In some emerging markets, more than half of the largest companies are family businesses. Yet, for decades, most of the research on family businesses has focused on benchmarks from developed markets. Leaders of such businesses in emerging markets seeking guidance on key topics, such as governance, succession, and talent management, should be wary of relying on insights derived solely from the experience of their counterparts in developed markets.

Emerging markets present a distinctive context for operating a family business . Regulations, institutions, and contract law, for example, are still evolving in many countries, and talent shortages are common. Moreover, families in emerging markets are often much larger, more cohesive, more respectful of hierarchy, and less open to talking about mortality (among other attributes) than families in developed markets.

To understand how this context should influence decision making, The Boston Consulting Group conducted extensive research on family businesses in both developed and emerging markets. The research included about 200 family businesses in developed countries and 1,000 in India, Southeast Asia, and Brazil.

We found that family businesses in emerging markets perform and evolve very differently than the benchmarks from developed markets predict. For example, they grow faster than the non–family businesses in their markets, often at the expense of profitability. And families that remain active in the business over time outnumber those that do not. Our findings point to a clear implication: the distinctive context of emerging markets warrants an equally distinctive approach to fundamental issues affecting the family and the business.

Breaking Down the Differences

We define “family business” using two criteria: the family must own a significant share of the company and be able to influence important decisions, particularly the choice of chairman or CEO; and there must have been a leadership transition from one generation to the next or, in the case of a founder-owned company, plans for such a transition.

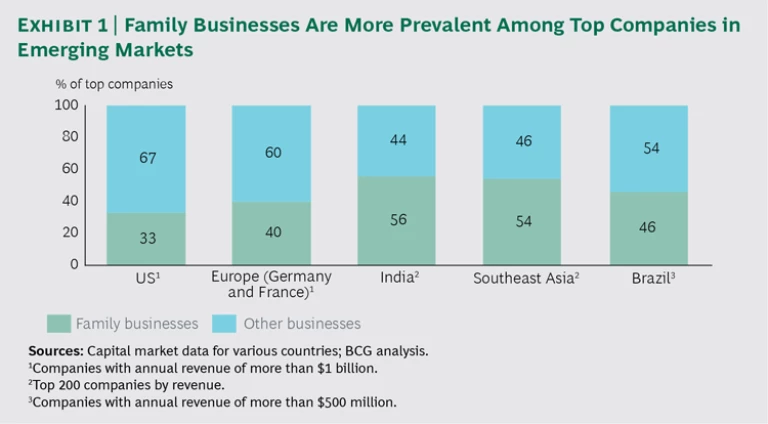

In applying this definition, we found that family businesses are among the major companies in all regions globally. They represent 33% of US and 40% of French and German companies that have annual revenues of more than $1 billion. And they are even more prevalent in emerging markets, accounting for approximately 55% of large companies in India and Southeast Asia and 46% in Brazil. (See Exhibit 1.) If we exclude multinational companies, family businesses constitute a considerably higher share of large companies in emerging markets—more than 70% in India, for example.

Family businesses in emerging markets are also more likely to have family members in managerial roles. We found that such individuals are directly involved in managing approximately 90% of these businesses in India. In Europe and the US, in contrast, family members are investors without managerial responsibility in more than 60% of family businesses.

Family characteristics and cultural differences are distinguishing features in emerging markets. The family is thought of in broad terms, including in-laws and their relatives. Moreover, emerging-market cultures are often more hierarchical and less individualistic than those in developed markets, which further elevates the

Performance: Resilience Versus Ambition

Our research confirmed the widely held view that family businesses in developed markets take a conservative approach to their performance, focusing on resilience and on sustaining the company. As a result, these businesses grow more slowly than others in their markets, have stable profits in good times and in bad, take on less debt, pursue smaller mergers and acquisitions, and take fewer risks. We found that family businesses in emerging markets follow a very different approach. In fact, they are among the world’s most ambitious companies, as evidenced by their aggressive pursuit of growth and acquisitions and their willingness to accept risks.

