Consider this scenario. Rolf, age 32, lives in Berlin with his wife and their infant daughter, who is approaching her first birthday. One Monday morning, as he rides the bus to work from his new apartment in the city’s Wilmersdorf section, where the family moved over the weekend, Rolf downloads his insurance company’s mobile app and updates his account information. He is surprised and impressed when he discovers that inserting his new address triggers a series of 12 questions.

After providing the answers (which takes only half his 20-minute bus ride), Rolf realizes that he should consider increasing his property coverage for the contents of his home (the new apartment is larger than the old one, and he and his wife bought new furniture), and that he needs liability coverage against problems such as leaks (since he now lives on an upper floor). He has an appointment to speak by phone the next day with his agent to discuss life insurance to protect his newly expanded family. And the company has e-mailed him a link to information on its retirement products.

Before Rolf reaches work, his agent sends him an e-mail inquiry about his car coverage (which is with a different carrier), asking whether the move to a new home means less driving, which could in turn mean lower premiums. Rolf arrives at his office wondering why he hadn’t thought of those needs himself—but grateful that his insurer and agent had.

Although this scenario is unlikely to unfold today—in Germany or anywhere else—it will soon: the data and the technology necessary to support it already exist. The primary holdup is lack of ambition. Most insurers are locked into a products-and-process business model; they don’t put themselves in their customers’ shoes and consider the journeys that people need to take. Often, life events—such as an expanding family or a move to a new flat—trigger such journeys. Many insurers also fail to think about how they can adjust their products to make them more adaptable to digitization. And they may not assess how their business model, and the data and systems that support it, could better serve customers—and generate new revenue streams for the company while cutting costs—if they adapted the model to help guide these journeys.

The Journey, Not the Process

Insurers need to modernize and digitize their systems and business models. This is true even though companies throughout the industry have already invested billions of dollars or euros, and years of effort, in updating their systems. They have—or think they have—digitized the customer experience by building websites and mobile apps, creating digital offerings (online auto insurance, for example), and constructing in-house digital capabilities.

The flaw in all of these undertakings, however, is that they attempt to apply digital technologies to a company’s existing products and processes—underwriting, claims, and so forth. Meanwhile, from their interactions with service leaders such as Amazon, Zappos, and Google, customers have come to expect convenient digital solutions. Among the advanced features that customers appreciate and demand are one-click buying, set-and-forget refill ordering, product recommendations based on purchase history and social media review, and personalized suggestions curated according to their own purchase history and the experiences of similar people.

Customers are also less and less likely to discriminate between traditionally discrete industries and sectors: if a bank can provide quick, effortless ways to manage household finances online or on the go, customers see no reason why other service providers—including insurers—should not be able to do the same thing.

In BCG’s annual Brand Advocacy Index—which identifies and ranks the percentages of surveyed consumers who are likely to recommend a brand to friends and family—the top-ranking car and health insurers routinely receive index scores in the 20s, 30s, and 40s in such markets as France, Germany, Italy, and Spain. Many banks (as well as companies in other industries) receive scores in the 50s and 60s.

In order to successfully reimagine business processes and meet customers’ rising expectations with regard to service, insurance companies must shift their point of view to the customer’s perspective. Neither the product in question—be it property, casualty, life, or health coverage—nor the internal organization is the correct lodestar for digitization. The focus must be on the underlying customer journey . Developing an up-to-date business model starts with asking the right questions.

Following the Customer

A customer journey starts with a trigger event. An insurance claim is one example, but so is Rolf’s move to a bigger apartment—or a wedding, a divorce, the birth of a child, a promotion at work, or a new job. Any such event can spark the need for new insurance and can call for adjustments in one or more insurance products that a customer already has. Customers don’t consider the company’s internal processes or organization when they encounter a trigger event. Indeed, like Rolf, they may not even consider the insurance ramifications without third-party guidance. But customers do know that they need to change their on-file address after a move; and once informed of that event’s insurance policy implications, they will want to resolve all of its insurance-related aspects. A smart insurance company will ask, not how big the new apartment is, but what caused the customer to move in the first place?

