For consumer goods companies looking to improve bottom-line growth, the top line is the critical place to focus.

In the past three years, more than two-thirds of revenue growth —and an even bigger share of profit growth—among the top 50 global fast-moving consumer goods (FMCG) companies has come from pricing and mix rather than from volume increases. FMCG companies are operating in an increasingly challenging retail environment: they face slowing top-line growth in many developed and developing markets, and smaller brands are gaining share against more established rivals. Retail consolidation, e-commerce, and continuing incursions by discounters result in ever-fiercer price competition. In many developing markets, the organized trade is replacing the traditional trade, shifting sales to a channel with lower prices and profits. Companies must deal with rising promotion intensity, and, typically, the growth of trade discounts is outpacing sales growth. As a result, FMCG companies are finding it difficult to increase revenues and ex-pand margins at the speed investors expect.

In recent years, smart FMCG companies have been looking to net revenue management (NRM) techniques as part of the solution to their growth challenges. But in our experience, many struggle to get full value from these efforts. Revenue management requires a structural approach that builds and embeds a cross-functional capability into the organization and is supported by the right analytical tools and methodologies. Most FMCG companies approach revenue management as more than 70% art and less than 30% science. Companies that want to reignite sales and profit growth need to flip this ratio in their favor. Here’s how they can go about it.

The NRM Opportunity

NRM is an approach for maximizing the revenues and profits from a company’s brand and product portfolio over time. Success requires disciplined strategy, analytics, and execution. To do this effectively, companies need to get a lot of factors right: it’s about selling the right brand in the right pack for the right occasion to the right customer at the right price. Given the complexity typical of today’s product portfolio, the changing retail landscape, and fragmenting consumer demand, it is almost impossible to pull off this combination by relying on management’s gut feel alone.

Fortunately, FMCG companies have access to more and more internal and external data that can inform the key revenue management tradeoffs. Taking advantage of this data requires a robust and disciplined analytics capability that can distill key NRM insights from the various company, customer, and shopper data sources available. It also requires actively involving all the functions that touch NRM, including marketing, trade marketing, sales, finance, and supply chain management. Each plays a role in optimizing and executing price and promotion decisions.

For companies that succeed, NRM can have a big impact on both revenues and profitability. Most of the benefits from more effective pricing either drop straight to the bottom line or provide funds for investment to accelerate growth. Working with clients, BCG has seen companies that have made the effort to build rigorous NRM programs achieve improvements in EBIT ranging from 2% to 5% of sales. For a $10 billion company, that’s $200 million to $500 million a year in newfound profits.

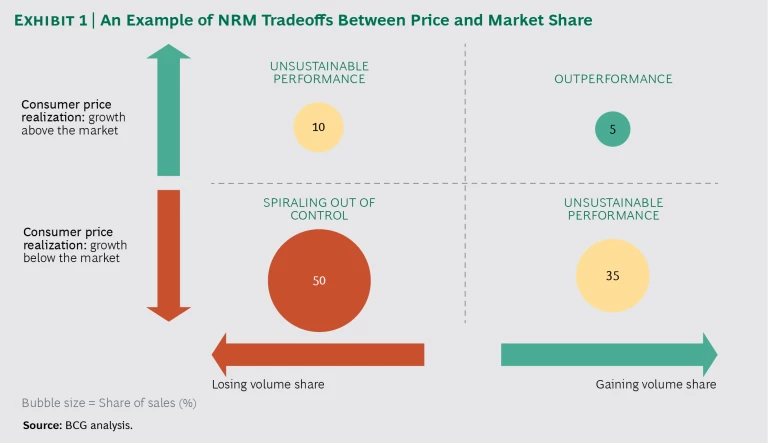

To clarify their understanding of their overall NRM performance, companies can compare their volume and pricing performance with that of the markets and categories they compete in. It is not that difficult for a company to grow volume share if it drops prices or to increase prices if it is willing to accept declining unit sales. A company achieves true outperformance when it increases both volume and price realization faster than the market. For most companies, this is a struggle. One FMCG multinational, for instance, found that barely 5% of its sales were in category-market combinations in which they were outperforming in terms of both price realization and volume share. (See Exhibit 1.) This company is not alone. Most FMCG players, in our experience, have plenty of room for improvement.

