Best-practice inventory management is essential to success in the competitive metals-manufacturing market. Excess inventory can conceal underlying issues, such as production bottlenecks, poor-quality manufacturing, and overly complex product portfolios. Moreover, excess inventory can lead to operational issues by creating unnecessary inefficiencies in the production process.

With today’s tough market conditions, active inventory management is—more than ever before—essential. Demand for metals is falling rapidly, and the prices of commodities, such as iron ore, steel, and nickel, have fallen approximately 50% since January 2014. As customer orders decline, companies risk being caught with too much inventory relative to new levels of business activity.

By establishing a firm grip on raw materials, work in process (WIP), and finished goods, many businesses have been able to increase efficiency and free up cash all along the value chain, and they have used their newfound liquidity to, for example, make critical capex investments and strategic acquisitions. The journey is not an easy one, but the benefits can be substantial.

For instance, a leading Asian downstream metals manufacturer was able to reduce its total inventory by more than 20% in just six months through a series of strategic cross-functional actions. In North America, a company that manufactures specialty metals was able to free up almost $100 million in cash in less than a year without starving its production lines or hurting customer deliveries. Both companies are beginning to see benefits in other areas as well, such as shorter lead times and improved product availability.

Why Inventory Management in Metals Can Be Complicated

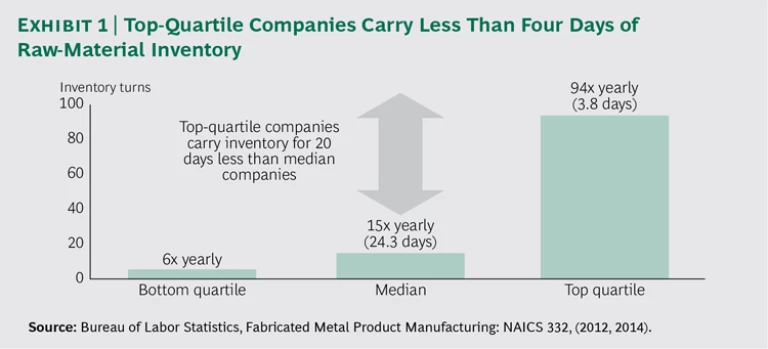

Inventory management varies widely among metals companies . Companies in the top quartile of inventory turnover tend to have no more than three to four days of raw materials on hand. (See Exhibit 1.) Other companies hold onto aging, unsold finished goods longer than they should, believing that one day they might get full value for those products. And some metals companies hold more than a month’s supply of commodity raw materials as “safety” stock to cover unexpected shortfalls.

One distinctive challenge facing this sector is that metals—unlike, say, food or electronics—neither spoil nor do they quickly become obsolete, so managers can stockpile inventory at any step of the manufacturing process without immediate repercussions. Take, for example, the case of “revert”—scrap metal from the manufacturing process that can be remelted and sent back into production. Not all revert can be used immediately, particularly if the manufacturer is making many different products. As a result, managers can end up holding onto excess revert for years—a poor use of the business’s cash.

The industry’s lengthy manufacturing process, which can be as long as six months, poses a second significant challenge. While many industries carry the bulk of their inventory as either raw materials or finished goods, some metals manufacturers have as much as 50% of their inventory at any given time in the form of WIP. The resulting dynamic creates numerous opportunities for production problems and bottlenecks. The combination of a poor sales-and-operations-planning (S&OP) process and suboptimal product flows, for example, can boost WIP to multiples of what is truly required.

A third challenge, while not unique to the metals industry, is product proliferation. The more products a company manufactures, the greater the inventory required and the more changeovers necessary all along the manufacturing line. In addition to reducing overall efficiency, multiple products also mean a greater risk of products becoming obsolete, leaving the company with significant amounts of finished goods to be sold at a loss or remelted.

Fourth, some manufacturers try to protect themselves against commodity price swings by building raw-material inventory at what they believe to be low prices. But because most of these manufacturers have limited hedging capabilities, it is risky for them to try to predict the future. By making bets on the future of commodity prices, they could easily find themselves on the wrong end of market price swings.

