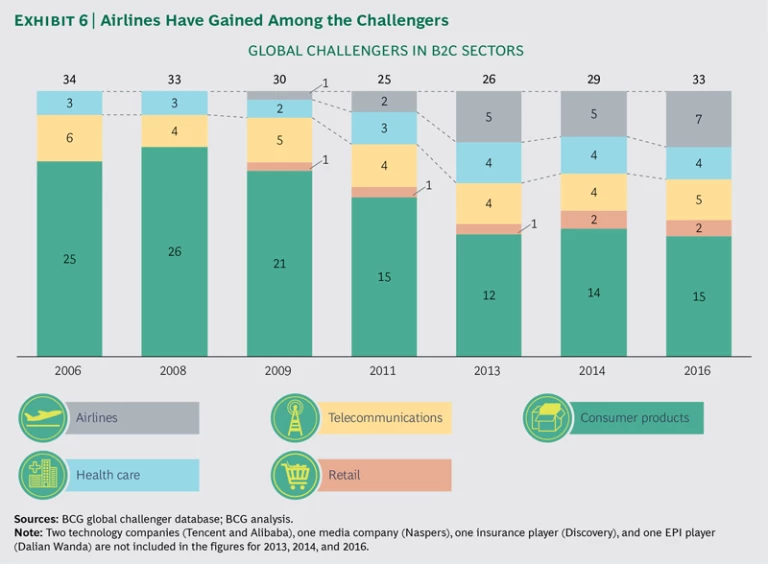

Several other new challengers are likewise emblematic of larger themes. The emergence of China Eastern Airlines and Pegasus Airlines as challengers reflects the rise of air carriers in emerging markets. From 2005 through 2014, the revenues of such airlines tripled, and their global market share rose from one-fifth to one-third. Seven airlines based in emerging markets are now global challengers, compared with none ten years ago. (See Exhibit 6.)

Pharmaceutical companies based in emerging markets have also grown rapidly, from $8 billion in revenues in 2005 to $80 billion in 2014. This growth reflects both inroads in mature markets and rising health care spending in emerging markets. Lupin Pharmaceuticals and Sun Pharmaceuticals, both of India, have completed acquisitions to round out their product portfolios. Indian companies now have a 20% global market share for generic drugs and own 22% of pharmaceutical plants approved by the US Food and Drug Administration. (See “The Sun Machine.”)

The Sun Machine

Just a decade ago, Sun Pharmaceuticals was a successful, midsized company in India with $300 million in sales. But like so many other challengers, the company was restless and eager to expand. Powered largely by both overseas and domestic mergers and acquisitions, Sun recorded sales of $4.4 billion in fiscal year 2015 and has a portfolio of more than 2,000 products.

Since 2005, Sun has nearly doubled its percentage of overseas sales, from 39% to 74%. It has established manufacturing facilities on five continents and in 14 countries, including Bangladesh, Hungary, Malaysia, Nigeria, and the US. In fact, the US accounts for half of Sun’s sales, while other emerging markets account for 14% of revenues.

Since 2010, Sun has completed 11 acquisitions to achieve both geographic reach and portfolio expansion. Its 2015 acquisition of the US company InSite Vision, for example, strengthened its ophthalmic portfolio, while its acquisition of Ranbaxy the same year strengthened its generics footprint in emerging markets.

While Sun remains primarily a generics manufacturer, it is increasing investments in specialty and complex products with higher margins.

Few global media companies have launched from emerging markets, although that may be starting to change. China’s Alibaba has investments in several online media properties, and Dalian Wanda is buying a majority stake in Legendary Entertainment, a Hollywood studio.

Building and Supplying the World

Emerging markets continue to play a significant role in supplying the world’s raw materials and meeting the infrastructure needs of both emerging and mature economies. That role is in flux, however, and most of the new challengers in this category are emphasizing integration, value-added services, and other higher-end capabilities. The name of the game is no longer simply low cost.

- Braskem (Brazil). Braskem is the largest producer of thermoplastic resins in the Americas. The company manufactures polypropylene, polyethylene, PVC, and basic petrochemicals. It has grown both organically and through acquisition. Braskem entered the global market with the acquisition of Sunoco Chemical in 2010 and Dow’s polypropylene business in 2011.

- DMCI Holdings (Philippines). The main businesses of this conglomerate are power generation, property development, construction, mining, and water distribution. The growing economy and population of the Philippines are increasing demand for energy, infrastructure, water, and real estate. Despite softening nickel and coal prices, operational efficiency has helped DMCI Holdings’s mining business continue to generate value.

