Throughout the world, companies recognize that their success depends on adopting the new digital industrial technologies that are collectively known as Industry 4.0. To assess how quickly this fourth wave of technological advances is gaining momentum, The Boston Consulting Group recently studied the status of adoption in Germany and the US.

BCG’s study focused on a survey of more than 600 managers and senior executives representing 312 German and 315 US companies. (See “About the Survey.”) We found that, so far, companies in the two countries have implemented Industry 4.0 technologies at approximately the same pace. However, German companies appear to be better prepared to implement these advances in the coming years, and they have higher ambitions, which could give them an edge as adoption proceeds. Overall, companies see the lack of qualified employees as their biggest challenge in implementing Industry 4.0. Data security and the significant investments required for new digital technologies also ranked as major challenges, although the survey found notable differences between German and US companies.

ABOUT THE SURVEY

In March 2016, BCG conducted an online survey of companies and their progress toward Industry 4.0. The survey’s participants included executives and operations management personnel of 312 German and 315 US companies with revenues of more than $50 million. The survey’s goals were to evaluate the extent of companies’ progress in implementing Industry 4.0, understand what their management considers to be the major challenges, and identify how implementation could be more efficient. The survey also covered the implications of Industry 4.0 for employee qualifications and the investments required for introducing new Industry 4.0 technologies.

Our study demonstrates that companies in two leading industrial nations have set high ambitions for Industry 4.0 but will need to accelerate their efforts to implement these technological advances and achieve their goals.

In this report, we present the survey’s key findings and share related insights from BCG’s analysis of the effects of Industry 4.0 on the manufacturing workforce. We also discuss how BCG supports companies’ efforts to implement Industry 4.0 through its Innovation Center for Operations (ICO), which includes model factories that allow companies’ executives and staff to experience and test new technologies.

The Status of Adoption

Companies on both sides of the Atlantic understand that the adoption of Industry 4.0 brings important benefits. Three-quarters of German respondents and two-thirds of US respondents associate Industry 4.0 with increased productivity and cost reduction. In addition, many respondents (48% in Germany and 43% in the US) associate it with revenue growth.

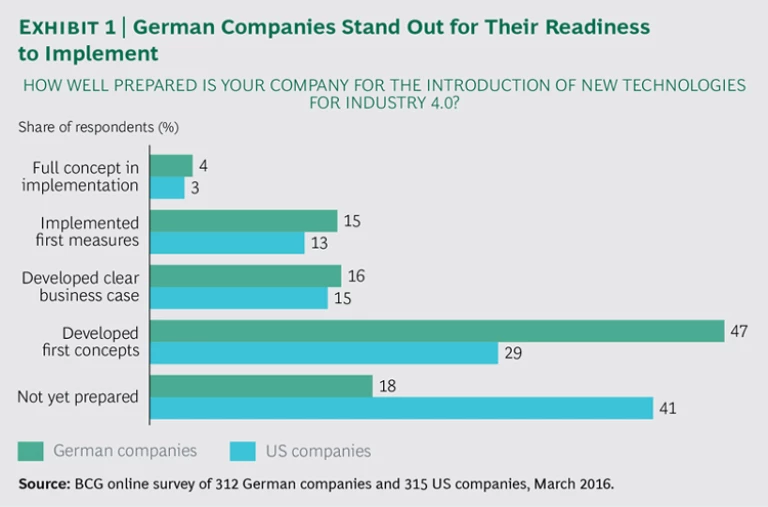

The pace of Industry 4.0 implementation is similar in the two countries. As shown in Exhibit 1, 19% of German companies have implemented either a full Industry 4.0 concept (such as a smart factory) or first measures toward a concept (such as the introduction of autonomous robots), compared with 16% of US companies. German companies are off to a somewhat faster start of implementation despite the common perception that US companies are the front-runners in embracing digital transformation.

