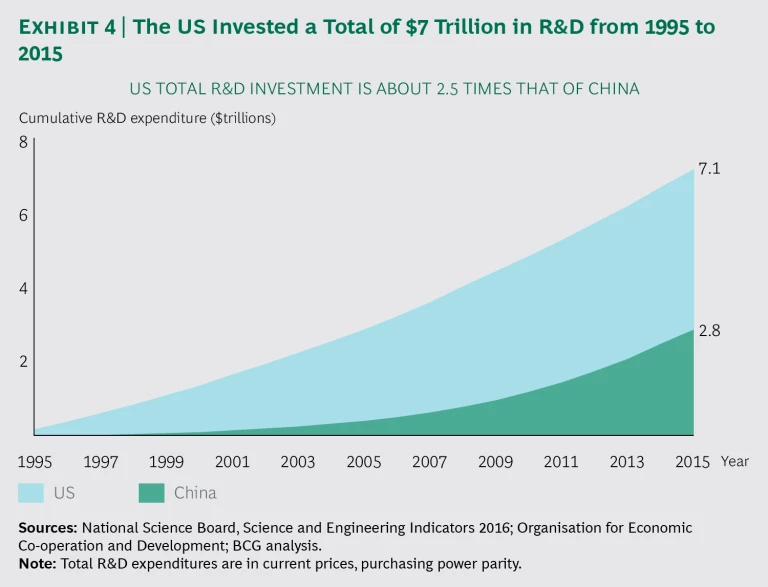

If any one factor explains why the US has remained the world’s innovation powerhouse since World War II, it is the country’s overwhelming leadership in research and development. This commitment, combined with a passion for taking risks, underpins America’s ability to create more intellectual property than any other economy and has spawned many new industries, including semiconductors, computers, aerospace, and digital telecommunications. Continued US R&D investments—some $7.1 trillion from 1995 to 2015—have enabled the US to remain at the forefront of such fields as advanced materials, energy, and biopharmaceuticals.

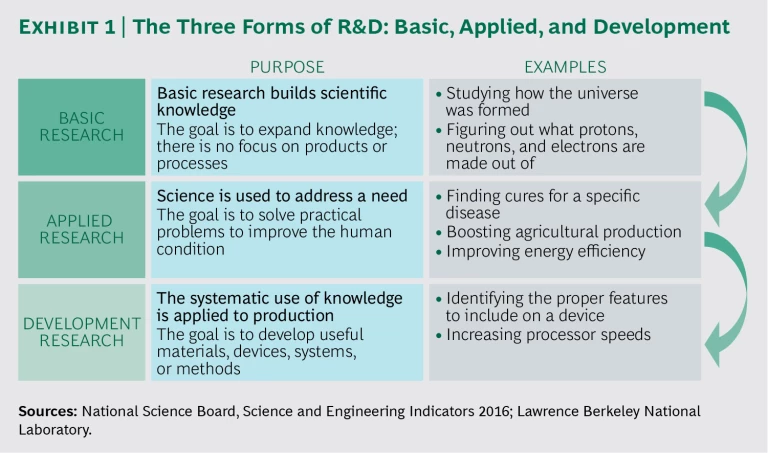

Dive deeper into the latest data on R&D spending, however, and continued US leadership in industrial innovation looks far less secure. The US remains dominant at the front end of R&D: the nation invests three times as much as any other economy in basic research, which focuses on the pursuit of scientific knowledge, and applied research, which turns discoveries into technologies useful to industry. (See Exhibit 1.) Breakthroughs in physics and material sciences, for example, have led to the digital technologies that have revolutionized virtually every industry.

