The market for chemicals in North America is experiencing a rebirth, posting strong growth from 2011 through 2014. Yet the market for specialty chemicals is growing even faster. Renewed manufacturing in the US and strong construction activity—particularly in housing—have led to increased demand overall.

In addition, the share of third-party

distribution of specialty chemicals

—rather than the sale of products directly to customers by suppliers—has grown faster still. Our analysis indicates that these trends will continue through 2020. As a result, both suppliers and distributors of specialty chemicals in

Over the past five years, The Boston Consulting Group has published a

Methodology

We drew from a wide variety of primary and secondary sources to analyze the North American specialty-chemical market. We spoke with more than 50 experts across the US chemical market, including suppliers (especially those with well-established, third-party-distribution-management practices), global and regional distributors, and a cross-section of specialty customers to identify trends and best practices.

We also consulted a variety of authoritative industry sources—including the American Chemistry Council, the Economist Intelligence Unit, ICIS, and IHS—as well as public financial-reporting data from major distributors. Moreover, we reviewed current literature to better understand the underlying demand for chemicals. We examined, for instance, regional perspectives based on US manufacturing, GDP and census data, construction activity, automotive production figures, and general economic data.

In addition, we adapted the definition of specialty chemicals to incorporate business practices in the North American market. For example, we included specialty agricultural chemicals and certain industrial chemicals in our analysis. This resulted in a larger market than any analyzed in our previous reports. Furthermore, also unlike in previous reports, we included Mexico in the North American market. Our extensive primary research thus indicates a higher incidence of third-party distribution in North America today than was observed or assumed in earlier analyses.

Market Overview

The North American chemical market generated sales of approximately $1 trillion in 2014 and is projected to grow at roughly 3.5% per year through 2020. Overall, it grew at an annual rate of 2.4% from 2011 through 2014, while the commodity segment of the industry grew at a slightly slower pace: 2.2%. The specialty chemical segment, however, grew significantly faster, at 3.5% per year. A number of factors that align with the principal segments of specialty chemicals have contributed to this growth:

- The coatings, adhesives, sealants, and elastomers (CASE) segment has benefited from sustained construction activity that has been driven by a continued recovery in the housing market.

- The household and personal care (HPC) segment has benefited from strong consumer purchasing power and discretionary spending.

- The industrial segment experienced robust growth because of vehicle manufacturing.

- Oil and gas activity in North America has increased demand for specialty chemicals as well, though that activity has leveled off lately as oil prices have dropped.

- The specialty chemical market for agricultural applications posted slightly slower rates of growth because of a slowdown in the pulp and paper market and reduced government spending on vegetation management for road and rail applications.

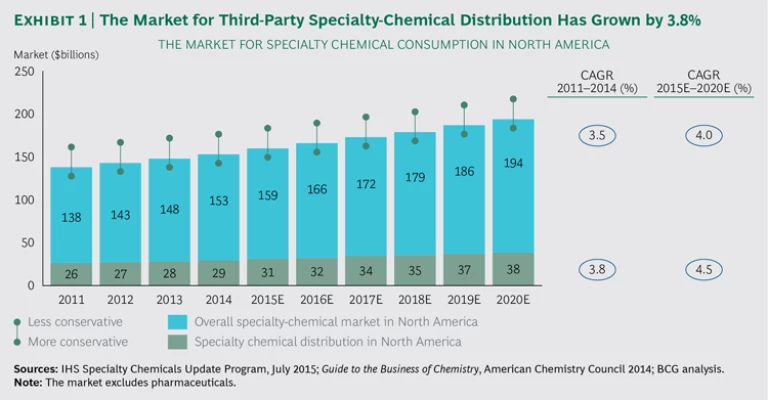

A closer look at third-party distribution, rather than at chemical suppliers’ distribution of their own products, reveals that the market share for specialty chemicals in North America is 19%—significantly higher than the global average. Critically, the specialty distribution market has been growing faster than specialty consumption—3.8% per year versus 3.5%, respectively. (See Exhibit 1.)

Such compounded growth stems from two causes. First, suppliers have realized that the cost to serve low-volume customers is quite high, and they continue to push customers with orders for smaller quantities to third-party distributors. Second, suppliers are increasingly using such distributors as a platform for growth, tapping into new regions or markets in which distributors already have strong relationships with customers in place.

