As US policymakers search for ways to create more good-paying jobs, boosting manufacturing is high on their agendas. Some 900,000 US manufacturing jobs have been added since 2010, a big portion of which were for skilled workers such as industrial engineers, machinists, and welders. Recent announcements by companies including Apple, Foxconn, Ford, and Intel that they are either expanding US production or exploring new manufacturing investments have buoyed hopes for further job gains.

The current policy discussion has focused mainly on one particular aspect of the manufacturing challenge: how to get more factory work to locate in the US rather than abroad. Thus, proposals to overhaul the corporate tax code, impose “buy America” conditions on federally funded infrastructure projects, and renegotiate major trade treaties are all on the table.

But convincing companies to bring tangible factory work to the US is only half the battle. Indeed, as we have documented in previous publications over the past five years, the twin forces of improved American cost competitiveness and rapid advances in manufacturing technology have already prompted many companies to bring the production of goods consumed in the US back onshore—even without changes in trade policy.

For the US to achieve sustainable growth in jobs and manufacturing output, it will have to take other measures to improve its global competitiveness. For example, it must accelerate product and process innovation, upgrade infrastructure, and shore up the country’s domestic supply base. (See “ Honing US Manufacturing’s Competitive Edge ,” BCG article, January 2017, and An Innovation-Led Boost for US Manufacturing , BCG Focus, April 2017.) But perhaps no need is more urgent than building a bigger, more highly skilled workforce that is equipped to install, operate, and maintain a new generation of digitally enabled manufacturing technologies, including advanced robots, additive manufacturing, and digital simulation of entire factories. We estimate that these new processes and systems, collectively known as Industry 4.0, will create demand for another 900,000 high-skill jobs in the US over the next decade. Many will be in essentially white-collar manufacturing occupations, such as IT and R&D.

Little of the current US manufacturing workforce or the pipeline of future workers is equipped to compete in the world of Industry 4.0. The new systems will require more than the technical training provided in today’s vocational schools and in the workplace. They will also demand “adaptive skills,” such as the ability to think critically, solve complex problems, and continually learn. In fact, we estimate that roughly half of today’s skilled workers and those currently being trained may not qualify for the jobs that will be in the greatest demand.

Little of the pipeline of future workers is equipped to compete in the world of Industry 4.0.

To successfully compete against manufacturers in China, Germany, South Korea, Japan, and other countries that are making success in Industry 4.0 a national priority, the US will have to dramatically ramp up programs that teach adaptive skills.

The Growing Need for Skilled Workers

To understand the opportunities to be gained from better workforce training, it helps to put recent employment trends in perspective.

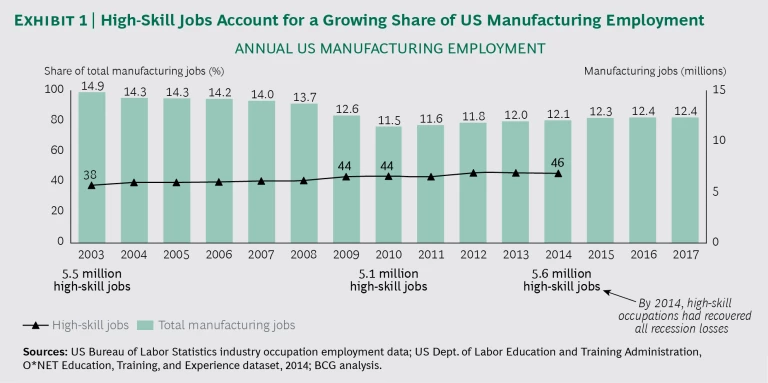

In discussions about the decline in American manufacturing, the number that often commands the most attention is total manufacturing employment. Indeed, even taking into account the big job recovery since the financial crisis of 2008 to 2009, US manufacturing employment has contracted by 19%, from 14.9 million jobs in 2003 to 12.4 million today.

Often overlooked is the fact that employment in high-skill manufacturing occupations has remained remarkably stable. We define high-skill jobs as those requiring at least a high school diploma plus three to six months of on-site or on-the-job training and/or two years of related work experience. The 5.6 million high-skill workers on the payrolls of US manufacturers in 2014 (the last year for which data is available) actually represented a slight increase from 2003. Over that period, the share of manufacturing employment in high-skill professions rose from 38% to 46%. (See Exhibit 1.)

In fact, of the ten professions that accounted for two-thirds of all new manufacturing jobs added in the US between 2010 and 2014, five were highly skilled. Around 37,000 machinist positions were created over that period, for a compound annual growth rate of 3%. Demand for industrial engineers and operators of computer-controlled machine tools registered annual growth of 5%. That compares with a growth rate of only 1% for traditional semiskilled manufacturing jobs. Employment of setters and operators of multiple machine tools surged by 9% annually. There was also strong demand for computer support specialists and general and operations managers.

Most of these jobs were filled through the US system of education and vocational training. But this system is not set up to provide the training that workers will need in order to qualify for the majority of jobs in the next generation of US factories.

