This is the first of two publications on the impact of digital technologies on consumer behavior in two of the world’s largest and fastest-growing consumer markets—India and China. Each piece goes behind the simple headline trends—massive growth in online activity and rapidly spreading e-commerce, for example—to examine in detail how different types of digital consumers actually behave online, what drives this behavior, how the behavior shapes consumption, and what these factors mean for companies that want to engage digital consumers. We start our examination with India.

Even though widespread internet usage is still a relatively recent phenomenon in India, most observers agree that it is changing everything—social relationships, shopping habits, even societal norms. Often overlooked, however, are India’s extraordinary diversity and the fact that no technology, no matter how powerful or pervasive, will affect each of the country’s 1 billion consumers—of whom 50% will soon be online—in the same way.

A recent study by BCG’s Center for Customer Insight examined the changing behavior of Indian consumers across more than 50 product categories through questionnaires and interviews with more than 10,000 consumers in 30 locations nationwide. (See The New Indian: The Many Facets of a Changing Consumer , BCG Focus, March 2017.)

As part of this research, BCG arranged to track the online activity of a subset of 35 consumers, chosen for their diversity in terms of age, location (including both urban and rural residents), income, and gender. For five weeks we monitored all of their online doings, including their spending, online and offline, across multiple categories. We supplemented these observations with in-depth interviews to gain insights into the role of the internet in each consumer’s life and to fully understand the decisions each made at various points—and in various product categories—along the pathway to purchase. Our goal was to delve beneath the typical research data—consumers’ memories of their online actions—to capture exactly what individuals did, where and when they did it, and the reasons why.

The results paint a much more detailed and nuanced portrait of digital’s impact on Indian consumers than has been available to date. They provide insights that challenge conventional views about online behavior and shed light on some blind spots. The findings also point to new ways that companies should think about their marketing strategies and business models (both online and offline) to address the changes taking place.

What We Know

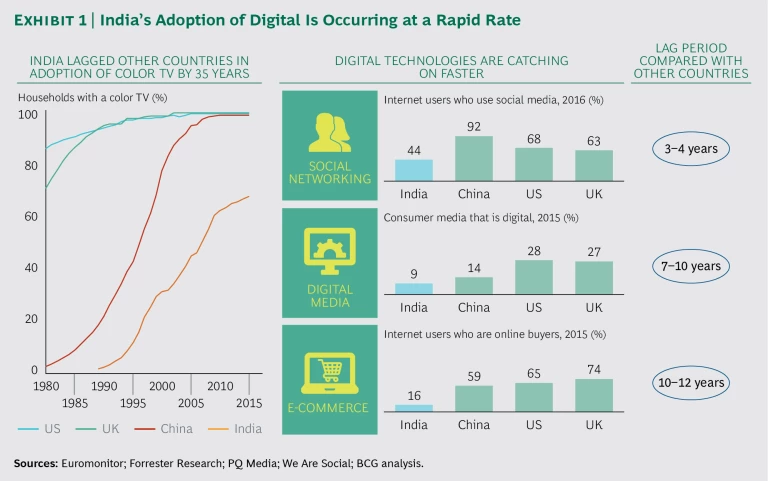

Let’s start with a quick summary of what is commonly known. Four points are relevant. First, the digital opportunity is large and growing. The adoption of digital in India is occurring considerably faster than that of technologies in the past. (See Exhibit 1.) We estimate that India will have more than 850 million online users by 2025, more than the combined populations of the G7 countries.

Second, digital’s impact is becoming pervasive across all consumer segments. India’s initial digital consumers were male, millennial, and mostly metro-based. The future looks very different. By 2020, half of all internet users will be rural, 40% will be women, and 33% will be 35 or older. (See “ The Changing Connected Consumer in India ,” BCG article, April 2015, and The Rising Connected Consumer in Rural India , BCG Focus, July 2016.)

Third, internet penetration has been, and continues to be, mobile first. Four out of five users go online with mobile devices. Today, these devices are a mix of smartphones (with 3G or better connections) and feature phones with primarily 2G connections, but the trend is toward faster connections and more capable devices. To get a sense of the speed of this shift, consider this: it took nearly eight years for India’s mobile market to reach 250 million 3G connections, but the country’s Reliance Jio 4G network added 100 million connections in just seven months.

Finally, the primary determinant of consumer behavior is not age, gender, or location (urban versus rural), but digital maturity—that is, the number of years that a user has been online. The more digitally mature people are, the more they do online. As a consequence, digital’s influence on purchases and actual digital commerce are both increasing. From 2014 through 2016, the number of online buyers rose sevenfold, to between 80 million and 90 million. Digitally influenced spending, currently $45 billion to $50 billion a year, is projected to increase more than tenfold, to between $500 billion and $550 billion—and to account for 30% to 35% of all retail sales—by 2025.

