Digital technologies are reshaping the banking industry at an unprecedented rate, generating waves of fresh opportunity and potential peril for traditional banks. Digital has increased customers’ expectations for greater efficiency, quality, and speed, and it has opened the door to new competitors and disruption. (See Global Retail Banking 2016: Banking on Digital Simplicity , BCG report, May 2016.)

In other industries, prominent companies, including Google and Apple, are emerging as serious competitors through digital innovation. And a rapidly growing number of smaller fintech digital platforms—such as alternative-payment provider Earthport and mobile bank Moven—are winning customers with new digitally enabled products and services.

The traditional value chains of banking incumbents show signs of fragmenting. New technologies, such as blockchain, are evolving as potentially fundamental elements of the emerging new industry structure that we call industry stacks.

The Shift from Value Chains to Industry Stacks

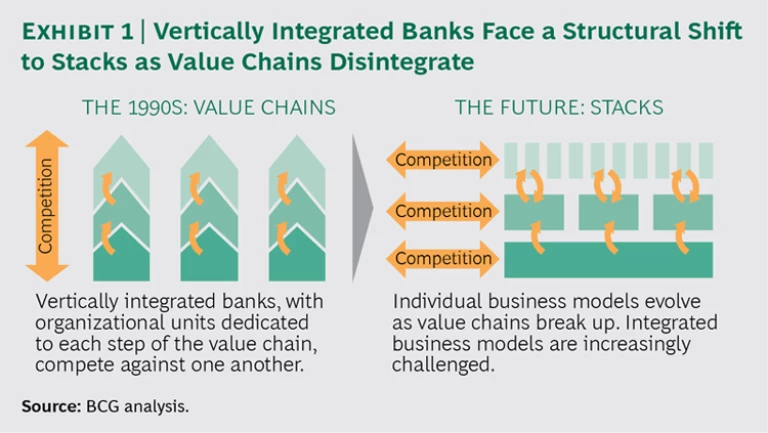

The emergence of industry stacks represents a shift away from vertically integrated companies competing head-to-head across the entire value chain and toward a horizontally layered industry architecture. (See “ Borges’ Map: Navigating a World of Digital Disruption ,” BCG article, April 2015.) The winning organizations in the industry stacks structure will be those that adapt their business models to compete and prevail in specific layers of a stack.

Remember when IBM mainframes did the heavy lifting of global corporate computing? The computer industry began shifting to a stacked business architecture in the early 1980s. The arrival of the PC and the rapid distribution of increasingly powerful and inexpensive personal software dissolved links in the industry’s vertical integration and introduced a new balance of power. Today, those mainframes and supercomputers have largely been superseded in business applications by cloud computing and storage, as well as by racks of networked modular PCs running open-source Linux.

Stacked business architectures result in incumbents either taking on new roles—witness IBM’s evolution to a largely services and advisory company—or exiting the business entirely as their industry consolidates. Will digital technology threaten leading roles in banking, as it has done in many other industries, including computing, telecommunications, media, retail sales, and travel? We believe the answer is yes. In fact, a fundamental change in the structure of the industry has already begun. That conclusion is evident in the shifting dynamics of banking and in the drivers of change, as well as the new structures, that can be seen in other industries that are further along the digital disruption path.

The Vanishing Advantages of Vertical Integration

Many industries, banking included, have been characterized by oligopolistic competition among large, vertically integrated companies. Until now, the market dominance of those companies has been secured by two advantages of size: low transaction costs and moderate economies of scale. Transaction costs are incurred when interfacing with other firms and dealing with information asymmetry. They can be reduced through vertical integration. Economies of scale have been typically moderate because the value chain includes a mix of fixed and variable costs as well as a blend of activities that are more or less sensitive to scale. The net effect has been to confer some benefit to market share and to drive industries toward oligopolistic, but not monopolistic, structures.

Changes in technology, however, are undermining these two advantages. By broadening access to information and advanced analytics, digital and information technologies are eliminating asymmetries in the use of large amounts of sophisticated data while slashing communications costs. Smaller companies and digitally empowered consumers now have access to market information that previously was monopolized by large companies. At the same time, certain infrastructure activities—such as cloud computing and the curation of the cloud’s immense databases—are revolutionizing economies of scale.

