Around the world, traditional brick-and-mortar retailers are grappling with serious challenges. These include sluggish economic growth in the countries where they have a presence, along with relentless pressure from online rivals as well as big-box and innovative specialty retailers. The ever-stiffening competition has eroded traditional players’ margins, prompting them to cast about for wellsprings of new growth and enhanced profitability.

An increasing number of companies are taking advantage of cash-rich balance sheets and a reviving market to drive growth through acquisitions and to capture revenue and cost synergies. In the last three years, the global retail sector has seen more than 150 M&A deals greater than $250 million in value—a 45% increase over the previous three years. However, the retail sector has unique characteristics that make M&A particularly challenging. Store footprints cannot be changed quickly, owing to lease obligations. Supply chains have taken on international proportions. Each company has its own pricing philosophy and models. Many have outdated IT infrastructure and applications. And given SKU proliferation, integrating IT and operations has become more complex than ever.

In this mature industry, merely snapping up companies isn’t enough to overcome those challenges and achieve the hoped-for growth. To better ensure that M&A deals deliver the desired outcomes, companies should master the complexities of the integration process in the preclose period. By properly planning for postmerger integration , companies can position themselves to reap faster and greater synergies immediately after closing—starting on day one of the new entity.

Wanted: A Proactive Approach to PMI Planning

Businesses that excel at PMI planning can quickly stabilize the newly combined entity and generate the funds they need to transform their business. For many, such transformation can take the form of expanding into adjacent spaces that offer higher growth. Consider Starbucks’s acquisition of Teavana in 2012. Starbucks referred to the purchase as an enhancement to its core business and as “connective tissue in the master blueprint for Starbucks’ growth.” Its intention is to learn from Teavana, an authority in the tea market. In return, Starbucks will bring its excellence in beverage service while greatly expanding its store footprint.

Companies that don’t swiftly capture M&A synergies risk destroying value. In particular, shareholder returns can decline, driven by managerial distraction and ballooning one-time charges (such as transaction costs and consolidation of supply chain networks, IT applications, and infrastructure). Such value destruction could put the acquiring company’s core business in peril, causing it to lose ground to rivals that manage to move more swiftly into high-margin markets. Indeed, in BCG’s analysis of 400 M&A deals of retail and consumer products companies, 48% of the newly combined entities saw their