What Companies Need to Know

So far, so good, but much of this common knowledge has led to a commoditized approach to the consumer. Most companies see the same trends, and they try to capitalize in similar ways—building websites, launching e-commerce platforms, and developing their social media presence, for example. Nothing in the conventional understanding of digital’s development translates into a source of competitive advantage. Our research has uncovered some insights that challenge the existing notions.

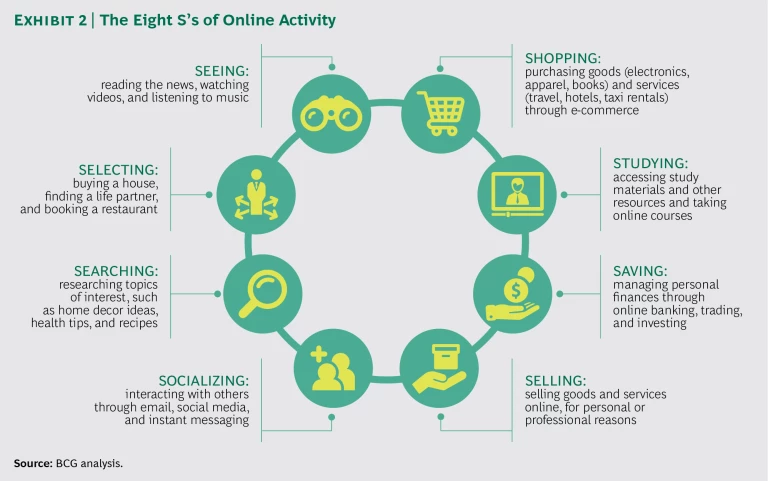

Online activities defy stereotypes. One popular stereotype has the Indian consumer using the internet largely for socializing, window-shopping, and staying abreast of Bollywood. Our research identified a much more engaged consumer and a broader set of online activities—eight categories of behavior that include, for example, consuming media, pursuing studies, managing finances, and, of course, shopping. The “eight S’s” of online activity outlined in Exhibit 2, some of which overlap, characterize the Indian consumer in a much more complete and specific manner than does a more conventional, simplified view of online presence.

Consider the case of Aniket, a 23-year-old postgraduate student in Lucknow, the capital of Uttar Pradesh, India’s most populous state. Aniket works part-time as an accountant for an auto dealership and lives in a two-bedroom apartment with his family (his father, a regional sales manager for a pharmaceutical company; his mother, a housewife; and his younger brother, who is in high school). The family’s monthly household income is the equivalent of $2,000, which puts them in the affluent income segment and provides a comfortable lifestyle. Aniket spends four to five hours a day online (using his smartphone)—more than a quarter of his waking hours. Half of this online time is spent socializing with friends, using apps such as Facebook, WhatsApp, and Skype. Almost 20% is spent consuming media and playing games, and another 10% to 15% is related to his schoolwork at the University of Lucknow. He spends the remainder looking for e-commerce deals, searching for information, and managing his finances.

Like Aniket, many Indian consumers have seamlessly integrated digital technology into their daily lives; the phone is central to much of what they do, and they do not even think about the division between online and offline activity. Our research indicates that it is difficult to correlate any consumer’s usage pattern with any single variable, whether age, income, gender, occupation, or some other social or demographic factor.

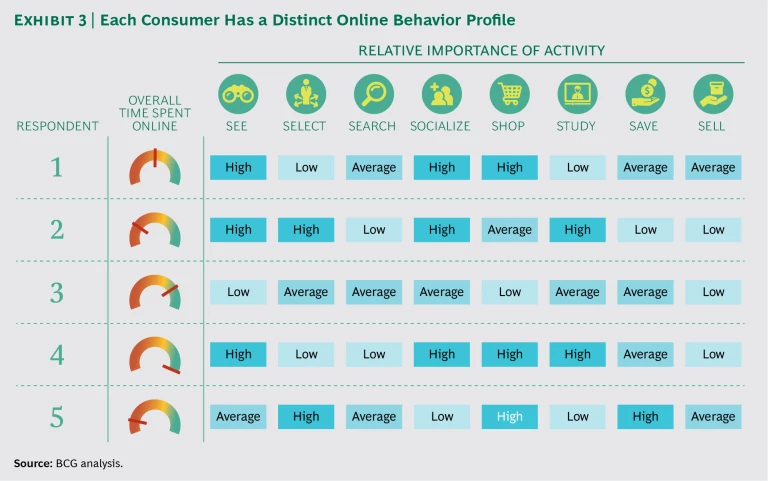

Each user is unique. Individual consumers exhibit their own digital behaviors and footprints. Each decides how much time to spend online and what to do there. (See Exhibit 3.) It may be convenient for marketers to segment digital consumers into three or four archetypes, but the reality is that behavior patterns are not easily grouped. For Aniket, for example, the internet is first and foremost a social medium. For Siraj, a 32-year-old event manager in Kochi, Kerala, it is an indispensable part of his job. “The internet makes me better at my work,” he says. “It gives me leads for events and shows me what is working in bigger cities.” Anish, a 28-year-old shop owner in rural Gujarat, is a shopper himself. He says, “The internet gives me access to products that are not yet available in my town. I also show off my purchases to my friends by posting them online.”