As the cost of market interaction plummets, the dismantling of vertically integrated value chains accelerates. And as value chains are reconfigured, the various elements can consolidate or fragment on the basis of their specific economies of scale. The result is a move toward the industry stacks structure. (See Exhibit 1.)

The computer industry clearly illustrates the shift from value chains to stacks. During a 20-year period, it evolved from a vertically integrated market dominated by IBM to a horizontally layered one. Some layers stayed concentrated—Intel remains the leader in processing chips and central processing units, and Microsoft still prevails in operating-system software. Other stack layers, including application development and hardware manufacturing, continued to fragment.

The ramifications of such an evolution for the banking industry are significant. Until now, winning has required mastering the whole value chain from end to end, and doing so better than your competitors. An advantage in one part of the value chain could support selling the whole value chain of services, thus compensating for disadvantages elsewhere.

Fighting Battles in Each Layer of the Stack

In stack-based competition, players have to fight separate battles in each layer of the stack. Competitive advantage requires a company to be flexible enough to win in diverse and changing markets while collaborating with winners in layers in which it doesn’t dominate. Vertically integrated incumbents will now confront different competitors in each arena. They will need to excel at all layers of the stack or eventually be forced to limit their focus to the layers in which they already have a competitive advantage.

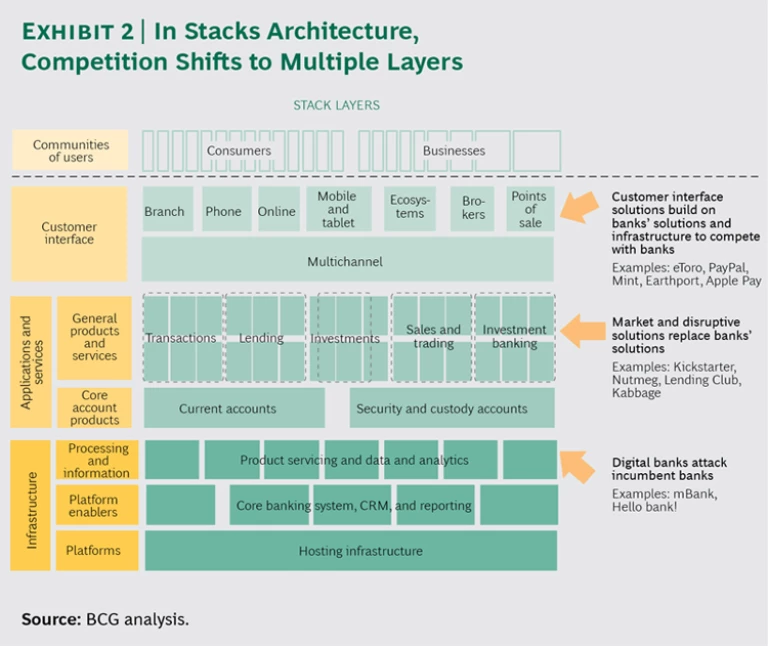

Banking already shows signs of moving toward a stacks architecture. (See Exhibit 2.) The bottom layer of the stacks model is infrastructure, which benefits from scale. It includes platforms that incorporate hosting infrastructure; platform enablers, such as core banking systems; and other processing and information services based on data, such as clearing.

The second layer up comprises banking applications and services. These include basic accounts for money and securities as well as transaction, lending, and investment products.

Above that sits the customer interface layer—which includes not only traditional channels, such as branches, but also brokers, points of sale, and ecosystems—through which products and services become accessible to users.

At the very top are the communities of users, including consumers and businesses. Here, users are quickly becoming producers and information sources. For example, in financial services, investment platforms offer user-generated advice and information.

Incumbents Face Attack in Every Layer

In banking today, new industry entrants are attacking incumbents in every layer of a given stack. Players from other industries typically attack at the customer interface, offering select, high-margin products. These include giant global retail technology pioneers, such as Apple, Google, and Amazon; focused global players, such as PayPal; and telecom providers.

The degree of peril posed by these players depends on the services they offer. A new front end to traditional banking services could prove to be a major threat to banks if it allows the interloper to steal the customer’s loyalty or to substantially reduce business volumes, confining the bank’s role to commodity back-end processing. In the worst case, these outside competitors will aim to become full-service banks, though many shy away from doing so because they don’t want to be regulated.

