For more than four decades, manufacturers have designed their global production, investment, and sourcing strategies around the assumption that the movement of goods across the world’s borders would continue to grow ever freer. In the process, many have built complex, intricately linked, and cost-efficient supply chains that span the globe. Products as varied as Apple iPhones and Boeing 787s, for example, while designed in the US, contain parts, materials, and components from multiple countries.

This faith in the inexorable advance of globalization is now being challenged. The UK is preparing to exit the European Union. US President Donald Trump has vowed to renegotiate the 23-year-old North American Free Trade Agreement (NAFTA) and take measures to reduce the $366 billion US trade deficit with China. Top Republicans in the US House of Representatives have called for imposing a “border adjustment tax” (BAT) that would effectively tax imports while giving a tax break to US exports as part of an overhaul of the corporate tax code.

The possibility of dramatic changes in trade policy comes at a time when the economics of global manufacturing are already shifting in complex ways as manufacturing technologies advance and labor costs rise in China and other traditionally low-cost countries. These factors on their own are significant enough to prompt many manufacturers to reconsider their global supply chain strategies. The prospect of a major overhaul of trade agreements among leading economies makes such a reassessment urgent.

The High Stakes of Changing Trade Rules

The implications are enormous for any company that relies on raw materials, components, and finished goods crossing international borders. Our analysis indicates that if these extreme, but plausible, US policy changes are adopted, the impact on certain companies would be severe. For example:

- Implementing a BAT, even if corporate tax rates fall to 20%, would essentially eliminate the operating profits of one US sensor manufacturer that now builds most of its devices in Mexico.

- A major US retail chain that sources goods primarily from Asia would see its operating profits from electronic products plunge by nearly 550% if the US levies a 35% tariff on imports from China. Entire product lines would become unprofitable if the retailer were unable to raise prices.

- A Mexican food manufacturer that imports agricultural products duty-free from the US under NAFTA could see profits wiped out on one of its main product lines if Mexico applies a 35% tariff in response to higher US duties on Mexican goods.

The strategic implications of these potential impacts are significant. Depending on the structure of their supply chains, some manufacturers would go from being today’s cost leaders to tomorrow’s laggards. Large importers, such as brick-and-mortar retailers, stand to lose a significant portion of their operating profits, making this a much more immediate threat to their profitability than the rise of e-commerce. Other companies, however, are better positioned to weather the storm and improve their competitive position under the proposed trade changes.

The magnitude, details, and timing of these changes remain uncertain. Managers, therefore, face wrenching decisions. If they opt to be proactive, they risk making major shifts prematurely that could undermine their cost competitiveness. If they decide to wait until new trade rules are clarified, they risk being unable to adjust quickly enough. Moreover, identifying the best option is complex; even for companies in the same industry, the impact of new trade rules will vary according to business model, dependence on imported inputs, mix of products, and blend of offshore and onshore manufacturing.

We offer a framework to help companies assess the vulnerabilities of their end-to-end supply chain—from procurement through sales. This framework will support their development of a set of actions to adapt to these potential policy changes and to longer-term economic and technological trends.

Our framework specifies five steps a company needs to take to prepare in these uncertain times. First, assess the exposure of the company’s entire value chain to changes in trade policy. Second, understand the implications for the company and its product portfolio. Third, identify actions to mitigate risk and seize competitive advantage. Fourth, develop a playbook to specify which actions to take under various circumstances and scenarios. Finally, begin preventive and proactive actions—such as advocating for beneficial policies.

One option that few companies have, however, is simply to wait and see. With the global trade system facing the possibility of some of the most disruptive changes in decades, the risks are too great to ignore—and so are the opportunities.

Although our framework applies globally, this article focuses on the shifting environment in North America and the repercussions and options for manufacturers, retailers, and distributors.

NAFTA and BAT

Two types of proposed policy changes are likely to have the greatest impact on North American manufacturing: a revision of trade rules currently agreed to under NAFTA and tax reform that may include imposition of a BAT.

Changes to NAFTA could raise costs of traded goods in the following ways:

- Tariff Levels. Most goods now cross borders between the US and Mexico and the US and Canada duty-free. A renegotiation or US pullout from NAFTA could result in new tariffs on Mexican and Canadian goods entering the US. Mexico and Canada could retaliate with tariffs on US-made goods.

