G lobalization is supposed to be in retreat.

How, then, do you reconcile the following? Since 2005, the number of travelers crossing international borders each year has risen by around half, to 1.2 billion. The number of people using the internet has soared from 900,000 to more than 3 billion. By 2020, their ranks are projected to exceed 4 billion, while the number of connected digital devices is forecast to more than triple, to nearly 21 billion. Global data flows, which have exploded by tenfold over the past decade, to 20,000 gigabits per second, are also projected to triple by 2020.

Companies that have learned how to carve out markets in this increasingly connected world have built large global businesses at an astonishing speed. Consider the fact that Uber has penetrated more than 80 countries in just six years, while the augmented-reality game Pokémon Go was being played in almost 150 countries and had generated nearly $1 billion in revenue just six months after its launch, showcasing a globalization on digital rocket boosters.

Yet the dominant geopolitical narrative in the popular press, in corporate boardrooms, and around many dinner tables is one of growing nationalism, protectionism, and job losses, and the social backlash caused by the increasingly inequitable distribution of global gains. The UK’s pending exit from the European Union and the position on trade articulated by the new US administration and several political parties in Europe suggest that globalization is in retreat.

Which of these two very different narratives of globalization is correct? The answer is both. While the world is becoming more decentralized politically and physically, customers, devices, services, processes, and businesses continue to integrate digitally. The simultaneous rise of economic nationalism and of digital integration is redefining the economic, business, and political framework that has shaped our understanding of globalization for the past half century, ushering in a radically new model. If the retreat narrative is the only one that informs your global strategy, you are at risk of failing to recognize some of the most important growth opportunities and the fundamental shifts in business models on the horizon.

If the retreat narrative is the only one that informs your global strategy, you are at risk of failing to recognize some of the most important growth opportunities and fundamental shifts in business models on the horizon.

Capturing these opportunities will become increasingly critical as the pace of global economic growth slows. Global GDP growth was as high as 6% annually in the 1960s. It has since cooled to around 3% to 3.5% and is likely to stay in that range for the short to medium term in the absence of a trade multiplier effect, in which global trade grows faster than global GDP. Global trade growth has slowed for a decade now, after four decades of rapid expansion.

What, then, is the new globalization? And how should businesses respond in order to keep up?

The Old Globalization

First, let’s consider the economic, business, and political models that have long defined our view of globalization.

- The Old Economic Model. During previous phases of globalization, a country or group of countries emerged as an economic “pole,” such as Britain and other maritime powers in the late 19th century, the US after World War II, and China in the late 1990s and early 2000s. These poles contributed 20% to 25% of global GDP growth, largely through the multiplier effect of ever-rising trade. In the phase of globalization that is now receding, growth rates across emerging markets were higher than in developed economies.

- The Old Business Model. Commerce was expected to integrate globally through the cross-border flow of goods and capital via the global supply chains of multinational companies. The level of integration varied across sectors; the highest was in the auto and electronics industries.

- The Old Political Model. Globally shared “rules of the game” were introduced and enforced by institutions such as the World Trade Organization and the International Monetary Fund, which were strongly influenced by developed economies. Global economic growth and free trade took precedence over politics, and multilateralism over nationalist pressures.

The changing geopolitical context and the impact of digital technologies on business models call into question this understanding of globalization. We see four major geopolitical shifts underway.

First, protectionism is growing. The US, Russia, and India have each introduced more than 500 discriminatory trade measures since 2009. Global Trade Alert reports that in 2016 alone more than 500 discriminatory measures and only 300 liberalizing measures were introduced worldwide. Second, the ability of multilateral institutions to establish and enforce shared rules seems to be weakening. Bilateral agreements based on national interests are taking precedence over multilateralism. Third, the dominant role of Western countries in the multilateral financial institutions that have provided global capital appears to be receding as new financial institutions emerge, such as the China- backed Asian Infrastructure Investment Bank and the New Development Bank. Fourth, state capitalism is on the rise: examples include the growing economic role of state-owned enterprises and sovereign wealth funds and the increased direct government support of domestic industries. Sovereign wealth funds now manage portfolios valued at $7.3 trillion, compared with the $4.2 trillion in assets under management by closed-end private funds, according to the financial market research firm Preqin.

Equally profound are the structural shifts in the world economy that have been set in motion by digitalization. We see three forces at work:

- Industry 4.0. In addition to boosting productivity by as much as 30% and reducing labor costs, advanced digital manufacturing systems let businesses alter their global production and delivery footprints by making it feasible to operate smaller, more flexible facilities closer to customers around the world instead of concentrating production in large plants in countries with low labor costs.