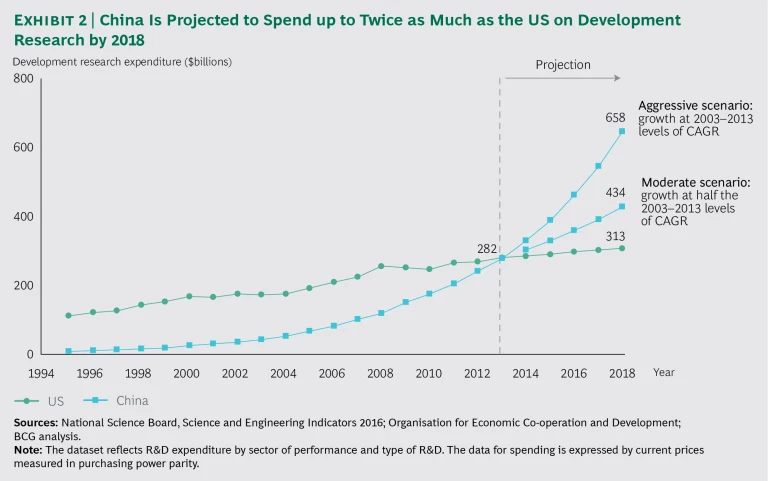

But the picture is different when it comes to the back end of the R&D chain— development research, which translates new knowledge from basic and applied research into commercial products and new manufacturing processes. China recently surpassed the US as the biggest spender in that area. In another five years, China will be investing up to twice as much as the US on development research, assuming that both economies maintain their recent pace of spending growth. (See Exhibit 2.)

Concerns that US global leadership in innovation is eroding have led to calls from think tanks and blue-ribbon commissions to dramatically increase government spending on R&D and to promote strategic industries. Many of these proposals have merit, and several US initiatives to support manufacturing that have launched since the 2008–2009 financial crisis show promise. Large new infusions of federal money, however, are difficult to sustain. And bigger R&D budgets alone will not address the core issues facing America’s manufacturing sector, if the way those funds are spent doesn’t change.

There is a lot of friction in the US innovation system that slows the translation of scientific and technology breakthroughs into commercial products and processes. One source of friction occurs between academia and private industry. The lion’s share of basic and applied research is funded by the federal government and conducted at universities, while industry focuses overwhelmingly on development research.

Friction among companies, meanwhile, slows innovation on advanced manufacturing processes. While many companies participate in public-private research consortia devoted to developing new processes, a reluctance to fully collaborate often results in solutions that are too narrow to meet the needs of entire US industries or that are not disseminated widely enough through manufacturing supply chains.

What can the US do to get more economic bang from the immense sums it already invests in R&D? Our analysis indicates that there is significant potential for the US to generate much more product and process innovation from its investments in basic and applied research by streamlining existing “adapters,” such as universities, for linking government-funded academic research to private industry. US research universities can accelerate product innovation by reducing friction and serving as better bridges between academia and industry. Research consortia can also be productive adapters for developing innovative manufacturing processes if companies improve the way they collaborate. Such collaboration is especially critical if US industry is to successfully compete with other nations in deploying advanced Industry 4.0 manufacturing systems, such as autonomous robots, additive manufacturing machines, and digital simulation tools. (See “ Why Advanced Manufacturing Will Boost Productivity ,” BCG article, January 2015.)

