At first glance, the insurance sector has had a great run of value creation over the past five years. Although there have been challenges, from January 2012 through December 2016, the global industry racked up an annual median total shareholder return (TSR) of 18.5%, compared with 16.2% for the 2,400 companies in the BCG 2017 Value Creators database.

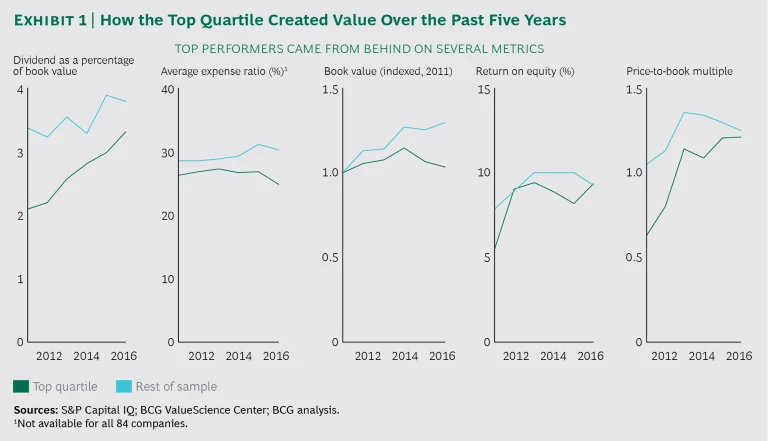

Some may ascribe this performance simply to the bounce back from the depths of the 2008 financial crisis, and indeed, this is part of what occurred. On average, companies in the top quartile of insurance value creators started from behind on several metrics and caught up. (See Exhibit 1.) But dig a little deeper, and a richer picture emerges. For many of the industry’s top performers, payout has expanded faster than the underlying fundamentals, and these dividend increases have played a big role in expanding valuation multiples. The value that investors have placed on increased payout has accounted for as much as 80% of the valuation multiple expansion and 65% of total returns for some players. These companies also divested high-cost, lower-return units and cut expenses, while costs at other companies rose.

Given this history, two big questions loom. For those players whose performance has relied heavily on a combination of rising payout, portfolio restructuring, and cost cutting, what’s next? Is there room for further improvement? If not, can these companies pivot to create superior value the old-fashioned way—through growth, innovation, and progress in the core business? And for those that have not yet played the cards of capital allocation and cost reduction, how long will they maintain the goodwill of their investors and boards of directors before a more activist approach is thrust upon them? Put another way, what does the next era of value creation look like for insurers?

What the Winners Have Been Doing Right

Allocating (or reallocating) capital is a powerful value creation lever. From 2012 through 2016, insurers in the top quartile not only focused their portfolios but also built stronger balance sheets than the rest of the 84 companies in our global sample. The top performers also increased their dividend payouts. As a result, price-to-book (P/B) multiples continued to expand, even after 2012, when ROE gains flattened out.

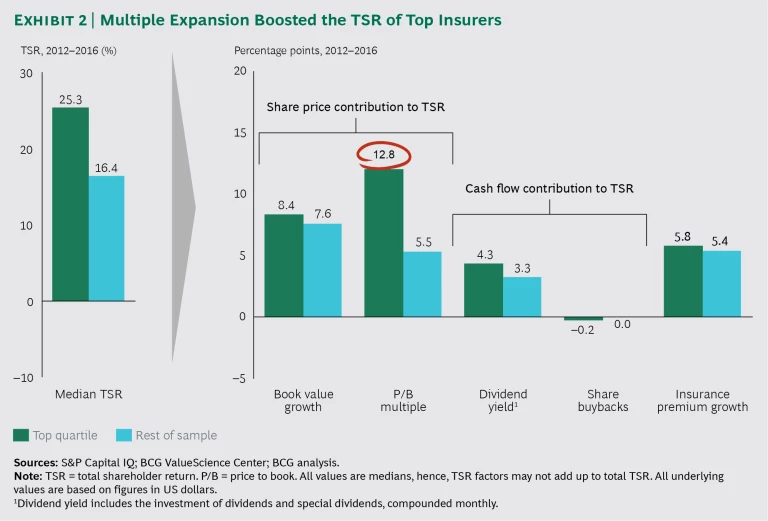

Top-quartile performers had a median TSR of 25.3% over the period. P/B multiple expansion contributed about half of this increase, compared with about one-third for the rest of the sample. (See Exhibit 2.)

