Emerging markets have driven growth for many multinational corporations (MNCs) for years, and they will continue to do so. But these are turbulent times as commodity prices plunge, currencies are devalued, and equity markets gyrate. The profitability of many MNCs’ operations is already under attack, and future performance will be challenged by slower macroeconomic growth, increasing costs, and heightened competition from local companies, which are rapidly gaining scale, experience, and capability. To reduce these pressures, companies will have to focus much more on improving their competitiveness through constant productivity gains.

Most MNCs have emphasized growth in emerging markets at the expense of other metrics, such as operating margins. Shifting the emphasis to include profitability requires implementing process discipline, leveraging scale, and instituting behaviors that focus on constant efficiency gains. Such changes are not easily achieved. For many MNCs, a fundamental transformation will be necessary, executed market by market.

The Changing Nature of Growth and Competition in Emerging Markets

For years, the BRICS (Brazil, Russia, India, China, and South Africa) were synonymous with broad-based, rapid growth. Not anymore. Data for 2015 from Oxford Economics shows China’s GDP growth slowing to 6.5%, South Africa eking out a percentage point or two, Brazil flat, and Russia actually contracting. Growth in other emerging markets, especially those with commodity-dependent economies, has slowed as well.

The economics of emerging markets are also becoming more challenging. China is losing its cost competitiveness in exports thanks to rising labor costs, as well as higher energy costs than those in countries such as the U.S. and Mexico. China has plenty of company: the cost advantages of Brazil, Russia, Poland, and other countries are also diminishing.

Despite the slowdown, this is certainly not the time for MNCs to retreat; if anything, it may be a good opportunity for reengagement, as we have observed before. Some 300 million additional households will enter the consuming class in emerging markets during this decade. The populations of less developed countries are still growing four times faster than those of their developed counterparts: by 2020, 6.4 billion people (out of 7.5 billion worldwide) will be living in emerging markets. These economies will add more than 600 million urban dwellers between now and 2020. An increasing number of free-trade agreements will help contribute to sustainable economic growth. Still, these markets present big challenges for MNCs—the biggest having to do with competition, costs, and shifting relationships with key stakeholders such as employees and governments.

Competition. Most MNCs now face a fast-rising number of agile and aggressive local competitors that are winning share in many industries. The number of companies in Asia with more than $1 billion in annual revenues jumped sixfold to 1,015 between 2003 and 2013 and doubled in Latin America, Africa, and the Middle East to a total of almost 700. And these are not only companies making simple low-cost products or commodity components; many are in sophisticated segments of the engineering and manufacturing sectors. For example, emerging-market-based companies now control between 30% and 80% of the global markets for rolling stock, onshore wind-power equipment, coal power-generation equipment, wireless telecommunications equipment, and photovoltaic equipment. Their competitive prowess is typically rooted in three factors: a significant cost advantage owing to small overheads, lower wages, and lower R&D costs; a deep understanding of local markets and strong relationships with local stakeholders, including both customers and suppliers; and a nimble and aggressive corporate culture, which enables quick decision-making and significant risk-taking.

As the search for growth pushes many MNCs into middle markets in emerging economies—where they seek new middle-class consumers in B2C businesses and small-business customers in B2B—these companies run head-on into local competitors. Middle markets are tough, and in our experience most MNCs have struggled to make money in them. Prices are often only 50% to 70% of those in “high end” markets, where MNCs have traditionally focused. In mobile handsets in Asia, for example, local (mostly Chinese) competitors have erased profits in the lower price segments. In banking, new local operating models based on digital or mobile technologies are constantly pushing down price points. And in many infrastructure projects in emerging markets, competition from local companies has made it much harder for global players to bid successfully.

Costs. MNCs also face profitability pressures owing to flattening revenues and rising factor costs. Data from the European Union Chamber of Commerce in China shows 40% of European MNCs reporting flat or declining revenues in China in 2013, 2014, and 2015. EBIT margins have contracted over the same period, compared with the companies’ worldwide averages. Only 28% of European MNCs are optimistic about their profitability prospects in the next two years, compared with 36% in 2012. Almost one-quarter of companies are actually pessimistic about profitability.