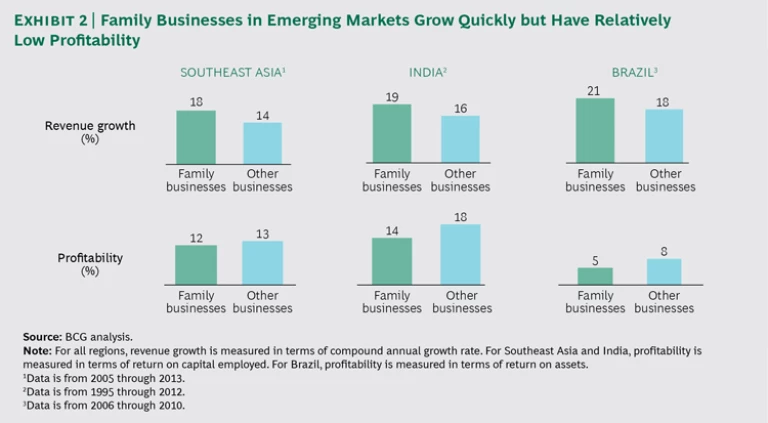

- Growth. Whereas family businesses in developed markets grow at a slower annual rate than other companies in their markets, the CAGR of family businesses in emerging markets is 3% to 5% higher than that of other businesses. (See Exhibit 2.)

- Profitability. Return on equity is higher for family businesses in developed markets than for other companies. And family businesses’ emphasis on stable profits instead of aggressive growth is evident during both boom times and economic downturns. The picture is considerably different in emerging markets. Looking at return on capital employed in Southeast Asia and India, and return on assets in Brazil, we found that family businesses have lower returns in all those markets.

- Debt. Family businesses in developed markets take on less debt than other businesses—we found that their financial leverage is 27% lower on average. In emerging markets, family businesses take on a similar amount

of debt as non–family businesses. - M&A. Family businesses in developed markets spend less on M&A than other companies, pursuing fewer and smaller acquisitions. In emerging markets, they take a more ambitious approach, making more and larger deals than other companies. Both the average number of deals and the deals’ size or value are greater.

Evolution: Stepping Down Versus Stepping Up

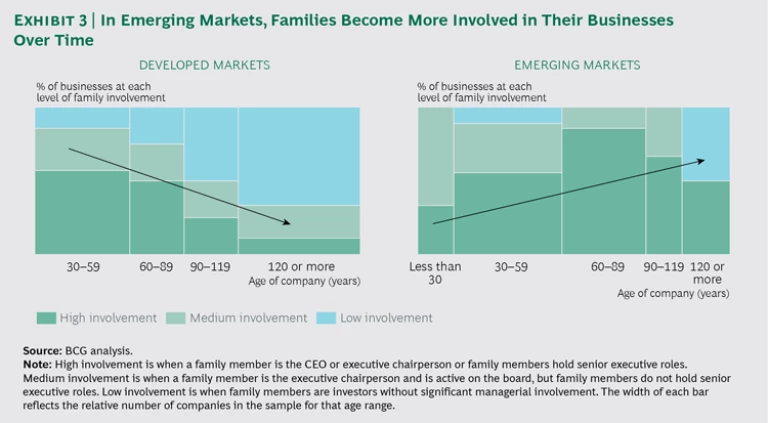

In studying how families’ involvement in the management of their businesses has changed over the past 200 years, we found that in developed markets it has generally declined over time. As non–family members are brought in to manage the increasingly complex organization, family members’ status has evolved from owner-managers to owner-investors (who continue to participate in major decisions) to passive investors.

The opposite is true in emerging markets, where families have become more actively involved in their businesses. (See Exhibit 3.) Indeed, we found that families play an active management role in more than 90% of family businesses in these markets.

Thinking Differently About the Future

What do our findings mean for families that have built successful businesses in emerging markets? Put simply, they should not feel compelled to model themselves on their counterparts in developed markets. To win in their context, they must chart their own course. While this advice applies to many aspects of their business, three recommendations stand out.

Stay with the business if your contribution is valuable. In many cases, families offer singular benefits. Examples include:

- Credibility and Trust. Families often bring credibility and trust to the business, which are highly valued by partners, lenders, and government officials. Maintaining the faith of these parties is especially important in emerging markets.

- Deep Knowledge of the Business. The family’s extensive understanding of the business, in some cases acquired over generations, can be a source of competitive advantage.

- Agility. Because they are not weighed down by burdensome governance structures, many family businesses can make decisions quickly. In a rapidly changing environment, this agility lets them seize opportunities that other companies move too slowly to capture.

- Long-Term Perspective. Family members often apply a longer time horizon to decision making than executives in non–family businesses. This helps avoid the pitfalls of managing the company to please equity analysts on a quarterly basis.