For some companies, other factors such as higher book value growth, ROE increases, and an improved balance sheet drove some of the multiple expansion. But overall, and especially in the top quartile, rising dividend payouts were a key factor. (See the sidebar, “TSR in Insurance.”)

TSR IN INSURANCE

In the long run, value creation measured by TSR is the true bottom line for any business. From the shareholder’s perspective, TSR is easily measured (the combination of share-price gains and dividend yield for a company’s stock over a given period of time) and benchmarked. However, how do operational managers generate TSR? That’s where disaggregation of the primary TSR drivers comes in.

In insurance, TSR is broken down into three components: the growth of book value, change in the P/B multiple, and the contribution from cash flow (comprised of dividend yield and share buybacks). Over the long run, book value growth and cash flow are the major contributors to TSR. Over the short to medium term, changes in the P/B multiple matter a lot more. (See the exhibit below.) The most important challenge for management is making the right tradeoffs among growing book value, deploying free cash flow, and expanding or protecting valuation multiples. BCG’s TSR methodology helps companies simulate such tradeoffs and make informed decisions about factors such as portfolio focus, capital allocation, and business units’ financial targets.

Making the right tradeoffs requires accurate estimates of the impact of strategic and operational decisions on not only book value and free cash flow but also the valuation multiple. BCG’s smart multiple methodology uses regression analysis to estimate differences in valuation multiples. In insurance, almost 90% of the variance in a company’s P/B multiple relative to its peers can be explained by fundamentals: profitability metrics (ROE and dividend payout), balance sheet health (credit rating, liabilities, and debt), forward growth expectations, and size. When we help a company chart a course for superior shareholder value creation, we develop a plan on the basis of the tradeoffs among the fundamental TSR drivers (book value growth and free cash flow, for example) and the expected impact of each factor on the client’s valuation multiple, while also considering the risk and long-term strategic implications.

In contrast, bottom-quartile insurers, which did not make many of the same financial and operational moves, saw their P/B multiples shrink over the period. For the industry as a whole, P/B multiples also trailed the broader market. (See the Appendix for the key performance metrics of the top insurance companies in our sample.)

Appendix: 2017 Insurance Value Creator Rankings

The following tables show the top 42 insurers in our sample sorted by TSR for 2012 through 2016, which is then broken down by the fundamental TSR drivers. Wherever a company falls on this list, past results do not predict future performance. TSR has to be earned, year in and year out. The challenge for those companies on top is to continue their superior performance; the others have the opportunity to improve. We have seen time and time again that value creation is much less dependent on industry, sector, or region than it is on the strategies and actions of individual companies.

What of the Future?

The companies in the lower half of the TSR rankings may want to take a page from the playbook followed by their top-quartile peers over the past five years. Many of the companies in the third or fourth quartile have not fully exploited the lever of capital allocation and tight expense management. These organizations have the opportunity to cast a much more critical eye over their portfolios and make hard choices about which businesses deserve the capital bases that support their insurance premiums. In our experience, a combination of portfolio restructuring and aggressive performance improvement is possible for almost any insurer in today’s environment, and these steps can substantially move the needle, improving ROEs and increasing the cash available for payout, the two main drivers of expanding P/B valuation multiples.

Capital allocation and cost efficiency strategies have their limits, however, and they can reach a point of diminishing returns. Although investors may reward these actions through increased valuation multiples, the endgame can leave companies with few strategic options and the value creation profile of a bond portfolio. Going forward, industry leaders that want to deliver a new era of value creation will have to evolve their playbook and refocus their efforts on growth.

Each industry segment faces its own challenges. As we reported last year, the property and casualty business is looking at major long-term disruption. Sales of life insurance policies and annuities have been essentially flat for more than a decade. Investment income has become a critical mainstay, yet that income stream is weakening, because low-risk investment yields remain depressed and central banks continue to drain the bond markets. (See Motor Insurance 2.0, Morgan Stanley Research and BCG report, September 2016, and “Why Life Insurers and Asset Managers Must Join Forces to Win,” BCG article, December 2016.)

The outlook for the commercial and reinsurance markets is potentially exciting. The rise of massive new industries and large category risks, including climate change, artificial intelligence, autonomous vehicles, and cyber-related risks, are big areas of opportunity. Some estimate that the cyber-related insurance market could grow tenfold to $20 billion, for example, and the Internet of Things insurance market could exceed $40 billion within the next decade.