On the manufacturing side, many emerging markets, such as China and Brazil, are no longer the labor bargains they once were, thanks primarily to rising wages. Productivity-adjusted manufacturing wages in China almost tripled from $4.35 to $12.87 per hour between 2004 and 2014; they are now higher than those of Asian neighbors such as Vietnam and India—and roughly on a par with those in Mexico. Manufacturing costs in Brazil jumped 25% over the same period. Workers with the engineering and technical skills that many MNCs need are still few in number, making finding, hiring, training, and retaining them expensive. In addition, their productivity significantly trails the productivity of skilled workers in developed markets.

Relationships with Stakeholders. Adding to these challenges, MNCs are losing their allure for local employees precisely at a time when they need skilled managers and staff on whom they can place added responsibility. And once-welcoming governments are becoming less accommodating as economies mature. Governments feel more confident in their ability to regulate and influence markets, and local companies have become more numerous, more competitive, and more deliberate in lobbying for their benefits. Governments in many emerging markets are less hesitant to flex their muscles, and their actions or interventions usually favor local players. Unpredictability in the regulatory arena, including tariffs, import duties, licenses, and local content requirements, for example, are another source of frequent frustration for MNCs. Governments’ actions are often beyond MNCs’ control, of course, but they underscore the need to improve performance.

The Transformation Imperative

The shifts taking place in emerging markets are big, structural, and long-term. As macroeconomic growth slows and competition rises, improved productivity is a critical foundation for MNCs to continue to grow revenues and profits and gain share. Our MNC clients today talk continually of the need to make operations in emerging markets as productive as those in developed markets. Given such issues as smaller scale and volatile political and economic environments, this is a tall order—and certainly not one to be underestimated. Moreover, companies in many markets should adopt an entrepreneurial approach and find innovative ways to overcome challenges related to talent, infrastructure, and the regulatory environment, rather than wait for governments or others to solve structural problems.

Shifting focus from growth toward a combination of growth and rapid, steady productivity gains requires changes in both strategy and execution. It also usually requires a shift in thinking about goals, processes, and governance on the part of both global and local management.

Many MNCs will have to undertake a process of transformation in emerging markets. As we have written before, transformations are not just for troubled companies; they have become necessary interventions in many, if not most, corporations. Less than half of BCG clients that have undergone a transformation effort over the past decade had been chronic underperformers, and nearly one-quarter had been consistently ahead of their competitors.

We define a transformation as a profound change in a company’s strategy, business model, organization, culture, people, and processes. A transformation is not an incremental change but a fundamental reboot that enables a business to achieve a sustainable quantum improvement in performance, altering the trajectory of its future. Successful transformation normally requires rapid short-term improvements to the bottom line to establish traction and position the company to win in the medium term. At the same time, companies need to build the right organization and culture to achieve sustainable results over the long term. All these changes must happen in parallel.

Because of their comprehensive nature and the need for companies to implement them quickly, transformations are complex endeavors. Most of them fail either to fully capture the potential value or to embed new behaviors and processes in the time allotted. Evidence from the experiences of non-BCG clients undergoing publicly announced transformations from 2003 through 2013 shows that up to 75% of those efforts fell short of their targets in terms of implementation time, value captured, or both. Only 25% captured short- and long-term performance gains compared with their sector average.

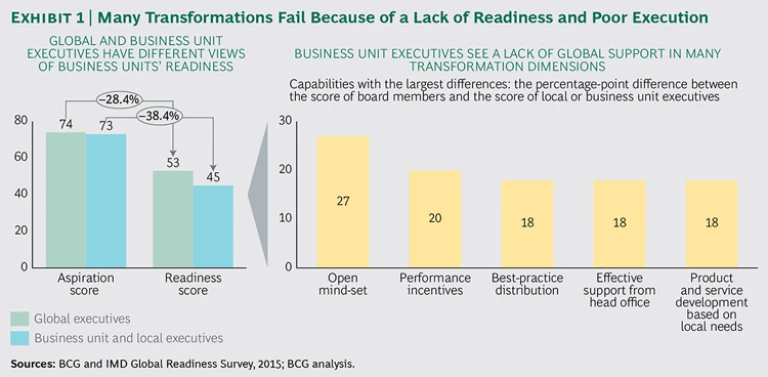

The risk of failure in transformations in emerging markets is even greater. As we observed recently, only about 10% of companies believe they have the full complement of capabilities required to win overseas. Most think they are barely mastering the basics. Moreover, while many companies get their broad globalization strategies right, they come up short on execution in individual markets. Issues related to execution were where our research found the biggest gaps between leaders and laggards. (See Exhibit 1.)