In addition to better financial results, NRM also enables a more rigorously fact-based dialogue with retail partners and helps focus discussions on how to grow the category and the category profit pool for retailers and suppliers alike. In many cases, some of the pricing gains can be reinvested to accelerate innovation, build brand equity, and strengthen the brand’s relevance to consumers. In this way, NRM supports the long-term health of the category and helps gain buy-in from retailers through demonstrable impact.

Five NRM Levers for FMCG Companies

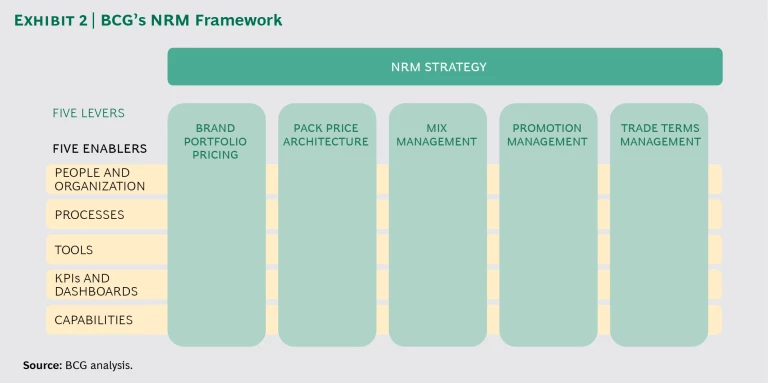

We have worked with many of the leading FMCG companies and found that best-in-class NRM performance is achieved by applying five levers that are supported by five enablers. (See Exhibit 2.) The relative importance of each lever varies depending on company circumstances and category dynamics. Some companies try to improve performance by pulling just two or three of these levers, but to achieve the full benefits, all five levers need to be applied in concert.

First of all, companies need to set their overall NRM strategy for every category and location. Very few companies have a well-articulated view of the strategic pricing opportunity in their categories and markets. As a result, many lack a clear direction for revenue management. In some category-market combinations, volume gain is critical; in others, revenue realization or improvement in margins is essential for driving value creation. In order to set the strategic stance toward brand portfolios in different markets and categories, a company must answer four key questions for every category-market combination:

- How is the category evolving—by segment, by region, and by channel?

- Where are the pockets of growth and decline?

- Which brands and SKUs are winning in the category and why?

- Where are the profit pools, and how are they shared across the value chain in different channels?

Outperformers differentiate their strategic stance effectively by category and market. Systematic review could uncover big profit pool opportunities or gaps in the company’s offering, such as opportunities to better serve different occasions or cover the full price range.

The five levers allow companies to translate the NRM strategy into actionable interventions that can improve performance.

Brand Portfolio Pricing. Many companies fail to capture their brands’ full value to consumers by underpricing or overpricing relative to consumers’ willingness to pay and competitors’ pricing in specific regions, channels, or segments. The strategic logic is quite often straightforward: if a brand or product has better equity with consumers and a share advantage in a segment, it should also command a price premium. In reality, most companies’ brand portfolios either overlap or fail to cover all the key price points. By reviewing brand strategies and equities, assessing existing price ladders compared with those of the competition, and evaluating brand-price elasticities, companies can set clear strategic brand-pricing guidance across the portfolio and across sales channels. (See “Brewing a Better Price for Beer.”)

Brewing a Better Price for Beer

Brewing a Better Price for Beer

A leading brewer had been facing several years of declining price realization in its brand portfolio in an important market. The company embarked on an NRM journey to better understand its own brand-pricing dynamics and the deflationary pricing dynamic of the category. Management reviewed the margin structure of the company’s brands, the impact of the frequent price changes on demand, and the competitive responses to the company’s price changes. It found that its biggest mainstream brands could build on relatively strong brand equity to raise prices and achieve higher profitability for both retailers and the company. At the same time, there was an opportunity to gain significant volume for the company’s premium brands by targeting slightly lower price points than those of the competition. For the brand portfolio as a whole, this resulted in higher average-price realization and a favorable shift in the mix toward premium brands.