- Digital Platforms. Both traditional companies such as General Electric, with its Predix platform, and relative newcomers such as Uber, Airbnb, and India’s Flipkart are gaining access to borderless global markets through their information technology platforms and ecosystems of local partners. In the period from 2012 to 2015, some platform-based companies grew at a rate in excess of 100%, compared with single-digit growth at established multinational companies.

- Digital Services. Advances in digital technologies and platforms are enabling the rapid growth of cross-border digital services such as online travel booking, entertainment sites, and asset performance improvement services. New value-added services are becoming a key generator of value and revenue growth for traditional businesses.

A New Framework Raises New Questions

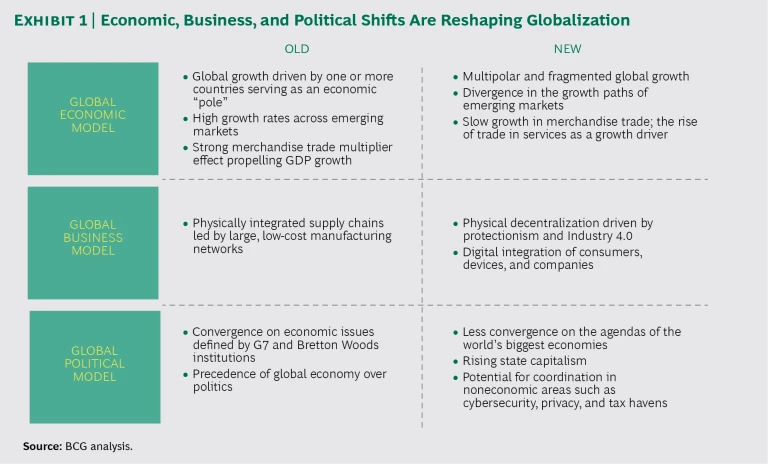

Together, these geopolitical and digital shifts are redefining the economic, business, and political models of the old globalization framework, giving rise to a very different paradigm. (See Exhibit 1.)

- The New Economic Model. The global economy is becoming fragmented and multipolar, with more countries driving global growth. In emerging markets, economic growth rates, development models, and the chief sources of growth—such as manufacturing, services, and consumption—are diverging. Flatter growth in merchandise trade will continue to translate into lower growth in global GDP, at least in the short to medium term.

- The New Business Model. Because growth in trade, especially merchandise trade, and in cross-border investment is slowing as a result of rising protectionism, shifts in global manufacturing costs, and the economics of Industry 4.0 technologies, companies must find new drivers of global growth. These forces are also decentralizing global supply chains, while growth in digital services and platforms is integrating many parts of businesses and the ecosystems in which they operate.

- The New Political Model. As the influence of the world’s biggest economic powers wanes, nationalism and political interests are taking precedence over globally shared economic goals. Sudden changes in policy and regulation are becoming the new normal. There is still potential, however, for countries to collaborate to address cross-border issues such as cybersecurity, international terrorism, and tax havens.

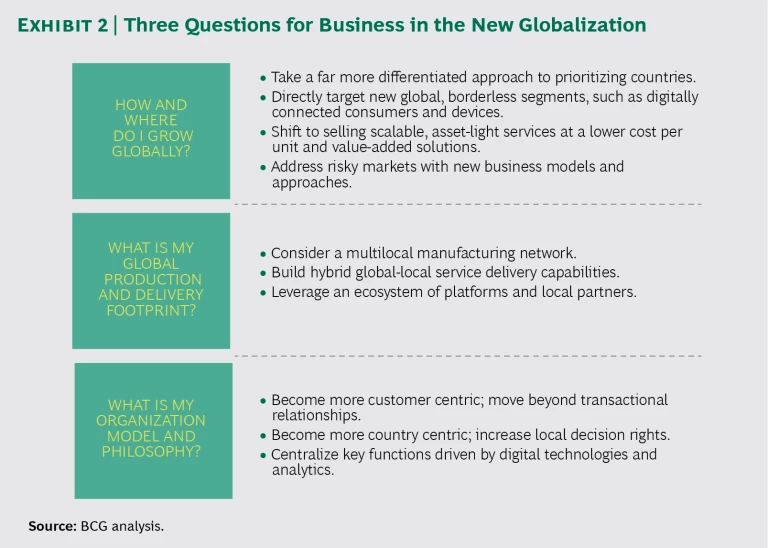

This radical new model of economic, business, and political decentralization and digital integration is rewriting both the rules of the game and the winning plays for global competitors. Global companies now must reexamine three fundamental strategic questions. (See Exhibit 2.)