Four Simple Rules for Doing Better

To address these challenges, we recommend a rigorous analytical approach to inventory management. Companies should follow four key strategies: keep it down, keep it simple, keep it moving, and keep an eye on it.

Keep It Down. Metals-manufacturing companies should begin every effort to reduce inventory by analyzing their historical and anticipated demand—as well as required product lead times—to understand the optimal amount of stock they should be holding at every point along the value chain. Safety stock requirements and reorder points should be established on the basis of robust, reliable data. A well-managed, cross-functional S&OP process that is independent of sales and production—and carefully considers the inventory implications of each proposed action—is pivotal to the process.

A disciplined approach is also critical, whether the goal is to prevent creep in finished-goods inventory or to limit the quantities of raw materials that are ordered in advance. One European metals business, for example, found that orders were often initiated without a firm customer commitment. In too many cases, the confirmed order never came, and the company was left with excess inventory in the form of WIP. Subsequently, the company established rigorous cross-functional criteria to restrict the raw materials entering the production process and experienced significant improvement as a result.

Companies should also establish strict rules on the scrapping and disposal of inventory so that materials can be quickly returned to production or removed from the plant. When possible, unusable scrap and aging, unsold finished goods should be sold—even at a loss—to a third party.

To minimize such losses, companies can be creative, for example, reworking inventory into alternative, more saleable forms and changing an item’s finishing or size to make it viable for another customer. A European metals company developed a robust process for scrapping the residuals from its manufacturing process, creating a set of well-defined criteria on the basis of current demand and materials specifications, such as length and width. It then implemented 30-, 60-, and 90-day scrapping rules for each class of residuals, significantly reducing excess inventory.

As they work toward best-in-class inventory management, companies should explore opportunities to optimize inventory levels jointly with suppliers, coordinating across their inventory, manufacturing, and procurement departments on, for example, just-in-time (JIT) and consignment initiatives. While JIT is not a new concept, it is not as widely applied as it could be in this sector.

Analytics can play an important role in helping companies determine how aggressive they can be with JIT without hurting their value streams. Consignment strategies can give companies increased flexibility: one US-based company created an agreement that allowed it to take more inventory one month, when necessary, and less the next, while still meeting its overall obligations.

Keep It Moving. Metals manufacturers should always try to keep their inventory moving. A critical, if basic, first step is to run a thorough analysis of the amount, type, and location of the company’s inventory, particularly if the company has a widely distributed warehouse and manufacturing network. A recent audit at an Asian metals company, for example, pointed to significant inventory sitting in the wrong stockyards across its network. Getting these materials flowing through the system again allowed the company to meet existing orders and free up working capital for other uses.

Systematically analyzing and monitoring the flow of materials through the manufacturing process can reveal bottlenecks. Where true bottlenecks are found, companies can employ well-known approaches such as rebalancing labor or investing in additional capacity.

Holding a kaizen event can help determine which solutions are most appropriate. For example, one US manufacturer that makes metal bars in different sizes was stopping to reset the machine for each new size. After a kaizen event, the manufacturer started grouping the bars by increasing size, reducing the product changeover time. Having improved the equipment-constrained operation, the company was immediately able to free up capacity for production, increasing throughput by more than 10%.

Even after such efforts, many companies still struggle with WIP buildup during the manufacturing process. One cause may be poor-quality production that results in the need to rework some products. A thorough understanding of the procedures, tolerances, and quality controls required to manufacture a specific product for a given industry will help increase the robustness of the production process, as will stringent controls to detect poor-quality products early on. Beyond getting inventory moving again, these will also be effective inventory-reducing efforts.

WIP may be sitting idle also as a result of poor scheduling coordination in a complex production process, particularly in push-based manufacturing systems, whose production is geared to keeping machines utilized whether or not demand exists downstream. Companies using this model should set clear limits on WIP at each step of the process. One European metals company recently implemented this cross-functional approach by using its existing manufacturing-planning software.