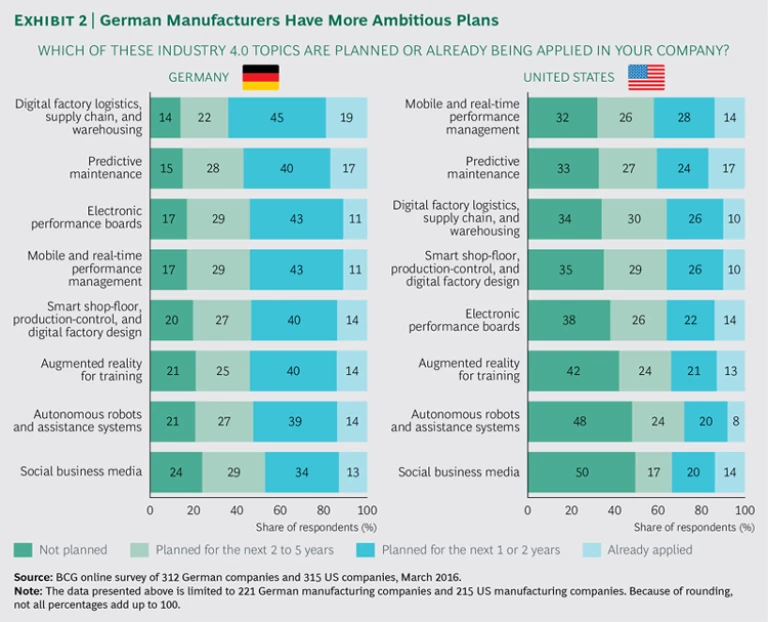

Furthermore, German companies appear to be better prepared to adopt Industry 4.0. Almost half (47%) of the German companies have developed their first full Industry 4.0 concepts, and only 18% of German respondents say that their company is not yet prepared to introduce Industry 4.0 technologies. In contrast, only 29% of US companies have developed their first concepts, and 41% say that their company is not yet prepared. In terms of manufacturers, German companies appear to have higher ambitions than their US peers with respect to applying, or planning to apply, advanced technologies. For example, approximately 60% of German manufacturers have applied, or plan to apply (within the next one or two years), digital factory logistics or predictive maintenance, compared with approximately 40% of US manufacturers. (See Exhibit 2.)

German companies’ strong ambitions for Industry 4.0 reflect their need to overcome the challenges of significant factor costs that arise from high wages and a less-flexible labor market. These factor costs encourage companies to strive for greater productivity and, thus, promote faster adoption of new technologies. The fast pace of adoption in Germany is also fueled by companies’ advanced industrial-manufacturing capabilities. Companies can apply these capabilities to accelerate the introduction of new digital technologies, thereby reducing costs, increasing flexibility, and accelerating the speed of manufacturing. For example, German manufacturers lead in robotics adoption, enabling a higher level of automation and promoting productivity gains. In 2014, the rate of robotics penetration in Germany was among the highest: 292 industrial robots per 10,000 workers in manufacturing. This level of penetration exceeded the level achieved in the US (164 per 10,000 workers) by 78%.

