Of all the challenges faced by the Blue Cross and Blue Shield Plans, few are as significant as the likely mergers of the big US health care companies.

Players such as United Healthcare, Anthem, and Aetna (“the Nationals”) have grown substantially through acquisitions and will continue to do so if the proposed Cigna and Humana mergers go through as planned. These mergers will produce tough competitors with diversified portfolios, sturdy balance sheets, greater scale, and advanced capabilities, including consumer engagement, provider collaboration and informatics, population management, and digital channels.

With few exceptions, the Blues are less diversified than the Nationals, more focused on slower-growth commercial risk segments, and they have less capital to invest in new capabilities. Yes, their strong, entrenched local relationships, brand, and other advantages will remain relevant going forward. But the Blues will need to act assertively to maintain market relevance and a competitive financial footing in light of the Nationals’ pending mergers. Assuming that the Aetna-Humana and Anthem-Cigna deals are signed later this year, these plans will enjoy advantages over Blues in three main areas.

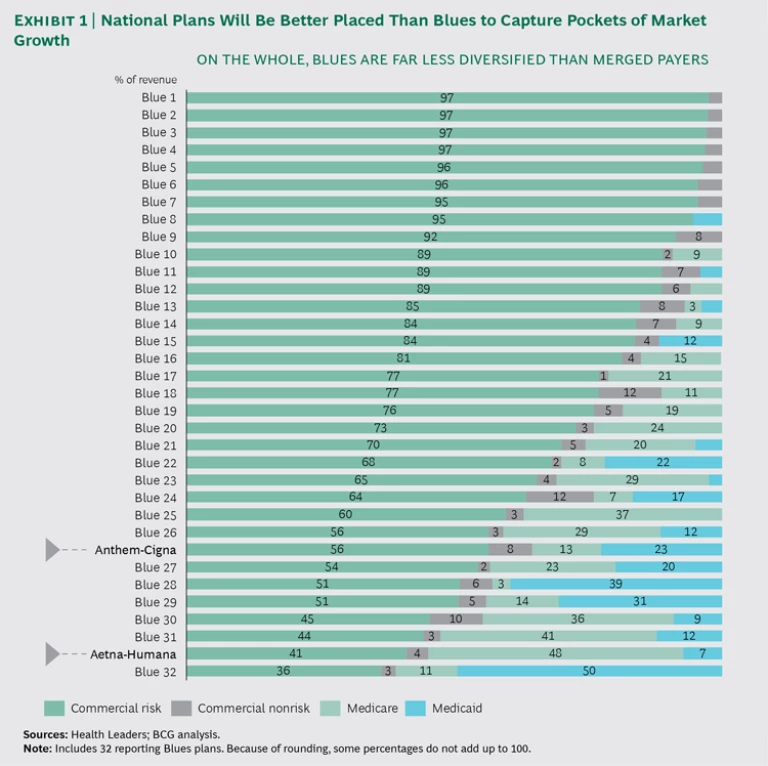

To begin with, the merged Nationals will benefit from cost synergies. The new plans have promised a 7% to 8% reduction in sales, general, and administrative (SG&A) costs—equivalent to $1 billion to $1.5 billion—which corresponds to a drop of $2 to $4 per member per month. In addition, these players will likely gain share in local markets and win new negotiating power with local providers, which could enable them to secure more competitive rates and ultimately lower medical costs. Second, the National plans will benefit from stronger balance sheets, helping them to invest in new initiatives and capabilities. For example, consolidation will make it easier for them to invest in best-in-class medical management approaches to improve member health outcomes. Third, the National plans will be better placed to capture pockets of market growth. (See Exhibit 1.) One prominent scenario: an Aetna-Humana combination will be geared for big wins in the high-growth government market.

An additional wrinkle is that consolidation is not evenly distributed. Depending on how Cigna and Anthem reorganize their holdings, some Blue plans may face more direct challenges than others. (See the sidebar.)

POTENTIAL RESULTS OF THE CIGNA-ANTHEM DEAL

Not all Blue plans will feel the same impact from the combining of Cigna and Anthem. Much will depend on how the new entity is structured. Currently, Anthem holds the Blue Cross Blue Shield Association (BCBS) license to operate in 14 states, and it cannot compete under the Blue brand in the remaining states, where other companies hold exclusive BCBS licenses.