Another way to tackle the overall issue is to introduce a pull-based system, in which production is determined by actual downstream demand. This system may be difficult to implement: it means running equipment only when truly necessary. It also requires taking an end-to-end view of the manufacturing process that reveals where—at any point—inventory is being built up or depleted. Shifting to a pull-based system can mean significant changes in the production process, such as the introduction of cellular manufacturing, in which work stations and equipment are arranged in a sequence that supports a smooth flow of materials throughout.

Keep It Simple. To further reduce excess inventory and keep the production line moving, companies should work to minimize the complexity of their product portfolios. We have found that best-in-class companies thoroughly analyze inventory turnover to keep the portfolio streamlined, prune out low-performing products, and reduce inventory exposure. They also work to understand the inventory implications of every new-product introduction. Some high-performing companies go as far as to enforce a strict one-in, one-out policy that ensures an existing product is eliminated for each new product added.

As noted above, this challenge is not unique to metals companies; in fact, metals companies could learn a great deal from best- practice consumer-goods companies, which monitor their product complexity religiously.

Keep an Eye on It. Underlying every inventory-management strategy is a set of universal requirements for success: metrics, transparency, accountability, and good governance. To support decision making, companies should set clear targets across the value chain for metrics such as days-on-hand measures and the absolute level of inventory at each stage of the production process. They should establish a regular reporting process and push for company-wide transparency on inventory levels. Finally, to identify budding issues before they become real problems, companies should establish early-warning alerts supported by the new metrics.

Companies that struggle with inventory issues might need to start by assigning a sort of inventory “czar” who has responsibility for improving inventory management and freeing up cash across the business. This executive—the CFO, head of planning, or an independent inventory manager—will need to make inventory a top organization priority and be actively involved in propelling the most appropriate inventory decisions in the S&OP process, which involves the management of key trade-offs across inventory, costs, lead time, and revenues.

Eventually, companies will also need to embed the new inventory-management approach into the daily responsibilities of employees from multiple departments, including planning, manufacturing, and finance. Only in this way can they ensure that the gains will be sustained over the long term.

An Achievable Target

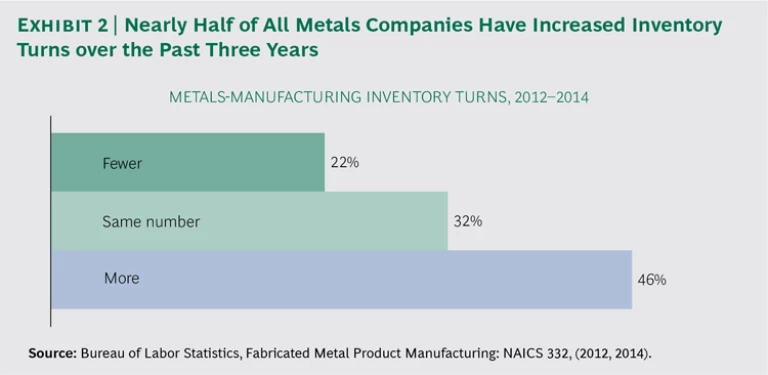

Using strategies such as these, a number of metals-manufacturing companies have improved their inventory turnover significantly in recent years. (See Exhibit 2.) When management is supportive and deploys the appropriate tools, it is not unusual for companies to reduce total inventory by 20% or more without disrupting operations in any way. The benefits can be multiplicative: for every dollar a company frees up by reducing inventory, $5 to $8 can be gained for investment as a result of the company’s higher debt capacity.

As metals manufacturers strive to achieve best-practice inventory management, they should remember these guidelines:

- Keep It Down. Maintain minimum stocks, making and keeping only what is required.

- Keep It Moving. Ensure a fluid and efficient production process with no buildup or bottlenecks.

- Keep It Simple. Streamline the product portfolio, weeding out low performers.

- Keep an Eye on It. Set clear targets, push for transparency, establish an early-warning system, and create accountability to ensure that long-term gains are preserved.

With the right strategies in place and the determination to pursue them rigorously, top-tier inventory management is not only achievable but is also an important differentiator, freeing up cash and ensuring smooth operations from start to finish.