MNCs should move quickly, but they should also advance with care. The biggest mistake they can make is to pursue a transformation driven by headquarters that tries to standardize and centralize processes and operating procedures for all markets. MNCs are much better advised to approach the challenge one market at a time, starting with a high-profile struggling market and experimenting with what works there.

Transforming Local Operations

Historically, rapid growth in emerging markets allowed most companies to support behaviors such as approving investments without defined returns or time frames, extensive customization of products, limited process discipline, and building up teams in anticipation of future growth. A growth bias was vital to capturing share in markets that were expanding at breakneck speeds. Disciplines such as applying proven practices, cost containment, and investment prioritization were secondary considerations, partly because local organizations were overwhelmed just keeping up with their growth.

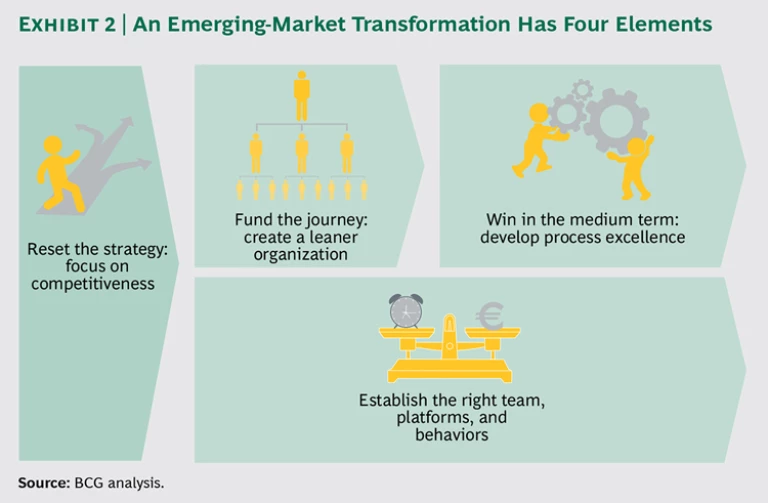

MNCs need to rethink and rebalance trade-offs in their priorities, products, systems, and people as they seek to improve their competitiveness by moving from greater centralization to strengthening local accountability. In our experience, this sort of rebalancing is best achieved through a four-step transformation process. (See Exhibit 2.)

- Resetting the strategy to focus on competitiveness

- Funding the journey by restructuring the local organization to make it leaner and more accountable

- Winning in the medium term through process excellence—eliminating waste and instilling simplification, standardization, and automation

- Establishing the right team, platforms, and behaviors for longer-term competitiveness

Resetting the Strategy to Focus on Competitiveness

MNCs need to shift their focus from purely maximizing growth, typically by investing in all sizable emerging markets, to determining which emerging markets offer the best potential for establishing leading positions and achieving above-average profitability. We have worked with many clients making such decisions. For example, one global medical-equipment manufacturer made its emerging-market plans on the basis of projections of the number of devices to be sold ten years out. A global industrial-equipment manufacturer launched a massive expansion of its operations in China despite profitability concerns—in order to put pressure on local competitors in their home markets.

While the assessment of growth potential remains critical, MNC strategy also has to focus on profitability and returns on investment. More and more companies are asking such questions as, What is the investment risk in each of our markets? Which customer segments can we serve competitively? Do we have product segments in which slowing growth and declining profitability mean we should question the viability of the business?