A digital solution delivers value only if it enables the company to solve all of the customer’s trigger-related needs and requests comprehensively and conclusively (at least from the customer’s perspective), without additional process loops or delays. For the insurer, this means following (or anticipating) the customer journey across segments, products, and channels. Product features, processes, and company departments and functions must follow the customer—not, as is usual today, the other way around.

Taking a customer-centric approach offers insurers a huge and multifaceted opportunity to address customer needs. Improvements in this area will promote customer satisfaction and increase the likelihood of cross-selling. At the same time, reducing the number of process loops decreases the internal processing capacity necessary, and thus reduces costs.

What Insurers Need to Do

The insurer should assess each customer journey along two dimensions: customer benefits (for example, the potential to increase customer satisfaction, or the gap between current digitization and customer expectations) and efficiency gains (such as the elimination of redundant or unnecessary processes, or the expected acceptance rate calculated by the customer journey digitization tool). After examining the results of these assessments, the company can create a prioritization model combining customer benefits and efficiency gains. This model can then serve as the basis for the practical methodology of digitizing customer journeys.

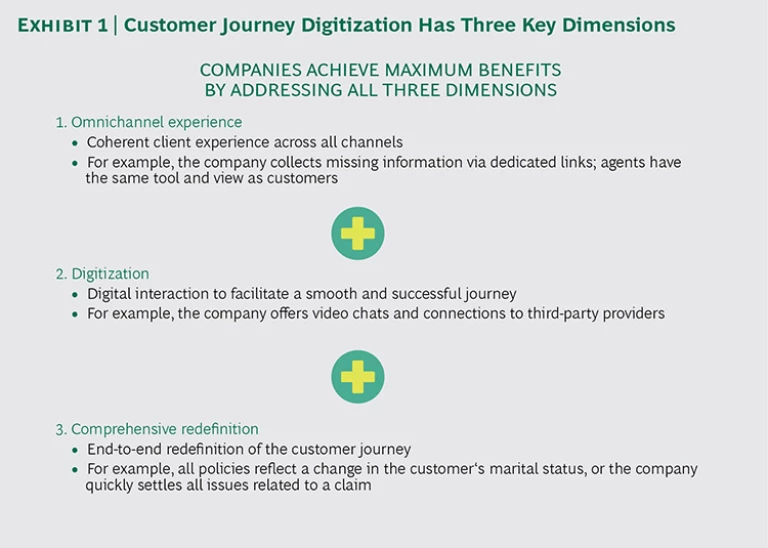

The first step toward digitizing individual customer journeys is to develop a design platform for the reimagination of such a journey. (See Exhibit 1.) The design platform must start with a deep understanding of customer needs (obtained through research). It should include a mapping of current processes and IT architectures, and detailed decision trees for the customer journey.