What makes some of these companies particularly dangerous is that they approach banking with a different financial logic. Banks focus on earning money from their products and services, but players from other industries are more interested in building the value of their ecosystems and gaining access to rich data. To enhance that value, they are willing to disrupt business by giving products away for free, as Apple did with maps and navigation systems.

Fintechs, which have grown rapidly in number and in level of investor funding, similarly aim to take control of the customer relationship. They enter specific, attractive banking segments with focused products and services, aiming to disrupt banks through platforms, such as peer-to-peer lending and investment services. Some fintechs address customers’ new or unmet needs through innovative business models, such as the online money transfer service TransferWise. Others upstage the existing services of traditional banks with improved offerings, such as Mint, Intuit’s online personal-money-management service.

Fintechs that insert themselves into customer relationships or limit direct access to clients pose a particular challenge to banks, jeopardizing margins if not volumes. They threaten to disrupt banks’ ability to provide a full-service offering by going after the most attractive pockets of revenue and profitability, such as payments or investments. This leaves banks with lower-margin, unattractive products and underused platforms and networks.

Specialized service providers are active at lower layers of the stack, mainly in the infrastructure layer but also in the applications and services layer. Some companies—such as IBM, Experian, and SAP—offer IT services, data management, and risk management. Others, such as Wirecard, provide private-label platforms.

Most radical of all, perhaps, are the companies that use blockchain technology, which harnesses large federations of computers (that may or may not be owned by banks) to validate transactions through a shared protocol.

These institutions can exploit scale and innovation beyond what a single bank can achieve. Some take advantage of the increasing volume and availability of data, thus eroding banks’ information and analytics advantage in the products and services layer. These players do not pose a direct challenge to banks but rather see them as customers. Nevertheless, they threaten banks by facilitating disruption as they provide services to attackers and lower the barriers of entry for players that need only to master the top layer of the stack.

Incumbent banks will find it increasingly difficult to prevail. A strong position in accounts, for example, can no longer be relied upon to sell a bank’s own service solutions. Further, as new entrants continue to compete for the customer interface, banks will lose control of the channels that are driving volumes in the lower layers of the stack. Regulators, however, might protect the current industry structure and slow down the emergence of a stack structure if they focus on regulating services rather than certain players.

At the same time, the innovation driven by fintechs provides an opportunity for incumbents. Banks can innovate at an unprecedented speed if they embrace new market solutions, such as robo-advice.

These changes to the banking industry’s structure are in their early stages, and further shifts toward the stacks structure are likely. A greater proportion of banks’ revenues will therefore become vulnerable to attack by new entrants at various layers.

Four Viable Business Models Emerge

In BCG’s article “Borges’ Map,” Philip Evans and Patrick Forth argue that business architecture has itself become a strategic variable. Technology may be used to optimize and create competitive advantage within a business model. But real success stems from an organization’s ability to reinvent its business model or adapt to the opportunities provided by both technology and the ubiquitous availability of digitized information that can be generated, mined, analyzed, and used at low cost.

In this world, stacked business architecture will be the dominant structure, and four distinct, viable business models are emerging within it: traditional oligopolist, infrastructure organization, platform, and user community.

What will this mean for the future of the banking industry?

Traditional Oligopolist. Companies following this business model have a competitive advantage in environments where uncertainty is high but not incalculable and where economies of scale are significant but not overwhelming. Their advantage stems from continuous improvement in core products and processes as well as from investments in sustaining the advantages of scale. The successful traditional oligopolists will continue to control a large part of the value chain.

Current incumbent banks, whose number one priority is to keep their offerings relevant for customers, are naturally positioned for this space. When they lose access to the customer, these banks will have to become the new winners’ best partners at the customer interface to avoid losing platform scale. Partnering with future winners will also allow them to gain share on volumes. Margins will come under pressure as products are commoditized, and some products will even become unsustainable for the majority of integrated banks that fail to reach the scale required.

Overall, the model of traditional oligopolists will become less relevant.

Infrastructure Organization. This type of company will be found at the bottom of the stack, where scale matters most and uncertainty is lowest. Scale and efficiency are key here, and IT providers, utilities, and global product players, such as credit card companies, will continue to prevail. Several products currently manufactured by banks will migrate into this space, especially in the capital markets business; consider foreign exchange trading, for example. Infrastructure organizations will therefore both partner and compete with traditional oligopolists.