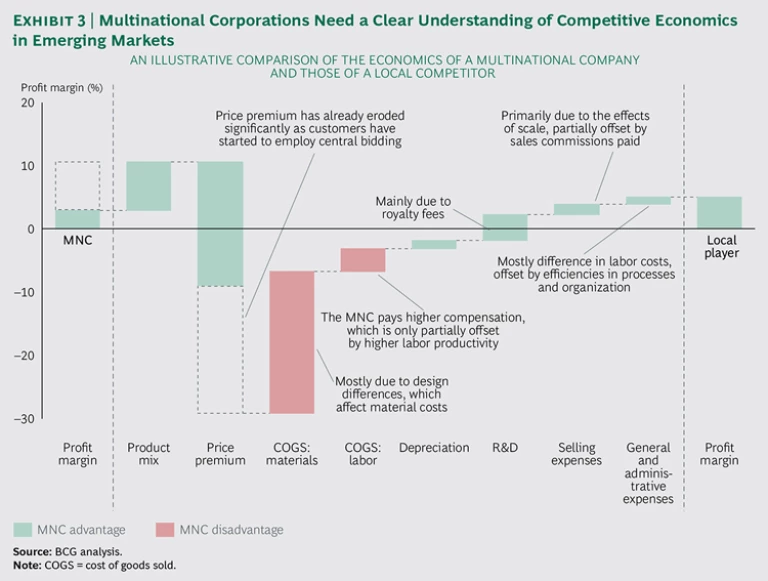

The biggest difference between past and future assessments needs to be a more radical examination of the actual competitiveness of the MNC’s local operation in each market and segment. The best companies will know exactly how big the cost differentials are between their operations and those of their strongest local competitors. They will develop a systematic approach to gaining local competitive intelligence, regularly analyze their competitors’ offerings (often by reverse engineering them), and assess the strategic and operational gaps.

For example, some MNCs undertake regular market-by-market analyses of their economics versus those of their local competitors in order to truly understand where their own advantages—and disadvantages—lie. (See Exhibit 3.) These companies have often found that their costs of goods are at least 20% higher than those of their principal local competitors because of product design and material costs. Their compensation costs are also higher because higher pay packages are only partially offset by higher labor productivity. The companies use these insights as the basis for restructuring their local activities to address competitive weaknesses.

Another manifestation of this shift will be developing new ways to think about portfolio management. Many companies have developed a broad portfolio of offerings in emerging markets, often with individual products tailored only for individual countries. These products lack the scale necessary to make a significant contribution to global results. While this approach has been a big driver of growth, a tougher outlook now requires a different kind of product portfolio management.

Leading companies are now applying a much sharper definition to targeted segments in order to assess products’ cost-effectiveness. They are systematically using target costing to further ensure competitiveness, often setting targets of 30% to 50% less than that of the previous product. And they are rethinking how they can adapt offerings from one emerging market to others and thus gain scale advantages.

Funding the Journey with a Leaner Organization

Transformations take time, and local operations must continue contributing to results even while priorities are redirected. MNCs should take an outside-in look at their organizations and cost structures, as if examining the company through the eyes of a private-equity buyer. After years of chasing growth, many local organizations are neither sized nor organized optimally for a tougher market environment.

The resulting restructuring often includes delayering of the local organization to make it leaner and faster, reducing back-office personnel, lowering the dependence on expatriate executives, and rebuilding the leadership team to ensure that high-performing people are in high-impact positions when more fundamental work on process and functional excellence starts. Putting people with a strong competitive and entrepreneurial mind-set into new leadership roles is vital.

Winning in the Medium Term with Process and Functional Excellence

While many companies have systematically replicated their manufacturing processes in new plants in emerging markets, the establishment of process excellence in other parts of the organization has been slow. Scores of manufacturing, quality, and engineering expatriates are normally sent to a market to build new facilities according to global blueprints and to establish strict process discipline. But in other key functions, such as procurement, sales, and logistics, we have found either that there are often no process definitions or that they aren’t thoroughly followed in emerging markets. Equally often, there is good reason for this: emerging markets need adapted processes, especially in externally facing functions; it isn’t possible (or a good idea) to simply copy global models as one copies a building design.

More and more companies have to recognize that they should establish process excellence across all their functions in all emerging markets. For some processes, they must stringently foster global standardization; for others, they should require their local units to improve process transparency, discipline, and quality but adapt them to local circumstances. Some companies are even starting to use emerging markets as pilots for completely new definitions of processes, especially in the area of digitization. Emerging markets can have distinct advantages in this regard: there are few embedded legacy processes or cultures to combat, and these markets are often technology savvy, so digitally enabled, leaner processes can be deployed with relative ease.