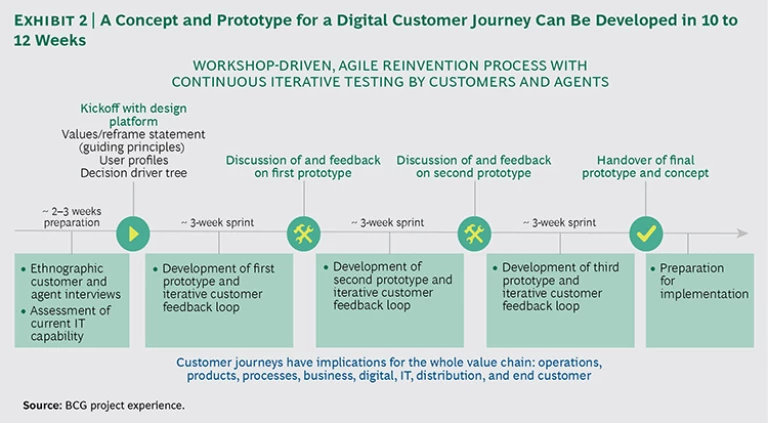

The next step is to develop a digital journey prototype. This involves combining deep ethnographic research into customers’ digital usage and behaviors, and the agile methodology of concept and prototype development. (See “ Five Secrets to Scaling Up Agile ,” BCG article, February 2016.) Multiple development sprints, interspersed with customer and agent feedback, produce iterations of the target journey prototype that reflect actual customer use. (See Exhibit 2.) By proceeding in this way, the insurer can maintain its focus on user needs. These sprints also help identify which products and processes are easy to digitize and which require a more comprehensive transformation.

Finally, the company must develop an implementation plan. In a relatively short period (typically about ten weeks), the insurer can produce a ready-to-implement prototype of a digitized customer journey as a proof of concept. It can then use this prototype to advance the broader digitization of all customer journeys.

Benefits of the Digital Journey

Fully digitizing the customer journey offers insurers multiple benefits. Most important, when it works seamlessly (and invisibly to the customer), the digitized customer journey can lift customer satisfaction levels significantly and can yield cost savings of 15% to 25%. It also increases organizational speed and agility. And it can reduce by up to 40% the number of process loops required to complete a customer journey.

The key to achieving these benefits is to generate traffic that uses the digital solution. Customers can complete digitized customer journeys by using an app or the company website, or by working with an agent, broker, or call-center agent who has access to the same digital solution as the customer. Either way, the journey relies on self-service rather than on processed operations, which decreases staffing needs in the back office. We expect self-service rates from customers or from agents and brokers to approach 80%, depending on the complexity of the customer journey.

Nevertheless, some customers, especially older ones, may not be keen to complete their customer journey themselves via an app or a website. And agents and brokers need to be in the digitized journey loop, too. So insurers must establish the interaction logic for the digital customer journey on all channels—especially agents, brokers and call centers—to ensure that customers can complete their journey seamlessly across multiple channels.

As we pointed out recently with regard to customer service journeys in several industries (including insurance), digital technologies have added at least seven channels to the customer service mix: website self-service, e-mail, website live chat, mobile app, text messaging, online forums, and social media. (See Digital Technologies Raise the Stakes in Customer Service , BCG Focus, May 2016.) These new avenues of interaction are a lot for any company to manage. But most of the added complexity relates to the omnichannel interaction that many pathways involve.

To build an overall picture of their service users, all companies need to understand why a customer chooses a specific channel in each instance, and how the customer’s journey progresses through channels over time. This understanding should inform both the explicit design of the transition between channels—such as online click-to-connect—and the seamless sharing of information collected along the pathway at each stage. Productive use of customer pathway information is vital. Customers mark down the service experience when they encounter no recognition of what they have already done or when they have to repeat the same information multiple times. Anticipating customers’ needs and addressing them proactively are other features that customers cite as being part of a flawless experience.

Defining Success

In our experience, five factors are crucial to the success of any effort to reimagine and digitize insurance customer journeys:

- Adopt the customer’s perspective, and be ambitious.

- Subordinate both products and processes to strict development of customer journeys from the customer’s perspective, and make ease of switching among channels a priority so that customers have a seamless experience.

- Pursue agile development with cross-functional teams using short time frames and high-frequency user/customer tests.

- Pursue continuous development and improvement (because, from a customer’s perspective, products and processes always have room for improvement).

- Communicate broadly and focus on enabling the organization to ensure sustainable results.

Insurers that focus on these success factors will be able to make the transition relatively quickly from trying to digitize products and processes to delivering digital customer journeys. Such companies will set themselves on a path of continuous improvement. Early movers have the opportunity to establish a digital advantage over the competition—an advantage that will grow over time and pay continuing dividends as fast-moving technologies evolve.