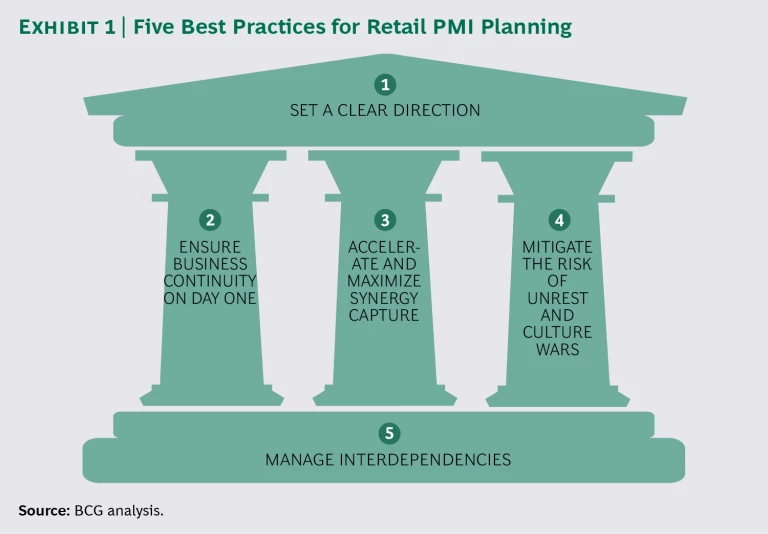

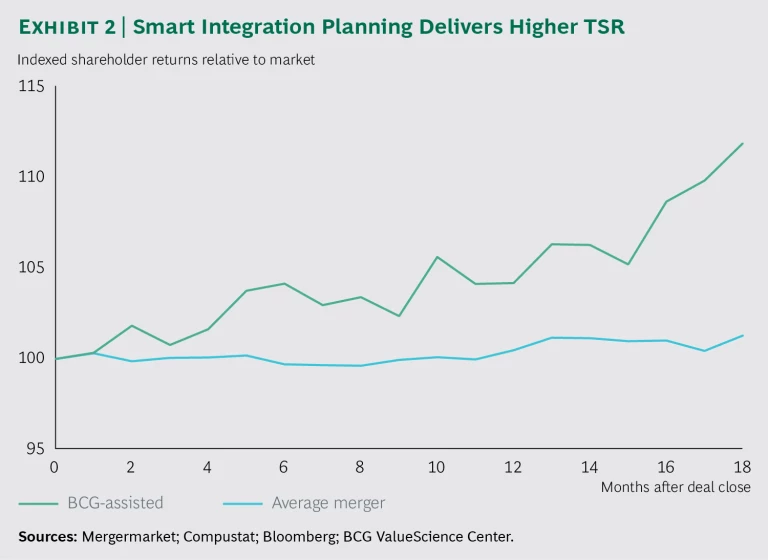

To capture the synergies promised by an M&A deal as soon as possible after closing, retail companies need to master five key practices during the PMI planning effort, which should be conducted after due diligence and before closing. (See Exhibit 1.) These five practices are vital for all retail M&A deals, regardless of the financial health or size of the companies involved. In fact, clients we have worked with over the past five years that have focused on these practices (550-plus M&A deals with a cumulative value of more than $2 trillion) achieved TSRs as much as 11 percentage points higher than those delivered by the average M&A deal. (See Exhibit 2 and "Retail PMI Best Practices in Action," for an example of one company where these practices generated impressive results.)

RETAIL PMI BEST PRACTICES IN ACTION

In preparation for an M&A deal involving two retailers with combined sales of $15 billion, BCG worked with the leadership teams of the acquiring and the to-be-acquired company over a six-week period.

Defining the Deal’s Direction

To set the direction of the post-deal integration, a senior vice president from each company, sponsored by the corresponding CFO, was designated as an integration coleader. Among other tasks, the coleaders established a planning calendar and chose integration teams (including COGS, merchandising, supply chain, contracts, finance, IT, HR, and legal). They then assigned a sponsor for each team and designated team leaders.

The coleaders also proposed synergy targets approved by the steering committee and gathered financial and personnel baselines. For instance, they consolidated employee data from both companies and analyzed the combined human-capital picture compared with that of the two separate organizations. Besides helping to set a clear direction for the integration planning teams, these activities laid a foundation for coordinating all the teams’ efforts. They also ensured effective management of interdependencies across functional areas, such as aligning SKU harmonization with decisions regarding supply chain, inventory planning, and store operations.

Setting the Stage for Business Continuity

The acquiring retailer identified the functions critical to establishing a business continuity plan and then defined those functions’ day-one priorities. Roughly a month before closing day, planning leaders met with each functional team once or twice each week to assess their progress and bring any challenges to the attention of the integration coleaders. As a result, the day-one period came and went without any incidents that could threaten business continuity, and the integration teams were able to stay focused on executing the integration plans they had developed.

Ensuring Early Synergy Capture

Because this new company planned for synergies well ahead of closing day, it was able to capture run-rate cost synergies by the end of year one that were double the estimate developed during the due diligence process. These synergies translated into roughly 25% higher P&L impact over the first three years after the integration. These gains, in turn, helped offset the one-time cash costs that the company had incurred earlier in the integration process. In addition, the retailer was able to meet with key vendors quickly after closing day to negotiate more favorable pricing. And its B2B sales force could immediately communicate the combined entity’s new value proposition to major customers.

Making Organizational Design Decisions

In planning the design of the newly combined entity, the acquiring retailer’s CEO selected his direct reports and charged them with designing the third layer of leadership (their own direct reports) and selecting individuals to fill those roles. Third-level leaders then designed and selected for the fourth level, leaving fifth-level managers to do the same for all remaining reporting layers. In managing these design tasks, the CEO rigorously applied clear organization design principles (including spans of control) and savings targets.

All the design and selection work was completed in less than three months postclose, thanks to the integration planners’ thorough preparation and training of HR practitioners, compensation experts, and leaders. Moreover, the CEO remained a strong sponsor of the effort during the process. Though the resulting design meant painful changes for some individuals, the clarity and speed with which it was executed quickly stabilized the organization in the PMI period.

