T he number of “things” interconnected online will outnumber the human population by a three-to-one margin by 2020, according to Gartner. From doll houses to washing machines to pills, robots, and cars, these things will upload and download rich streams of data whose value could one day reach hundreds of billions of dollars.

Traditional product manufacturers face new and complex challenges in monetizing the services made possible by “smart” products. They will need to redefine who their customers are and how those customers value data-driven services. They will need to adopt pricing models unconventional in their industries—models that can accommodate various price levels and payment frequencies. And they will need to change from an approach based on discrete product life cycles to one based on a continual flow of data-driven service innovation.

Traditional product manufacturers will need to redefine who their customers are and how those customers value data-driven services.

To accomplish this, a company must answer four questions that have a familiar ring but require insights that are fundamentally different than those the company has relied on.

- Who are our customers?

- How do they value our IoT services?

- How should we charge them?

- How much should we charge them?

The answers to those questions help companies determine the nature, size, feasibility, and pricing models of IoT services.

Who Are Our Customers, and How Do They Value Our IoT Services?

Think about light bulbs. Consumers who buy “dumb” bulbs use them until they burn out and then replace them. A “smart” light bulb, however, acts as a node in a network rather than as a glass and metal object screwed into a socket. As consumers learn to manage their lighting environment and their usage on connected devices, application programming interfaces (APIs) enable software developers to create new use cases, such as automated on/off and dimming, and connection to music devices. In this spirit, the Dutch technology company Philips Lighting launched a “personal wireless lighting system” called Hue, whose API has led to an ecosystem of applications to improve the user experience.

IoT services create flows of value in a network rather than along a traditional value chain. In a network, it is harder but no less essential to define who creates value for customers, who creates value at other nodes in the network, and who derives that value. Smart bulbs transform consumers from occasional, anonymous buyers of light bulbs into consumers of connected lighting. If consumers opt in to the network, their usage data can yield insights that are valuable not only to the light bulb provider but also to other firms within the broader network, which could include utilities, interior designers, and consumer electronics firms. The challenge is to figure out how valuable the IoT data is to each of these potential customers.

Smart bulbs transform consumers from occasional, anonymous buyers of light bulbs into consumers of connected lighting.

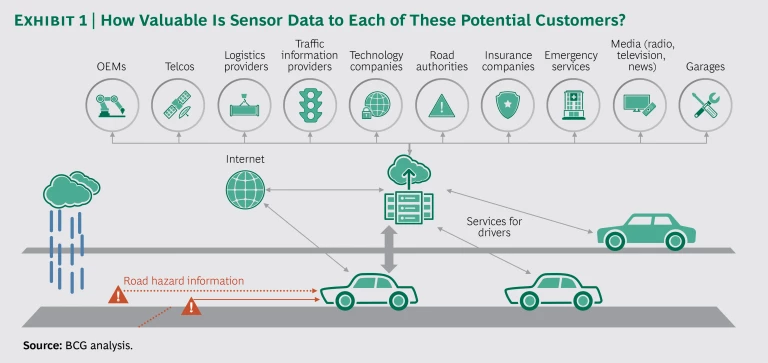

B2B companies need to think just as broadly about their potential customers. These are the companies that do not sell directly to consumers but whose products make other products smart. Think of a company that equips passenger cars with sensors that detect and transmit detailed, real-time information on road conditions. If the sensor supplier collects and analyzes these millions of data points, it could offer valuable services to any number of customers.

Identifying the potential customers is not necessarily a straightforward matter. One customer group could be the companies that manage the armadas of snow plows and salt trucks that take to the roads every winter. A service provided by the sensor supplier could help fleet managers direct those trucks to the riskiest locations in real time with pinpoint accuracy, thus saving a lot of money. Other potential customers may include emergency services and media outlets. The company could also partner with other data suppliers (such as providers of traffic information) to create an even more valuable service. The sensor supplier could also look at a B2C model , offering a service to drivers in real time, either directly or through a partnership with a company with an established relationship with the driver. These and other potential interactions are shown in Exhibit 1.

Identifying the potential customers for IoT services is not necessarily a straightforward matter.

