Health care payers in the US have been on a hot streak: from September 2013 to September 2016, the five largest payers generated extraordinary value, achieving an annual TSR of 22%. To put this in context, the top quartile of S&P 500 companies managed an annual TSR of just 18% during that period. But times are changing. Analysts predict that from 2017 through 2019, annual TSR for payers will drop by half.

Our analysis shows, however, that companies can take a series of actions in core and adjacent markets to forestall this downward trend and maintain strong annual TSR. We believe that if payers adjust their strategy accordingly and execute well on these initiatives, they can continue to significantly outpace the stock market.

The Expected Drop in TSR

TSR measures the combination of change in share price and dividend yield for a company’s stock over a given period. It is the most comprehensive metric for value creation.

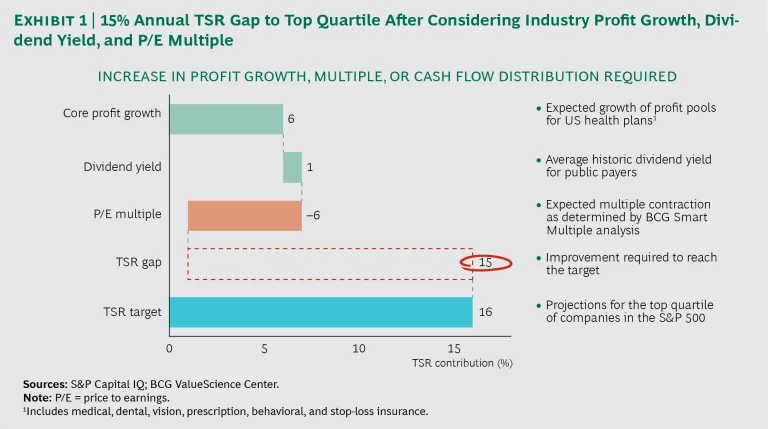

We developed a composite snapshot of the top five payers on the basis of publicly available data and our knowledge of the payer industry. Over the next three years, investors expect the top five payers to achieve an annual TSR of 11%. The annual TSR for the top quartile of the S&P 500 during the same period is projected to be 16%. Analysts’ forecasts for payers include an average dividend yield of 1% and a price-to-earnings multiple contraction of –6% as a result of lower growth expectations.

Given these projections, payers would need to achieve an additional annual TSR of 21% to stay in the top quartile—a sizable gap to overcome. There is some good news, however: we also expect that payer health plan profit pools will grow by 5% to 7% across the board. If that does happen, then the gap with target annual TSR will be reduced to a more manageable 15%. Companies can work to achieve that target through a combination of profit growth, multiple expansion, and return of cash to shareholders. (See Exhibit 1.)

It is important to note that Donald Trump’s administration has introduced a high degree of uncertainty about the future of health care in the US and that our estimates do not account for any major legislative or policy changes that may come into play. BCG has been closely monitoring the health care reform environment, and we believe that the summary implications will hold for payers, even with significant legislative changes. Aetna’s acquisition of Humana was called off in February 2017 following a judicial ruling. Anthem is also no longer pursuing the acquisition of Cigna following recent court rulings. Whatever the future holds, payers need to take a clear-eyed look at where the big shifts are occurring in health insurance and make smart decisions about where to invest resources and how to seize growth opportunities.

Action Plan for Payers

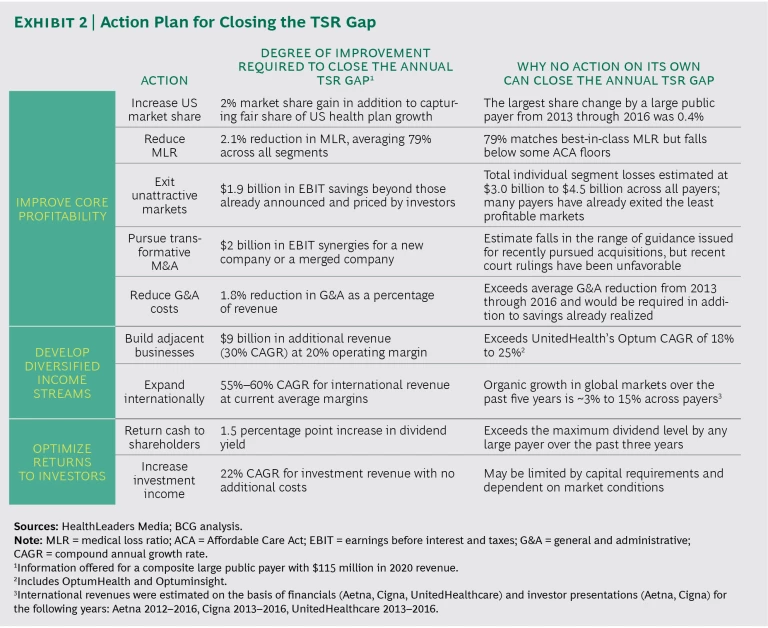

Payers can boost TSR by improving their core profitability, developing diversified income streams, and optimizing returns to investors. We have identified nine specific actions within three broader efforts that companies can take to make headway in these areas.