- How and where do we find global opportunities in the new environment of fragmented, relatively slow global growth and economic divergence among emerging economies?

- What kinds of business models will be most effective for producing and delivering goods and services in a global economy that is decentralizing economically and physically, in terms of supply chains, but integrating digitally?

- What organization management philosophy and model will help us succeed in the new globalization?

We will delve more deeply into how companies can approach these questions in subsequent publications. Here we present some of the key implications in a nutshell.

Finding New Growth Opportunities

Given the changing economic model, the traditional practice of assessing markets on the basis of per-capita income and market penetration levels needs to give way to a more nuanced approach. We see four imperatives for identifying global growth opportunities in this new phase.

Take a differentiated approach to prioritizing countries. As a group, the ten biggest emerging markets are on track to overtake the G7 economies in aggregate GDP by 2031. But the growth paths of some of these markets, such as Brazil, China, India, Nigeria, and Russia, have diverged as a result of falling global commodity prices, differences in economic management, and shifts in manufacturing cost structures. Success in these countries, however, remains an imperative.

To recognize opportunities, one must look beyond top-line macroeconomic statistics such as GDP and per-capita income. Even in many slow-growth economies, there are rich pockets of growth for certain goods and services and for companies with the right business models. Even though Brazil’s economy has stumbled, for example, the US drug store chain CVS is expanding there in response to surging consumer demand for modern retail outlets. The deep structural changes underway in emerging markets—such as the shift from manufacturing exports to services and personal consumption as the chief economic driver—can also point to big new opportunities. While China’s GDP growth is slowing, for example, strong demand for premium coffee among the country’s swelling consumer class is propelling the rapid expansion of Starbucks.

To identify new hot spots, consider the size of the growth opportunity and the pace of change in various economies. For example, struggling Argentina may be a much more promising market for many companies than its more economically stable neighbor, Chile, because the needs and the potential for improvement are much greater—even though per-capita income in the two countries is comparable.

Target new borderless segments. The rise in the digital connectedness of consumers, devices, and machines is creating market segments that transcend country boundaries. And the growth in global digital platforms lets businesses target these segments without the need for large-scale operations in multiple countries. International tourists and business travelers represent one such global borderless market. China’s Alipay, for example, is building a global business by targeting the country’s rapidly growing market of overseas travelers, who use the mobile payment platform as an alternative to credit cards at department stores and retail chains in more than 100 countries.

The rise in the digital interconnectedness of consumers, devices, and machines is creating market segments that transcend country boundaries.

Shift toward services and solutions. In many markets, it is not viable for companies to sell their physical goods, either because the unit costs translate into prices that are too high for potential customers or because demand is too low to justify heavy capital investments in supply chains to serve those markets. In such situations, business models that provide value-added services and end-to-end solutions are often more successful. Turning a product-based model into a service-based one lowers the cost per use of a product, opening up previously unavailable customer segments. India’s Trringo, for example, is building a significant business renting agricultural equipment to farmers in rural areas who cannot afford the purchase price.

Moving to services can also help companies tap into latent demand in existing markets. A supplier of medical devices told us that its “pay for performance” solutions for hospitals are growing twice as fast as product sales for CT scanners. The company provides equipment, technicians, and diagnostics for a fee that is based on outcomes, such as a certain percentage of positive diagnoses. Even in markets where demand is low, companies can achieve growth by leveraging global platforms and partnerships to deliver services. Such offerings can be scaled up with little investment in assets. Many e-commerce aggregators have used this model to reach rural consumers.

Develop new models for risky and regulatory-challenged markets. Risk is becoming the new normal, so businesses must be adept at dealing with it. Companies increasingly must be able to develop new business models at the local level in order to adapt to sudden regulatory shifts, changing economic conditions, and other risks.

Establishing New Global Footprints

The new model of globalization will allow businesses to change their global production and delivery footprints. Historically, companies have built competitive advantage by achieving scale and lowering costs through big facilities and integrated supply chains. Most companies have focused on selling physical goods in foreign markets, and they’ve managed their global operations through multinational organizations with large central headquarters that oversee operations and value chains.

The balance between global and local footprints is changing. In response, companies should consider the following actions.