Pack Price Architecture. Best-in-class companies aim to provide the right format, pack, and price for each purchase occasion and shopper mission in every channel. With typical category assortments running in the hundreds of SKUs, this is a complex task that needs to be refined continually. Most companies that start to apply advanced analytics on pack price architecture find that they are pricing at suboptimal points, missing opportunities to differentiate themselves from competitors, and losing sales by not covering key premium or affordability price points. Pack price architecture is a critical area in which big data tools that combine internal, customer, and shopper data can reveal highly specific and detailed insights.

Companies must take into account competitor behaviors in their pack price assessments. We have found that, too often, companies adopt black-box pricing models that recommend lower prices on the basis of individual SKU elasticities only to find that competitors respond immediately with their own price cuts. The net result is lower pricing across the category with no volume upside for anyone. Companies should strive for a clear pack price architecture by channel—based on sound shopper insights—that the sales teams can take to the trade.

Take the example of a premium ice cream brand that was looking to accelerate growth through better NRM. At the time, 90% of its volume was in an iconic, relatively large one-size-fits-all pack. The brand was losing out on opportunities to increase penetration and reach a broader set of consumption occasions and shopper missions. It was also priced at more than twice the “magic” retail price point for ice cream. By applying a disciplined approach to differentiate the lineup and pricing by channel, the company was able to cover a much more diverse set of price points and consumption occasions. This allowed the brand to accelerate growth significantly.

Mix Management. Once the optimal pack price architecture has been set, it is the job of the sales and key account teams to drive the SKU and channel mix to the best sources of profits and growth. The first step toward active mix management is a clear SKU and channel segmentation that is based on profitability and growth potential. The second step is a disciplined execution plan, structured by account, that is supported by the right incentives.

Many FMCG companies have found that managing the SKU mix is the key lever for ensuring that pricing strategies bring year-over-year benefits—as much as 1% to 2% in pricing improvement annually. Still, many FMCG companies are not disciplined in the execution of their mix strategy.

As a result, it is common to find priority SKUs with high margins or high shelf rotations that are not being distributed as widely as they should be, are not being positioned at the optimal in-store points to maximize sales, or are missing out on attractive promotion slots.

Promotion Management. Over the past decade, promotion intensity has grown in virtually all categories. Some categories, such as beer and laundry detergent, now have the vast majority of their sales in almost continuous promotion at big retailers. It may not always be fully visible in financial reporting, but many companies invest more than 10% of sales to fund these massive promotion programs. At the same time, the effectiveness of promotions is eroding because consumers have come to expect deals. Although many manufacturers spend more on promotion discounts than on capital expenditures, promotion effectiveness receives much less scrutiny. Each year’s promotion calendar is pretty much a repeat of the previous year’s with a few add-ons to fill the gaps or cover special events.

FMCG companies need to take a much more structured approach to promotions, aligning spending with brand objectives and ensuring rigorous assessment of promotion performance. Working with a wide array of clients, we have found that more than half of promotion investments failed to add to either retailer or company profits. Most companies have a clear opportunity to cut the tail of unattractive promotions and invest in only the most effective.

Part of the problem is that few key account managers today know which promotions are the most effective. Companies and their sales teams need to understand both sales and the margin impact of their promotions and eliminate the “noise” that clutters their perceptions. The first step is to gain a thorough understanding of baseline sales. This can be tricky because of the need to correct for seasonality, cannibalization, and competitor and retailer behaviors. At times, promotions that appear attractive at first sight are, in reality, destroying value. Changing a category’s promotion dynamic starts with a deep understanding of the effectiveness of category promotions and the key performance drivers. This opens up opportunities for fact-based discussions with retailers on how better promotions can unlock further category growth and profitability.

Consider the example of a leading snack food company in a major Latin American market. The company’s trade spending with the country’s largest and fastest-growing chain store was increasing at a much quicker pace than revenues. Cutting spending unilaterally would have been difficult and damaging to the relationship, so the supplier, working in concert with the retailer, looked for a more creative solution.