All insurers (including mutually owned companies, which could also benefit from a TSR-type analysis) need to take a hard look at where they stand today on the market maturity curve with respect to their current positions and advantages in their lines of business, segments, and regions. Capital requirements and regulatory changes imposed in the wake of the financial crisis mean size and global scale no longer confer the advantages they once did. Scale in individual markets and segments is much more important. (Some companies are already taking action; divestitures made up about 40% of all industry deals from 2012 through 2016.)

In addition, price-based competition and product commoditization are common challenges. Product innovation is hard to come by—and has been limited mostly to distribution. M&A is expensive and risky. The industry is also headed into a period of disruption: a large number of well-heeled “insurtech” players are starting to attack multiple links of the insurance value chain beyond distribution, such as product development, underwriting and risk assessment, claims, and asset management. These “digital natives” move fast, and they have a laser-like focus on the customer, understand how technology leaders such as Amazon and Google have raised customers’ expectations, and have multiple successful fintech models to emulate. Some 1,700 insurtech startups are active today (up from 1,100 in 2010) across all personal lines and some commercial lines, and they are backed by almost $35 billion in venture funding.

A few fortunate companies have viable avenues for value-creating growth because they have positions in fast-growing markets (which are mostly in Asia) or they moved quickly into growing market segments. For most insurers, however, the way forward will not be so clear cut. These companies will need to make tough decisions about where their opportunities lie, and they will very likely need to transform their businesses in order to achieve them.

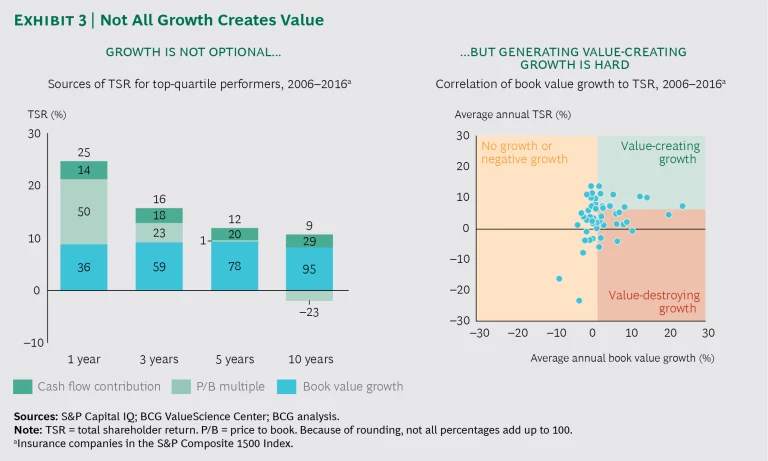

Advantage, Returns, and Growth

A few years ago, our colleagues observed that most companies must “grow uphill,” because they face maturity and commoditization (which erode advantage) or disruption and changing customer behaviors (which erase it). These circumstances certainly apply to the insurance sector. But making even small changes in the trajectory of profitable growth can create substantial value. Our research shows that over longer time frames, mature companies that increased their top-line growth even modestly (by 2 points or more) delivered shareholder returns 40% higher than the market average. (See “Growth for the Rest of Us,” BCG Perspectives, January 2014.) And our analysis of insurers shows that over a ten-year time frame, almost all of the TSR for the top-quartile value creators came from growth in cash flow contribution and book value. (See Exhibit 3.)

There are four lessons from uphill growers that apply to insurance companies.

Know your advantage. Insurers do best when they understand precisely what they do well. They define the particular market or segment where they have built a competitive advantage and outperform their peers. Then they use this knowledge to edit portfolios and evaluate growth opportunities. For life insurers, for example, a review of the in-force book of business from an investor’s point of view can lead to moves that have major impact. In our work in this segment, we have frequently found a disconnect between how management and investors look at the business. Management teams typically allocate about 60% of their time to new business and 40% to the in- force book. Investors, however, are much more concerned with the here and now and with the potential for harmful disruption. They allocate about 70% of their valuation to the in-force book and how it is being managed and about 25% to the potential for longer-term disruption. They devote only about 5% to near-term new business.

Investors react positively when they see insurers’ moving to improve operations (for example, by implementing more effective customer management and reducing fixed costs), tighten financial management (in terms of assets, liabilities, and capital), and make tough business model choices (such as deciding to restructure, sell off, or divest back books of business). Such actions can result in substantial double-digit improvements in multiple areas, including lapse rates and in-force profitability, operating costs, the value of the in-force book of business, and the use of capital.