Planning for Interdependencies

The retailer set up an integration management office, which monitored decisions about interdependencies across integration teams and encouraged cross-team conversations about how choices made in each function might affect other parts of the business. The company held “summit meetings” attended by all the integration teams, which presented and discussed status reports on cross-functional interdependencies. As a result, everyone involved understood how each interdependency would be managed after the close, such as when the SKU portfolio would be harmonized and when IT applications and infrastructure would be rationalized.

1. Set a Clear Direction For the M&A Deal

In M&A deals involving combined sales of $10 billion, it’s not uncommon for the PMI planning process to involve large numbers of people (often more than 100) from both the acquirer and the target company. Some focus full-time on the deal, but the majority work part-time to ensure business continuity during integration planning. These individuals participate in teams that concentrate on specific aspects of the deal, ranging from merchandising, cost of goods sold (COGS), store operations, and real estate to supply chain, IT, finance, and HR. As with any other large-scale transformation effort, a clear direction is critical. Defining the deal’s strategy, establishing strong leadership, and setting synergy targets can help.

Define your strategy and vision. Everyone involved in PMI planning needs to understand the strategy and vision behind the deal. They also need to know the outcomes that the company wants the deal to deliver. The acquiring company’s executive committee must therefore articulate the deal’s strategic aims, such as building scale; gaining new efficiencies, capabilities, or product lines; and entering an adjacent market.

Committee members also need to communicate the vision of the combined entity—specifically, how they plan to integrate the two companies. For instance, in some companies, the intent may be to blend “best in breed” processes, people, and systems from each company. In others, the objective may be to keep the acquired company intact and “tuck” it into the new parent business instead. Still other organia may want to create an entirely new entity that bears little resemblance to either original business. By understanding the vision, integration teams can more easily see where they should focus their efforts.

Establish strong leadership. To set and maintain a clear direction, top leaders at the acquiring firm need to be closely involved in the PMI planning process and held accountable for the deal’s success. At the very least, the company must set up an integration management office that has the authority and resources needed to orchestrate PMI planning activities. The CEO should chair the steering committee established for the M&A deal, with the committee designating an integration leader who will focus exclusively on planning the deal. Ideally, this leader will be someone who has authority as well as the respect of people throughout the company. He or she doesn’t need to come from a specific function but must be very senior and have strong general-manager skills. To attract the best possible talent, this role should be positioned as a key stepping stone to advancement. Indeed, it is a determinant of success in any integration.

Meanwhile, senior line executives from both companies should be chosen before the closing to cosponsor integration teams. These teams will be responsible for those functional areas of the business that promise the best synergies (and thus the greatest value) or that carry the highest inherent risks. In the traditional retail industry, these areas typically include COGS, goods not for resale (GNFR), supply chain, organization design, IT, store footprint, B2B sales forces, and e-commerce channels. Teams in charge of these areas should be equipped with the skills, funding, and technologies they’ll need to capture the promised value and mitigate the inherent risks.

Set synergy targets. The steering committee must set aggressive yet achievable synergy targets for each functional area, such as specific percentage cost savings and revenue gains. The committee can also define “stretch” targets for each area, challenging the integration teams to identify the best potential synergy opportunities. Additionally, the committee should set a target for total synergies achieved in the first year after the close in order to ensure that the teams move quickly to integrate the companies. In BCG’s experience, the most effective newly merged companies capture most

2. Ensure Business Continuity on Day One

In an M&A project, “day one” isn’t a single day but rather the period immediately after close, usually one to two weeks. During that time, a number of issues can arise and destabilize the new entity, putting business continuity at risk. Examples include the inability to close the two entities’ books on day two, confusion over reporting relationships, and conflicting hiring or firing policies. PMI planners have only one chance to get day one right, so they need to determine early on how they will mitigate such risks and ensure flawless execution of day-one responsibilities. PMI planners therefore need to help specific functional areas meet several imperatives.

Finance. In M&A deals, finance is responsible for a hefty volume of work. Professionals in this function must close the two antecedent companies’ books and open the combined entity’s books—all during the day-one period. (Most companies will want to close the books as soon as the deal has received regulatory approval, even if one or both companies are in the middle of their fiscal year.) Finance professionals also have to define finance-related decision rights and approval authority for the new entity, value assets (including inventory) using a common methodology, and align accounting policies and business unit structure.

