After decades of slow productivity growth, the engineering and construction (E&C) industry is poised to make major gains through digital technology. This breakthrough is centered on building information modeling (BIM), a software platform that integrates 3D modeling with project management and visualization tools. BIM presents all the physical objects in a building along with their physical, technical, and commercial characteristics. The technology makes it possible to quickly assess shipping and construction timing, life cycle cost, and other key variables.

Similar to digital breakthroughs in other industries, BIM is beginning to transform the construction business by reorganizing the value chain. Instead of reinforcing the industry’s traditional silos, BIM will promote collaboration at each stage of a project. Its advantages are prompting many large contractors, as well as engineering and architecture firms, to invest in the technology.

But BIM also poses a challenge. Making it work requires a substantial upfront effort not just to adopt the technology but also to acquire relevant know-how, set standards, find the right strategic positioning, and align stakeholders. So far,

building materials companies

have been less aggressive than others in the industry. Some

of these companies are concentrating only on the immediate task of turning their product list into a BIM object library; others see BIM as a burdensome government regulation.

As the construction industry starts to reorganize around BIM, the time is now for building materials companies to act. Those that go beyond object libraries and embrace BIM’s capabilities may gain a first-mover advantage and enjoy a variety of opportunities for capturing value. Those that are slow to adopt BIM may fall short not just in efficiency but also in innovation.

How BIM Will Disrupt Competition

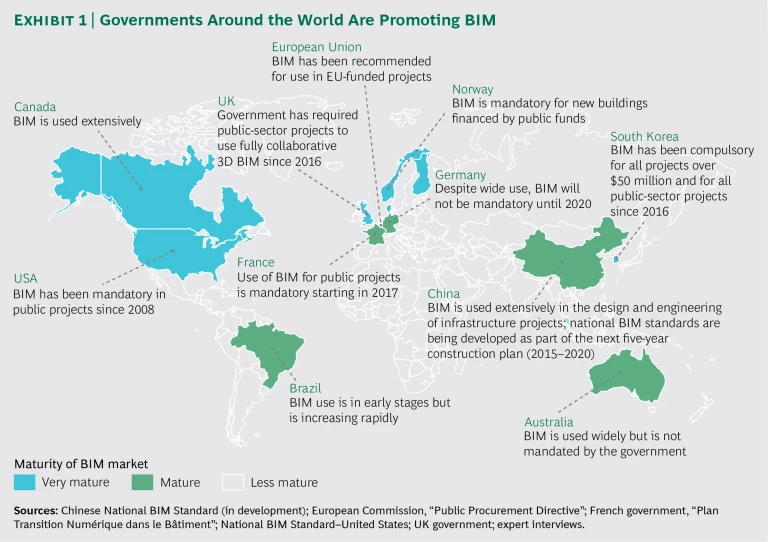

So far, BIM has spread mostly in affluent countries where its use is mandated in public projects, such as the United Kingdom, the United States, Australia, South Korea, and some Nordic countries. Given the required investment of capital, management attention, and strategic thinking, it’s impressive that so many companies are also using the technology in private projects. BIM is useful for small projects, but it’s invaluable for handling the complexities of large buildings and infrastructure, especially in light of the trend toward life cycle management. As proponents spread the word, China and some other developing countries, where a large share of the world’s construction is predicted to take place, are also showing an interest. (See Exhibit 1.)

We estimate that by 2025, BIM will have advanced enough in the E&C industry to generate productivity gains of 15% to 25%. Because of the silo-busting nature of BIM, everyone in the value chain has an opportunity to grab a piece of this pie. Over time, we expect that companies will use BIM to integrate ever more information about customers’ needs and aspirations, and to promote ever more cooperation among themselves.

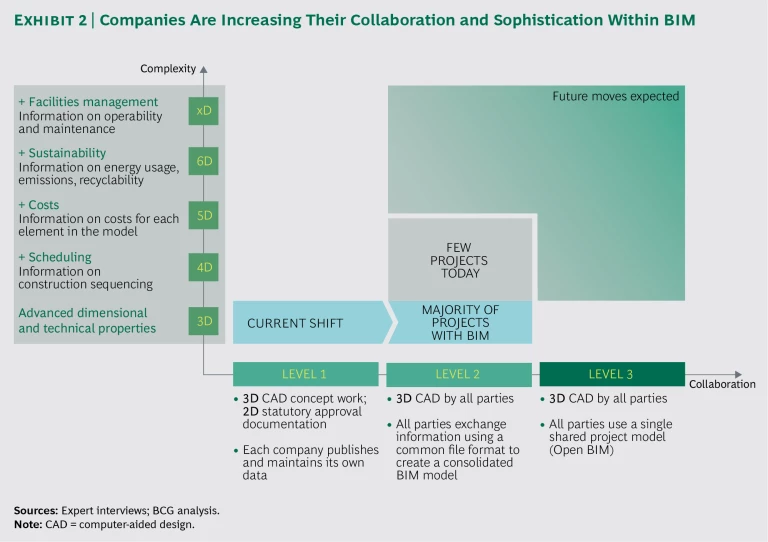

To understand these developments, it’s helpful to consider the different levels of BIM use. (See Exhibit 2.) At level one, firms do the foundational design work for a project using 3D, BIM-based, computer-aided-design (CAD) software and clash detection tools. But all the practical blueprints are generated in conventional ways. Each firm on the project works independently with its own data and has a manual interface with the BIM platform.