Earn the right to grow. Value creators pursue growth in the proper order: they ensure operational soundness first, followed by reinforcing their core businesses and expanding into adjacent business areas. Value creators hold or expand margins as they grow, and they build margins by aggressively funding operational improvements for the future.

Companies that have been successful in reducing expense ratios, for example, produced TSRs 4 percentage points higher than those of other players from 2012 through 2016. A powerful way to root out embedded, value-draining costs is through a zero-based budgeting program—while keeping one hand firmly on the growth lever. We have seen companies achieve sustainable cost reductions of as much as 25% by differentiating costs and focusing on cuts that will have a positive impact on performance, while causing little or no collateral damage. (See “Zero- Based Budgeting for the Growth-Oriented CEO,” BCG article, March 2017.)

Expand your field of vision. Uphill growers look broadly before selecting a growth plan. They consider adjacencies that deliver standalone growth, profit accretion, or some benefit that reinforces the core business. They also seek new frontiers of opportunity where they can exploit old advantages or assets in radically new ways. A few insurers have moved aggressively and are recognized for doing so: AXA and Allianz (which respectively rank in the first and second quartiles of insurance value creators) both featured in BCG’s annual rankings of the 50 most innovative companies in 2015 and 2016.

New technologies can help insurers not only reduce costs but also improve performance and customer satisfaction. Some companies have used digitized claims processes and robotics to lower costs by 20% to 40% within a year while improving the customer experience by increasing execution speed and eliminating errors. A large global insurer has achieved productivity gains of 20% to 30% by digitizing its claims processes—while cutting the time it takes to resolve claims from up to two months to three days.

The rise of a new generation of digitally oriented customers provides other opportunities to insurers. In both personal and commercial markets, the most advanced—and successful—companies will use data and digital technologies to pursue strategies of personalization. The combination of data and advanced analytics enables insurers to develop one-on-one customer relationships at scale. Leading companies today are already working toward giving each customer a personalized experience at each stage of the purchasing journey. A digitized customer journey can lift customer satisfaction levels significantly and yield cost savings of 15% to 25%. (See “Digitizing Customer Journeys and the New Insurance IT Model,” BCG article, August 2016.)

Consider the case of China’s Zhong An. Launched in 2013 as a partnership among Ping An Insurance and two technology giants, Alibaba and Tencent, Zhong An’s digital-centric strategy focuses on quick, iterative product cycles and many and varied partnerships, such as those with major online travel agencies Ctrip.com and Qunar.com. Zhong An can launch a new product in as few as five to ten days and focuses on creating innovative products with cutting-edge features, such as reducing a premium when a customer’s integrated data from a wearable technology device meets a target level. As of December 2016, Zhong An had written more than 7 billion policies for more than 490 million customers.

In the US, Principal Financial Group is using big data to streamline underwriting and ease the purchasing processes for term and universal life insurance. The company uses an e-application; a quick, app-guided screening call; and various data sources (such as a medical information bureau and the department of motor vehicle) to offer 48-hour approval of term and universal life policies.

In commercial lines, insurers are looking at the promise of digital technologies to not only improve how they sell and deliver risk management offerings but also change the essence of the insurance product itself with new blends of risk transfer and management services. Underwriting, for example, is becoming more of a continuous activity, as opposed to a one-time or periodic one, and risk detection takes place at an increasing level of detail and specificity. Embedded machine learning is enabling insurers to learn from not only incurred losses but also “near losses.”

From their position at the top of the market, reinsurers are leveraging their access to data and working directly with innovators, including insurtech startups, to find new ways to deploy capital, even dipping their toe into the direct business. Brokers perhaps have the most to gain or lose. The key role they play in matching companies and risks and, increasingly, portfolio underwriting presents new models for bringing capital to bear in a more efficient and calibrated way.

All the while, corporate risk managers are looking for tools—from any source—that help them spot unforeseen internal and external risks. Risk managers also value insights that help them modify their risk profile in near real time.

One potential model for the future is Attune, a joint venture formed by AIG and Hamilton Insurance Group with Two Sigma Investments, a data sciences company. Attune provides a technology-enabled platform that allows insurance agents to better serve small businesses. In September 2016, Two Sigma cofounder David Siegel told the Wall Street Journal, “It’s not just about taking manual processes and automating them. By using our data science, we think we can do a better job of underwriting.”