A good first experience is critical. Many consumers are strongly influenced by their early experiences online: their first online purchase and receipt of the item, for example, or their first online booking of an appointment with a new doctor and subsequent experience with the practice.

These early “moments of truth” shape future behaviors. Many Indian consumers are still apprehensive about online transactions, and the first one looms large in their minds. A good experience encourages a second transaction, and a third. A bad experience sets the individual’s online development back. If an online retailer makes it easy and natural to research, buy, and take delivery, for example, the new online consumer will be off and running. When the shopper encounters problems—a hard-to-use website, payment difficulties, poor-quality goods, or, just as important, trouble with delivery—the experience is likely to inhibit further online shopping. One consumer told us, “I ordered a lehenga online; some celebrity was wearing it. In reality, it was of such bad quality that I had to return it. I never buy clothes online anymore.”

Even many consumers who could be considered digitally mature retain some level of distrust in the online world. “My kids introduced me to the internet three or four years back when they showed me a recipe on YouTube,” one urban woman in her forties told us. “But I have never shopped alone—my daughter always does it for me.”

The product category makes a difference. While the current retail buzz is all about the need for omnichannel options, the reality of how people shop—and will continue to shop—varies substantially depending on the particular consumer and the product or service category. In some categories, such as small appliances, more than a third of all buyers travel the entire purchase pathway online, and more than half combine online and offline shopping activities. In others, such as apparel and accessories, two-thirds of purchasers follow an exclusively offline path to purchase. This figure rises to more than 90% in consumer staples and fresh foods.

During the course of our research, Aniket (our postgrad in Lucknow) bought a sofa without going to the store. He found a good offer on a “daily deals” website, discussed the idea with his family, and put in the order, all on the same day. This behavior may not yet be typical, but for some it is the norm. At the other extreme, we observed digitally mature consumers who spent plenty of time online but never conducted a single transaction.

What Companies Need to Do

As both e-commerce and the influence of digital continue to grow, companies that want to maintain their relevance with consumers and increase sales and share must take steps in four areas.

Focus on solutions over products. As their digital maturity grows, consumers will increasingly migrate toward online companies that offer integrated solutions, rather than to companies that simply serve up individual products or services. Companies have the opportunity to serve a broader set of customers and deepen their relationships, but to seize the opportunity they must provide complete solutions and manage the overall experience. This typically means either complementing core offerings with ancillary products and services or developing multiple core propositions that overlap with the various pathways customers follow on their way to making a purchase.

Digital natives offer some useful models. Quikr started off as India’s answer to Craigslist, but it quickly learned that operating only as a listing site was insufficient. It has since transformed itself into a full-service company that offers B2B and B2C classifieds, orchestrates delivery of the products purchased through its ads, and manages escrow accounts for buyers and sellers. Practo began as a cloud-based software-as-a-service provider for doctors, but now it also functions as an online marketplace for doctors and patients. It serves as an appointment-making service for patients and provides doctors with the data they need to better manage their patient base and their practices.