If families make important contributions such as these to the management of the business, then staying involved is the best course. This involvement can take various forms, depending on how the family chooses to build and change the company over the long term.

In Indonesia, for example, a family professionalized its large company by establishing clear accountabilities, putting in place proper checks and balances, and empowering nonfamily managers to make operational decisions. But instead of completely stepping out of operations, the family maintained control of a strategic unit responsible for buying, selling, and managing the company’s real estate interests. This unit continued to benefit from the family’s experience and networks, even as professional managers assumed greater responsibilities in other areas.

Design processes and procedures that support, rather than stifle, entrepreneurship and efficient decision making. Even the most talented leaders of family businesses eventually find it hard to manage a rapidly growing company solely on the basis of willpower, charisma, and hard work. All too often, they try to deal with complexity by establishing the kinds of systems, processes, structures, and KPIs that are used by large companies in developed markets. As a result, these companies stifle the qualities that were essential to their success while not achieving the efficiencies they sought.

In Brazil, for example, many large family conglomerates adopted a corporate governance model in the 1990s that was regarded as best in class at the time. This model, which entails rigid oversight by governance bodies and strict adherence to a multitude of procedures, was well suited to a stable and predictable business environment. Today, however, it impedes companies from rapidly adapting to developments arising from globalization and digital disruptions. One family business leader told us that he came to realize that his company’s branded management model had “simply killed the very essence of what made us successful in the first place: the passion to create and build business opportunities.”

To maintain their competitiveness, family businesses must establish the processes needed to manage complexity while applying, where beneficial, entrepreneurial skills and the knowledge acquired over generations. (See “ Governance for Family Businesses: Sustaining the “Magic” for Generations to Come ,” BCG article, October 2014.) For example, a family that has successfully operated a shipping business for generations knows how and when to buy ships. Knowledgeable family members should retain responsibility for those decisions rather than relinquishing control to a committee or adhering to a burdensome process.

In Indonesia, a family-owned consumer goods company was an early adopter of a modern information management system. Today, the company can track and report sales in real time for each stock-keeping unit on a regional basis, broken down by salespeople—a feat not even the biggest multinationals are able to achieve. By applying an agile decision-making process to respond to this information, the family can react quickly to changes in the market and competitive landscape. Indeed, the family is able to make many decisions that require coordination among operations, sales, and marketing during its weekly lunch.

Emphasize stewardship, not greed. In addition to leadership skills and entrepreneurship, stewardship is critical to a family business. Successful family business leaders bring patience, equanimity, generosity, and a sense of purpose to their roles. They give priority to the greater good, not the pursuit of wealth, and establish core values to ensure that family members regard themselves as trustees for future generations.

Stewardship and core values are a family’s best protection against poorly managed successions, which are the single biggest destroyer of value in family businesses. (See “ Succeeding with Succession Planning in Family Businesses ,” BCG article, March 2015.) Many families spend significant time creating contracts and charters to manage risks such as those arising from succession. These documents are important, but instilling a larger sense of purpose for the business is the best way to build cohesion and avoid disputes.

In India, as in many other countries, family businesses have split apart over family disputes, some of which have occurred in the public eye. But several large family businesses have continued to exist for generations because the family emphasized stewardship as a core value. One family went through an elaborate and public process of putting in place its governance charter. A key element of the charter is the family’s responsibility to contribute to the nation and society, which is considered as important as running the business. The charter also speaks of the need for family members to be trustees for all stakeholders, not just for themselves. These provisions are part of an effort to create an institution that could last for more than a century.

Planning for the Future

Family businesses in emerging markets are among the market leaders across industries. Many seem destined to be the growth champions of the future, forever altering the business landscape. To seize the opportunity, they must recognize and build on their unique strengths and chart their own paths. As family businesses seek to position themselves for success, they should consider a set of key questions:

- Is our aspiration for growth ambitious enough to capture the full scope of opportunities available to us?

- Do we understand our distinctive strengths and how to apply them to achieve the maximal impact?

- Have we designed our family governance, business governance, and ways of working to preserve our strengths and achieve our growth aspirations?

For many family businesses, the answers will point to the need to reassess the company’s governance, strategy, and operating model. Those that lead the way in cultivating their strengths stand to gain a significant competitive advantage in their home markets and globally.