In many ways, digital technologies have had polar-opposite impacts for consumers and companies: For consumers, life has been simplified and empowered by devices such as smartphones and innovations such as social media. For companies, on the other hand, business has been made more complex by the need to manage many more channels and points of interaction—in-store, on the phone, online, e-mail, social media, and mobile apps, to name a few. With so many channels, platforms, and devices to get right, companies frequently struggle to craft effective customer pathways and make the most of customer interactions. Worse yet, they have difficulty defining the right metrics to measure success. (See What Really Shapes the Customer Experience , BCG Focus, September 2015.)

ABOUT THIS REPORT

The Boston Consulting Group and NICE Systems, a leading provider of enterprise software solutions, have established a partnership to help companies address their customer service functions. This report describes common customer service issues in the digital age and presents solutions.

Customers spread the word about their experiences—whether positive or negative—far and wide among friends and family. Social media extends and magnifies the impact of each advocate—and critic. Conversations about the customer experience boost financial performance. Research by The Boston Consulting Group, which most recently assessed the experiences of more than 227,000 customers with 650 brands in eight countries and seven industries, shows definitively that brands with high levels of advocacy significantly outperform those that are heavily criticized. In our sample, the top-line growth of the highest- and lowest-scoring brands differed by 27 percentage points on average.

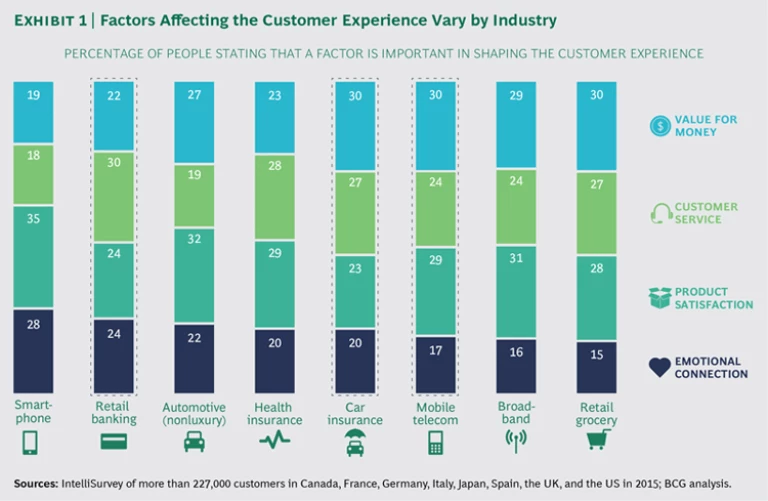

In addition to assessing how advocacy fuels growth, we have identified the precise rational and emotional factors that shape the customer experience: value for money, customer service, product satisfaction, and emotional connection. The mix of the four factors varies by company and industry, but in industries that involve ongoing interaction between consumers and companies (as opposed to the simple purchase and use or consumption of a product), the customer service component ranks high in importance; between 24% and 30% of customers in retail banking, car insurance, and telecommunications, for example, consider it important. (See Exhibit 1.)

Getting the service component right is critical. Not only does service have a big impact on loyalty, but service operations are an excellent laboratory for the wider organization. As customers’ expectations are increasingly set by innovative “native” digital players such as Amazon and Uber, and as competitors raise their digital games, companies are forced to adopt new technologies at an unprecedented pace, in service and beyond. With digital channels and tools constantly emerging, companies must become (to borrow a term from the world of software development) more agile, iterating much more quickly to adapt to rapidly changing conditions. Companies need to develop both the infrastructure and the in-depth customer understanding to manage this transition.

Getting service right is far easier said than done, and many companies struggle. For example, research done for this report by BCG and NICE Systems—surveying 1,704 consumers, ages 18 through 65, in five markets (Australia, France, the Netherlands, the UK, and the US)—found that overall satisfaction ratings for self-service channels, including all-important digital channels, declined by ten points, from 65% reporting satisfaction in the previous survey, in 2013, to 55%.