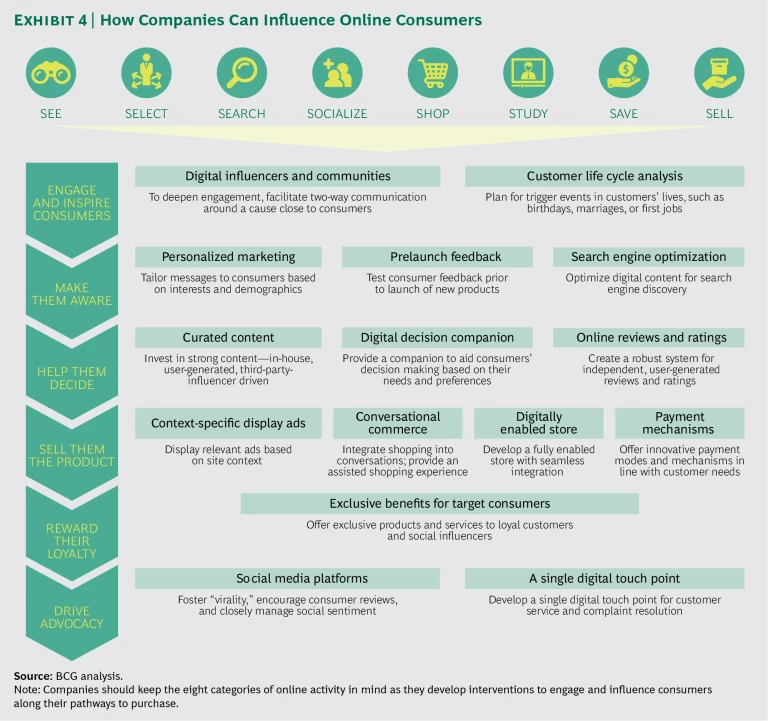

Companies in India should begin by examining their interactions with consumers through the lens of the categories of online activity mentioned earlier, keeping in mind their ability to guide consumers along the purchase pathway. They should then develop a set of interventions that can engage consumers and influence their decisions and actions. (See Exhibit 4.)

Build a network of partnerships. As they broaden their focus from products to solutions, companies may find that they can’t do everything themselves. Incumbent players need to understand what their core offering is. Understandably, many will want to own the entire customer relationship, but in some areas, such as the delivery of products and services, customers may be better served by others. (Remember how important the success of that first transaction is.) Quikr, for example, partners with Delhivery, which manages delivery logistics. Indiapost (equivalent to the US Postal Service) has partnered with retailers such as Amazon and Flipkart (the two largest e-commerce companies in India) to provide delivery and collection, especially in smaller cities and in rural areas. Practo’s partnership with Uber and Ola enables users to book cabs to visit their doctors. The platforms are seamlessly integrated—users get a reminder an hour before their appointment and can book a cab directly through the Practo app.

Invest big and differently in digital. Companies recognize the power of digital, and most are building websites, mobile apps, and e-commerce capabilities. They understand the importance of digital marketing and social media, and they are investing in IT infrastructure and assets.

In our view, however, many companies are basing their plans and investments on the expectation that the Indian digital marketplace will evolve as it did in developed markets. We believe this underestimates the digital potential in India; companies may actually be underinvesting for the long term. In addition, many companies are failing to realize that fast-rising digital demand requires more investment in people and capabilities than in physical assets. Making the transition to a digital organization is a challenge for most companies, but it is all but impossible without the right technology and talent.

Consider omnichannel—one channel at a time. The rise of e-commerce and digital influence has led to a great deal of discussion about omnichannel customer journeys and the need to be present in all channels. The reality is that many companies would do much better if they made sure their offering in each channel was right before they focused on how the different channels interact. For most businesses, there is ample opportunity in both online and offline channels, at least for now. Most of the action for consumer packaged goods companies is still in stores. Consumer electronics players, on the other hand, have seen close to 40% of their sales move online. Each type of company should make sure it is serving its primary channel as effectively as it can before trying to develop multichannel or omnichannel capabilities. And companies whose business is still primarily in one channel should probably focus for now on getting that channel right, rather than solving the omni puzzle. There is more than adequate upside in the near to medium term in addressing the basics—putting the right images and descriptions on the website, ensuring high fill rates with channel partners, and providing proper after-sales service, for example.

For companies that are pursuing omnichannel strategies, multiple factors—affecting consumers, retailers, and marketers—shape the purchase pathway for each product category and determine the extent to which digital channels can play a role. For consumers, the most important factors are trust (including dependable guidance from the seller), the degree of product standardization (standardization facilitates online sales), purchase size (expensive or inexpensive), and assortment. Digital retailers, as they think about which categories to push, are concerned primarily with the gross margin of the product, the price relative to the cost of delivery, and the challenge of logistics and payment. The interplay of these factors determines whether a category moves substantially online (as ticket sales, travel, and media have), develops omnichannel customer journeys (health products, electronics, and banking), or remains mostly an offline activity (food and groceries).

Within categories, pathways can vary. In apparel, for example, men’s casual wear—which involves limited prepurchase research, no customization, and modest expense—is likely to remain a single-channel purchase (either online or offline) in most circumstances. Women’s fashion, on the other hand, involves considerable prepurchase online research, limited standardization in fit and quality across brands, and frequent customization and tailoring. Most consumers of women’s clothes, therefore, are likely to follow a multichannel path to purchase. This does not make life simple for companies, but managing such complexity is critical in this fast-changing environment.

India is defined by its extraordinary diversity—something that digital technologies will not change. In the future, more and more Indians will do more and more things online, but individual users will approach the digital experience in their own ways and integrate digital tools into their lives in the manner they see fit. There is a massive opportunity for companies that understand this diversity and know how to engage digital consumers as individuals. These companies will build relationships, collect data, and create experiences that will lead to a large and growing online (and offline) customer base for years to come.