As is often the case in emerging markets, the availability and quality of retailers’ consumer sales data tied to specific trade promotions were spotty, and it was impossible to do an in-depth ROI analysis of specific promotion vehicles, such as end-caps, checkouts, or banners. The company asked its sales reps and leaders to specify which of the vehicles they would be most willing to support with their own money. It used input from all its reps to create a proxy for the ROI of each type of trade promotion, which it compared with aggregate consumer sales data to confirm that the proxies were directionally correct. It also checked the results against the market experience of its sales leadership. And because the company and the retailer were able to distinguish the most and least valuable investments, they could create a more compelling, win-win trade investment plan that put spending behind the mechanics that delivered the highest returns. Both the company and the retailer have enjoyed much faster revenue growth, and this approach has strengthened the commercial relationship between them.

Trade Terms Management. The final lever, trade terms management, is critical for ensuring that FMCG companies capture their fair share of the category profit pool. In many cases, list prices are not well aligned with target consumer prices and trade terms structures are not effective. This lack of alignment means lost opportunity: trade terms are among the largest commercial investments FMCG companies make. Top-performing companies put effective pay-for-performance mechanisms in place to motivate and reward the behavior they seek. They deliberately skew their investments to the most attractive retailers and shift discounts toward conditional working terms that are aligned with their NRM strategy.

Sustaining NRM

NRM is not a one-time program; it is a capability that needs to be continually improved. Companies that embark on the journey to step up their NRM quickly find that having the right enablers in place is critical to sustainable success. On the basis of our work with many leading FMCG companies, we can highlight five enablers that every FMCG company needs.

People and Organization. Best-practice NRM execution requires dedicated resourcing. NRM is predominantly a local game that is won on the ground in local markets, and success depends on local management ownership and local NRM resources. If a company aims to make a step change in its NRM capability in a particular market, it needs a clear local owner with sufficient seniority to make change happen. Local teams can be supported by a lean regional or global “center of excellence” that drives the broader development of methodologies, tools, and best practices. Senior leadership must also focus visibly on NRM, and talent must be recognized and developed. Some leading companies view time spent in an NRM role as a critical career step toward becoming a general manager or CFO.

Processes. NRM is not a standalone function. It should be fully integrated into the company’s strategic planning, operations, and performance management processes. Roles and responsibilities need to be clearly defined. Revenue management must be fueled by the right insights, but these insights matter only if they are available to the right people at the right point in the process so that they can influence critical revenue management decisions.

Tools. Analytics are the lifeblood of NRM, and teams need ongoing access to crucial insights to set the right prices, optimize promotion calendars, and manage the SKU mix. Best-in-class NRM requires tools that support decision making by leveraging data from both internal and external data sources. Advances in big data and digital solutions enable today’s companies to make deep and granular insights available to revenue managers as well as sales, marketing, and operations executives. Companies should, however, avoid the trap of rushing to acquire new IT tools. Complex systems rarely deliver the benefits they promise, and many are too cumbersome. A better approach starts with establishing NRM understanding and processes that are supported by pragmatic solutions tailored to specific needs. Building on these solutions, the company can expand the tool suite to better integrate with existing systems and unleash the full power of insights in pricing, promotion, and SKU mix.

KPIs and Dashboards. What gets measured gets done. Companies will need to develop globally consistent NRM metrics and reporting dashboards that can be put in place throughout the organization. Too many companies fail to take pricing metrics sufficiently into account in their monthly and quarterly reporting or incentives. The best dashboards cascade from the top down to individual market and brand levels, enabling each level to gain better understanding of the drivers of NRM performance.

Capabilities. Finally, just as a muscle requires training to develop, NRM is a capability that must be built and practiced. NRM teams should be trained on the methodologies and tools, and best practices should be shared and updated regularly. Critical NRM processes should be documented (globally and locally) and used consistently across the organization.

For today’s tough retail environment in which demand is increasingly fragmented, NRM is a critical capability with robust and disciplined analytics at its core. Getting it right is not easy. It requires a programmatic approach that addresses five key NRM levers, supported by the right enablers to drive on-the-ground impact.

Stepping up NRM capabilities can help FMCG companies ensure that they are neither undercutting their own performance nor leaving money on the table—and that they are maximizing the full potential of their brand portfolios.