The addition of digital channels to a company’s service mix brings new challenges for traditional organizations: each additional channel creates new customer experiences that must be carefully considered and managed. Complexity has become a fact of life and a source of barriers of many kinds. Consumer data is scattered across the different channels and touch points, and it is often difficult for a company to gain a consolidated view of a customer’s interactions. Worse still, the data is typically highly disparate and unstructured, including, for example, text information in cookies and voice recordings from call centers. All of this makes it hard to turn data into operational actions. And companies have to balance security requirements and regulatory limitations with the speed, simplicity, and reliability that customers expect from a digital experience.

Our research examined the state of customer service in three industries—retail banking, insurance, and telecommunications—and shines a light on the main challenges that companies face in managing customer service pathways in an increasingly omnichannel world.

Service Channels Are in Flux…

Not only is the usage of digital channels rising but the nature of that usage is evolving, making it difficult for companies to know where to place their bets.

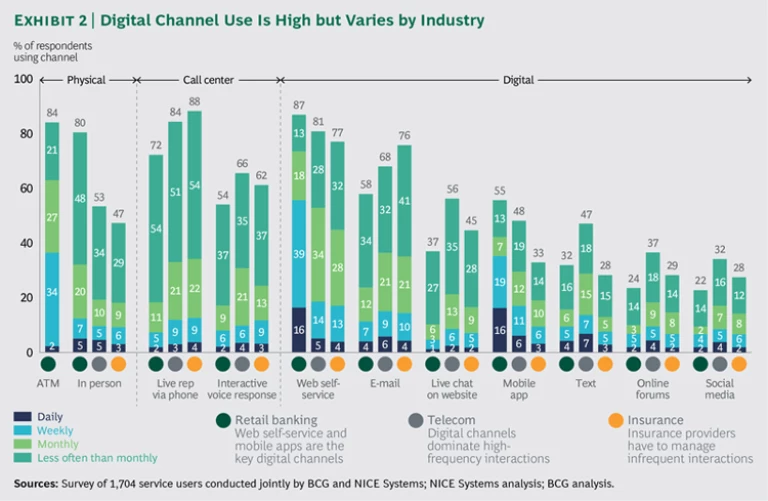

Across the three industries we surveyed, large majorities of customers use digital channels. (See Exhibit 2.) In some industries, digital pathways have become more important than voice—presenting companies with an important opportunity given the low cost of managing digital interactions (once they get them right). In retail banking, for example, Web-based self-service has surpassed both in-person contact and the call center as the most-used service option. Of the 87% of respondents who use banks’ Web self-service offerings, 64% use them at least once a week. Customers appreciate the 24-7 availability and easy-to-use interfaces of online self-service.

Despite a lot of hype in their early years, social media and online forums are falling in popularity as service vehicles. After a rapid increase, from 16% in 2011 to 36% in 2013, usage dropped to 29% in the current survey. The decline was consistent across the three industries. Customers have disparate reasons for shunning these channels but most frequently cite long wait times (40%), limited functionality (36%), and the lack of a smooth pathway to contact a live rep if desired (23%). It’s possible, however, that social usage may pick up again as more companies approach social platforms as true customer service channels and not simply marketing opportunities.

Mobile apps are increasingly popular; 56% of banking customers now use apps, up 6% since 2013. This is a high-frequency channel, accessed daily by 16% of customers and at least weekly by 35%. Mobile apps are also increasingly popular in the telecommunications industry, with 48% of respondents now using apps (up 7% since 2013). In both sectors, it is the “anytime, anywhere” availability of apps that users value the most; 61% of banking users and 54% of telecom customers cite these attributes. And even with increasing mobile popularity, there is still plenty of room for growth.