The Lack of Qualified Employees Is the Top Challenge

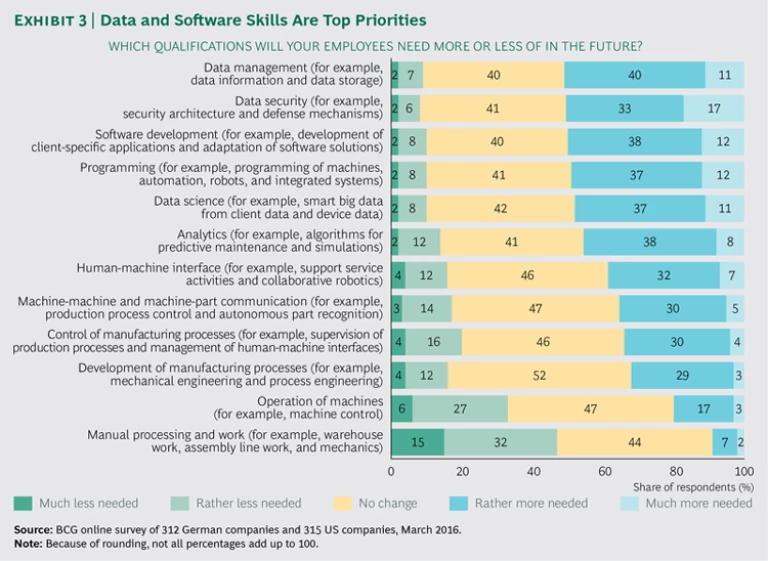

Industry 4.0 is having a significant impact on the industrial workforce. Because Industry 4.0 requires fundamentally new skills, there have been job losses in some work categories (such as manufacturing and maintenance) and gains in others (such as IT). Reflecting this transition, data management, data security, software development, programming, data science, and analytics are among the most desirable Industry 4.0 skills in both Germany and the US. (See Exhibit 3.)

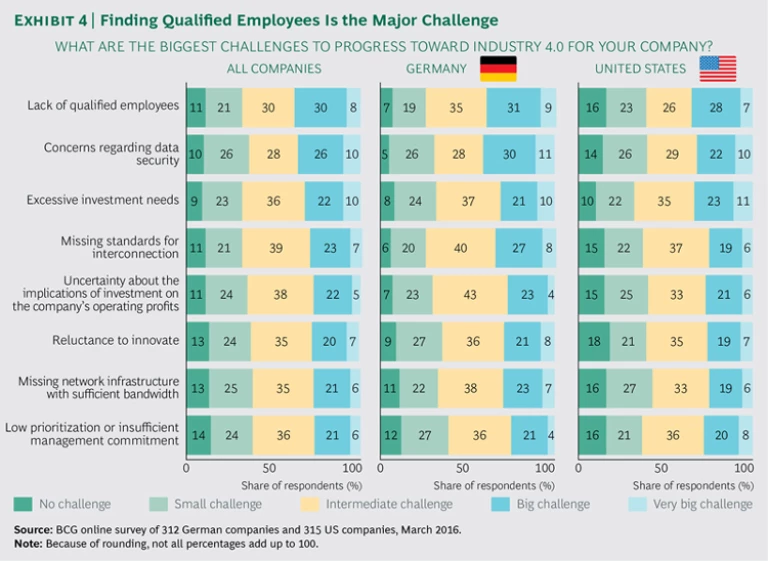

The extent to which companies benefit from Industry 4.0 will depend on how successfully they build and manage newly skilled talent pools. Respondents recognize the challenge: 40% of German companies and 35% of US companies regard the lack of qualified employees as a major (“big” or “very big”) challenge. (See Exhibit 4.)