HR. For HR, continuity challenges during the day-one period include retaining talent and ensuring ongoing operation of payroll. Professionals in this function may also have to handle complex personnel situations. For example, how does the entity address individuals (at headquarters or in the stores) who were fired with cause by the acquiring company and then hired before the merger by the acquired firm? What about employees who happen to work part-time at both companies’ stores or distribution centers, or those from the acquired company who’ll bring health care liabilities into the picture? Who in which company will report to whom after closing day?

Additionally, key policies on such matters as vacation and sick time, severance, retirement benefits, promotion schedules, parental leave, and job titles must be reconciled. To resolve conflicts in such policies, an interim decision may have to be made (to keep each policy as is for a certain period, for instance). Disparities in policies and benefits can trigger conflict in groups that are now expected to work together closely or that are combined into one. HR will want to address such issues quickly.

To help HR go into day one prepared to resolve such questions, integration planners can train HR to develop and communicate consistent messages to employees.

Corporate Communications. The corporate communications team will be in charge of developing robust and detailed internal and external communications plans supporting company leaders. For instance, they will have to get the proper information out to investors, employees, customers, and vendors of both companies. Such communications may range from press releases and policy documents to conference calls and live stakeholder meetings. These professionals will also need to guide employees in how to communicate with customers after closing day. For instance, what will company A’s store employees say to customers who want to exchange company B’s products in A’s store? What if customers of either company wish to use gift cards from the other company?

These and other considerations need to be worked out by developing clear communications plans well before closing day.

IT. A retailer’s IT function typically supports other functions’ day-one priorities, such as helping finance close books, creating management reports, and helping employees from different functions gain visibility into each other’s address books and calendars. To accommodate these priorities, the IT group has to develop a day-one plan. That includes understanding the needs of all the functions it supports, clarifying which tasks IT will and won’t shoulder, consolidating requests across functions, and prioritizing tasks that IT can address with its existing capacity.

Legal. To ensure business continuity during the day-one period and after, people in the acquiring company’s legal function must analyze their own and the acquired company’s outstanding legal obligations, ongoing litigation, and any potential new legal claims that could arise, such as product liability or customer lawsuits. They will then need to determine how each legal situation will be processed after the M&A deal closes.

3. Accelerate and Maximize Synergy Capture

Capturing estimated cost synergies as soon as possible after closing day can magnify an M&A deal’s positive impact on a retailer’s bottom line. The earlier in the integration planning process that a company defines potential synergies and crafts a plan for achieving them (such as by reducing headcount or combining business systems), the sooner it can execute the plan—and garner the intended savings. For every month that synergy capture is accelerated, the newly combined entity gets one-twelfth (roughly 8%) of end-state savings on cash flow by offsetting one-time costs. To this point, $100 million in cost synergies can deliver as much as $8 million in cash generation per month of acceleration.

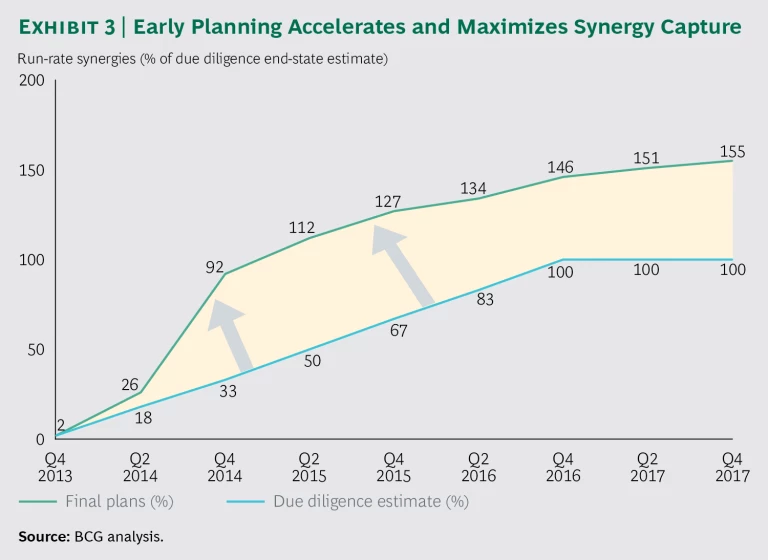

In addition, starting synergy planning early enables rigorous and in-depth planning, rather than the often rushed planning that occurs immediately after close. This can increase total synergies dramatically.