The Future Skilled Workforce

More complex jobs will account for nearly half of the new direct manufacturing positions created by Industry 4.0 over the next decade; three-quarters will require distinct skills. Advanced-manufacturing technologies will also create significant demand for entirely new positions, such as industrial data scientists and robot coordinators. Employees who can work with autonomous robots and self-driving vehicles, digital-simulation design tools, augmented reality, and new processes such as 3D printing will be needed, as well as those who can integrate software and leverage big data to perform quality control and predictive maintenance.

We project that 280,000 additional IT specialists will be required to create and maintain networks of smart machines, define interfaces, and develop software applications in the US manufacturing sector. Industry 4.0 will generate demand for nearly 30,000 production workers, 70,000 logistics specialists, 90,000 robotics coordinators, and nearly 150,000 R&D personnel. Office occupations—such as in administration and sales—will account for roughly one-third of new manufacturing jobs.

These jobs will demand workers with adaptive skills. Most current manufacturing jobs require general skills and technical skills. (General skills include the basic social skills needed to work effectively with others, such as the ability to coordinate and persuade, and the managerial skills that enable people to efficiently manage personnel, time, and other resources.) Adaptive skills are more complex than either of these; they allow employees to learn more quickly, solve real-world problems, and understand, monitor, and improve systems.

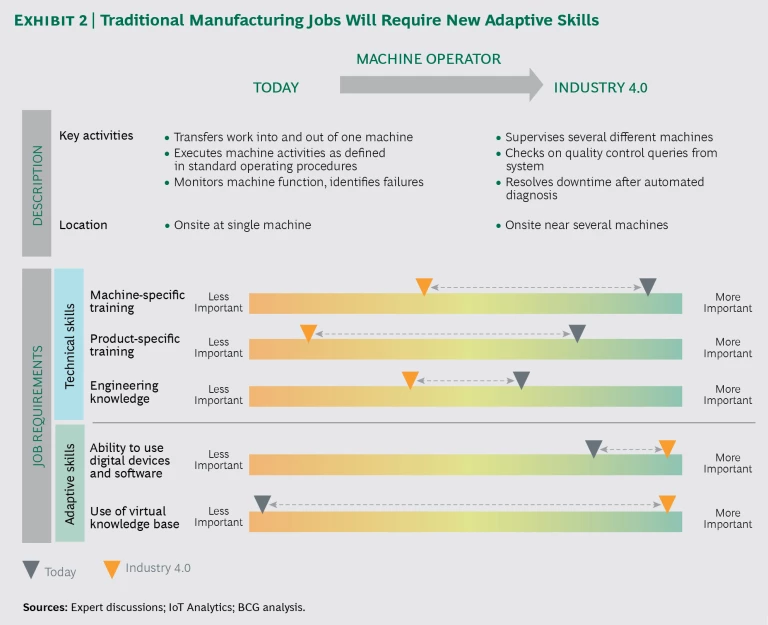

For an example of how Industry 4.0 will change existing manufacturing jobs, consider machine operators. Today, most operators mainly need specific technical skills. They work with a single machine and transfer work into and out of that machine according to standard operating procedures. They monitor the machine, identify failures, check the quality of its output, and clean and maintain it. Their most critical training is in the operation of specific machines used to manufacture specific products.

Industry 4.0 operators, by contrast, will likely supervise several machines according to operating procedures shown on digital displays. They will respond to quality control queries from the system and resolve issues according to automated diagnoses using augmented reality or remote instructions. Traditional technical skills will be less important, while adaptive skills—such as the use of online repositories of technical information known as virtual knowledge bases—will be absolutely essential. (See Exhibit 2.)

New positions created by Industry 4.0 will be even more demanding. Industrial data scientists, for example, will be in great demand. These experts need a holistic understanding of both IT systems and entire production processes. They must be able to analyze big data, develop ways to improve products, determine the root causes of problems, identify correlations, and find solutions. Training in the use of specific machines and products is relatively unimportant for industrial data scientists, while adaptive skills are critical.

Robot coordinators, too, require skills that go well beyond the operation of particular machines. Coordinators oversee several robots at a time, respond to signs of malfunction, and perform routine maintenance. They must mitigate production stoppages, such as by introducing an alternative robot if one fails. These employees need to be more familiar with software and virtual knowledge bases than traditional machine operators are.

Industry 4.0 will greatly accelerate the pace of technological change. As a senior executive at a major advanced manufacturer put it, “In the early 2000s, new technological breakthroughs occurred every five to seven years. Today they occur around every three years.”