For example, BMW, in its joint venture in China, started working in 2013 on a significant two-year productivity-improvement program for all nonproduction processes, with the goal of optimizing them to be as effectively run as factory processes. Although most processes were already defined in some way, a number of employees were not aware of them or not sufficiently trained to do more than “check the boxes” in compliance. The program focused systematically on process redesign, training, new tools, and new governance mechanisms. Clear accountabilities for continuous improvement were also established.

Another example is FrieslandCampina, one of the largest global dairy-products companies. A few years ago, it recognized that its biggest opportunity in emerging markets lay in optimizing the go-to-market model and pushing a higher level of sales excellence. Starting in one country, the company deployed a systematic approach for reaching consumers more effectively through new channels and new sales-management processes. It put enormous effort into training and skill building for sales teams. The approach was copied and moved to other markets one by one, using salespeople from one market to help deploy the program in the next. The company institutionalized the approach in each market by developing and regularly updating a handbook that combined standardized practices with local adaptations.

Getting the balance right between standardization and local adaptation of processes can be tough. In our experience, a general guideline is to be more aggressive in standardization for purely internal processes and to allow more freedom for externally facing ones. (See “Go-to-Market Approaches Continue to Be Highly Localized.”)

GO-TO-MARKET APPROACHES CONTINUE TO BE HIGHLY LOCALIZED

GO-TO-MARKET APPROACHES CONTINUE TO BE HIGHLY LOCALIZED

The commercial success factors in emerging markets can be very different from those in more developed economies. For example, consumer segments are highly heterogeneous and much more fluid in their makeup. Different segments have widely varying needs and financial potential, both of which can be moving targets.

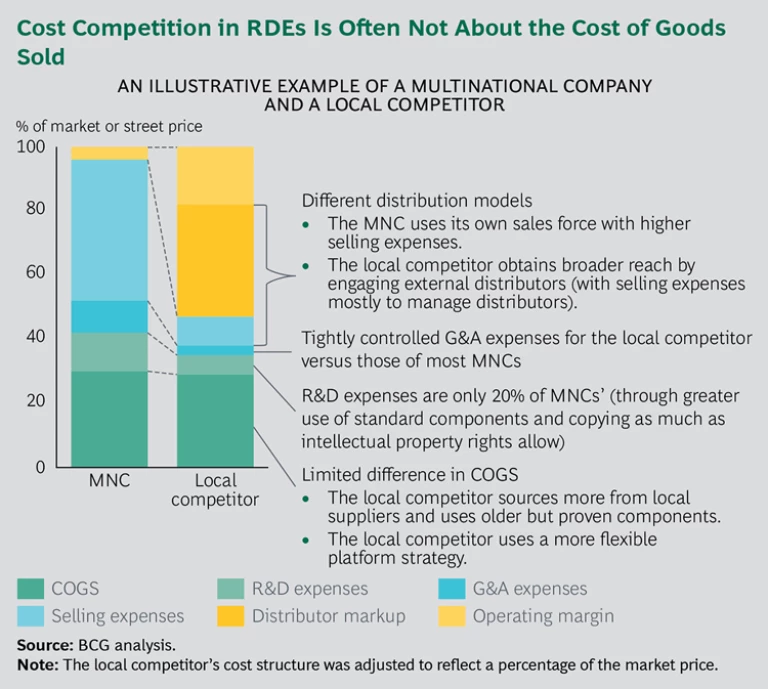

As growth slows and competition increases, it becomes more important for MNCs to understand the commercial environment. MNCs face very different competitive economics than their local counterparts. Product development costs can be much lower, but sales and distribution costs are high. Companies need to adjust their bases of comparison and adopt new or revised KPIs. Our analysis indicates that while a local company and an MNC might have similar costs of goods sold, the local company’s selling expenses are often 10% or less of a product’s retail price, while the MNC’s selling expenses can easily rise to 45%. Higher distribution costs must be offset with aggressive cost savings across other parts of the value chain. (See the exhibit “Cost Competition in RDEs Is Often Not About the Cost of Goods Sold.”)