Consider using a “clean room.” As soon as possible before closing day, acquiring companies should develop bottom-up estimates of the merger’s high-value cost synergies. Estimating these synergies often requires access to sensitive information, such as the target company’s COGS or GNFR, or the volumes that it buys from its suppliers. By law, companies cannot share sensitive data until close.

For this reason, the acquiring company may want to establish a clean room, in which an independent third party—a clean team—can view and analyze sensitive information without either company seeing the data. The clean team can assess where the best cost synergies lie and share summarized output with both companies. Clean rooms and teams can help accelerate synergy capture, so they should be established as soon as possible in the preintegration phase and continue functioning until the close.

Quantify the highest-value synergies. An effective clean team focuses on synergy opportunities that will yield the most value. In retail, more than 75% of cost synergies can come from smart decisions about how to manage COGS, supply chain, GNFR, store footprint, and B2B sales forces after the merger. Clean teams may concentrate on activities such as matching SKUs, comparing supplier contract terms and GNFR pricing, mapping store footprints, and identifying overlaps in the two companies’ expansion plans.

To identify and quantify potential synergies in COGS, GNFR, and B2B sales forces, the clean team can prepare “playbooks” detailing who in each company is responsible for which vendor or customer and what each person’s “ask” may be. Examples include requesting parity across the combined purchase volume with the lowest contracted price or negotiating better prices with a vendor immediately after closing day. Such moves are especially relevant when the two companies involved in the deal have vendors or large customers in common. Suppliers and customers will craft strategies for doing business with the newly combined company the instant they learn of the merger.

When it comes to the two companies’ store footprints, the clean team can assess existing footprints and generate ideas for optimizing them. For instance, the team may suggest conversions from one footprint to another to best serve consumers’ needs (such as by changing a company A to a company B store).

Using clean teams to quantify high-value synergies can significantly accelerate and maximize synergy capture. For example, a retailer that invests in three months’ worth of clean-team planning for COGS synergies before closing day can accelerate capture of those synergies by three months. This translates into about 25% (three-twelfths) of COGS run-rate synergies in terms of additional cash generation. More rigorous planning can result in identification of higher synergies. We have seen companies identify synergies that are over 50% higher than the due diligence estimates, which are often on the more conservative side for a lower-risk deal valuation. (See Exhibit 3.) In most cases, such results represent a handsome return on the investment in synergy planning and the clean team before close.

4. Mitigate the Risk of Unrest and Culture Conflicts

M&A deals can spark disruption and unrest among managers and employees in the acquiring and acquired company alike—before and after closing day. Before the close, people on both sides often worry about how the deal will affect them. They wonder if they will keep their jobs, if their responsibilities will change, or if they will have to move to a different team or report to a new supervisor. Two companies with vastly different organizational cultures (a common occurrence in increasingly consolidated industries) can experience an us-versus-them mentality. And conflicts over “how we do things around here” can erupt postmerger.

To guard against such disruption, integration planners need to manage the “softer,” human side of the deal with as much rigor as they manage the “harder” aspects, such as synergy quantification. Defining the desired culture and making smart choices about organization design can prove invaluable.

Define the desired culture. Integration planners can use workforce surveys to gauge how the two companies are similar or different in terms of organizational culture. They then need to define what kind of culture they want the newly combined entity to exhibit. Cultural considerations can range from how people make decisions and whether job performance is based on individual or collective achievement to how much value is placed on risk taking and counterintuitive ideas.

Once planners have developed a clear picture of the desired culture, they should design change initiatives aimed at fostering the attitudes and behaviors associated with that culture. For example, suppose leaders in the newly combined entity want to encourage a more innovative, customer-focused culture. They may decide to offer training programs that will help managers and employees practice behaviors essential to such a culture—exposing themselves to unfamiliar ideas, for example, and interacting more frequently with customers. Planners must also ensure that each change initiative has an executive sponsor, skilled implementation leaders, and adequate resources to ensure successful execution.

As with any other major change initiative, leading cultural change requires clear and ongoing communication with those involved. Before people can enthusiastically commit to contributing to change, they need to know what’s expected of them, why the changes matter, and how they will benefit from a successful merger. To manage change effectively, PMI planners can use frequent “pulse checks” to identify resistance to change within the organization and address any emerging concerns quickly, before they erode workforce morale and confidence in the new entity.