- Rules of Origin. Under NAFTA, a product qualifies for free trade as long as a certain percentage of its value is added in North America. The value-added level on automotive parts, for example, is 62.5%. If the agreement is renegotiated, imported goods may be required to have a much higher North American content to remain tariff free.

- Trade Facilitation. Programs that reduce the friction in trade—such as the “trusted trucker” program that permits precertified trucks to haul cargo from Mexico and Canada through US border crossings without inspections—could be curtailed. This could raise costs, lengthen lead times, and force companies in the US to carry higher inventory or cope with more supply chain interruptions.

- Mobility of Talent. Current NAFTA immigration norms allow certain personnel from manufacturers based in the US, Mexico, and Canada, such as managers and technicians, to cross borders and work in the US with NAFTA Professional visas. That freedom of movement could disappear.

- Nontariff Standards. Protection of intellectual property rights could toughen, and the US could demand that Mexican factories meet high labor standards to qualify for preferential trade treatment.

A BAT is one of several changes being considered to the US corporate tax code. A BAT could be imposed in addition to higher tariffs or be used as an alternative to tariffs to increase the cost of imports relative to US-made goods and potentially create more US manufacturing jobs. Under a BAT, the cost of goods entering the US would no longer be exempt from corporate tax. If the US corporate tax rate drops from 35% to 20%, as proposed, a BAT would have the effect of adding a 20% tax to imports. In addition, the proposal calls for US-made exports to be exempt from taxes.

Potential Policy Outcomes…

Whatever the exact policy outcome, the impact of any changes is likely to be considerable. So it is important to think in terms of plausible scenarios. One scenario, of course, is that future policies will resemble the status quo more than something radically different. We have developed three additional scenarios with varying degrees of change to NAFTA and US tax law:

- Reform NAFTA. A new agreement comes into effect, primarily tightening rules of origin and modernizing the agreement to include elements such as data flows.

- Wall Against Trade. Failed negotiations lead to high discretionary US tariffs on Mexican goods, leading Mexico to raise its tariffs in retaliation. Trade facilitation and the mobility of managers are reduced; nontariff barriers are raised.

- BAT Implementation. The US enacts a BAT and lowers the corporate tax rate. A BAT could be implemented with or without changes to NAFTA.

Companies must also anticipate second-order implications, such as potential retaliatory measures from other nations. A BAT and other policies could also have an undetermined effect on exchange rates. The World Trade Organization could assess penalties on US-made exports. Downstream, these policy and economic changes could have an impact on the cost of goods to companies and consumers, which could affect demand.

…and How They Would Affect Different Companies

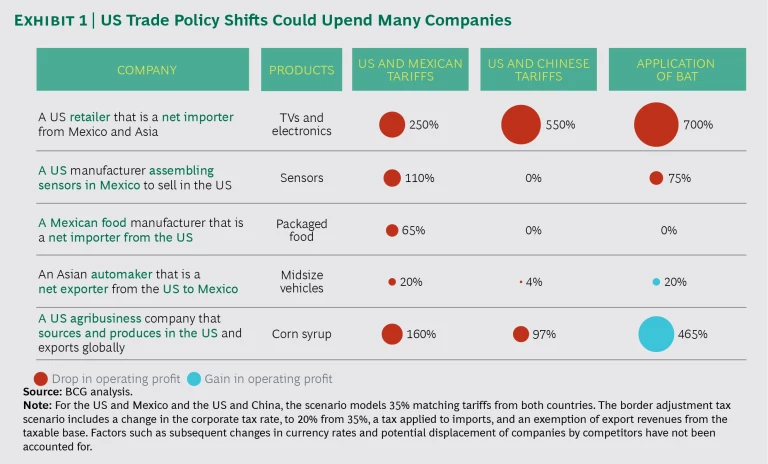

To understand how these scenarios would affect a wide variety of businesses, it is helpful to analyze the impact on several companies with different profiles. (See Exhibit 1.)

- A US retail chain that sources products domestically and from abroad—including Mexico and Asia—primarily for sale in the US

- A US-based manufacturer that buys materials from Asia, assembles sensors in Mexico, and sells them in the US

- A Mexican packaged-food manufacturer that buys agricultural products in the US and sells its finished goods in Mexico

- An Asian car manufacturer that procures parts globally, manufactures vehicles in the US and Mexico, and sells the assembled vehicles in both countries; the company is a net exporter from the US to Mexico

- A US agribusiness company that sources and produces domestically and exports globally, including to China

Our analysis found that the impact of a BAT and higher tariffs within North America would vary greatly among the five companies. The financial impact on each would be significant, however, and in some cases severe. The sensor maker’s operating profits would be wiped out under the higher tariffs and drop by 75% under a BAT.