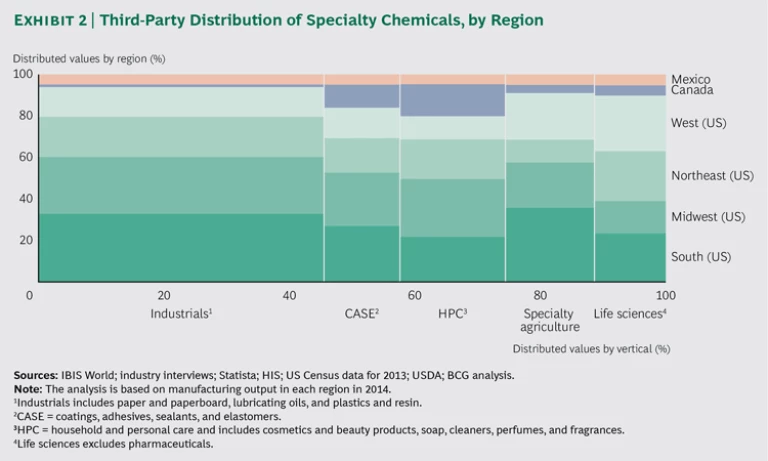

The shift toward third-party distribution is fairly consistent across major verticals: CASE, HPC, and industrials. In certain segments, such as laboratory chemicals, the incidence of third-party distribution is extremely high because of sector-specific factors, which are often related to strong customer relationships. Indeed, third-party distribution accounts for more than 80% of the sales for specialty agricultural chemicals.

In the US, which represents more than 80% of the North American chemical market, there are clear growth trends in the South and the Midwest, where chemical customers increased their manufacturing capacity from 2011 through 2014. Several large customers—particularly in the CASE and HPC verticals—have relocated and built new facilities in Texas and Oklahoma, as well as in several other states in the Southwest. Increased regulations in the West, particularly in California, have accelerated this trend. (See Exhibit 2.)

We expect that growth for the overall US chemical market will accelerate through 2020. Key factors in that acceleration will be the revitalization of manufacturing in the US, driven by cheap energy and attractive productivity-adjusted labor rates. (See North American Chemicals 2020: Capturing Opportunities in the Revitalized Industry , BCG report, July 2015.) We also expect that the specialty market will pick up in line with this increased momentum and grow at an annual rate of approximately 4% through 2020. The trend toward third-party distribution of specialty chemicals will continue—with projections for annual growth of 4.5%—leading to a larger gap between overall specialty growth and the share of volume that goes to customers through third-party distributors.

Comparing the North American, European, and Asian Markets

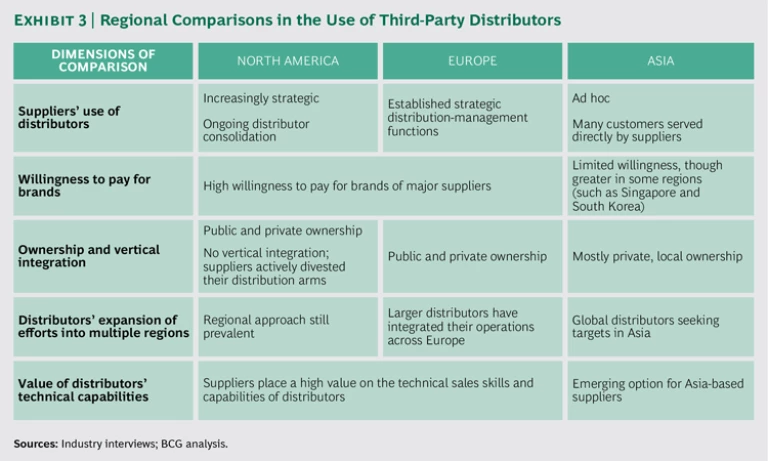

To understand the North American market, it’s helpful to compare it with the markets in Europe and Asia. (See Exhibit 3.)

The North American and European markets share many similarities. Both have customers that are willing to pay for supplier brands, and suppliers in both markets rely on technical sales excellence from distributors. Customers in these markets also frequently require value-added services, such as mixing and reformulation, storage, and logistics. Few suppliers in either market have distribution subsidiaries; those that used to have such subsidiaries in the past have mostly sold them off to focus on core manufacturing capabilities. (BASF in Europe is a notable exception. The company has an internal distribution unit that competes for business with external distributors.)

Yet there are clear differences as well. European suppliers are more likely to have formal distribution-management functions that can oversee their networks of external distributors. Such internal expertise is needed in Europe because of the complexities in managing distributors across many countries and jurisdictions.

