This article is an excerpt from the e-book Transformation: Delivering and Sustaining Breakthrough Performance.

Many transformation initiatives focus on improving a company’s financial and operational performance from “good” (or moderate) to “great”—that is, the company is already doing well in some or most areas, yet management still sees a need to make improvements. Other companies occupy a separate category of transformation because they are in the midst of immediate, urgent crises. We refer to these as turnaround and restructuring efforts. With the business environment becoming so volatile and unpredictable, an increasing number of companies need to take dramatic actions to generate rapid impact or they risk going out of business.

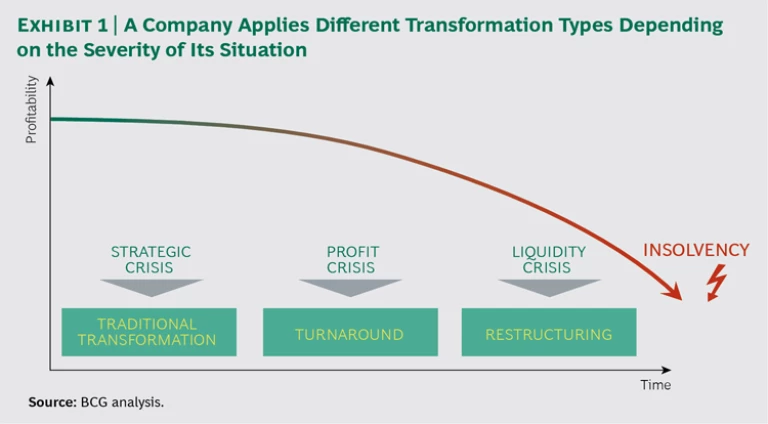

Typically, business problems unfold in three phases. (See Exhibit 1.)

During the first phase—a strategic crisis—the company is no longer able to compete effectively. Sales numbers may be stable, or even growing, yet profitability has begun to decline. Very often, management has tried a new strategy, or several, without success. (In some cases, management may not recognize the scope of the problem.) This is the phase at which traditional transformation programs are relevant.

If the company does not change its course, the second stage is a profit crisis. Sales are now stagnating or declining, while profit margins turn markedly negative. At this point, the company starts burning through cash reserves and needs to launch a turnaround.

Failure to do so—and continuing to burn cash—leads to the third and final phase: a liquidity crisis, in which the company may soon lack the financial resources to keep operating. At this point, the management team typically loses the ability to make changes on its own, and different stakeholders such as banks and other debt holders may have a say in trying to restructure the company.

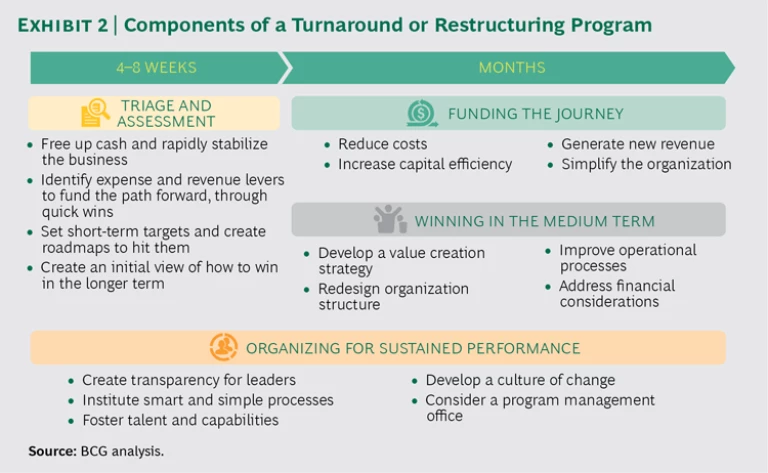

Based on BCG’s experience working with clients, we have developed a three-part transformation framework. (See Transformation: The Imperative to Change, BCG report, November 2014.) Turnaround and restructuring programs involve applying all three components:

- Funding the Journey. Launch short-term, no-regret moves to establish and demonstrate momentum and to free up capital to pay back debt and help the company reposition.

- Winning in the Medium Term. Develop a business model and an operating model to increase competitive advantage.