The retail chain would be the biggest loser, because it is a big net importer and its ability to pass along higher costs to customers is limited: higher prices would likely mean a drop in demand. Operating profits for its electronics product line would fall by 250% if the US enacted a 35% tariff on Mexican imports and by nearly 700% if a BAT were imposed. This does not account for any changes in price or demand.

The impact of tariffs would vary at different levels—among industries, among companies, and across the product portfolio within companies. In the retail sector, for example, e-commerce retailers that function primarily as platforms for other companies to sell their goods would be less affected. Companies within industries would also see their competitive positions change, potentially leading them to adopt new strategies as cost leaders become laggards and vice versa. The net exporter of cars from the US will see its cost competitiveness rise compared with peers that are net importers if a BAT is implemented.

Similarly, the impact of tariffs would not be consistent across companies’ product portfolios. This would have implications for how they allocate capital. The Mexican packaged-food producer that sources from the US would be affected far more dramatically by a 35% tariff on certain ingredients than it would be by the same tariff on others. The company could therefore explore substituting ingredients that are more available locally or can be sourced at a much lower cost, so long as their functionality is similar.

It should be noted that these assessments are based on short-term and first-order implications. We have not accounted for such factors as subsequent changes in currency rates and the potential displacement of companies by competitors from regions unaffected by trade policies.

A Framework for an Uncertain Future

Of course, these are specific examples, and the profile of each company is unique. So it’s important to have a framework for evaluating impact that can be applied to any company engaged in cross-border trade of goods—and beyond the context of North America should trade barriers proliferate in other regions. This framework analyzes the upstream impact on the supplier ecosystem, the impact on the company’s manufacturing network if it has one, and the downstream impact on distribution, retail channels, and end users.

Once a company has developed plausible scenarios, we propose that it start mapping exposure throughout the value chain and develop a playbook of responses that are based on several scenarios.

Mapping Exposure

Companies should take a comprehensive approach to identify risks associated with the potential policy outcomes and estimate their likely costs. They need to consider these across the three key components of their value chain:

- The Upstream Network. Begin by mapping the risk exposure of the supplier ecosystem, including the suppliers’ suppliers.

- The Manufacturing Network. Rigorously analyze the vulnerability of the company’s manufacturing network and that of its contractors; this includes performing an operational flexibility test.

- The Downstream Network. Assess the risk to the logistics and distribution networks. Also analyze the effects any potential price increases may have on customers.

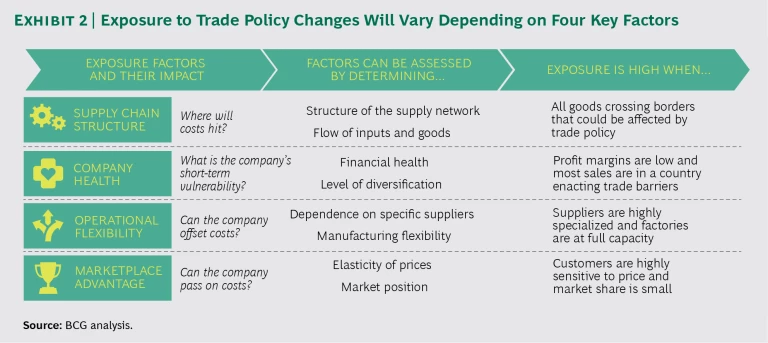

There are several factors that determine a company’s degree of exposure to trade policy changes and their potential impact. (See Exhibit 2.) An assessment of these should consider the degree to which supply chain networks are concentrated in countries where trading relationships are at risk, whether the company is financially healthy enough to postpone major sourcing changes in response to new trade and tax policies, and the ability of operations to offset higher trade costs by shifting suppliers or production. This assessment should also determine whether the company’s position in the marketplace allows it to pass on the added costs to customers.

It is also vital to assess the exposure of competitors and anticipate their responses. This will help companies understand the competitive asymmetry that policy shifts may create in their industry.