Explore multilocal manufacturing. The combination of rising protectionism and falling costs of advanced manufacturing technologies is instigating a structural change in global manufacturing. Under the old globalization paradigm, it made economic sense to build one or a few high-volume production facilities in low-cost economies and ship goods around the world. Now, more companies are manufacturing products or building plants in multiple locations that are closer to consumers. The prospect of higher tariffs and border taxes is in part what’s prompting companies to create more value in the economies they serve. At the same time, greater connectivity and Industry 4.0 manufacturing systems, such as 3D printing, advanced robotics, and digital factory management, are redefining economies of scale by making it cheaper and more feasible to build small batches of products tailored to local tastes and needs. These are among the reasons that Adidas says it is moving manufacturing to more locations around the world after decades of concentrating production in a few large factories in low-cost economies.

Consider global-local services delivery. To capture the benefits of scale in high-skill, capability-led functions, companies will want to consider delivering some services globally from a few centers of excellence. To comply with regulation, meet specific market needs, or ensure effective last-mile delivery, however, companies must explore models that combine both global and local capabilities. The balance will vary by industry. Philips, for example, has joined forces with the NGO Imaging the World and the governments of Kenya and Uganda to provide cost-effective, easy-to-use telemedicine services, such as ultrasound screening in remote hospitals and clinics that transmit from specially designed devices to the cloud. The partnership combines global diagnostic and analytics capabilities with local screening services.

Build ecosystems of global platforms and local partners. One powerful way to reach global, digitally connected markets at minimal cost is through partnerships between global information technology platforms and local companies. Chinese smartphone manufacturer Xiaomi, for example, has achieved rapid growth in device sales by partnering with e-commerce companies such as Amazon and Flipkart.

Organizing for the New Globalization

Globalization’s next phase of greater digital integration combined with economic, physical, and geopolitical divergence has profound implications for the structure of the multinational enterprise that evolved over the 20th century.

Global organizations in the 21st century need to consider three fundamental changes.

Sharpen the focus on customers. As companies offer more and more services and solutions to more and more digitally connected buyers, relationships with customers will need to be more than transactional. As the chief strategy officer of a global industrial goods company noted, to make the transition from selling transportation equipment to providing mobility solutions, “our entire sales organization will need to become more customer centric and understand customers’ needs—not just for equipment and upgrades but also for real-time maintenance and platform solutions.” As many global firms set up services and solutions businesses that cut across products, responsibility for profit and loss could shift from product business units to those that own customer relationships.

Decentralize operations and decision rights. The traditional matrix model of overarching tiers of global and regional management control over function areas and product groups is being replaced by more flexible and decentralized structures that empower management teams in individual markets. The need to serve local customers, respond to growing regulation and economic nationalism, and take advantage of local capital will require companies to strengthen their local operations. Decision rights will likely have to decentralize as well. In this environment, global organizations will increasingly achieve scale by using digital technology to exchange information and maintain global standards. “Technology is now enabling real-time data collection at the local level, removing the need for layers of regional and matrix oversight,” explained the chief operating officer of a global consumer goods company.

Centralize select global functions. Greater connectivity and advances in computing and digital technologies are also enabling companies to centralize some critical functions in one location run by a single global team. These teams could be located at headquarters or wherever the company has the greatest capabilities. An example is clinical diagnostics. The global analytics team of a leading medical provider we spoke with uses its access to vast amounts of data to provide diagnoses of tomography scans that are more accurate than those of most physicians in the field. Product design and marketing are other functions that could become more centralized as data is collected locally and then sent via a digital platform for analysis at one location by a team that then uses the insights to develop solutions.

Navigating the New World

The emergence of a new model of globalization does not mean, of course, that the old ways of engaging with the world will suddenly become irrelevant. Nor are we at an unprecedented moment—the ebbs and flows of globalization are nothing new. Each previous wave of globalization was halted by some crisis but was then redefined by new technology. And each time, globalization emerged stronger than ever. The current era is no different.

The precise contours of the new global economy have yet to be defined, for we are at the early stages of this epoch. We do believe, however, that the old approaches for successfully engaging the world will not provide the best opportunities for sustained growth. The new globalization also calls for new metrics. Instead of tracking cross-border flows of physical goods, money, and people, it is becoming increasingly important to measure connected consumers, communities, devices, and machines and to monitor the flow of data and ideas. Companies that can recognize the underlying shifts, identify the new opportunities, and adapt to change will seize formidable competitive advantages in this new world.

In a series of publications, we at The Boston Consulting Group will continue to explore the many dimensions and implications of the new globalization. Among other topics, we will offer our insights into what the new paradigm means for corporate growth, business models, world trade, global manufacturing footprints and supply chains, and economic development.