This report is based on a survey conducted by BCG and the Grocery Manufacturers Association.

Generating revenue, directly or indirectly, hasn’t been the responsibility of chief information officers (CIOs) at consumer packaged goods (CPG) companies. In a sector where growth has depended on brand strength and mass marketing, CIOs have played a corporate technology role behind the scenes.

Times have changed. Mature CPG brands are losing market share to younger companies, and those brands are increasingly turning to technology to help them foster innovation and recapture growth. That is thrusting their CIOs, and IT organizations, into a new role.

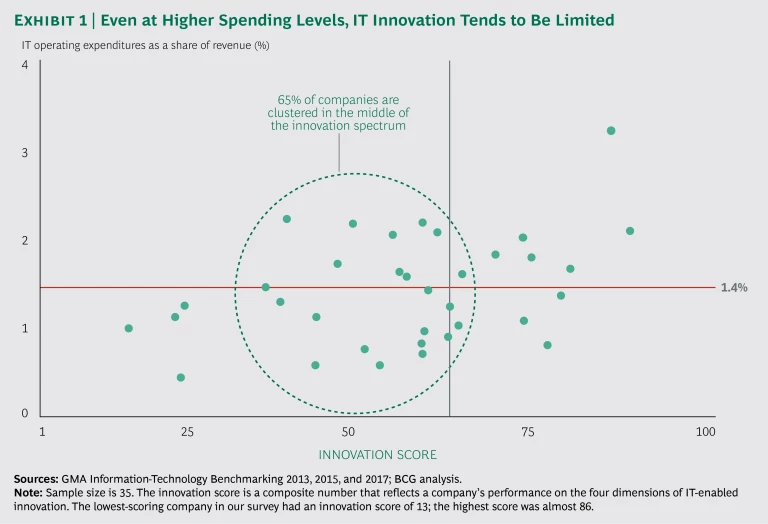

The results of BCG’s biennial survey show how CPG CIOs are responding to the new pressures. Most IT organizations still have a long way to go to meet the digital innovation imperative. Only about one-third of this year’s participants qualifies as innovative. On the bright side, they have made good progress in reducing IT spending. The savings may provide them with funds that they can plow into innovation.

Assessing CPG Innovation in the Context of IT

BCG evaluated IT organizations’ innovativeness on four dimensions: the breadth and level of their digital investments; the extent of their direct-to-consumer activities; their application of advanced analytics; and their use of innovation accelerators. (See the sidebar.) When evaluated on these four dimensions, most CPG companies have a composite score that puts them in the middle of the pack. Very few companies stand out. (See Exhibit 1.)

How We Measure Innovativeness

How We Measure Innovativeness

To evaluate innovativeness, BCG looked at CPG companies’ activities on four dimensions.

- The Breadth and Level of Digital Investments. This refers to the number of ways in which a CPG company makes digital investments to enhance its capabilities. For instance, a CPG company may invest in digital marketing; integrating its systems more tightly with those of third-party e-commerce channels, such as Amazon and Walmart.com; adding transparency to its supply chain so, for example, customers know exactly when a shipment is arriving; or improving cybersecurity. The breadth and level of such investments speak to how fully a company’s operations are digitalized.

- The Extent of Direct-to-Consumer Activities. CPG companies have an opportunity to create consumer databases in three main ways: by collecting information from consumers who use company-owned digital media, such as websites and apps; by purchasing third-party data; and—perhaps most powerfully—by combining the two. The existence of these databases and the richness of their insights about individual consumers are indicative of innovation; so is a company’s use of such databases to test new product concepts or to target customers with personalized offers on the basis of their unique demographics.

- The Application of Advanced Analytics. CPG companies can use analytics to improve business performance in a number of ways. At many companies, analytics programs now optimize pricing, increase the effectiveness of the sales force, or improve inventory management.

Demand forecasting and equipment management are other areas where the use of analytics is growing. Some companies are using analytics to predict demand for new products, and these automated forecasts have turned out to be more accurate than manual ones that rely on spreadsheets or sales managers’ prior experience and judgment. Other companies are using analytics to more effectively manage plant equipment. At these companies, sensors alert operations staff when equipment needs to be serviced, helping to avoid breakdowns and costly delays.

- The Use of Innovation Accelerators. A CPG company’s commitment to innovation is also evident in its willingness to explore new technologies. For example, the company might invest in startups; agree to pilot new technologies; open offices in places such as Silicon Valley, Berlin, or London, all of which have talent with the latest skills; hold “hackathons” in which programmers collaborate; or pay outside developers to build working prototypes of new products.

Few CPG companies have also embraced agile software development as an innovation imperative, despite agile’s role in helping companies such as Amazon, Google, and Netflix dominate their markets. CPG companies deal with physical products, so it isn’t surprising that they would lag behind digital natives in implementing agile methodologies. The surprise is how little progress they’ve made. Today, much like two years ago, the majority of CPG companies use an agile development approach for less than one-third of their projects. Only about half of all companies plan to increase their use of agile in the near term.

Lower IT Costs Are Partly Due to Cloud Adoption

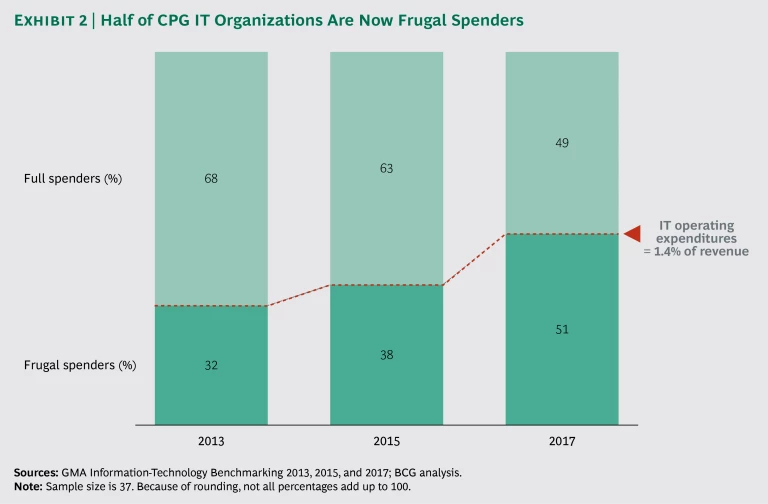

An area where CPG IT organizations have made significant progress is in reducing their IT spending. Four years ago, only about one-third of CPG companies could be characterized as frugal spenders, with IT operating expenditures accounting for 1.4% of revenue or less. Today, about half are below this threshold. (See Exhibit 2.)

The improved cost control stems partly from companies’ increased use of software as a service (SaaS) platforms and the cloud. SaaS has become the standard for certain applications in CPG, such as email and payroll. More significantly, SaaS is starting to be used in areas where it previously wasn’t seen as a possibility. For instance, 22% of CPG companies now use a SaaS version of ERP, and 14% rely on a SaaS platform to support plant maintenance.

Just as CPG companies have sharply increased their use of SaaS since 2015, so, too, have they expanded their use of cloud environments, including public clouds (such as Amazon Web Services) and private dedicated clouds. But 73% of participants’ IT workload still takes place in a manner that doesn’t involve the cloud. This suggests that there are still significant opportunities for savings.