The United Kingdom’s vote to exit the European Union is already leaving a mark on the country’s economic landscape. The full timing and extent of the break are uncertain and may not be known for several months, but many British companies are starting to reassess aspects of their business. Private equity firms will have to step up their due diligence and accept additional risk in UK investments. But the breakup also offers an opportunity for PE firms that have honed their capabilities in helping companies deal with change.

Brexit will put UK companies under stress in several ways. The British pound will be more volatile against other currencies, and overall macroeconomic growth is likely to weaken. UK companies that rely heavily on trade or labor flows with the EU will struggle.

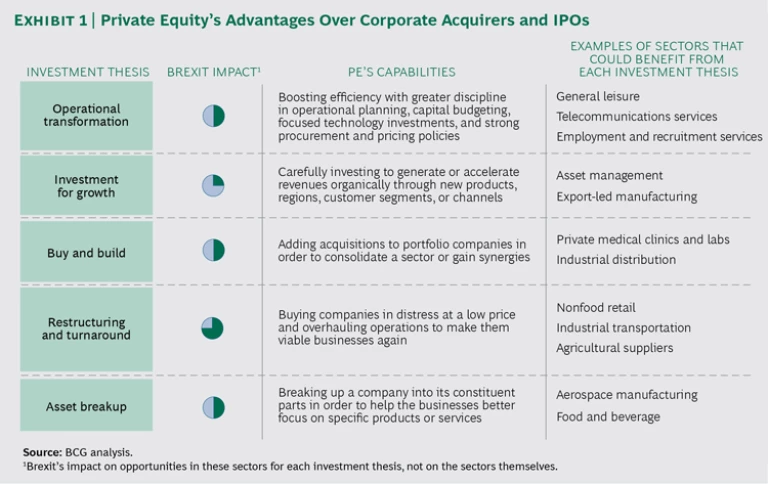

PE firms have notable advantages over corporate acquirers and IPOs during periods of change. (See Exhibit 1.) They combine abundant capital with a sense of urgency, yet their longer investment horizons allow them to acquire companies in uncertain times. Whether the goal is operational efficiency, investment for growth, bolt-on acquisitions, or spinoffs, companies can generally move more aggressively under private equity than under corporate or independent ownership.

Prospects in the Sectors

There’s no simple answer to Brexit’s effects on private equity. In some industries, mergers and acquisitions may grind to a halt, while in others, transactions will pick up. It’s essential to understand the PE opportunity sector by sector.