European distributors are also further ahead than their North American counterparts in expanding their efforts to operate in multiple regions. These so-called super regionals have specialists for individual segments and countries, but they manage products throughout Europe. In the US, there is some evidence that suppliers are looking for distributors that serve the entire country, but thus far few have established that kind of footprint. Instead, most operate regionally.

The specialty chemical market in Asia, however, is far more fragmented and less mature than the markets in North America and Europe. Customers are willing to pay for branded products in some locations within the region, such as Singapore and South Korea, but most are served directly by suppliers. Moreover, markets tend to be local, rather than pan-Asian.

Key Trends Among Suppliers

Chemical suppliers have two primary rationales for using third-party distributors. The first is that such distributors reduce the complexity of going to market because they can serve customers more efficiently. This is particularly true for lower-volume customers because distributors are better set up to offer them value-added services. These distributors can also bundle inventory and distribution for multiple customers, which is more efficient. And they usually have strong relationships with local customers.

The second rationale is that third-party distributors can drive growth in areas to which suppliers have no direct access. For example, distributors may have a presence in a market or a line in which a supplier would like to do business, and contracting with the distributor is far easier for the supplier than building up its own presence internally.

Both of these rationales are apparent in the North American market. Chemical suppliers have realized that low-volume customers have a high cost to serve (after taking into account factors such as sales, stocking and transportation costs, and credit risks). Indeed, many North American suppliers have set sales and volume thresholds for orders, and some add a surcharge for small orders as well, despite third-party distribution.

In addition to shifting to third-party distribution, many North American suppliers have been consolidating the number of distributors they deal with, especially during the past five years. We believe that this consolidation will continue but at a slower pace. Among the industry experts we spoke with, many cited a 50% reduction in the number of distributors they are using. But just as directly servicing low-volume customers leads to greater complexity for suppliers, using a large number of smaller, local distributors is also difficult. Which ones make the cut? Most suppliers have focused on distributors that can dedicate technical and sales resources to their products. In addition, many suppliers favor distributors that can offer value-added functions such as mixing, blending, and formulating, or services such as filling and packaging.

Some suppliers have gone a step further and established internal distribution centers that coordinate and oversee distribution while also providing advice to business units. The centers set criteria for assessing distributors, help business units select them, and maintain a pool of potential distribution partners.

As a result of consolidation, suppliers are forging closer relationships with a handful of strategic distributors. In such arrangements, a supplier’s sales force often works directly with that of the distributor (one may even be based in the other’s offices), and the two companies hold joint sales and technical training sessions. They also share warehouse facilities, along with customer and sales data when appropriate.

Moreover, suppliers that build the right relationships with strategic distributors have gone beyond treating them as an extension of the sales force and instead consider them a platform from which to tap into new growth opportunities. For example, a distributor that has expertise in a particular territory or with a specific customer profile that is unfamiliar to the supplier could help the supplier take advantage of those opportunities.

Because sales growth is so critical, suppliers no longer use only basic metrics, such as the number of sales reps that are covering a region, to assess the sales capabilities of their distribution partners. Instead, they are looking one level deeper, at sales force productivity; using hard metrics, such as sales volume; and analyzing leading indicators, such as contacts with customers, the size of the pipeline, and related data.

To determine which distributors they should prioritize, in terms of both assessing their current vendors and spurring improvements, some suppliers are also using performance management tools. For example, a clear set of soft and hard targets gives distributors definitive objectives to hit. And financial incentives, such as rebates and volume awards, can encourage distributors to help suppliers hit their financial and operational targets.

Because these relationships can be so mutually beneficial, they usually last for the long term. Once the relationship between a supplier and a distributor is well established, switching out is rather rare, because the cost of such a change—in terms of both time and money—can be substantial. Among the experts we spoke with, only 5% said that they switch out at least one distributor annually. And that typically occurred only because of repeated technical problems, product quality issues, or when one of the partners changed ownership. Suppliers do indicate some willingness to change distributors on the basis of price, but given the cost of switching, the incentive must be significant—10% to 20% lower than the cost of working with the current distributor. However, the market is becoming more dynamic because of frequent acquisitions and a shift toward strategic distribution partners.

Key Trends Among Distributors

The specialty-chemical-distribution market in North America includes three main types of companies:

- Global companies known as full-liner distributors—including Brenntag, Univar, and Nexeo Solutions—typically offer both commodity and specialty product lines. Suppliers tend to rate these companies well in terms of product quality and reliable, flexible deliveries, largely because of their expanded distribution networks across North America.