Even as digital channels grow in popularity, traditional channels are hardly going away: 82% of all respondents start out or end up on the phone, although there is an important distinction to be made here. Customers that start out on the phone do so by preference; they represent an opportunity for the company to show how its service stands out. Those that end up on the phone use voice because other channels have failed, and they are likely already frustrated to some degree. A poor call center experience (which is far from uncommon), especially one that comes after the customer’s problem has eluded resolution through other channels, can do real damage. On the other hand, the impact of a good experience with a live rep is huge. The second-most-cited source of satisfaction in the current survey, at 49%, was “The rep already knows what I need and provides me with an immediate solution,” behind only “My issue is immediately resolved” (51%).

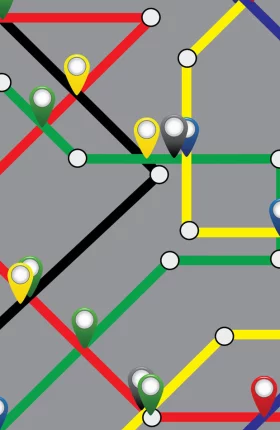

…Fueling Increasing Complexity for Companies

Digital technologies have added at least seven channels to the customer service mix: website self-service, e-mail, website live chat, mobile app, text messaging, online forums, and social media. These new avenues of interaction are a lot for any company to manage. But the real added complexity comes in the omnichannel interaction that many pathways involve today. To build an overall picture of their service users, all companies need to understand why a customer chooses a specific channel in each instance and how his or her journey progresses through channels over time. These factors can vary widely.

In retail banking, for example, almost all customers use a combination of channels to interact with their provider, creating a complex set of experiences. Banking customers use an average of 6.1 different channels for their interactions, and almost 20% of customers claim to have used at least 10 channels one or more times.

More than 96% of telecom customers use a combination of channels—the average customer uses 5.7 different channels; 15% say they have used at least 10.

While insurance providers have been less affected by the advent of digital channels, their customers use an average of 5.1 different channels for their interactions, with 15% claiming to have used at least 10.

Moreover, the mix of channel use varies significantly across industries and with age. Younger users are more likely to use a larger number of channels than older users, because of their greater general uptake of digital technologies. For example, 18- to 30-year-olds are more than twice as likely as 45- to 65-year-olds to contact companies via mobile apps, social media, or online forums.

These complex experiences are now a fact of life for providers, but companies and industries vary widely in their ability to manage them effectively. In retail banking and insurance, respondents who had used a single channel and respondents who had used more than one were equally likely to report a perfect interaction. Among telecom customers, 23% of respondents who used a single channel reported a flawless experience but only 14% of those using multiple channels reported the same.

To deliver a flawless experience, or even an acceptable one, companies need to carefully craft their customer pathways. This involves both the explicit design of the transition between channels, such as online click-to-connect, and the seamless sharing of information collected along the pathway at each stage. Productive use of customer pathway information is vital. Customers mark down the service experience when they encounter no recognition of what they have already done or are forced to repeat the same information multiple times. Anticipating customers’ needs and addressing them proactively are other factors that customers cite as features of a flawless experience.

Perfection is more often the exception than the rule these days. Many channels are managed in isolation: the mobile app has no link to the call center, and the call center is optimized without digital integration in mind. This needs to change, for the benefit of both customers and companies.

Self-service channels—which can identify the customer’s immediate need—can play a significant role in improving call center performance. Information from other channels can be used to route calls to the appropriate staff, reduce the number of questions that need to be asked, and prevent the transfer of calls between multiple service reps. A quarter of consumers would be happy to use an interactive voice response (IVR) system—a generally unpopular channel—if they knew that by doing so, they would be routed to a more specialized rep who was aware of their IVR experience. Similarly, contact service reps trained to assist customers online (and given incentives to do so) can have a dramatic impact on digital adoption.

An omnichannel approach is the key to achieving two important goals: using customer service to further overall customer experience excellence, and driving significant savings for organizations as average call volumes and handle times are reduced and resolution at the time of the first call is improved.