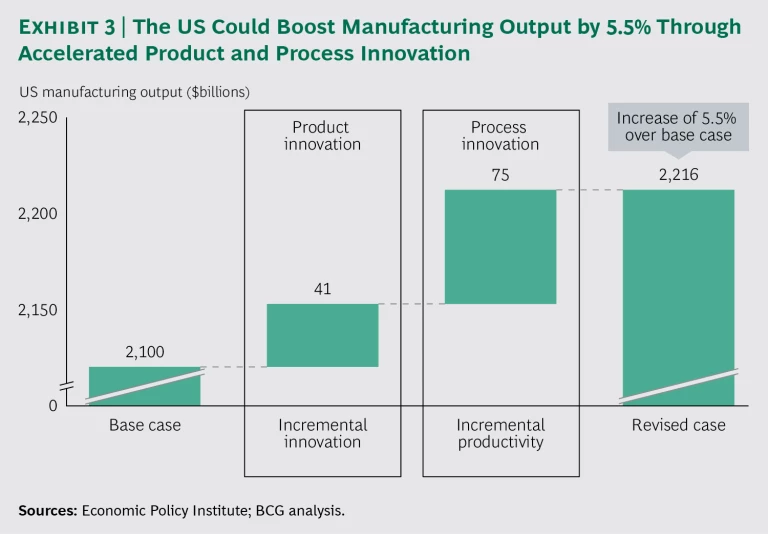

We estimate that accelerating product and process innovation in the US can boost annual manufacturing output by more than 5%, or around $100 billion. (See Exhibit 3.) Even more important, it could create a virtuous circle of ongoing productivity improvement and output growth.

America’s R&D Leadership in Perspective

American competitiveness in industrial innovation rests on a powerful base. From 1995 to 2015, the US has invested around $7.1 trillion in total R&D, about 2.5 times as much as China, the next biggest spender. (See Exhibit 4.) Even though the annual R&D investment gap has narrowed dramatically over the past decade, the estimated $500 billion that the US spent in 2015—around 2.8% of GDP—was nearly one-third more than what China spent (on a purchasing power parity basis), three times as much as Japan, and about four-and-a-half times as much as Germany, according to estimates by the Industrial Research Institute (IRI), an organization of corporate and federally funded research organizations. One-third of US R&D spending is dedicated to basic and applied research, a far higher share than in other industrial economies.

Another big advantage for the US is its university system, which directs more than $65 billion in research annually and marshals the expertise of some 450,000 graduate students and research assistants in science and technology fields. The US is home to 75 of the world’s 200 highest-rated universities and to more than 100 universities that conduct research at the highest level. Indeed, the US university system is a valuable resource for the entire world: academics in Japan, South Korea, China, France, and other industrial economies cite US publications far more than the other way around. According to a recent survey of global researchers by IRI, most believe that the quality and productivity of R&D remain far superior in the US than in China and most other major trade partners.

The US has struggled in recent decades, however, to translate technological breakthroughs into domestic manufacturing. Flat-panel displays, lithium ion batteries, digital mobile handsets, notebook computers, and photovoltaic cells and panels are all examples of products created with technologies that were invented in the US but largely industrialized elsewhere. While low production costs in East Asia have been one of the major factors accounting for this phenomenon, another is the fact that governments and companies in other industrial economies have focused far more heavily on developing and disseminating applications to local manufacturers as a matter of national industrial policy. Development accounts for 84% of China’s total R&D spending, for example. Over the past decade, Chinese spending on development rose by a compound annual growth rate of around 20%, compared with 5% in the US. In 2003, the US spent four times as much as China on development research; in 2013, the two nations spent roughly equal amounts.

Of course, China is hardly alone in focusing on development. Other nations that have made advanced manufacturing a high priority—including Germany, Japan, and South Korea—are also moving more aggressively to translate technological advances into new commercial products and next-generation processes. Because scientific and technological knowledge travel quickly around the world—while development tends to remain close to where the goods are produced—the US has essentially been subsidizing innovation in other economies that have made advanced manufacturing a high priority.