- Regional distributors have a footprint sufficient to cover one of the four main geographic territories in the US—the Midwest, the Northeast, the South, or the West. So-called super regionals, such as Harcros Chemicals, serve two or more regions and may even have a national presence. Regional distributors tend to do well in product expertise, supplier collaboration, and value-added services for customers. Many customers find that regional distributors are able to be more flexible and are more willing to offer technical support than their global counterparts.

- Local distributors focus on a narrow niche in a small geographic area and usually offer limited product lines.

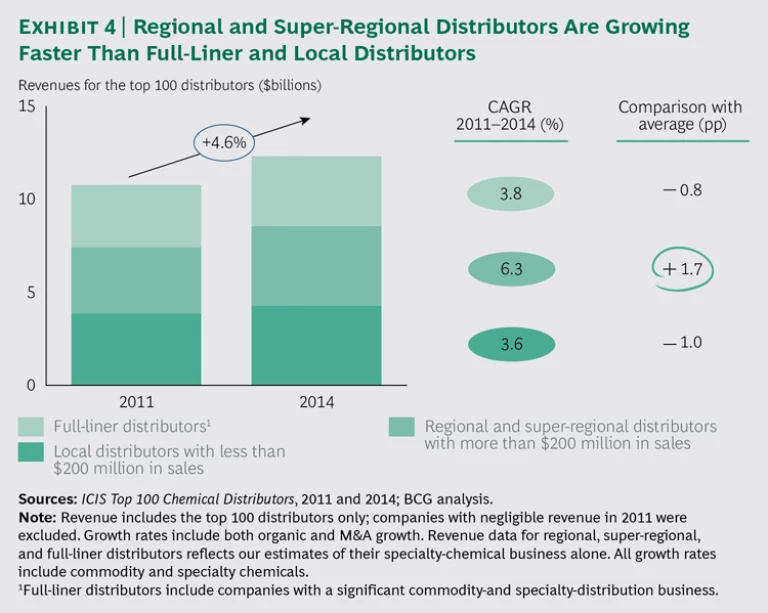

Of the three, regional players have been growing the fastest in the US. Super regionals have been growing particularly fast because they have been gaining market share as suppliers reduce the number of distributors they work with. Specifically, global full-liner companies posted a compound annual growth rate of 3.8% from 2011 through 2014, while local players grew at 3.6%. But regionals grew several percentage points faster during the same period—at 6.3%. (See Exhibit 4.)

In addition, M&A has reshaped the landscape for US distributors during the past four years. Distributors are seeking to expand in order to provide better coverage across the country, fill in gaps in their portfolios, and become strategic partners. In some cases, regional companies have acquired local distributors and small regional players.

Consolidation is happening among larger companies as well, increasingly among global players that are buying regional distributors in the US. The top five global specialty distributors (including Brenntag, Univar, and Nexeo) have done more than ten deals with US companies in the past four years. IMCD, a large global distributor based in the Netherlands, recently acquired M.F. Cachat, a super regional that has a presence in roughly 30 US states. (See “IMCD’s Acquisition of M.F. Cachat Could Signal More Transatlantic Deals.”) Incidentally, global distributors are also acquiring companies in Latin America. In 2014, for example, Brenntag acquired SurtiQuímicos, a specialty Colombian distributor, and Univar acquired D’Altomare Química, based in Brazil, in 2014.

IMCD’S ACQUISITION OF M.F. CACHAT COULD SIGNAL MORE TRANSATLANTIC DEALS

In the first few years of the 2000s, a handful of Europe-based full-liner distributors acquired distribution companies in the US. For example, Brenntag acquired HCI, and the company that later became Univar acquired Ellis & Everard. Both deals immediately gave the acquirers a footprint in the attractive US market.

Now, similar transatlantic deals are under way among specialty chemical distributors. IMCD, which is based in the Netherlands, has been growing rapidly during the past several years, both organically and through acquisitions. The company has publicly stated its objective to become the leading global specialty-chemical distributor, and it has been buying up competitors in pursuit of that goal. But it only recently completed its first acquisition in the US, M.F. Cachat, closing the deal in June 2015.

With headquarters in Ohio, M.F. Cachat excels in technical sales of specialty chemicals, particularly in the coatings, plastics, construction, advanced-materials, and food segments. It represents leading global chemical suppliers in more than 30 US states. The deal valued M.F. Cachat at $286 million (or slightly less than the company’s 2014 revenue of $300 million), and it gives IMCD a strong and growing platform for expansion into the US. There is clear alignment between the two companies. Both have an asset-light business model that emphasizes technical sales, strong partnerships with leading chemical companies, and a fully outsourced supply chain.