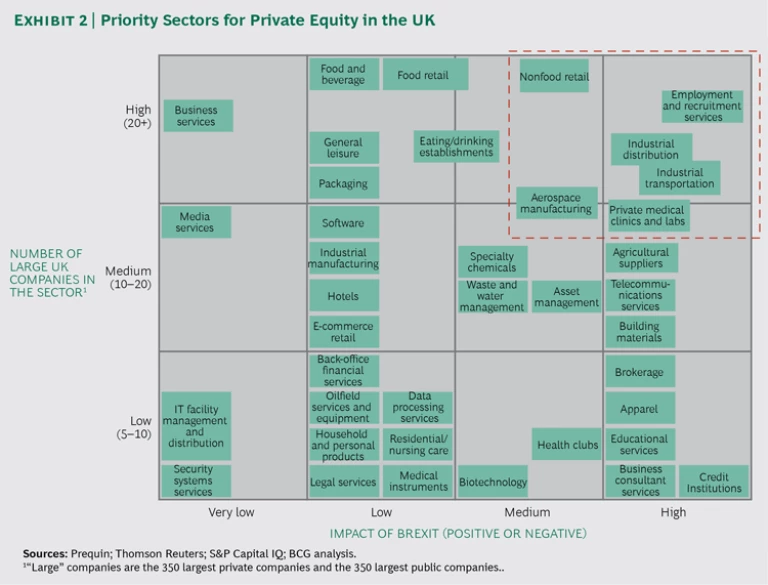

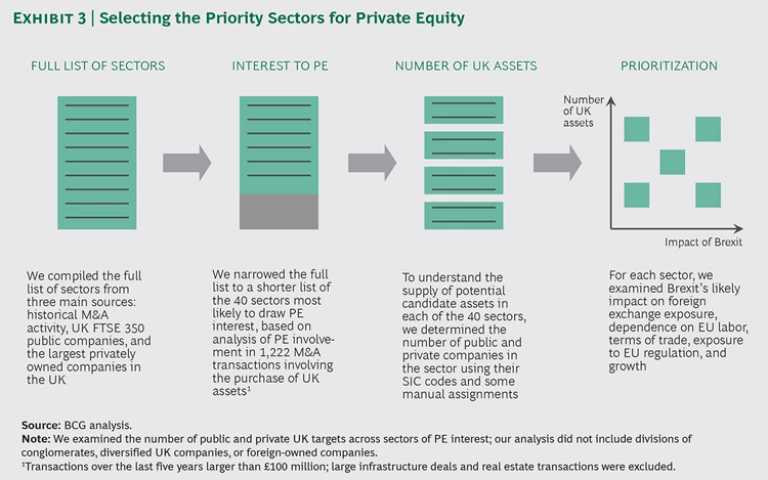

To find sectors that have an intrinsic fit with private equity, we first analyzed those with significant PE activity in the past five years. That yielded a list of 40 sectors, each of which we assessed for the availability of large companies that might be of interest to PE firms. (See Exhibits 2 and 3.)

We also analyzed Brexit’s likely impact on each sector in five areas where it is most likely to have major consequences:

- Foreign Exchange Exposure. Different sectors will be affected differently by the weakening pound depending on their geographic mix of revenues. UK businesses that rely heavily on international revenues will get a boost, while those that sell domestically but import most of their supplies, especially in dollar-denominated currencies, will get squeezed.

- Dependence on EU Labor. Several sectors depend heavily on the freedom of movement across Europe. Many of them rely on low-cost labor, but others—such as health care and financial services—need access to sometimes-scarce skilled workers.

- Terms of Trade. Once outside the EU, the UK will need to negotiate not just with the EU but also with other countries with which it previously operated under EU agreements. Some sectors will be more protected than others, but most are likely to face higher tariffs or lower quotas, or both, when they export. Domestically oriented companies may see somewhat less competition.

- Exposure to EU Regulation. Most exporting industries depend heavily on EU permission to operate, from financial services’ passporting rights to agriculture’s rules on output to aviation’s airport landing rights.

- Growth Constraints. It’s unclear how much Brexit will affect economic growth in the UK or the EU, but sectors sensitive to consumer demand, or whose growth correlates with overall output and productivity, will suffer from a general economic slowdown.

The Most Promising Sectors

It’s important to note that some sectors, such as software, will likely see little effect from Brexit regardless of how it plays out. Their attractiveness to PE will depend on their growth rates and the potential value that can be added by transformation or consolidation.

Among sectors likely to be hit by Brexit, we identified four of particular interest to PE firms, as well as several secondary sectors. We chose them mostly because we think they present the greatest opportunities, but also because they illustrate the advantages that PE firms have in competing for these assets, especially in the short term. Most promising are companies that depend heavily on EU trade, workforces, or regulations.

Companies in all of these sectors will face substantial risks at this time of uncertainty and volatility. But PE firms, especially those focused on adding value to operations, are well placed to help them succeed. Corporate buyers, by contrast, are often limited by the pressure to ensure short-term earnings stability. As for the IPO market, the current turbulence will dampen demand for all but the strongest assets.

Industrial Distribution. The distribution industry is highly specialized and depends heavily on the health of its underlying sectors. But as a whole, the industry tends to be resilient in a downturn. Volumes may fall but prices hold up, so margins quickly return as demand returns. That is in contrast to industrial transportation, which has minimal pricing power and high fixed costs, and is ripe for consolidation and vertical integration.

The far bigger risk from Brexit is in the terms of trade, both out of and into the UK. While export-oriented manufacturers will benefit from the fall in sterling, many of them may end up shifting their focus to domestic markets in order to avoid higher tariffs and other barriers. Distributors that specialize in exports could lose significant volume.