Keeping Customers in Digital Channels

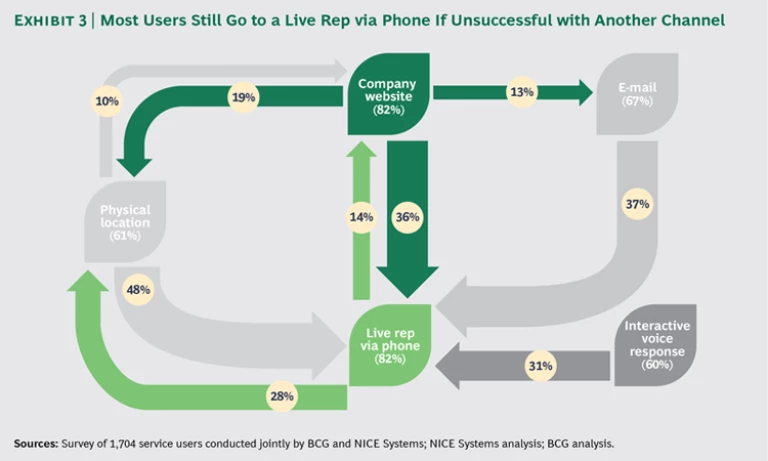

Regardless of the channel they start in, customers who don’t get a resolution to their problem or the service they need most often seek help from a live rep on the phone or in a branch or store. (See Exhibit 3.) Banking customers are most likely to head to their local branch; insurance and telecom customers hit the phone. Either way, the flexibility of a live interaction is the primary appeal, along with the simple preference for speaking with a real person.

The issue for companies, of course, is that both of these channels carry a significant cost to serve—much higher than that of digital and other self-service interactions. Moreover, every switch to a new channel risks provoking customers’ annoyance, especially if they believe their efforts thus far have been for naught or if the information they have provided is not captured at the next stage of the interaction.

Of the industries we studied, banks have been the most successful at addressing customer issues in self-service digital channels: they successfully resolve 65% and 57% of self-service interactions through their websites and mobile apps, respectively. Telecom and insurance companies’ rates of success are much lower, particularly with respect to mobile apps. (IVR tends to be less successful across the board, but banking providers again come out on top, with a 39% success rate compared with 32% for telecom companies and 28% for insurers.)

Part of the reason for banks’ success is the nature of the issues and inquiries they deal with—it’s easier to move money between accounts using a smartphone, for example, than to resolve an insurance claim or address a communications service problem. But their success also reflects the investment that many banks have made in their systems and their strong focus on simplification. Banking is an industry that felt the heat of digital disruption early. Consumers were quick to grasp the ease and convenience of online banking, and traditional banks were soon faced with fresh competition from financial technology, or fintech, startups that use software to disrupt nearly every step of the financial services value chain. One result was that most banks have invested significantly in digital capabilities, and many are taking a multiyear journey toward digital transformation. Others are opting to acquire existing digital banks. Regardless of the road chosen, the results can be seen in the digital capabilities of financial institutions relative to those of other industries. BCG’s 2013 research into digital satisfaction in the US found that banks had already opened a lead over other industries and that the top three drivers of consumer satisfaction with banks were gaining ready access to information, getting help quickly, and transacting business with ease. (See Delivering Digital Satisfaction: U.S. Consumers Raise the Ante , BCG Focus, May 2013.)

Getting the Call Center Right

Customers rank the call center experience—both speaking to a live rep and using IVR—as the worst among all channels. This is a big problem for many companies because a large percentage of customers and prospective customers use the phone, either as their first choice or when they strike out on other channels. Technology can help make the call center experience more personal—and successful—by tracking the other channels that customers have used and the information that they have already imparted about their need or problem. This sort of capability is particularly important for personalizing the service experience and for turning around situations in which customers use the phone as a last resort.