- Grupo México (Mexico). This conglomerate is the fourth largest copper producer in the world and operates the largest rail network in Mexico. Grupo México benefits from a low cost structure, geographical diversification, fully integrated operations, and strong finances.

- OCP (Morocco). This fertilizer company has exclusive access to the largest phosphate-rock reserves in the world. OCP has focused on integration, ranging from mining to the production of fertilizers and other value-added products, while reducing its environmental footprint. It has production and distribution joint ventures in Asia, Europe, and Brazil, one of the fastest-growing fertilizer markets in the world, where OCP has created an innovative supply channel. The company is also pursuing growth in Africa by encouraging the development of agriculture and the smart use of fertilizer.

Capturing Middle-Class Consumers

Many emerging markets are relatively young countries with a rapidly expanding middle class. This generation of consumers is optimistic, with the disposable income required to spend on goods and services.

Eight of the new challengers are serving the needs of these consumers, although only three of them are traditional fast-moving-consumer-goods companies.

- Alicorp (Peru). This consumer goods company has three main business lines: food, personal, and home care products; industrial food products, such as flour and food oil; and animal nutrition. Its consumer brands are well known throughout Latin America.

- Ayala (Philippines). This conglomerate, founded more than 180 years ago, has holdings in real estate, financial services, telecommunications, water infrastructure, electronics manufacturing, automotive dealerships, and business process outsourcing. It is moving into power generation, transport infrastructure, and education and is expanding primarily in Southeast Asia.

- China Eastern Airlines (China). Started as a largely domestic carrier in 1998, China Eastern has been rapidly expanding overseas. With its main hub in Shanghai, the airline now flies to several destinations in the US and Europe. It also offers flights throughout Southeast Asia that appeal to Chinese tourists.

- Dalian Wanda (China). This Chinese conglomerate has achieved a trifecta. It is the largest owner of luxury hotels, the largest commercial property developer, and the largest owner of cinema chains in the world. It recently announced a deal to buy a majority of Legendary Entertainment, becoming the first Chinese company to own a Hollywood studio. By 2020, Dalian Wanda expects to be one of the world’s five largest companies devoted to entertainment and cultural activities.

- Discovery (South Africa). This insurer has created partnerships and joint ventures with other insurers to enter China, the US, Singapore, Australia, and Europe. Its Vitality health insurance program rewards consumers who make healthy changes in lifestyle. Vitality is currently available in China, South Africa, the UK, and the US.

- Gloria (Peru). This consumer goods conglomerate is training its sights on regional expansion throughout Latin America. Gloria has an active presence in Bolivia, Colombia, Ecuador, Argentina, and Puerto Rico. In 2014, it acquired five companies in Colombia, establishing itself as an important player in that country’s dairy and food and beverage categories.

- Pegasus Airlines (Turkey). The largest low-cost carrier in Turkey, Pegasus increased revenues by 13% and earnings before taxes by 34% in 2015. The airline has a 28% share of the domestic market and a 10% share of international flights. It is growing twice as fast as the market for international routes.

- Universal Robina (Philippines). This is one of the largest food and beverage companies in the Philippines, with a growing presence throughout Southeast Asia and beyond. In 2014, Universal Robina bought Griffin’s Foods, the largest snack maker in New Zealand. Last year, the company was named the best-managed consumer company in Asia by FinanceAsia and Euromoney.

Meeting Digital Needs

The three companies below are tapping into the insatiable demand of consumers to be connected at all times.

- Axiata (Malaysia). This mobile operator has about 290 million customers in ten Asian countries. It recently bought a controlling stake in Nepal’s NCell. While most mobile operators based in emerging markets have struggled to maintain their profitability in recent years, Axiata’s margin has averaged 38% in the three years ending in 2015.

- Tech Mahindra (India). This IT and business-process-services company is active in many industries but especially telecommunications, which accounts for one-half of its revenues. Tech Mahindra is the only Indian IT services company with a major presence in the $43 billion network-infrastructure business. It has engaged in several key strategic deals and partnerships (described later in the report) in order to expand into new businesses.

- Xiaomi (China). Founded in 2010, Xiaomi is already the fourth-largest handset maker globally. It sells more phones in China than Apple and is rapidly expanding into other emerging markets such as India and Indonesia. It sells directly to customers through online channels and keeps close track of feedback and suggestions through social media.