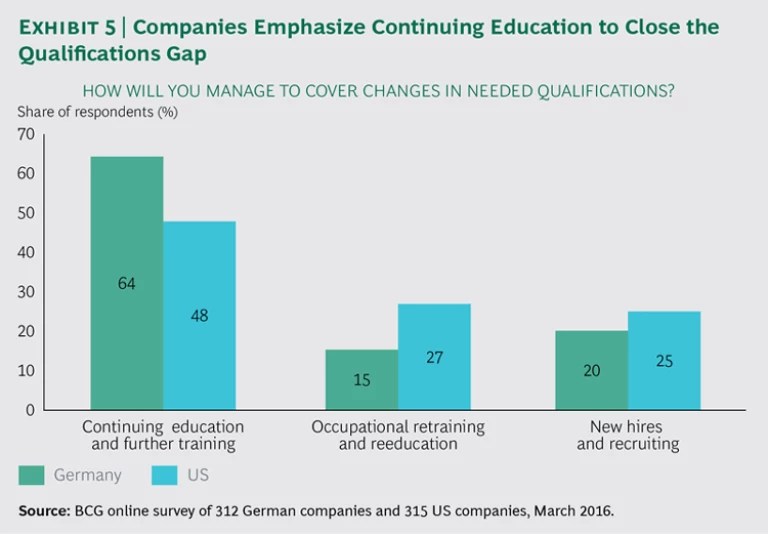

To close the Industry 4.0 qualifications gap, German companies appear to be considering an approach that is less aggressive than that of US companies. Consistent with the constraints imposed by Germany’s strict labor regulations, almost two-thirds (64%) of German respondents say that they will focus on continuing education to ensure that their current employees are qualified for Industry 4.0. (See Exhibit 5.) They place much less emphasis on occupational retraining (15%) and recruitment of new talent (20%). In contrast, approximately half (48%) of US respondents say that they will focus on continuing education, while about one-quarter will focus on occupational retraining (27%) and hiring new talent (25%).

By broadening and intensifying their efforts to educate employees internally and train them on the job, companies can facilitate their workforce’s transition to Industry 4.0. However, while German companies’ focus on internal education may help maintain the employment of the current workforce, it will not be sufficient to meet the skill requirements of Industry 4.0. The critical Industry 4.0 jobs—for example, for data managers and scientists, software developers, and analytics experts—require skills that are fundamentally different from those that most industrial workers possess today. To close such skill gaps, German companies need to place a greater emphasis on tapping into the global pool of digital talent.

A study that BCG conducted last year on the future of work in Industry 4.0 suggests that companies’ concerns about finding qualified talent are well founded. (See Man and Machine in Industry 4.0, BCG Focus, September 2015.) Our detailed modeling forecasts a net increase of approximately 400,000 jobs in Germany from 2015 through 2025. This analysis indicates that approximately 600,000 German manufacturing jobs will be lost during the next ten years. But the decline will be more than offset by the need for approximately 1 million new Industry 4.0 jobs in areas such as software development, advanced analytics, human-machine interaction, IT solution architecture, and user interface design. There will be demand for approximately 200,000 new highly skilled workers in IT, analytics, and R&D roles, as well as the creation of approximately 800,000 new jobs resulting from revenue growth opportunities. Design tasks, data analytics, and management of network processes will replace operating machines and moving objects as the most important aspects of industrial job profiles.

The survey found that IT and software development skills ranked as the most desirable skills for Industry 4.0. This result is consistent with our previous modeling of the evolution of Germany’s industrial workforce from 2015 through 2025, which indicated that demand for workers with competencies in IT and software development will increase the most. The modeling also found that the number of IT and data integration jobs in Germany will nearly double: 110,000 jobs will be added. Within this job category, growth in demand for industrial data scientists—one of the roles created by Industry 4.0—will be the highest: approximately 70,000 new jobs will be added. Industrial data scientists extract and prepare data, conduct advanced analytics, and apply the findings to improve products or production. Industry 4.0 will also require workers with programming skills, including the ability to use both statistical and general-purpose programming languages. The modeling estimated that 40,000 new jobs will be created in Germany for such Industry 4.0 roles as IT solution architect, user interface designer, and robot coordinator.

Data Security and Investment Needs Are Also Major Challenges

Noting first the lack of qualified employees, survey respondents overall cited data security and investment needs as the next-most-difficult challenges to successful implementation of Industry 4.0. However, delving into the findings by country, we found notable differences in how companies rated the magnitude of these challenges.

Of the German companies, 41% rated data security as a major challenge, compared with only 32% of the US companies. German respondents’ greater concern about data security no doubt reflects the strong sensitivity about data privacy in Germany and points to the need to develop a clear legal framework for data security and data privacy for the digital market. It also reinforces the importance of making further progress toward a long-term data-privacy and data-protection agreement between the US and the European Union.

Companies in both countries said that they will need to make significant investments in order to adopt Industry 4.0, and they estimate the level of investment at, on average, 7% to 9% of total revenues. About one-third of both US and German companies consider excessive investment needs to be a major challenge, although German companies rated this slightly lower than several other challenges. Notably, for manufacturing companies alone, excessive need for investment is the number one concern of US manufacturers: 37% rate it a major challenge. This issue is further down the list of concerns for German manufacturers: only 27% rate it a major challenge.

