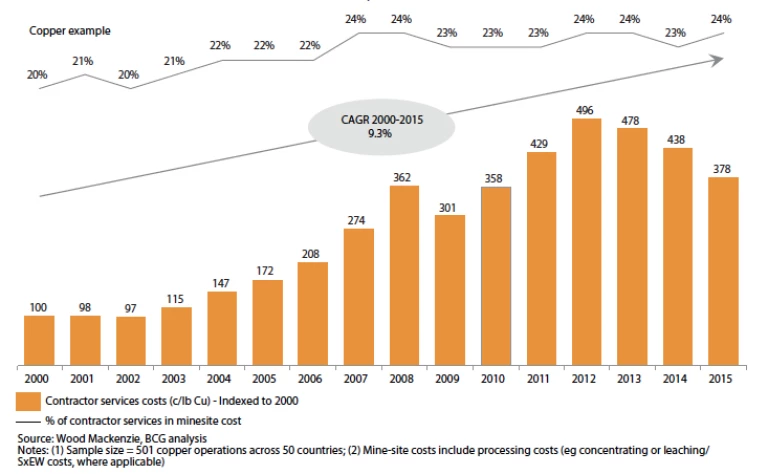

As noted in Mining Journal’s September 2015 article “ Creating Value Through Breakthrough Productivity ,” mining companies rely heavily on service contractors—from blasting and equipment leasing to equipment maintenance and industrial surveillance (to name just a few). For instance, in copper mining, contractor and services costs constitute nearly a quarter of total mine site costs. These costs have shown a compound annual growth rate of 9.3% over the past 15 years. (See Exhibit 1.)

For many miners, examination of their contractor situation would reveal vital opportunities to boost service productivity and lower service costs. There is a surprising amount of wasteful spending on outsourced services – from oversize contractor crews assembled for infrequent demand to proliferation of service providers performing similar onsite activities.

Often, this problem stems from a disconnect between procurement and operations. For instance, operations managers issue service demands to procurement, often overstating their requirements to ensure a smooth operation.

Sourcing professionals don’t question the defined scope of work if they’re not accountable for savings beyond those they can achieve during commercial negotiations. Moreover, many lack the tools and capabilities needed to challenge operations managers’ demands.

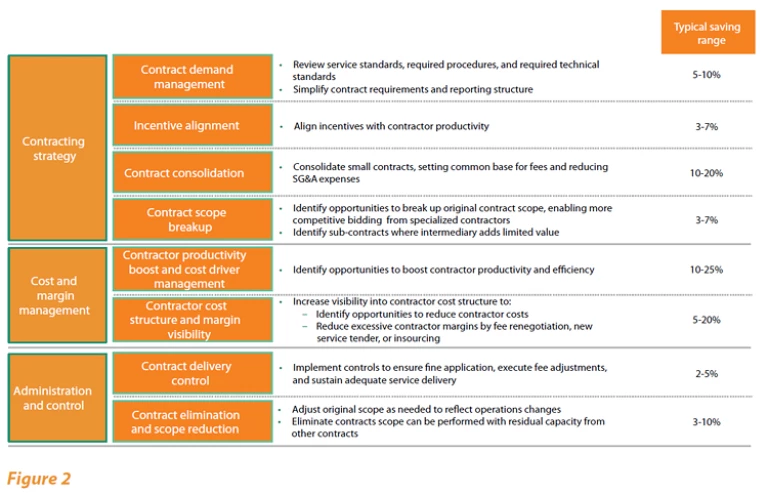

Drawing from work with clients in the mining industry, The Boston Consulting Group has defined eight “levers” that can help miners achieve 20% to 25% savings on contractor services. The levers fall into three categories: contracting strategies, contractor cost and margin management, and contract administration and control. (See Exhibit 2.)

One company we worked with had been leasing auxiliary equipment from four suppliers that provided similar equipment. Some equipment had low utilization rates; in other cases, different fees were charged for the same equipment type. The company redefined its contracting strategy to consolidate the contracts—improving utilization rates, reducing equipment required, and decreasing annual expenditure by 15% to 25%.

Another company experienced the benefits of more effective cost and margin management. It examined its maintenance contractors closely and saw that the contractors’ actual margins (in some parts of the contract) were higher than stated during the bidding process.

The miner brought the outsourced activities in-house—scoring a 5% to 7% decrease in yearly plant maintenance spending.

Yet another company benefited from strengthening its contract administration and control. It had been outsourcing its blasting operations and realized the contractor had been charging for double priming (two electronic detonators per blast hole). The reason was that some of the detonators the contractor provided incurred damage during blasting and could result in misfires.

According to the contract’s terms, such expenditures should have been covered by the contractor. But site managers lacked thorough knowledge of the terms negotiated by procurement. Correction of the oversight delivered a 3% decrease in annual spending on the contract.

To uncover greater savings opportunities in the future, procurement professionals and operations managers will need to work together to gain deeper insight into operations. The goal is to clarify what drives service productivity in different operations and identify changes the company could make to enhance productivity.

Surprisingly simple changes to processes and operating standards can deliver disproportionate improvements in contractor productivity that translate into major savings. For instance, one miner captured savings of 40% by eliminating a hopper-truck contract for dust control and instead using “supersucker” trucks already deployed in the operation that had excess capacity.

But to identify such opportunities, procurement staff and operations managers must be willing to challenge long-held assumptions about what constitutes “best” practice and “right” behavior.

Take the company cited above. Managers originally assumed that the existing supersucker trucks could not accommodate the incremental dust volumes. But utilization analysis and “muda walks” (close observations of processes to see where waste exists) revealed this assumption as incorrect—giving managers a fresh perspective on the situation.

At another company, managers assumed they couldn’t reduce full-time equivalent head counts from maintenance contractors. That’s because they believed they actually needed more people to get the work done.

Demand, capacity, and tool time analysis showed that the company could, in fact, decrease the number of contractor electricians and mechanics used, with no negative impact on operations.

To take full advantage of new cost-saving opportunities uncovered through operations analysis, miners need a disciplined approach to contract negotiations. Skilled use of negotiation tools can help them achieve better economic terms. Such tools are available for every stage of the negotiation process. For instance, while preparing for a negotiation, miners can define their BATNA (best alternative to a negotiated agreement) and estimate their suppliers’ BATNAs, as well as identify a ZOPA (zone of possible agreement) for the deal.

Once at the negotiation table, miners should be aware of the influence of cognitive biases in the outcome of negotiations. “Anchoring” (the tendency to use the first piece of information offered as a point of reference) suggests that the party that puts forth the first bid in the negotiation will have a stronger position.

“Justification” is another example: counterparts respond more positively to a request when the other party clarifies the rationale behind the request—because justification creates a sense of fairness.

Companies can also take a collaborative rather than combative stance when negotiating. Key skills here include actively listening in order to identify problems and brainstorm solutions, highlighting areas of agreement, and focusing on interests (what each side values most from the deal) rather than positions (a party’s stand on an issue).

Understanding cost-saving levers, analyzing operations to identify savings opportunities, and negotiating in new ways to capture more value from contractors are all capabilities that require a new approach to sourcing. This approach combines a traditional commercial perspective with deep operational insight that sourcing professionals can gain only by working closely with operations managers. Mastering this approach takes time.

But the investment can pay big dividends for miners: maximized service productivity that translates into considerable cost savings.

This article was first published in Mining Journal on December 20, 2015.