- Improve core profitability: increase US market share, reduce the medical loss ratio (MLR), exit unattractive markets, pursue transformative M&A, and reduce general and administrative costs.

- Develop diversified income streams: build adjacent businesses and expand internationally.

- Optimize returns to investors: return cash to shareholders and increase investment income.

But taking just one action alone will not deliver the additional 15% annual TSR needed. (See Exhibit 2.)

Companies will have to move on multiple fronts, and be disciplined in their approach, to generate top-quartile returns. (See the sidebar.)

HOW TO MANAGE CHANGE ON MULTIPLE FRONTS

Undertaking significant change on multiple fronts is difficult. When such efforts fail, it’s most often owing to a lack of clearly defined goals and milestones, insufficient buy-in from executives and employees, and poor communication.

Establishing a project management office (PMO) is fundamental to the success of an ambitious, comprehensive cost and growth management program.

The PMO can actively support the implementation of key strategic initiatives, coordinate communication to ensure engagement, and provide the discipline and oversight needed to help leaders manage multiple initiatives.

High-performing PMOs can also facilitate the right level of engagement with senior leaders—which is critical for strategic implementation—and support the capabilities, processes, and tools needed to successfully implement strategic initiatives.

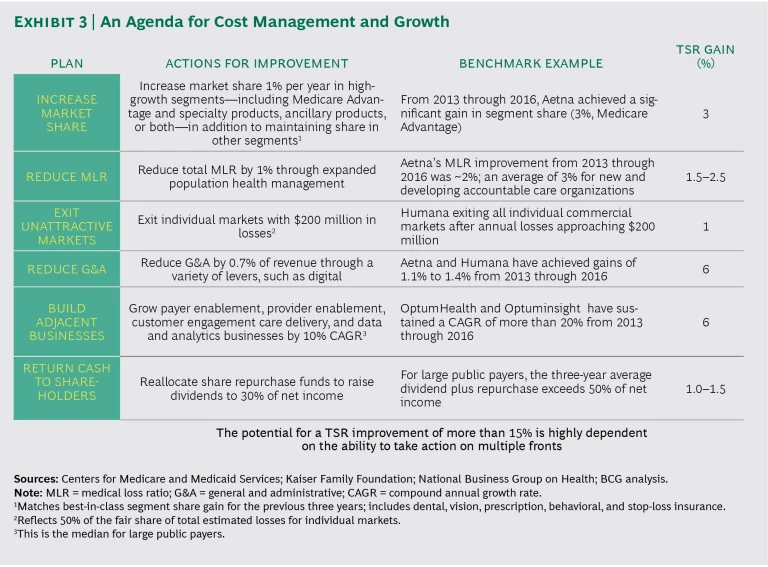

We recommend an agenda for comprehensive cost management and growth. (See Exhibit 3.)

Improve core profitability. Larger payers can expect to benefit from a tailwind of 5% to 7% in profit growth thanks to a combination of enrollment, higher revenue per member, and, in some segments, expanding margins. But to close the gap with top-quartile TSR, they will need to make progress on the following items over the short term:

- Increase market share. Companies will have to win share from their competitors, most likely in some of the high-growth segments, such as Medicare Advantage as well as specialty products, ancillary products, or both. An increase of 1% in market share in Medicare Advantage, for instance, could generate a 3% gain in annual TSR.

- Reduce MLR. Improving population health management can help contain medical costs. A 1% reduction in MLR could generate a 1.5% to 2.5% gain in annual TSR.

- Exit unattractive markets. The individual market has massively underperformed and thus has been largely unprofitable for payers. Companies will need to evaluate their strategies in these markets. Exits from unprofitable markets (those with at least $200 million in losses) could generate a 1.0% to 1.5% gain in annual TSR.

- Reduce general and administrative costs. Cutting general and administrative costs can also boost TSR: for example, a 0.7 percentage point reduction in general and administrative expenses (as a percentage of revenue) could generate a 6% gain in annual TSR. Digital cost savings and scale efficiencies from thoughtful M&A can contribute as well.

Develop diversified income streams. Over the medium term, it’s important to diversify into other areas besides health insurance. There are many opportunities for payers to invest in adjacent lines of business, such as data and analytics or enabling providers to succeed in risk-based agreements. This kind of diversification helps payers to generate new revenue streams and offset downturns within the core business. What’s more, adjacent businesses with a 10% compound annual growth rate could deliver a 6% gain in annual TSR.

Optimize returns to investors. Finally, payers need to make smart decisions when allocating profits to shareholders. Payers have an opportunity to return more cash directly to shareholders in the form of cash dividends. Dividends are a particularly attractive option because, as our analysis shows, they tend to positively influence stock price more than share buybacks do. Companies that can commit to returning 30% of net income as dividends by reallocating funds earmarked for share repurchases could generate a 1.0% to 1.5% gain in annual TSR through multiple expansion.

While large payers are already pursuing many of these strategies, given the expected—and significant—gap between forecast TSR and the TSR needed to stay in the top quartile, companies must grasp every opportunity to seize advantage. The strategy for each company will vary, depending on its exposure to various segments, its starting position in adjacent markets, and its current priorities. The last few years have been good for payers. With strong execution across several fronts, the future can continue to be prosperous.