Because the investment requirements for new digital technologies are significant, companies must develop clear plans for their Industry 4.0 expenditures early in the implementation process. Careful planning is especially important for companies—large US companies as well as small companies in both countries—that are most concerned about their ability to cover the necessary investment costs.

When they evaluate whether investments are excessive, companies need to consider the relatively short period required for capturing a return. BCG’s analysis found that, despite the expected initial investments of 7% to 9% of total revenues, implementation of new digital technologies will help lift overall productivity by 5% to 8% of total manufacturing costs in a steady state, resulting in a positive business case.

Additionally, the expected revenue growth resulting from the implementation of Industry 4.0 will help shorten the payback period to only a few years. (See Industry 4.0: The Future of Productivity and Growth in Manufacturing Industries, BCG Focus, April 2015.)

Moreover, these investments are essential for maintaining competitiveness. Industry 4.0 technologies represent a paradigm shift in industrial manufacturing that is comparable to the introduction of computer-aided design (CAD) systems that replaced analog technical drawing in the 1990s and the integrated CAD systems that subsequently combined the mechanical and electrical design of systems. Companies that failed to be among the early adopters of CAD systems could not keep pace with their competitors’ productivity increases. Because they were unable to participate in the standardized electronic data interchange between companies, many laggards dropped out of their business ecosystem entirely.

Mastering the Challenges

To master the challenges of implementation, a company needs to define a tailored Industry 4.0 strategy. BCG’s ICO supports companies’ efforts by using model factories to facilitate a four-step approach.

Understanding Pain Points and Assessing the Industry 4.0 Maturity Level. To understand where Industry 4.0 solutions can be deployed, we identify the key challenges to a company’s operations. At the same time, we use a health check to help the company assess its current state of Industry 4.0 progress. To better comprehend how the identified pain points can be addressed, company executives and staff participate in exploratory demonstrations of Industry 4.0 technologies at the ICO’s model factories. Recently, a European plant assessed its Industry 4.0 maturity level in more than 20 categories and found that it had to make specific improvements in two-thirds of those categories.

Developing a Long List of Specific Opportunities. Drawing on BCG’s database of more than 150 examples of Industry 4.0 applications, companies can identify specific use cases for further examination, and expert deep-dive workshops at the ICO’s model factories can help companies detail those opportunities. The European plant referred to above identified about 70 relevant use cases. On the basis of discussions during workshops at the ICO’s model factories, the plant’s representatives prioritized these use cases for further detailed assessment.

Assessing Impact and Selecting Priority Use Cases. At ICO’s model factories, additional workshops support companies as they quantify all related implementation costs and required investments for the long list of use cases. The assessment of expected financial and nonfinancial benefits helps companies select the priority use cases for implementation. In such a workshop, the European plant’s representatives prioritized more than a dozen use cases on the basis of attractiveness, using the time required for implementation to distinguish among short-, medium-, and long-term opportunities.

Starting Implementation. We help companies identify technology suppliers, perform application engineering as required at the ICO’s model factories, and prepare for implementing a pilot program and a full rollout. Companies should also assess the qualifications gap of their workforce as related to the use cases and then determine the best ways to respond, hiring new talent as well as retraining the existing workforce.

This study demonstrates that companies do recognize both the significant value of Industry 4.0 and the formidable challenges they must overcome to implement the new technologies. To build and sustain a lead in the race to full implementation, companies need to broaden and deepen their practical knowledge about digital technologies and the related use cases. This knowledge will provide the basis for developing and implementing the right digital manufacturing strategies. The early adopters have set a fast pace for implementation and are building capabilities that will enable them to increase their lead. To maintain their competitiveness, all companies will need to accelerate their efforts along the Industry 4.0 journey.

Acknowledgments

The authors would like to thank their BCG colleagues Marike Bartels, Barbara Eschlberger, Carsten Kratz, Leanne Lewin, Hemant Sangwan, and Romy Uhlig for their contributions to this report.