The value of an IoT service can differ significantly by customer and use case, even if the underlying data stream is identical. These differences drive willingness to pay. Companies need to examine and quantify each use case thoroughly to identify and understand current and future target customers, and then design, package, and price services specifically for them.

Knowing the nature of the use cases, the direct and indirect customers for them, and their estimated value is the critical first step. These results may tempt a company to move straight to the ultimate pricing question: How much should we charge? The correct second step, however, is to remove the word “much” from that question and focus instead on “how.”

What Are the Appropriate Pricing Models?

Many companies underestimate the importance of the question, “How should we charge?” Traditional manufacturers will be most familiar with the one-off payment, which is common for durable goods. In this pricing model, the product makes its way from manufacturer to end user through one-time transactions. Products sold under this model tend to be repaired or replaced, rather than enhanced. If this pricing model were applied to IoT services, the consumer would pay a one-time access fee for data or information. This would be analogous to an extended warranty, under which customers make one payment for predefined services they can use, if and when certain conditions apply.

While this pricing model makes perfect sense for products made in a conventional “product-parts-maintenance” business model, it is not well suited to IoT services. For those services, the most common pricing models are subscriptions, pay per use, and value sharing.

- Subscriptions. In this pricing model, the customer pays the supplier at regular intervals (monthly or annually, for instance) for a service or a bundle of services. OnStar was a pioneer in this area. Established in 1996, this unit of General Motors provides vehicle owners with communications, in-vehicle security, remote diagnostics, and turn-by-turn navigation. A subscription model lets a customer try out a service with a smaller initial monetary commitment and therefore less risk. The supplier receives a recurring revenue stream rather than a one-off payment and maintains regular contact with the customer. The supplier may offer tiers of service at different rates and can add or enhance services throughout the life of the underlying good.

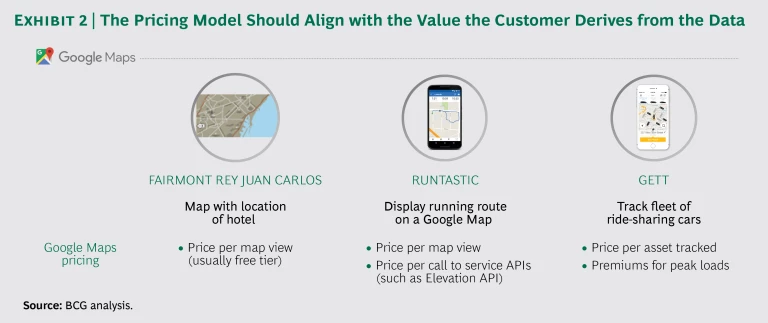

- Pay Per Use. This model comes closest to matching the amount customers spend with the amount they consume. The customer pays only for actual usage, with no commitments, and may not even pay for the underlying product. Pay per use for IoT services is currently far more common in B2B markets than in consumer ones.

- Value Sharing. This model aims to align the service provider’s compensation with the amount of value the service generates for the customer. Rather than charge by a discrete unit such as time or data volume, the supplier takes a share of the benefit the customer derives. The greater that benefit, the greater the reward for the service provider. This model can take many forms—a fixed percentage or an upfront amount combined with a sliding percentage scale, for instance—and is much more applicable to B2B scenarios. (See Exhibit 2.)

A company may use several pricing models for IoT services in parallel to address different customer groups, similar to mobile data plans that include flat rates and pay-per-use options. To determine which pricing models are appropriate, a company needs to delve into what its customers, suppliers, and other potential partners think about the use cases. Opting for subscription models is often the clear choice at first glance. But the transition to a model based on recurring revenue streams might be anything but smooth for a firm accustomed to one-off payments. Will customers accept subscriptions? Will they insist on owning products? How should services be bundled? Should the firm use a universal flat rate or graduated plans, as mobile phone companies do?

Just as manufacturers and dealers are accustomed to one form of payment (traditionally a one-off payment), customers are conditioned to expect that as well. Nudging them to a new model takes time and effort, and places great importance on customers’ ability to understand the model. Subscription models also demand a different level of performance. How well can a firm accustomed to occasional and infrequent interactions with customers serve the “always on” customer?