Customers report multiple call center pain points. Enduring an excessive wait time is often the most frustrating aspect (cited by 60% of telecom customers, 43% of insurance customers, and 31% of bank customers)—and an experience that erases the benefit of a direct, immediate channel. Having to speak with multiple reps and repeat information is another pain point (cited by 45% of bank customers, 36% of telecom customers, and 32% of insurance customers).

To build a good call center experience, companies need to make effective and productive use of information collected along the customer pathway. Call center technology must be able to deal with disparate data from different sources in real time. Customers want their needs anticipated and addressed—quickly and easily, without a lot of effort on their part. When service reps know what actions customers have already taken in a self-service channel and customers are not asked to repeat the same information during multiple steps, customers are much more likely to have a positive view of their experience.

Using deep knowledge of customers’ pathways can also improve service-to-sales interactions, ensuring that each customer gets the best, most relevant offer. A personalized offer can be tailored to fit a customer’s broader profile along with the specific pathway he or she has taken to that point. Tailoring such an offer not only increases the likelihood that the customer will accept the offer, it can also increase satisfaction and retention. More than 30% of surveyed customers cited an attempt to sell them an irrelevant product as a top reason for leaving a provider.

Three Areas to Address

Customers want obtaining service to be easy, and delivering ease (while solving the problem or fulfilling the need) can have a big impact on satisfaction and loyalty. The vast majority of surveyed customers who had an experience that required very low effort (93%) reported that they were very or extremely satisfied. Almost two-thirds of those reporting extreme satisfaction said that their experience had increased their loyalty to their provider.

Companies can improve customer service by taking concrete steps in three ways: carefully designing the customer pathway, improving self-service channel containment, and personalizing the experience for customers.

Carefully Designing the Customer Pathway. Tracking customers as they engage in multichannel pathways, often to resolve a single issue, can help providers identify and resolve a number of challenges and help guide investment across channels. Companies can take multiple steps:

- Map all customer pathways to understand significant patterns in customer behavior.

- Identify the root causes of dissatisfaction and churn, including the gaps in information that occur when customers move among pathways.

- Find broken pathways, pathways with low satisfaction, and pathways that lead to customer churn.

- Take action to build into service moments that can generate a customer response of “Wow!” and improve overall satisfaction and customer loyalty.

- Continually monitor and improve the customer pathway.

Improving Self-Service Channel Containment. To build a successful—and cost-effective—customer service operation, providers need a solid foundation of quality self-service options that can meet the majority of customers’ needs and contain customers within those channels, thus preventing the need for customers to attempt resolution by trying other channels. The following steps can help:

- Identify the root cause of each call going into the call center.

- Understand the flow of calls from digital channels to the call center.

- Pinpoint containment failures in self-service and digital channels, and identify new opportunities for self-service.

- Identify the customer issues that tend to generate the most repeat calls.

- Develop and implement clear action plans to increase channel containment, reduce repeat calls, and minimize the effort required of customers.

- When customers do need to reach out to a service rep, use predictive analytics to anticipate the reasons for their calls and provide agents with guidance to improve resolution rates.

Personalizing the Customer Experience. Technology solutions, especially those employing big data and advanced analytics, can help personalize the service experience for customers. Using the tools available today, companies can:

- Personalize service-to-sales interactions in real time.

- Drive both sales and satisfaction by combining “who the customer is” with “what the customer does” to present the best relevant offer.

- Optimize pure sales or service interactions, using personalization to fully engage with customers and help to create the perfect experience.

- Shape interactions as they occur by using real-time analytics.

Customer service is just one aspect of a customer relationship experience that increasingly involves digital channels. Getting service right is one part of a broader necessity. Companies must find ways to manage all aspects of the increasingly digital customer relationship. Fast movers will find good news on two fronts: they will not only see improved results from better customer service but also build capabilities that can be applied more broadly, to other areas of their business, as the impact of digital technologies continues to grow.