In addition, as noted earlier, advancing technologies are opening up entirely new markets and categories of risk, such as the Internet of Things and cybercrime. Determining how to assess these risks and develop products and services to address them will require a deep understanding of the underlying technologies and the organizations that employ them. Insurers that have successfully digitized their own organizations, business models, and IT will have a big advantage.

Integrate vision, choices, and action. Turning vision into action stumps many value-destroying growers. The alignment of vision, choices, initiatives, capabilities, and metrics is a hallmark of value-creating growers.

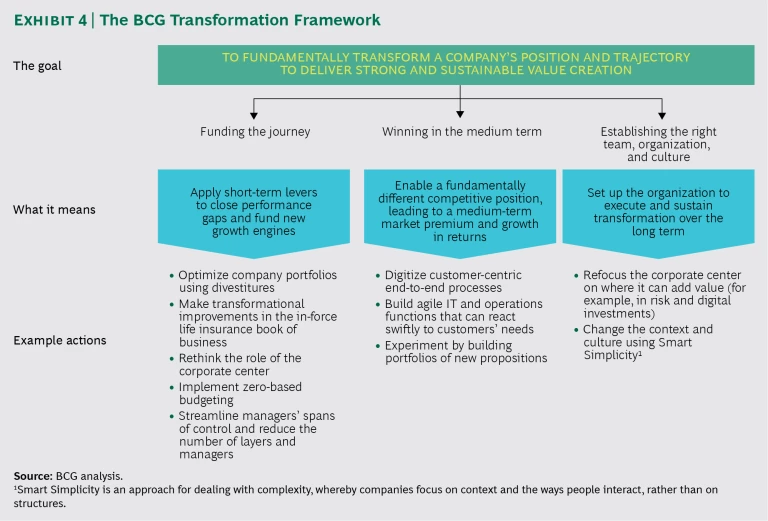

Transformational Decisions

For insurance companies that want to outperform in their respective market sectors, positioning themselves to grow uphill will require a process of transformation. Weaker TSR performers need to transform their portfolios and improve operational ROE through a tighter focus on expense reduction and financial management before turning their attention to growth. The companies that have put their operational house in order will need to generate the next wave of TSR from growth. A few companies are naturally positioned in growth markets; for them, it is all about execution. But even those players probably need to transform how they approach underwriting, claims, and distribution to stay abreast of digital disruption in the industry.

Business transformation used to be synonymous with cutting costs or building margins. Today, most business leaders recognize that it represents something much more fundamental. (See “How to Boldly Transform: An Imperative for Today’s Business Leaders,” BCG Commentary, August 2016.) In transforming their businesses, leaders need to address the following:

- How to position their company to win over the medium term (typically a three- to five-year horizon) in an environment where it’s hard to grow, competition is intense, and technology is changing the world around them. For most, this means growing uphill.

- How to fund this journey by reshaping business portfolios and improving productivity. It’s important for any company to notch some quick wins that demonstrate progress and build momentum while bigger initiatives for the medium term are in the early stage.

- How to build up the leadership, culture, and organization that are aligned with the businesses they want to create and that can drive growth. This will require acquiring news skills and capabilities. Digital technologies will be important, as will a more agile approach—one that is based on testing and learning and failing fast and cheap in various functions, including IT, product development, marketing, and distribution.

In the insurance sector, BCG has worked with multiple clients to mount successful large-scale transformations using a time-tested framework. (See Exhibit 4.) In many cases, regardless of the starting point, the agenda was ambitious: to double the stock price in five years. In the course of these programs, we helped establish clear links between value creation and financial and operational metrics.

Bringing Investors Along for the Ride

As companies pivot to more sustainable value creation models, they need to make sure that their investors understand the changes that will take place and the thinking behind them.

Forward-looking companies will want to set investor expectations with respect to the value-creating levers they plan to apply, whether financial, operational, or a combination of both. These companies will also want to focus attention on the relevant set of performance metrics that will document the progress of the transformation program. Some investors may balk if the planned moves do not align with their investment goals or models. An aggressive targeting, outreach, and communications program is important to gain the attention of new shareholders that are attracted by transformation stories.

TSR has no memory. What worked yesterday will not necessarily be successful tomorrow. CEOs of transformational insurers have a dual mission. They need to keep one eye focused on the vision of building a great company that rewards all of its stakeholders over the long term. The other eye must focus on being a great stock that is creating value now and is resilient over time.

Acknowledgments

The authors are grateful to Ted Bonanno and Richa Gupta, as well as their former colleague Katy Donahue, for their assistance in the research for this report.