Yet even these difficulties in trading could be an opportunity for distributors that elevate their capabilities. Those that do the work to provide seamless access to European markets—by prearranging shipping documentation and other customs tasks—could gain additional business. Over time, clients could see these companies as handling more than just the “tail” of their business. Distributors could become sales partners offering additional expertise, even reaching into new markets with a direct sales force that the client otherwise lacks. With margins perhaps coming under pressure from Brexit, manufacturers’ use of distributors could actually increase.

The distribution sector has already begun to consolidate in order to become more diversified, both within Europe and, most recently, across the Atlantic. PE could hasten this trend, especially for companies that handle specialty products and lack the scale to invest in value-added services.

Private Medical Clinics and Laboratories. By contrast, private medical providers, which exist outside of the National Heath Service, should be quite resilient in the face of macroeconomic weakness. Most of their revenue comes from insurance, which in turn comes largely from employers, not individuals. Patients tend to be highly skilled employees at companies eager to retain them with private medical insurance. In one respect, a recession could actually boost revenue if weakened government finances lead to cutbacks to the NHS and more individuals choose to go outside the system.

Medical tourism accounts for 15% of the sector’s income, largely from countries outside the EU. Many of those countries have dollar-denominated currencies, making UK providers a better value for the money. So the share of overseas patients could grow over the short term. In the longer term, though, overall sector demand could fall off somewhat if Brexit leads to a smaller UK financial services industry.

Brexit will also affect the sector by reducing the flow of skilled labor from other parts of Europe. Private clinics could face a shortage of doctors, dentists, and nurses that forces them to rely more on local contractors. Even less skilled positions, such as hospital porters, could face gaps. Laboratory services such as pathology are in a similar bind.

These pressures will put a premium on operational research methods and advanced staff planning that minimize the drain on resources. Larger clinics have the advantage of more capital and scope to make substantial improvements. They may even be able to improve on the NHS and gain some additional business if the NHS has to outsource more work.

Thanks to stable demand and gains from back-office scale, the private medical sector has been consolidating for some time now. PE can help further consolidation while also investing in capabilities to better manage staffing. Also, many clinics have quite a low return on capital, so PE can impose greater discipline on capital allocation.

Aerospace Manufacturing. The second-largest in the world, the UK aerospace industry is healthy and mature and boasts many sizable publicly listed companies. It serves both military and civilian customers and sells in regions around the globe. Taking advantage of that strong market position, some companies in the sector have been quite acquisitive over the last few years as they diversified their products and services.

The industry benefits from complex and interdependent global supply chains, as well as long lead times on orders. Companies sell to all the major aircraft providers worldwide, and revenues are evenly split between military and civilian customers. With much of their income in foreign currencies, aerospace companies are seeing a short-term gain from Brexit. But some smaller, domestically oriented companies are taking a hit on imported materials, and their share price declines could make them takeover targets for PE.

PE firms could pursue opportunities even with large companies. The long lead times typical of the sector force large companies in particular to maximize return on capital and cash generation. While many of these players have returns of more than 10%, there are several exceptions whose returns are below their cost of capital. Such companies may be reassessing their capital allocation and considering selling some divisions. PE firms could also buy and break up assets that have become unwieldy. And PE’s distinctive capabilities in transformation could help improve productivity and growth more generally.

Employment and Recruitment Services. The recruiting sector has been growing steadily in the past five years, and some large companies have emerged through acquisitions as well. But like distribution, this industry is highly sensitive to the sectors it serves. A general economic slowdown, or even prolonged uncertainty, will cause clients to freeze hiring. Diminished growth in the longer term will affect new hiring volumes and recurring revenues from the management of contractors.

Recruiters for financial services are particularly vulnerable to the final Brexit rules on passporting and the movement of labor. After becoming perhaps the leading global financial center, the City of London could see significant contraction. Not every recruiting hot spot is threatened—information technology and cybersecurity, for example, should be quite resilient. But enough are at risk to put the sector on notice. Likewise, many recruitment companies place EU workers with UK companies. This generates significant recurring revenue, which is now threatened by potential restrictions on the freedom of movement of these employees.