There are many reasons for the disparities. Emerging markets, especially those that are big and diverse, such as China and India, typically have much less well developed distribution systems. Companies must deal with a multistep regional, municipal, and local system, with players of widely varying competence and capability at each step. This adds to cost. MNCs also have to pursue multichannel distribution models and dealer networks to extend beyond tier 1 cities, maximize reach, and avoid coverage gaps. Distribution in such markets may involve accepting some level of sales cannibalization and dealing with distributors that also carry competitors’ products.

Retail sales are another issue. Many developing countries have large rural populations or populous secondary cities. Some 636 million Chinese lived in rural areas in 2013. India has 400 cities with populations of 100,000 or more. In Brazil, consumers in interior regions are expected to account for more than 45% of growth in the retail sector, or $60 billion in new purchases, through 2020. Such markets have widely varying, and often undeveloped, retail infrastructures.

Internet sales (which in many markets really means mobile commerce) are a big and increasingly important factor in reaching these new customers. China has more than 730 million Internet users and more than 380 million online shoppers. More than 16 million consumers from the country’s tier 3 and tier 4 cities are using mobile Internet. Alibaba already has more sales than Amazon and eBay combined. The next wave of growth in India’s online population will add up to 550 million new Internet users, including large percentages of older, more rural, and female consumers.

In large developing markets, MNCs may benefit from new capabilities that target small geographic markets embedded in second- or third-tier cities.

Rural markets and multistep distribution also mean that companies are a long way from their customers. It’s easy to lose contact or to have to rely on second- or third-hand information about developments in local markets. Local staff or representatives make a big difference, and MNCs should make bigger investments in relationship management and performance monitoring of distributors and dealers, all of which entails another layer of cost.

Compensation models can also be very different in emerging markets. In Europe, for example, the variable component of compensation is usually less than half of the total. In many emerging markets, compensation is often 100% variable or incentive based.

Establishing the Right Team, Platforms, and Behaviors

Most companies will need to redirect the behaviors of their local teams. Whereas the priority in the past was to gear up for growth by investing big in people development and potential needs, companies now should apply a tight focus on individual performance and accountability for costs.

We find operations in emerging markets beset by common problems, such as a limited sense of accountability beyond their own activities on the part of individual managers; little collaboration and a general hesitancy to ask for help; and an absence of cost consciousness. Addressing these issues requires clarification of roles, KPIs, and targets; explicit efforts to promote collaboration and trust building (including through peer pressure); providing for cost transparency in management information systems, especially in middle-management levels; and making cost control a principal target in annual performance reviews.

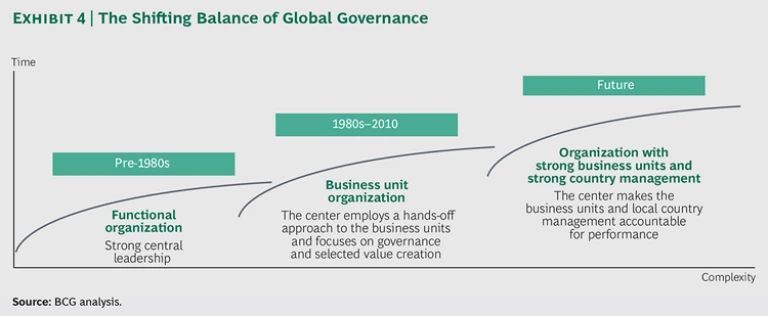

It remains critical that local management teams retain, or be given, decision-making ability, but MNCs must clarify the responsibilities that accompany this authority. Too often, in our experience, local managers are clear about day-to-day activities but not about longer-term accountabilities. Companies need clarity about the main targets that local managers are accountable for, both individually and together with others, and about the changes they are required to promote in order to achieve continuous improvement. This doesn’t mean that local managers shouldn’t make use of the advantages that their global platforms and capabilities give them; it’s a question of striking the right balance between local authority and global support. (See Exhibit 4 and the sidebar “Rethinking the Relationship Between the Center and Local Operations.”)

RETHINKING THE RELATIONSHIP BETWEEN THE CENTER AND LOCAL OPERATIONS

RETHINKING THE RELATIONSHIP BETWEEN THE CENTER AND LOCAL OPERATIONS

There are many successful governance models on a continuum from hands-on manager, where the center has full power, to hands-off owner, which leaves decision-making to the local management team—and several options in between. Choosing the right one depends in part on the company, its goals, and the markets involved.