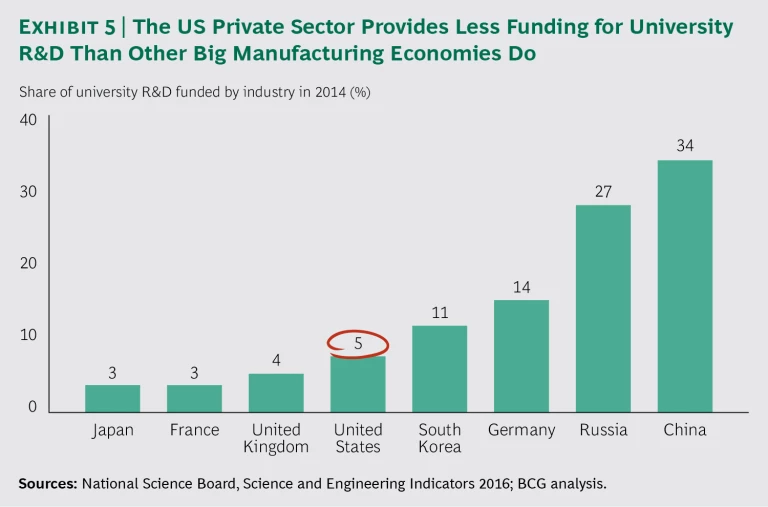

Academic research in other economies is also more aligned with the interests of manufacturing industries. In the US, contributions by the private sector account for less than 5% of university R&D budgets. In South Korea, companies contribute 11%. In Germany, that figure is 14%; in Russia, 27%; and in China, 34%. (See Exhibit 5.) What’s more, academic research in the US focuses less on the needs of manufacturing industries than such research in other economies does. Just 11% of US academic research publications relates to engineering. In China, 38% of all published research is about engineering. (While comparable data on academic engineering research is not available for China, it can be assumed that universities account for most of it.)

Impediments to Commercialization

We identified the key obstacles to converting basic and applied academic research into new products and processes—and more domestic manufacturing—through our interviews with several experts in US industry who have direct experience working with universities and research consortia.

The following sources of friction between academia and industry were cited as some of the strongest impediments to translating university research into innovative products:

- Communication Gap with Industry. Many US manufacturers find it difficult to identify academic research that they can develop into commercial products. Schools generally do a poor job of advertising their strengths, research agendas, and intellectual property in a standard way, making it tough for companies to assess and compare capabilities. What’s more, most research papers are written in a format that is not easy for industry to consume. Those publications do not highlight the commercial potential of findings, further compounding the challenge.

- Cultural Friction. University researchers often operate with few time constraints and organizational controls. The focus is on generating findings that are reviewed by academic peers; universities don’t consider commercialization when granting tenure. Private industry, by contrast, focuses on research that is likely to produce a return on investment. Projects are expected to adhere to timelines and fixed budgets, follow standard processes measured by key performance indicators, and be chronicled by regular progress reports.

- Lack of Long-Term Relationships. Most current engagements between universities and manufacturers are transactional. Because outcomes are uncertain, corporate sponsors often do not see the potential for returns on investment in long-term R&D programs. Therefore, they tend to partner with individual faculty on an as-needed basis.

The experts we interviewed also observed that several types of friction among companies hindered efforts to translate research into process innovation through R&D consortia:

- Reluctance to Collaborate. Because they view one another as competitors within an industry—rather than collaborators working to further a national interest—companies are often reluctant to cooperate to solve common manufacturing problems. When US manufacturers join research consortia, they often prefer to work in their own facilities and share little of their innovation with other members.

- Uncoordinated Supply Chains. Instead of offering full suites of advanced digital manufacturing tools that are applicable to entire industries, providers tend to have narrow capabilities and develop solutions that are specifically designed for certain technologies or manufacturers. Manufacturers are also reluctant to collaborate with their suppliers on process innovation. As a result, it’s hard for US industries to establish standards that would reduce costs, speed the implementation of new manufacturing technologies, and improve efficiency throughout the manufacturing ecosystem.

- Skill Gaps. Wide-scale adoption of advanced manufacturing technologies will significantly increase demand for skills that currently are in short supply in the US, such as robotics coordinators, information technology specialists, and data analytics personnel. The US public education system is also not well suited to training production workers who are able to quickly adapt to new and evolving manufacturing technologies.

If companies and research organizations can address these frictions, the US can more efficiently commercialize government-funded research and boost manufacturing growth.