Economic difficulties, however, can create opportunities for private equity. Margins at some of the largest recruitment companies have been quite low, even over the recent boom period. The sector has a flexible labor force with highly variable compensation, so it can shrink quickly to match a falloff in the top line. But a recession could still put several companies into a cash crisis that a PE acquisition could fix.

Private equity could also improve the overall health of the sector by consolidating the market. Many recruiting companies depend on a single industry. With Brexit likely to affect different sectors quite differently, these companies would benefit from a diversified client base or a functional focus. By consolidating the market and building companies that are diversified geographically and by industry, PE could boost the sector’s stability.

Perhaps more important, new Brexit rules on immigration could be an opportunity for PE to build up the recruiting sector’s capabilities. Assuming that the UK economy stays reasonably solid, there will still be a strong demand for talent. As with distribution and the opportunities created by changes in the terms of trade, recruiting companies that step up their capabilities could provide higher-margin value-added services to help clients cut through the new complexity involved in immigration.

Other Sectors of Interest

Our research also turned up a few other appealing areas for private equity.

Nonfood Retail. Companies in this sector were already struggling pre-Brexit with a fragile outlook for consumer spending and mandated higher minimum wages. With Brexit likely to raise the cost of EU imports and reduce the supply of low-skilled labor, PE firms can promote consolidation, diversification, or turnarounds. The discount and luxury markets may be the most attractive, since these include many privately owned companies with lower debt burdens than those of their listed competitors. (Some of these same dynamics also apply to food retail and eating and drinking establishments.)

Agricultural Suppliers. These are mostly distribution and service companies, and they may see an initial falloff in demand as UK farms lose EU subsidies and seasonal workers. Yet these losses could induce many farms to consolidate and invest in productivity-boosting technology. PE is well positioned to help suppliers deal with a shifting market.

Asset Management. Like other areas of financial services, this sector could be hit hard by companies shifting activity from London to elsewhere in Europe. It was already slowing down before Brexit, and now many banks are withdrawing from the market. But with the Bank of England keeping interest rates around zero, investors will continue to seek asset managers that can offer higher returns. PE’s best opportunity here may be with niche asset management companies.

Specialty Chemicals. This sector is especially vulnerable to trade disruption because exports to the EU are a significant proportion of total revenue. Unless the UK devises a new trade agreement with equivalent regulatory coverage, sales may fall significantly. But the sector has lately been moving toward global consolidation, a trend that would mitigate trade difficulties. Private equity could speed up consolidation and spur exports elsewhere.

Tailoring the Process to the Opportunity

As PE firms step up their due diligence for potential deals, we suggest that they categorize the uncertainties associated with Brexit according to the five effects described above. Then, where possible, they should estimate the value and likelihood of each of those effects for each target company. These estimates will generate an “uncertainty map” that will help in playing out different scenarios.

From there, an investor will want to systematically screen the most promising sectors. Such a study will reveal not just the most attractive companies but also emerging applications, disruptive technologies, customer trends, and other drivers of competitive advantage. Matching the candidate companies with the PE firm’s strategy and capabilities for adding value will yield a shortlist of targets to pursue.

Less appreciated may be the need to pay greater attention to postacquisition changes to the asset. Brexit will make operational improvements a key means of creating value. We recommend two main postacquisition planning activities. The first is a 100-day program in which the PE firm and company management develop a detailed action plan for operational improvements in the first few months of ownership. The second is a value creation roadmap: a comprehensive, long-term action plan for realizing the company’s strategic agenda. With critical milestones, timelines, designated responsibilities, key performance indicators, and links to the company’s budget and business plan, the roadmap imposes discipline on the changes vital to the success of the deal.

Of course, with all the uncertainty, PE firms need to be ready for their portfolio companies to adapt their strategy repeatedly during the holding period. The value creation roadmap may need revisiting multiple times. Those PE firms that carry through with structural and operational transformation may find golden opportunities in Brexit.