The Adaptive Skills Gap

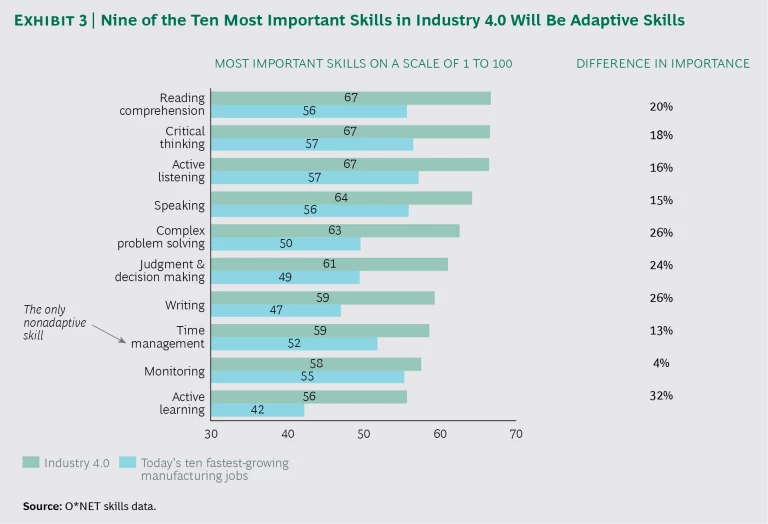

The need for adaptive skills will be paramount across virtually the entire skilled US manufacturing workforce. (See Man and Machine in Industry 4.0 , BCG report, September 2015.) According to the US Department of Labor’s Occupational Information Network (O*NET), nine of the ten most critical requirements for positions in Industry 4.0 are adaptive skills: active learning, active listening, complex problem solving, critical thinking, judgment and decision making, monitoring, reading comprehension, speaking, and writing.

These skills are far more critical to future manufacturing roles than to current skilled positions. On a scale of 1 to 100, O*NET gives reading comprehension, critical thinking, and active listening scores of 67 in importance for Industry 4.0 jobs. That’s 16% to 20% higher than the scores these skills receive in today’s ten fastest-growing manufacturing positions. The importance of complex problem solving and writing is 26% higher, and the importance of active learning is 32% higher. (See Exhibit 3.)

The big challenge for US industry is that current training for the blue-collar workforce is not designed to teach adaptive skills, which are generally developed in college. The vocational schools and corporate programs where many earn postsecondary certificates tend to focus on specific, “job ready” technical skills; they do not have a track record of teaching the adaptive skills that will be in greatest demand in the decade ahead.

Nine of the ten most critical requirements for positions in Industry 4.0 are adaptive skills.

This means that much of the current US skilled manufacturing workforce is unlikely to qualify for jobs in the coming era. Fewer than half of today’s workers in the ten fastest-growing manufacturing occupations—including team assemblers, tool setters, and inspectors—have a bachelor’s degree. To qualify for Industry 4.0 jobs, around two-thirds of employees will need at least a BA and nearly one-quarter will need a master’s or a doctorate. When it comes to the fastest-growing Industry 4.0 occupation—IT specialists—around 70% will need a BA or a more advanced degree.

Building an Industry 4.0 Workforce

Building a sufficiently large white-collar, adaptive, high-skill manufacturing workforce that will enable the US to compete globally in the era of Industry 4.0 will require upgrading the current system for training workers. It is not feasible for all skilled workers to earn college degrees—and even if they did, continual education would be needed to keep up with fast-changing technologies. The real education must take place in vocational schools, community colleges, and workforce training programs, which will have to go beyond teaching the technical skills demanded by today’s manufacturers and technologies and give graduates the ability to adapt.

Companies will have to take more responsibility for developing a skilled workforce than they have done in the past. They need to develop training capabilities, a talent pipeline, and the ability to retain the workers that they need. They can start with programs that build up the capabilities of current workers by equipping them with the adaptive skills required in an advanced-manufacturing environment.

Companies will have to take more responsibility for developing a skilled workforce than they have done in the past.

Companies should closely collaborate with educators and with one another to help build an Industry 4.0 workforce. They should help develop innovative vocational education programs that go beyond technical, job-centric training. These must not only teach the latest advanced-manufacturing technologies but also cultivate the ability to solve problems, quickly absorb new knowledge, work in collaborative environments, and command a holistic understanding of next-generation production systems. With companies and schools working together, new courses can be added to curricula within a few months, and entire new programs created within a year. Companies should also explore establishing a “knowledge repository” that workers can access to learn about new technologies and processes.

Some employers and vocational schools are beginning to introduce adaptive training. For example, B. Braun, a global leader in medical devices, provides coursework that develops a theoretical understanding of manufacturing technologies, along with more traditional technical training, in programs at local vocational schools and community colleges. Houston Community College and Texas A&M are jointly exploring a certificate program to teach adaptive skills.

So far, however, there has been no discernable effort to develop such training programs at scale in the US. The urgency of doing so will only intensify as the pace of technological change accelerates.

If the US cannot meet the demand for adaptive skills, many of the best-paying jobs in American factories will go to workers who are recruited abroad, or they will be outsourced to nations that have the best capabilities in digital manufacturing and information technologies. But if the US can rise to the challenge of developing world-class Industry 4.0 capabilities and skilled workforces, prospects for American manufacturing are bright.