Reducing Friction to Accelerate Product Innovation

The US already has an infrastructure for translating academic research into new products. For example, most major US research universities—and even national laboratories—have technology licensing offices, entrepreneurship training programs, and small-business incubators. Many also have research parks on or near their campuses where industry executives and academics can work together.

But manufacturers could generate more product innovation from federally funded research if friction between academia and industry were reduced and adapter mechanisms at universities were improved in the following ways:

- Enhance communication between industry and research institutions. Manufacturers, universities, and national labs need to work together to make basic and applied research with potential commercial applications more accessible. Research organizations can start by packaging their findings in ways that industry can more easily consume. For example, academic publications should clearly highlight the potential commercial applications of findings. Industry should collaborate with the US government to set up a central repository for intellectual property with potential commercial value that is created by federally funded research. All universities and colleges that receive federal funding should be strongly encouraged to participate.

- Strengthen the relationship between industry and academia. Although there is a long tradition of collaboration between academia and industry in the US, many manufacturing executives say they still have few, if any, meaningful ties with universities and have little insight into their research. “Federal “R” and corporate “D” are like two different planets,” explains Sridhar Kota, the head of MForesight: Alliance for Manufacturing Foresight, a think tank funded by the federal government that focuses on advanced manufacturing. “Corporations are not even looking at the best ideas that come out of universities.” Industry and universities can improve collaboration by harmonizing the way they work. Academic research that is sponsored in part by an industry partner is likely to be more productive if it follows R&D processes similar to those used in the private sector. It should be clear from the outset that the goals are to commercialize and to fit a business need. The project should adhere to specific time frames, strive to meet key performance indicators, and be monitored through periodic reviews. Industry partners should regularly review work and provide feedback to ensure that the project is on track to meet a product development need.

- Focus on long-term partnerships. Manufacturers should strive to build long-term partnerships with research universities. The government can encourage such alliances through longer-term contracts that include potential extensions of projects and by giving preference to companies with a record of collaboration when awarding research grants for projects. Universities should encourage faculty to expand existing relationships with industry, such as by joining corporate boards, and should include entire departments when building recurring R&D pipelines. Some corporations have been willing to invest in innovation partnerships with universities over time. Procter & Gamble’s relationship with the University of Cincinnati, for example, began with a single research project in 2006. In 2012, the company invested $5 million in a product simulation center at the university. Rolls-Royce has established a network of long-term research collaborations with leading universities in Europe, Asia, and the US. The Rolls-Royce University Technology Center at the University of Virginia, for example, specializes in advanced material systems, flow modeling, and other aerospace fields.

Academic institutions could reduce friction in collaborative research by adopting a more rigorous, disciplined, and transparent program management process. For years, the private sector has used program management tools to understand and manage massively complex projects with uncertain outcomes. In our experience, such tools have been able to improve the probability of successful outcomes from as little as 25% to more than 80%. A consistent program management process can also increase visibility into the R&D pipeline and help align a company’s commercialization efforts with a project’s timeline. (See Strategic Initiative Management: The PMO Imperative , BCG report, November 2013.)

Boosting Process Innovation Through Consortia

The US has decades of experience with public-private research consortia in which universities, industrial companies, and government laboratories develop and disseminate new manufacturing processes. For example, SEMATECH, a semiconductor manufacturing consortium established in 1987 and funded in part by the US Department of Defense, has provided crucial support to the development of next-generation lithography technologies, materials, and wafer designs that facilitated America’s resurgence in semiconductors. And, since 2014, the National Institute of Standards and Technology (NIST) has launched 14 R&D consortia with universities around the country. These consortia focus on innovation in such fields as digital manufacturing and design, additive manufacturing, photonics, and renewable energy systems.