A Response Playbook

Having mapped the risks, managers should define actions the company might take in response to changes in trade rules under various scenarios, and evaluate each of these against a set of relevant criteria. Next, managers should estimate how much these actions will affect exposure to trade policy changes and anticipate the likely response from competitors.

At this point, companies should develop a playbook of actions to be taken at different stages of these scenarios. They should identify preventive actions, which would be taken before the new policy agenda has been set and details can still be influenced; proactive actions, which would be taken when the policy direction is clearer and can make the future adjustment process easier; and reactive responses, which would be taken to adjust to the newly enacted trade regime and could help build long-term competitive advantage.

Preventive Action. While lawmakers are still debating, companies can take steps to help legislators craft trade policies that are less damaging to companies’ interests. Managers should arm themselves with data to educate lawmakers on the effects different policy options will have on their companies, employees, customers, and communities. Managers should also lay out for customers, suppliers, staff, and other stakeholders what they can expect under different scenarios.

Proactive Action. There are several moves that companies should begin to make in advance of specific policy changes. They should consider identifying and prequalifying suppliers in new locations, for example, or explore global pricing agreements with suppliers that manufacture in multiple countries. Companies should also consider postponing capacity expansions in at-risk locations.

Companies should take a fresh look at their optimal manufacturing footprint under various scenarios. In some cases, economics will dictate that companies begin to regionalize or localize their supply chains, migrating production closer to demand. They may need to add only some capacity in select locations, or they may find it more attractive to outsource production rather than build and operate new facilities.

Looking downstream, companies should consider whether they will need to build alternative distribution and sales assets. For instance, a retail chain might decide to scale back on price-sensitive consumer electronics, which are expected to see rising sourcing costs, and focus more on domestically sourced groceries.

Reactive Responses. When new trade policies are unveiled, management needs to be ready to act. At this point, the company should decide whether it is better to take short-term actions to mitigate risk or to find an opportunity for bolder moves that could capitalize on the new environment to gain competitive advantage.

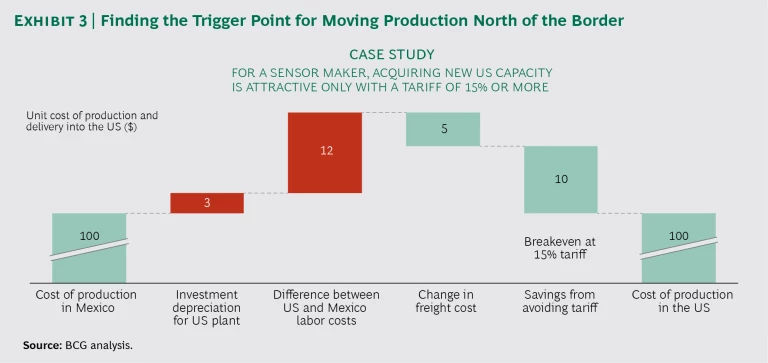

Trigger Points. Identify trigger points for putting plans into action under different scenarios. These triggers would include clarity on the level of the tariff, the cost implication of that tariff, and the estimated duration of the policy. Consider the case of the manufacturer that assembles sensors in Mexico and sells them in the US. Say it currently costs $100 to make a sensor in Mexico. Although the company would save some money on freight, moving production to a site in the US would add $15 in higher labor costs and depreciation for the new plant. By our calculations, then, the tariff on Mexican imports would need to be at least 15% for the company to break even on a relocation. (See Exhibit 3.)

A response with the long term in mind, however, would overlay the new trade costs with other trends likely to redefine the company’s optimal footprint in the years ahead. The rapid advance of robotics, for example, can be expected to flatten some cost differences between countries. The company may also decide that the time has come to accelerate plans for adding new capacity and modernizing its manufacturing approach at the same time.

Regardless of how the trade policy debate ultimately plays out, the stakes are too high for a wait-and-see approach. Technological and economic forces are already altering the math of global sourcing and manufacturing. Add to this a rewrite of trade rules, and companies could be facing the kind of disruptive change that renders well-honed business models and operations obsolete—and creates a new generation of winners. The time to prepare is now.

The BCG Henderson Institute is Boston Consulting Group’s strategy think tank, dedicated to exploring and developing valuable new insights from business, technology, and science by embracing the powerful technology of ideas. The Institute engages leaders in provocative discussion and experimentation to expand the boundaries of business theory and practice and to translate innovative ideas from within and beyond business. For more ideas and inspiration from the Institute, please visit Featured Insights .