In addition, all Blue plans—including Anthem—collaborate to cover people at companies that operate across state lines. For example, an employer in Georgia (an Anthem state) may have employees in Florida (a non-Anthem state controlled by another Blue plan). To cover those employees, all BCBS plans coordinate through the BlueCard, a nationally accepted card that gives employees access to Blue providers regardless of the state in which their employer is based. The BlueCard program benefits local Blue plans in that they gain access to more members—giving them more clout to negotiate with providers—and they also generate fees through the arrangement.

The Cigna-Anthem deal threatens both aspects of Anthem’s arrangement with other Blue plans: the degree of competition and the collaboration through BlueCard. There are four possible scenarios:

- No deal. Regulators, some investors, and provider groups may challenge the merger based on antitrust considerations.

- Cigna converts to Anthem. Theoretically, Anthem could convert Cigna to a Blue plan and operate the entire company under BCBS rules. That would mean that Cigna’s business (representing 10% to 15% of combined revenues) would need to be divested to the local Blue plans in many states—a positive development for local Blue plans, which could gain Cigna’s 35 million covered lives, giving them greater clout in negotiating prices with providers. (Alternatively, the BCBS rules could be changed to allow Anthem to compete beyond the 14 states where it currently operates.)

- Anthem converts to Cigna. Anthem could also choose to give up its BCBS license—for a subset of its 14 markets or en masse—allowing it to grow unfettered in the national market. Anthem would lose the advantage of the Blue brand, potentially be responsible for a fee of more than $3 billion1 under BCBS rules, and require a notification period that would give Blues time to react. Even then, the impact on Blues in other markets would be significant. Not only would Anthem be freed up to compete directly against them, but they would lose the Anthem lives in their states currently covered through BlueCard, reducing their fees and their negotiating power with providers. The remaining Blues would need to scramble to find new health plans in those states, in order to continue offering national coverage.

- The new company operates under separate platforms. The most likely scenario is that the company retains both platforms: Anthem in its current 14-state base and Cigna elsewhere. Anthem would likely shift some lives away from Blues and over to Cigna in its nonhome states. But BCBS has rules in place that effectively cap the number that Anthem could switch. (Anthem must keep an estimated 80% of local premiums and two-thirds of national premiums as Blue-branded.)

1. Anthem’s $3 billion fee based on a “reestablishment fee” of $98.33 per member and 28.6 million members as of December 31, 2014.

Gauging Blues’ Immune Systems

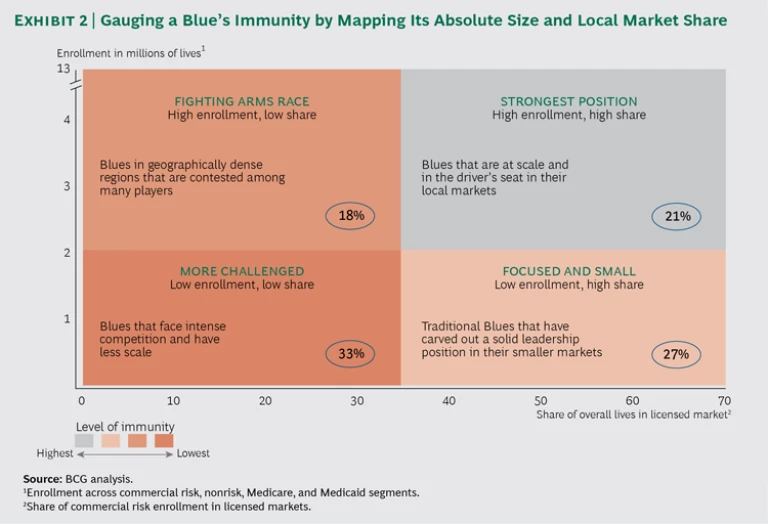

Consumers benefit from all this market upheaval, of course. But that does not blunt the reality that many Blues risk becoming less competitive. Some will be able to compete with the newly consolidated Nationals more effectively than others. Success depends on having a strong “immune system,” which consists of two main elements: size and local market share. Other factors are also in play—a Blue’s level of diversification into high-growth market segments is relevant, as are the influence of its local market providers and the intensity of local competition—but without meaningful size and share, a Blue will be much less able to withstand the impact of the consolidating health plans.