Finally, for many durable goods, such as cars, the dealer or retailer sells the product independently of the OEM. What incentive do individual dealers or retailers have to sell additional services on subscription when that revenue flows to the OEM or a third party, not to them?

How Much Should We Charge?

Setting a price point for IoT services is a critical strategic decision, because the price point inevitably creates tension between the goals of market penetration and of revenue maximization. The price point may also be dynamic, in that it can change continually or as the service reaches different stages in its life cycle.

The greater the speed of market penetration, the larger the company’s network of customers and data becomes. This network improves the volume and richness of data, expands the market for services based on it, and establishes barriers to entry. Setting comparatively low prices in the beginning of the life cycle helps a company penetrate the market quickly. On the flipside, however, if the pricing model is inappropriate or price levels are too low in this penetration phase, the company risks turning a lucrative opportunity into a set of unsustainable promises that become a drain on resources.

The necessary analysis for price setting focuses on understanding the monetary value customers place on various services and how urgently and frequently they would use them. A mix of established market research methods provides the deepest understanding.

Manufacturing companies tend to have more of an inward focus than a customer-centric one. To introduce IoT services—given their variety, complexity, and novelty—it is vitally important to engage with potential customers early and often in the development phase. These initial customer reactions shape concept testing and drive refinements to the services and the pricing models long before the product is launched.

To introduce IoT services, it is vitally important to engage with potential customers early and often in the development phase.

Focus groups or workshops conducted on artificial intelligence platforms have proved very effective in gaining these insights; these platforms bring together hundreds of potential customers, regardless of their location. The sessions reveal customers’ priorities and preferred service alternatives, expressed in their language and driven by their needs.

Indirect quantitative methods (such as conjoint measurement) as well as direct price-testing methods (such as van Westendorp and Gabor-Granger) draw out how much customers are willing to pay for various alternatives. Interviews with industry experts provide additional context on the value drivers, the feasibility of alternatives, and the value customers place on different uses.

All of this information flows into an economic benefit analysis that yields estimates of sales volumes, revenue, and profit under various pricing and variable-cost scenarios for a service. This mix of price and appeal is indispensable for validating the attractiveness of a service and assessing price points.

Moving Fast and Smart on Pricing IoT Services

Success in launching IoT services requires a balance between moving fast and moving smart. Companies should keep the following points in mind as they explore how to capture their share of value from IoT services:

- Identify the stakeholders who derive value from the data. The most attractive segments for IoT services are not always the immediately obvious ones. Map the value network, look beyond conventional segments, and don’t lose sight of smaller but lucrative niches.

- Understand how value is created in the network. In a value network, parties can simultaneously be creators and consumers of data. How customers derive value, and the drivers behind that value, offer guidance on the appropriate pricing model. Think first about how to charge, not how much.

- Listen to what customers expect from the service model. The world of IoT services is new to customers as well, not just manufacturers. This makes it all the more important to work through use cases with customers as early as possible in the development process.

- Move quickly to build network density. Network size confers numerous advantages, which gives companies a clear incentive to react quickly, establish control over flows of data, and maintain their influence over the pricing of services derived from that data.

- Beware of price erosion. The achievement of a critical mass of network density is advantageous but in some cases may be too good to be true. In other words, quick success may imply that barriers to entry are low, in which case competitors will enter the market, which could erode prices.

- Plan for future services now. Providing data-driven services is a portfolio game. A certain use case may be a low priority or less attractive today but could become important as network size increases and as services and pricing models become more established. Serving the “always on” customer will require companies to offer enhanced or new services on a continual basis. Companies should not close doors too early on opportunities nor give data away.

- Consider bolder pricing models. In some instances, the value of IoT services may be so large that a company can consider switching its entire business model to focus on service provision. The pricing options may then include providing hardware for free or at heavily discounted prices, or paying customers to supply certain kinds of data.

Monetizing IoT services represents an opportunity no company can afford to ignore. How well a company seizes it will depend on its imagination, willingness, and ability to look beyond existing business models and ideas about whom the company serves. Traditional manufacturers are being compelled to move into an entirely new world. It’s an exciting opportunity—one that requires companies to rethink many of the questions they have long taken for granted.