A second, more recent, deal is Belgium-based Azelis Group’s acquisition of Koda Distribution Group, which has a strong presence in the US. The response to both deals from competitors, suppliers, and equity analysis has been positive, and we believe that similar deals could happen soon.

While these deals can help distributors grow quickly in North America, and increase their coverage area for suppliers, they also present the challenges inherent in any acquisition. Increasingly, strategic selling partnerships between suppliers and distributors are moving away from more casual understandings and becoming formalized; distributors will need to manage these new types of agreements—and address exclusivity issues—when partnering with companies that have overlapping interests.

Similarly, distributors need to carefully manage their brand elements. Some distributors choose to maintain separate brands for individual regions under a central management structure. This approach can help manage exclusivity agreements that are already in place with suppliers. Others, such as IMCD, however, prefer to group the newly acquired entity under a unified global brand and generate efficiencies through centralized procurement and shared services.

Broadly, suppliers that use external distributors value reliability, flexibility, and strong product expertise. Specialty chemical distributors can meet those requirements in two ways.

First, they can establish anchor products in specific industries. For example, a distributor could create a strong position in the distribution of a certain baseline chemical component that goes into a variety of skin care products. To succeed with this approach, the distributor would need to win contracts with chemical suppliers that offer superior product performance in a given application. The distributor would need to demonstrate strong technical capabilities and, in many cases, offer value-added services for the wide variety of customers that need the product. In this way, the distributor can erect substantial competitive barriers in the market for that product.

Second, distributors can handle all of the niche products that make up a particular product vertical. In addition to focusing on a central anchor-product component for skin care products, for example, a distributor could become an expert in the entire skin-care niche and handle all the chemicals that a manufacturer would ultimately need. Many larger, Europe-based distributors pursue such a vertical-market approach, and it works especially well on a regional level. These distributors define product baskets for certain verticals (such as HPC) across all of Europe, and their experts for the industries and applications work regionally rather than in individual countries.

This approach requires strong selling skills, technical expertise in the vertical industries where the distributor wants to win, and additional services. Accordingly, distributors have been investing in these capabilities through acquisitions. For example, Univar has made a number of service acquisitions in the US, including a warehousing company called Fort Storage as well as Mini-Bulk, which helps manufacturers more effectively handle hazardous products. Univar plans to roll out both services across the US.

On the sales front, companies have been investing in sales force efficiency and technical-excellence programs, particularly among global distributors in the past two years. Brenntag, for example, generates new revenue through its existing sales force and thus reduces sales, general, and administrative costs even as it grows.

Transatlantic Players

Although a few differences do exist among the North American, European, and Asian chemical markets, some distributors are establishing global operations. For example, Brenntag and Univar both operate worldwide, though they tend to focus on commodity chemicals—in both sourcing and distribution—in Asia. Brenntag in particular is unique in that it maintains a global footprint, and the corresponding scale efficiencies, while still providing strong service that is based on local relationships. The company also offers access to a global customer base for smaller suppliers, which don’t have the resources to build global sales teams.

All things being equal, most suppliers tend to score global distributors higher than regional or local distributors in their assessments. They are also less likely to drop global distributors when scaling back their distributor partnerships, though this is probably based more on perceptions of market strength than on actual need: only 15% of chemical customers make purchases on a global basis, yet a significant portion of them say that a distribution partner’s global footprint is either nice to have or very important. Nevertheless, suppliers will continue to consolidate and centrally manage distribution and to seek a smaller number of relationships with fewer, larger players.

We believe that, in the near term, transatlantic operations will become more common for specialty chemical distribution, given the many similarities between the US and European markets. The US and European business units of global suppliers already share best practices, but they often still make decisions regarding distribution independently.

IMCD was the first specialty-chemicals company to extend its reach from Europe to North America through its recent acquisition of M.F. Cachat in the US. The rationale for the deal included leveraging access to suppliers across markets, using M.F. Cachat as a platform for growth in North America, and leveraging IMCD’s strong M&A capability. The company’s stated aim is to become the first truly national specialty distributor in the US.