- Organizing for Sustained Performance. Set up the right team, organization, technology, and culture to deliver long-term gains.

A turnaround or restructuring program should include all three elements, but the relative importance of each changes at various points in the process. In addition, it requires an initial triage and assessment stage, to determine the severity of the company’s challenges and determine the right path forward. (See Exhibit 2.)

Triage and Assessment

The initial stage, triage and assessment, is aimed at generating a clear picture of the company’s financial situation and identifying the most immediate priorities. At this point, management needs to launch rapid measures to stop the bleeding and free up capital as soon as possible—ideally in weeks; certainly no longer than a few months. (See the sidebar “A Retailer Cuts Costs and Fuels Growth.”)

A Retailer Cuts Costs and Fuels Growth

A large international grocer was struggling with increased competition from discounters and online retailers. Its operations were overly complex, and its costs were too high. After decades of strong growth, the company lost considerable market share and half its profits in just three years—along with the trust of its customers.

In response, the company launched a full transformation program, which included:

- Improving promotions, thus freeing up $250 million that it reinvested to boost sales growth

- Generating efficiencies across the supply chain, saving $75 million in annual operating costs

- Resetting product categories and renegotiating contracts with suppliers to focus on top sellers

- Rebuilding customer perceptions, leading to a 4% increase in sales (and significantly outperforming the market)

Collectively, these measures delivered $500 million in cost savings, new revenue, and profit over the first 18 months of the transformation, helping the company regain its leadership position in the market.

For situations in which the company is extremely stressed and on the brink of going under, short-term measures include postponing or canceling capital investments, freezing new hires and salary increases, and improving working capital. Management teams can also reach out to financing partners and ask for a short-term infusion of capital to maintain enough liquidity to continue operating. More broadly, companies at this stage need to generate a fully transparent view of their true liquidity situation. Detailed data at the level of individual business units and entities is critical for the company to make accurate short-term forecasts. In addition, companies need to understand the legal requirements of various options. For this reason, many organizations set up a liquidity office that collects, synthesizes, and reports this data directly to the C-suite and board.

Funding the Journey

Once the immediate crisis is over, companies can shift away from the intense focus on short-term liquidity and adopt broader measures to generate the capital needed to fund the forward-looking initiatives. Those measures—which typically generate results in 3 to 12 months—fall into several broad categories: revenue increases, organizational simplicity, capital efficiency, and cost reduction.

Winning in the Medium Term

Although companies tend to focus on cost reductions and capital efficiency at this stage, we find that measures to boost revenue and simplify the organization often have similar short-term effects and lead to more sustainable improvements. Measures to increase revenue include reorienting the sales force to sell the most attractive products, identifying the most promising customer segments, and improving pricing. Organizational measures include simplifying the corporate agenda to focus on only a few critical areas, tasking the right people to oversee them, and clarifying roles and responsibilities. Removing management layers is also a powerful short-term tool to cut internal bureaucracy and complexity. (See “A Vehicle Manufacturer’s Turnaround Generates $700 Million in Savings in One Year.”)

A Vehicle Manufacturer’s Turnaround Generates $700 Million in Savings in One Year

A $10 billion heavy-vehicle manufacturer was struggling to earn sustainable profits in a highly cyclical industry. A downturn led to consistent losses that threatened the long-term viability of the business.

To save the company, management launched a turnaround that focused on dramatically reducing costs and boosting sales, in part through an emphasis on aftermarket vehicle parts.

The company reduced head count by 25%. It generated more than 3,000 ideas about how to reduce product costs. And it rolled out a new pricing structure and boosted its market share in some segments from 35% to 50%. Overall, the measures led to $700 million in savings in the first year and $2 billion in margin improvements in the first three years (70% more than the company’s original savings target).

As the company shifts to winning in the medium term, management will need to address four principal areas:

- The Value Creation Strategy. In most cases, companies find themselves in a crisis specifically because they had the wrong strategy in place. Accordingly, management teams need to understand the root causes of their current situation, where their previous strategy went wrong, and how they can then improve it. A strategic reboot entails addressing bedrock questions: What are the company’s most profitable products and services? How can the portfolio be reoriented around them? What should the company include in its portfolio of products and services? Who are its target customers? In which geographic markets and steps in the value chain should it operate? And—critically—what does it clearly do better than the competition, in a way that leads to sustainable value creation? Collectively, the answers to these questions will enable a strategic repositioning and a long-term viable strategy, potentially including new products, services, and markets. (See “A Technology Company Quickly Transforms Itself to Boost Value Creation.”)