Size allows Blues to absorb shocks and protect against market uncertainties. For example, mispricing on public exchanges can lead to unexpected losses, which larger Blues have the means to withstand. Similarly, size allows plans to take advantage of scale effects and reduce administrative costs, freeing up capital for necessary investments in new capabilities. Our analysis found that larger Blues can generate two to three times more investment income for every dollar in premiums that they collect.

The second component of Blues’ immune system—local market share—often enables them to negotiate bigger discounts with providers, thus lowering medical costs. This is especially true in markets where providers are fragmented and less able to hold firm on pricing. Furthermore, plans with higher local market share are better able to influence premiums.

A useful way to gauge Blues’ immunity is to map their absolute size and local market share. Such a map reveals four broad categories, ranging from “more challenged”—the 33% of Blues that face fierce competition and have limited scale—to the 21% that are “strongest position” contenders, with high local share and substantial enrollment numbers. (See Exhibit 2.)

While there are still uncertainties about the most recent potential mergers, consolidation is not going away, and Blues need to act now. There are two main opportunity areas: no-regret moves that are unrelated to Blues’ degree of immunity, and segment-specific moves that depend on their size and market share.

No-Regret Moves

Historically, Blues have had the advantage of strong brands, deep provider relationships, and competitive pricing—advantages they must strive to maintain. However, as the basis of competition shifts, a set of no-regret moves will position them to more effectively align with growth in their markets.

First, plans should aggressively seek opportunities to scale, particularly in markets that will be directly affected by the Nationals’ mergers. Strategic partnerships, collaborations, joint ventures, and M&A are all potential avenues to scale. In turn, scale allows health plans to invest in new capabilities required by the market—capabilities that include clinical informatics, consumer-oriented products and services, medical management, and new distribution capabilities.

Second, plans should diversify by pursuing opportunities in higher-growth government and specialty segments that are projected to grow faster than their primary commercial risk segments over the next five years. Also, some acquisition targets could come on the market quite quickly if the US Department of Justice requires any of the big Nationals to divest businesses as a condition for federal approval of their mergers. Now is the time for Blues to start doing the necessary due diligence so they can pounce if such opportunities open up.

Third, plans should relentlessly reduce costs in administrative areas (through more efficient distribution, improved call-center operations, and shared services for back-office functions, for example), as well as in clinical areas.

A word of caution, though; these moves do not constitute a checklist. Almost all of them add complexity, so Blues need to carefully weigh the trade-offs. They run significant risks if they pursue all of them and succeed at none.

Organizational culture is a factor, too. Blues’ management teams must take a hard look at whether their organizations really are agile enough to thrive in tomorrow’s kinetic health care environment. Blues will need new mind-sets and capabilities if they are to remain competitive as the large players widen their capabilities and increase their talent advantages, and as consumers’ and providers’ demands intensify. It is not a question of making a one-time change to a new static state; the Blues must be geared to make constant shifts, ideally ahead of shifts in their markets.

Segment-Specific Moves

Some Blues can also make targeted moves. Those with the strongest immune systems—with high enrollment and high market share—can place big bets to compete as the Nationals do. They can leverage their leadership positions to innovate with providers in areas such as direct collaborations and risk sharing. They can also innovate with consumers by offering personalized products, new platforms, and other offerings.

Focused, smaller plans that enjoy high share in their local markets should try to grow from their positions of strength. They should seek partnerships with other Blues and look to capture shifting profit pools beyond the commercial risk segment. At the same time, they should push to make SG&A as variable as possible in order to free up capital.

Larger Blues with less entrenched local positions should push aggressively for greater share in vulnerable markets through local M&A, provider collaborations, and partnerships with other Blues. For example, Blues in several states can collaborate to address regional Medicare markets.

Blues with lower enrollment and smaller market share face the most immediate challenges. Their priority should be to exit markets that have limited potential for market share leadership, focusing instead on sectors where they are strong. Since scale is becoming more and more important, those plans must get big quickly by merging with other Blues or local health plans. This will allow them to reduce overhead, increase negotiating power with providers, and free up the capital they need to invest in the capabilities required to win. They should focus on forging these partnerships with other Blues before investing in adjacent spaces and new capabilities.

The good news is that the Blues have time to plot their next moves. We believe they have about two years of breathing room. The Nationals will not only be focused on realizing synergy goals and completing their integrations; they will also be losing some talent and facing more scrutiny from regulators. But two years will go by in a heartbeat. Blues must use this time to assess their immune systems, strengthen their current advantages, and invest in the capabilities they need to win in the long term.