Platform. Organizations using this business model provide services to communities and allow them to scale as a result of the network effect of serving a large number of users. This creates a winner-take-all environment with monopolistic structures. The value of these platforms must be sustained by continuous innovation and reinvention. Unlike traditional monopolies, which are protected by barriers to entry created by the immense investments in infrastructure—such as cables, pipelines, or railroad tracks—that are needed to form a traditional network, these new networks are generated by users’ decisions. And as users’ views and needs evolve, the new fragile monopolies can lose scale as quickly as they gain it.

Some traditional banks, including BBVA and Citibank, are exploring the platform approach—for example by opening their applications programming to benefit from external innovation. As the value of physical distribution networks erodes, more banks might want to explore options to create new digital platforms. With access to customer data, an understanding of customers’ needs, and the sheer scale of their customer base, banks have the assets that are essential for building a platform.

The bank as an app store in the center of an ecosystem might become a business model for the future.

User Community. Consumers, professionals, and small entrepreneurs will gather in communities at the top layer of the stack, consuming services and products offered by companies in the layers below. They flourish in environments that have high uncertainty and weak economies of scale. Members of these communities innovate to build solutions that are better than the ones provided by companies in the other layers. They build on platforms, and their costs of failure are low; the main investment is the creator’s time—and the upside is large when they hit it right. Innovative solutions can scale quickly and create global businesses within months.

This potential to scale quickly in the user community space is what attracts venture capital to fintechs and other startups. Though some banks are building disruptive business models independently—creating venture capital funds to fuel external innovation that they can internalize or using hackathons to create new digital solutions for their customers—this space is largely untapped by banks today.

The detailed structure of future banking is, of course, unclear. As the stacks architecture continues to evolve, however, banks will need to know which model to employ given their circumstances and then excel in its execution.

What Banks Must Do to Succeed

Some say that banks will be marginalized and become mere product providers. Others argue that banks should appeal to regulators for protection from the economics of disruption. Still others believe that determined banks will find paths to evolve and survive by leveraging their core assets, such as their customer base, relatively large investment budgets, and generally well-educated staff.

We believe that the organizations that embrace the opportunities of technology in the industry stacks structure will emerge the strongest. Banks that aim to be among the winners must take three actions:

- Build an understanding of their market’s dynamics and, more important, identify current and future competitors in each layer of the stack.

- Generate options for their future market position using the opportunities provided by technology for both digitizing the core and launching disruptive solutions.

- Above all, develop the ability to adapt to an uncertain and shifting environment.

Ultimately, banks will need to face the brutal facts about where in the stack they have a sustainable competitive advantage and are able to compete profitably. It may be necessary to focus activities more narrowly in some layers while investing heavily to innovate and broaden scope in other areas.

Because the precise outcome cannot be predicted, becoming more adaptive is the key challenge. Banks operate in an environment in which aversion to risk is part of the culture on all levels and where decision making is complex and slow. Those institutions will now have to be able to manage both continuous incremental improvements in their core businesses, where they still mainly compete against one another, and innovations in adjacent and new business areas, where they will compete against new, agile competitors.

Banks must be able to operate with a more diversified mix of channels and to supplement captive channels with other solutions. Technology will play the main role rather than just support it, and data management will become a key source of competitive advantage.

This will require a fundamental change in the way banks operate, starting with a significantly tighter focus on customers. Banks will need to take the following steps:

- Become less hierarchical and siloed and instead allow more distributed leadership and empowerment of teaming for customer-relevant solutions.

- Establish clear processes for innovation with KPIs and set up governance structures that differ distinctively from those of the traditional mature businesses that banks are used to running.

- Develop modular organizations, in which services from bottom layers are easily available to all services at the top.

- Create a new people strategy to attract and cultivate digitally savvy entrepreneurial talent.

- Foster a culture of excellence in everything they do; this is critical for banks aspiring to remain relevant in all layers of the stack.

Times of uncertainty are times of opportunity for entrepreneurs. Now is the moment for banks to rebuild entrepreneurship while retaining their abilities to manage efficiency and incremental improvement.

Yet disruption has not defined the future of banking. Organizations that understand and wield the digital opportunities to drive change, rather than be driven by its perils, hold the future in their hands. Taking a small number of decisive management actions now can lay the foundation for success.