A Technology Company Quickly Transforms Itself to Boost Value Creation

A leading global technology company was under pressure because of slowing growth and increased competition. In response, the company launched a detailed diagnostic to identify critical priorities. On the basis of those results, it developed a full transformation program to streamline the company’s cost structure and processes, build new capabilities, and increase margins.

Specific measures included:

- Reducing the size of the workforce to match the future revenue base

- Increasing efficiency across the organization to sustain innovation with fewer resources

- Improving pricing practices and discipline to increase margins

- Aligning sales and executive compensation with the right performance metrics

Within the first year, the company had reduced its run rate operating costs by more than $1 billion.

- Organization Structure. With the right strategy in place, the company can turn to creating the right organization structure to execute. This process entails assessing how the company should arrange its business functions and units—both vertically (the number of management layers and spans of control) and horizontally (the segmentation of business units). Companies may need to make sizable changes to support the new strategy, such as closing or divesting noncore divisions, realigning or consolidating business units, and making other moves aimed at improving the way the company creates value. Similarly, it will need to address its geographic footprint and spans of control. And it will need to determine the right level of outsourcing.

- Operational Processes. In tandem with decisions about the right organization structure, the company will need to determine how to revamp its operational processes in order to support the strategy. By rethinking processes from the ground up, companies can retool them to deliver greater cost efficiencies in terms of material, personnel, and other operational expenses. For example, companies have successfully lowered their costs by increasing efficiency, producing more with the current level of staffing, and improving their effectiveness in areas like procurement and pricing. In addition, the company needs to translate its overarching strategy into a new business model, with corresponding changes to how it goes to market and how it can best get products and services to market, all with the objective of increasing sales. Technology is typically a key factor in improving operations in this way.

- Financial Considerations. Fourth—and most important—the company will need to look at the financial implications of all decisions in the first three areas (strategy, structure, and operations). The company’s future target state should be summarized in a comprehensive business plan, including balance sheet structure, cash flow statement, and P&L. The company needs to quantify the benefits that each underlying measure included in the turnaround or restructuring will deliver to the company’s bottom line.

In some turnaround or restructuring cases, companies will need to secure additional capital in order to execute the transformation. (Successful funding-the-journey measures are often, but not always, enough.) Improving the capital structure of the company might also require extending the terms of its existing debt, stopping payments temporarily or even negotiating a “haircut,” in which lenders waive their rights to some of the payments they are due.

Organizing for Sustained Performance

Implementing turnaround and restructuring programs is extremely challenging in that management needs to fix the business as it continues to operate the business (often with scarce resources). Our experience shows that success comes from prioritizing several initiatives:

- Create transparency for leaders. Use the principles of change management to provide senior leaders with true operational insight through meaningful milestones and objectives for critical strategic initiatives. Such focus creates transparency into emerging issues and gives leaders the opportunity to correct course before problems become intractable, when small measures can have a big effect on the likelihood that a measure will achieve its target impact. This transparency regarding the status of the initiative also quickly gives company leaders a shot of self-confidence as they start to see it take root and generate results each week, with capital flowing to the bottom line and the company moving quickly in the right direction.

- Institute smart and simple processes. Establish program-level routines and processes that track these milestones and objectives systematically and communicate progress without adding undue burdens or usurping the businesses and functions executing the work.

- Foster talent and capabilities. Develop and nurture the right technical, strategic, business management, and leadership skills and capabilities within the organization. This is particularly important in periods of stress to ensure that the company retains key talent.

- Develop a culture of change. Actively build organization-wide support for—and commitment to—strategic-initiative implementation and change management as a real competitive differentiator.

- Establish a program management office. In our experience, an “iron fist” PMO plays a vital role in helping to coordinate and facilitate the steps of a turnaround or restructuring, leading to greater success in implementing strategic initiatives. This is particularly true for initiatives that cross business lines in the organization, where accountability and oversight need to be clear.