We would argue that two considerations rule in a new world where competitiveness and productivity are critical. The first is clarity. Research has repeatedly shown that fuzziness or lack of certainty with respect to roles and accountabilities between the center and local operations leads to trouble. Too often, functions from headquarters get involved in local activity without a clear mandate.

The second consideration is empowering local operations. Most MNCs’ competitors in emerging markets are locally staffed and sourced, more nimble at adapting to changing market conditions, and better positioned to capture larger growth opportunities. Local units of MNCs need authority to make quick decisions and act swiftly, without seeking approval from headquarters. MNCs’ centralized functions—such as R&D, marketing, finance, and human resources—should support, not encumber, local operations.

Some MNCs can do a better job of leveraging their scale and global resources, including sharing good practices, while not overwhelming local country organizations with global rules and initiatives. Local units can be linked to pooled resources and platforms to take advantage of the parent company’s global footprint. There are also opportunities for local product and process innovations to be rolled out across other emerging markets and even to certain segments in developed markets. Knowledge can be shared through multidirectional networks, such as global excellence centers, product councils, and information networks.

Most MNCs also need to retool their recruitment and training efforts, as well as their incentive programs, tying them all more closely to productivity improvement goals. For example, many employees in emerging markets spend a few years in an MNC, a significant portion of which is occupied by training programs, and then leave. In the future, training might have to de-emphasize formal classroom-type sessions in favor of on-the-job coaching.

Perhaps most important is rethinking the role of both expatriate and local executives in management. Expatriates in emerging markets should take the role of team builders rather than line managers. This happens in many companies, but most can go further, making expatriates accountable for developing strong local managers by actually transferring skills and know-how rather than simply meeting short-term KPIs. This is far from easy. Placing real responsibility in the hands of often-untested executives is difficult for many companies. Shifting from an executive role to a team-building or advisory role is often a tough transition for expatriate executives. But transformation is substantially about culture; putting local managers in key leadership positions is a big cultural shift for many companies and sends the entire organization a strong message of accountability for results (while at the same time leading to cost savings, thanks to fewer high-cost expatriates).

Getting Started—One Country at a Time

In 2013, a BCG survey of more than 150 senior executives of MNCs revealed an eye-opening disconnect. More than three-quarters, or 78%, of respondents said their companies expected to gain share in emerging markets, but only 13% were confident that they could take on local competitors. Not a single company stated that it had all the capabilities required for success. The biggest concern was not the ambition but the ability to execute locally. Our experience since then indicates that not much has changed—except the urgency with which many MNCs must address their emerging-market operations.

Emerging-market transformation has to start in one local market (or at most two or three) to ensure that it addresses gaps in local competitiveness and that a robust methodology is developed for subsequent rollout throughout the company. Once one market demonstrates results and positive momentum, the approach can be transferred to other countries. To take advantage of lessons learned in the first country or countries, companies should use the same templates and tools. They can develop handbooks and lessons for fast learning and ensure some continuity by transferring people who have experience with the approach to the transformation management team.

Chevron, for example, launched a program in 2013 to promote efficiency and productivity in its different upstream businesses all over the globe. It started in Nigeria and Angola, where—in addition to achieving significant productivity gains—the company built a toolbox that could be used by others; it included activity time-analyses, steps to streamline the organization, and process optimization programs. Chevron then rolled out the toolbox to other emerging markets in the Americas and Asia.

For many large global companies, this is not only the right time to rethink the operational models they deploy in emerging markets; it’s the essential time. The kind of global transformation we propose makes the company better adapted to local circumstances and strengthens its competitive capabilities worldwide. MNCs must become “multilocal” players if they want to succeed.

MNCs should ask themselves the following questions:

- Do we need some minor fine-tuning of activities in emerging markets or a more fundamental reset?

- Are the current trade-offs we make around investments, product portfolios, process excellence, and people development still valid?

- How do we want to approach the transformation of operations to ensure immediate results and a fast global rollout of the program?

Growth in emerging markets will continue, but only for companies that are set up to be competitive and that make growth profitable. In the changing world of emerging markets, this will become the new definition of winning.