How Suppliers Should Respond to the Changing Landscape

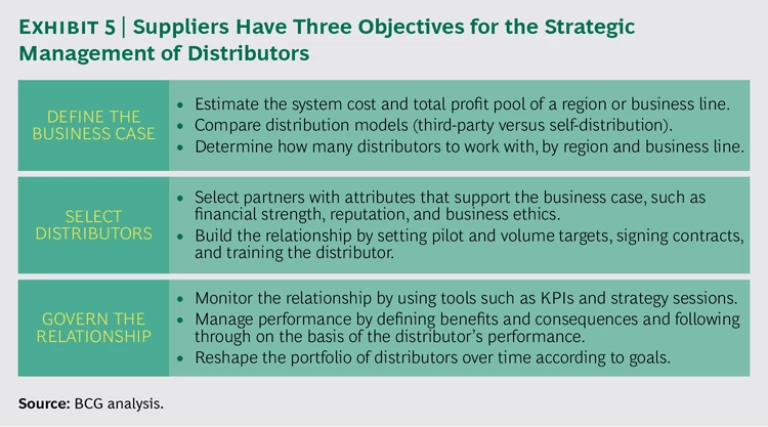

Given the changes under way in specialty chemical distribution, suppliers that serve the North American market should focus on three objectives. (See Exhibit 5.)

Define the business case. Delineating a clear business case for working with distributors—one that is aligned with the company’s go-to-market and sales strategies—is essential. Suppliers need to analyze their current cost to serve for customers, including factors such as logistics, freight, and warehousing. They also must ensure that their go-to-market and sales strategies support an overall growth strategy, including market segments in which the use of distributors could lead to faster growth. It may be more efficient for suppliers to reach some customers by using their own internal sales staff. Conversely, a third-party distributor may already have relationships with target customers that the supplier has not yet reached.

Select distributors. Suppliers must assess and select distributors using clear objectives. They should determine KPIs based on their go-to-market strategy and growth objectives. For example, given the importance of technical expertise and sales efficiency, suppliers should have a means in place to rank distributors along both dimensions—for the distributors they currently work with as well as for potential new partners. On the basis of that assessment, they can then thin their portfolios and select a smaller number of strategic distributors with which to collaborate more directly.

Govern the relationships with distributors. Once the right distributors are in place, suppliers need a process for managing relationships with them. This element includes configuring pricing and rebate structures to steer distributor performance. It also requires setting up the right information-sharing interfaces with distributors, supported by underlying technology. Suppliers should track and communicate the performance of distributors, using the KPIs they have identified, on a monthly and quarterly basis. And if a supplier chooses to establish an internal center to manage distribution across the entire portfolio of channels, then the supplier should clarify the center’s responsibilities and mandate within the organization, along with the method by which the center will interact with business units.

How Distributors Should Respond to the Changing Landscape

As distributors seek the right response to the evolving North American market, they should focus on several priorities.

Invest in technical capabilities. Given that suppliers and customers alike value additional services, distributors must find a way to provide them. This requires continually investing in lab services, along with mixing, blending, and repackaging services. Identifying the right investments for a specific chemical segment comes from proactive communications with suppliers regarding verticals and product lines that they would like to expand into. Distributors should also work with suppliers to ensure that they stay up to date on technical aspects of the product portfolio—by, for example, attending joint training sessions.

Invest in sales-force-effectiveness programs. As suppliers seek more direct collaboration on sales, distributors will need to ensure that their internal sales functions are world class. Accordingly, they should leverage technology that can monitor key sales-force-productivity metrics. They should also structure the right incentives for sales staff and managers, and—when required—embed people within the supplier’s own sales team to share customer insights and technical data.

Conduct strategic acquisitions. Size and scale will become increasingly important in the specialty-chemical-distribution landscape. Quite simply, the largest players with the best execution will win. Accordingly, distributors should build up their internal expertise when scanning for potential M&A targets and when closing and integrating deals. In addition to outright acquisitions, they should also consider options such as partnerships and joint ventures.

Manage brands effectively. As noted above, some companies are choosing to operate multiple brands in a given market, while others prefer to consolidate their business under one unified brand. Either approach can work, but each distributor needs to adopt the right approach for its needs, especially given the coming period of consolidation.

As the North American market for specialty chemicals continues to grow faster than the overall chemicals industry, clear opportunities for both suppliers and distributors are emerging. Those players will need to understand the dynamics of the market and develop the right business model in order to capitalize on those opportunities.

For suppliers, the objectives are to develop a clear business case for outsourced distribution, evaluate and select distributors accordingly, and manage them as true strategic partners. For distributors, the objectives are to build up institutional expertise in both technical capabilities and sales force effectiveness, make strategic acquisitions to increase their size and scale, and manage brands effectively.