The record of US consortia has been mixed, however. We believe that significant gains can be achieved if consortia focus on developing processes that have wider applications across entire industries. This will be especially critical in the era of Industry 4.0. While the US is at the technological forefront of Industry 4.0, some nations, including Germany and China, are moving more aggressively to adopt them. (See Time to Accelerate in the Race Toward Industry 4.0 , BCG Focus, May 2016.)

Consortia can be more effective by having members work alongside one another at dedicated facilities, by bringing in suppliers as members, and by helping to provide training for people who want to join the skilled, advanced manufacturing workforce.

- Build Industry 4.0 solutions around industries. To maximize adoption of Industry 4.0 technologies by US manufacturers, research consortia should focus on developing comprehensive solutions that can be adopted by the supplier ecosystems of entire industries. By spreading the costs across a range of solution providers and users, a consortium could solve problems that would be beyond the technological capabilities and financial means of individual players. It could harmonize standards and design rules so that digital solutions and tools are compatible and can be readily integrated, thereby lowering the cost and time required for implementation. A consortium focusing on the automotive digital supply chain, for example, could bring together OEMs, tier one suppliers, and other partners to develop solutions for augmented reality, 3D printing, advanced robotics, and digital factory management. AirDesign is one example of how this approach is being applied in the aircraft industry. AirDesign is a design and manufacturing collaboration platform created by Dassault Systèmes and BoostAeroSpace for European aerospace and defense manufacturers.

- Provide shared facilities for consortia partners. Research consortia often achieve the greatest impact when members physically work together in a dedicated space with dedicated resources. Shared facilities help consortia serve the interests of all members and disseminate knowledge through the manufacturing ecosystem. They also spread the costs of equipment needed to test unproven technologies. SEMATECH, for example, had a research facility on the campus of the University of Texas that included a wafer fabrication clean room. SEMATECH has since been absorbed into the SUNY Polytechnic Institute and is now located on its campus for nanotechnology in Albany, New York. The university has more than 300 corporate partners and has received $43 billion in private and government investment. Several new US advanced manufacturing consortia launched by NIST also have shared facilities. For example, a $260 million advanced composites innovation institute—whose members include 3M, Ford Motor, Canon, Dow Chemical, and several universities—has laboratories and a demonstration production line in Knoxville, Tennessee.

- Include the entire supply chain. Once a consortium is established, it is essential that innovative manufacturing processes be disseminated widely throughout an industry in the US. Key suppliers should be treated as full thought partners and work alongside the R&D teams of OEMs. Suppliers with limited budgets should get free or discounted memberships. The US might learn from Germany. As part of the nation’s High-Tech Strategy 2020 action plan, Fraunhofer IAO has launched its Manufacturing Activities 4.0 innovation network, which includes some of Germany’s largest manufacturers and dedicated R&D facilities and demonstration labs. The initiative aims to develop and implement new standardized, intelligent manufacturing applications and to work with small and midsize firms to build networked, flexible value chains.

The Payoff from Greater Industrial Innovation

We believe that the actions we have outlined above require only modest additional investments by industry, university, and government. That is because we essentially are calling for improving the “software” of the existing US industrial innovation system, rather than adding expensive new “hardware” in the form of new programs and bureaucracies.

The required investments are especially modest when compared with the potential impact. We believe that, in addition to boosting annual manufacturing output, increased industrial innovation can create a virtuous circle that will reinforce ongoing productivity improvement, output growth, and further R&D investment. Improved global cost-competitiveness and the arrival of advanced Industry 4.0 manufacturing technologies have presented the US industry with one of its best opportunities in decades to reset the game. Now the US needs to seize the opportunity by taking the actions needed to get the most value from its immense research assets.

Acknowledgments

This report would not have been possible without the efforts of Ben Brabston, Cassandra Grafstrom, and Doug Kochelek. We thank Pete Engardio for his help in writing this report, as well as Katherine Andrews, Gary Callahan, Lilith Fondulas, Kim Friedman, Abby Garland, and Sara Strassenreiter for their contributions to its editing, design, and production.