Decide on the organization’s design. Deciding on a design for the newly combined organization—including role definitions and reporting relationships—is a large, complex task. But tackling as much of it as possible well before closing day can go a long way toward mitigating disruption and unrest afterward.

At the very least, we recommend that acquiring companies design the first two or three managerial layers of the anticipated new entity before the close and determine which individuals will fill which roles within those layers. Immediately after the close, the company should announce these appointments and reporting relationships and activate them. Additional organizational design tasks could include defining roles and responsibilities lower in the reporting hierarchy and developing training for second- and third-level leaders. For every identified task, planners must line up HR professionals who will be responsible for executing plans.

Decision authority protocols are another component of organizational design. Integration planners will need to determine who has the authority to make which decisions and establish a process for making changes to those protocols. There are plenty of decision frameworks to choose from, but we’ve found the RACI model helpful. For each activity and decision, a company identifies who is responsible, who is accountable, who will be consulted on the decision (such as a subject matter expert), and who will need to be informed. The RACI model is particularly useful for the top 10 to 15 cross-functional activities and decisions in an organization, since the groups responsible for those activities and decisions are most likely to be affected by changes in organization structure. Examples include pricing and promotion planning, digital/online marketing, and inventory and merchandising planning.

5. Manage Interdependencies

Decisions made during PMI planning have ripple effects because of the interdependencies among different parts of the business. A choice in one area (such as whether the two companies will maintain separate brands after closing day) ultimately affects multiple other areas (such as marketing, store operations, real estate, and procurement, to name a few). To manage these interdependencies, companies need to anticipate them and devise plans for ensuring that different parts of the business don’t end up working at cross-purposes after closing day.

In our work with clients, we have identified a number of strategies for managing the most challenging interdependencies.

SKU Harmonization. Harmonizing SKUs can help a newly combined entity capture valuable COGS synergies. But it will also have complex implications for numerous parts of the company, including its marketing function, logistics groups, and teams heading up store operations. To manage this ripple effect, planners can start by identifying which SKUs both companies sell. Then they can harmonize all similar SKUs and, in parallel, rationalize SKUs by, for example, reducing an assortment from ten sizes of soda-brand bottles to just three.

IT Migration. Decisions about which IT applications and systems to migrate from which company to the combined entity will affect all functions in the new organization. To improve the odds of a smooth transition, integration planners can meet with function leaders and determine each functional area’s IT needs for day one, year one, and beyond. Armed with these insights, they can build more informed plans for migrating IT—plans that will support rather than hamper strategies aimed at capturing synergies.

Supply Chain Optimization. Retailers can capture synergies by optimizing their logistics network, but such changes will affect COGS, store footprint, and store operations. To ensure a coordinated effort, integration planners must make thoughtful decisions about such issues as where to locate warehouses and distribution centers and how many of each to have, which transport modes to use on which routes for which shipments and customers, and how frequently to order inventory from which suppliers. In making these decisions, planners have an opportunity to improve supply chain systems and processes in ways that help make the new entity more efficient than either of its antecedents, reducing costs throughout the network.

Headquarters Design. Decisions about headquarters design will powerfully affect the newly combined company’s operating model, including which business processes are standardized versus localized. For instance, the acquiring company will need to determine whether the acquired company’s headquarters will be closed down, whether it will continue to house certain functions or shared services, or whether it will continue operating much as it did before closing day. The sooner integration leaders make these decisions in the PMI planning process, the more easily they can anticipate the practical implications of their choices and craft plans for managing them.

M&A activity is on the rise in the retail sector. But all too many deals don’t deliver the hoped-for cost and revenue synergies that can translate into fresh growth, better shareholder returns, and healthier profit margins for the acquiring company. To extract maximum value from their M&A deals—as swiftly as possible after closing day—retailers need to invest sufficient time and careful thought as early as possible during integration planning. The five best practices we’ve laid out here can help acquiring companies capture greater synergies more swiftly—and promptly channel the resulting value into their next strategic move.

Acknowledgments

The authors give special thanks to Chris Barrett and Ioana Dumea for their help with this project. They also thank Lauren Keller Johnson for writing assistance and Katherine Andrews, Gary Callahan, Kim Friedman, Abby Garland, Gina Goldstein, Hannah Holbrook, and Sara Strassenreiter for editing, design, and production.