At level two, designs and blueprints are all fully in 3D CAD, and companies exchange at least some information in a common BIM file format. The work is still performed largely in silos, but there’s enough coordination for what’s called 4D BIM. The fourth dimension is time: designs include precise sequencing so that everyone knows which materials are to arrive at the site and when, and how they’ll go into the structure. Design, manufacturing, and logistics are tightly integrated with the actual construction. BIM can be expanded even further to encompass the dimensions of cost, sustainability, and facilities management.

Thanks to software add-ons that capture these dimensions, firms will eventually be able to calculate a project’s total value of ownership (TVO). Even if they’re still at level two, they’ll see how a given design affects the life cycle management of the facility and adjust as needed to meet the customer’s requirements at the lowest cost—work that is currently extremely time-consuming and resource-intensive.

Most E&C companies are at level one, but many are working up to level two and will eventually, we expect, advance to level three. That’s where all parties involved in a project work from a single, shared BIM model in the cloud, and all relevant communication happens around that model. Level three integrates the work of all parties, bringing together capabilities in real time to solve problems in collaborative hubs that can include a facility’s users and owners. By breaking down silos and promoting full collaboration, BIM will transform the construction business, just as digitization has overthrown the established order in other industries. (For more details on BIM technology, see The Transformative Power of Building Information Modeling , BCG Focus, March 2016.)

BIM will bring cultural as well as structural change. In many countries, for example, construction firms have had somewhat contentious relations with customers. They’ve historically charged low initial fees and made up their margins with change orders. Because BIM offers openness and interconnection, project stakeholders can work with one another in a more transparent fashion to create value for everyone.

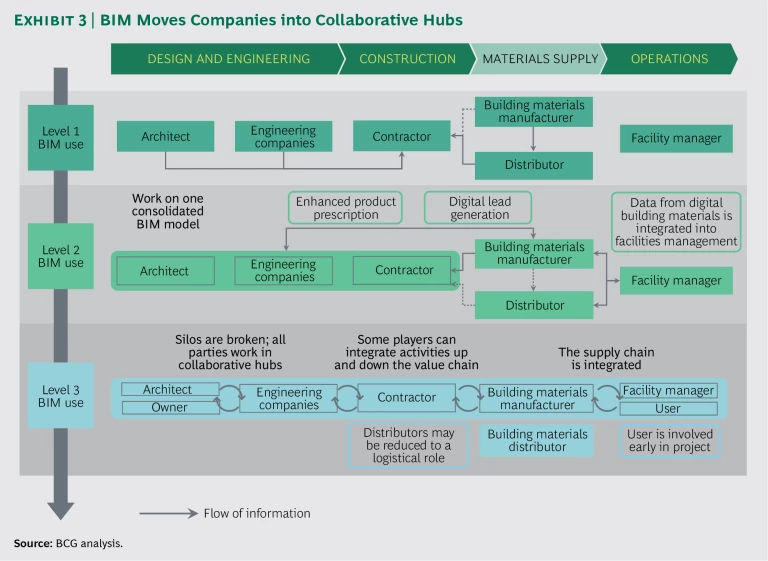

All of these shifts promote cooperation, but they also create new kinds of competition. Freed from their silos, many companies will likely expand their offerings, thus blurring the lines between players. Some contractors were starting to integrate vertically into design, engineering, and facilities management even before BIM, but BIM is accelerating that process. Contractors may also take on the role of BIM project manager, and as object libraries become readily available on the internet, they could bypass the distributors of building materials. They will also increasingly get involved with, or even take a leadership role in, life cycle management for finished buildings. (See Exhibit 3 for a look at the new kinds of collaboration BIM will promote.)

Similarly, some engineering firms are partnering with project management companies to develop the capability to steer construction projects, a task that contractors have traditionally performed. Others are considering partnerships with building materials companies to develop standardized object libraries. Not only could this squeeze out distributors, but architects and engineering firms could even codesign materials with select manufacturers, customized for each project.

Thanks to BIM, project management companies may play a leading role in the industry. They could develop advanced BIM platforms that gain enough popularity to exert network effects that threaten rival platforms. BIM is also giving rise to specialists in facilities management, experts that help clients design buildings to take advantage of emerging high-tech options.

A key question is which company will serve as the owner’s representative and therefore “own” a project’s BIM model. While all companies on a project have access to the model, the project manager administers it and so could have special access to all the data streaming in and out. Depending on how the underlying platform is structured—some will be more open than others—that access could position the project manager to capture future opportunities, such as life cycle management.

We can already see tensions related to BIM model ownership and access to the detailed materials characteristics required for facilities management. For example, large contractors and software companies have been investing in or acquiring project management companies. Distributors could also try to take advantage of their access to object information in order to jockey for position. In the next 10 to 20 years, the E&C industry—and the role of building materials companies—could look very different.

The Opportunity for Building Materials

The building materials industry produces light materials, such as facades, plasterboards, windows, and doors, and heavy materials such as concrete, steel, and composites. Most companies specialize in one or the other and focus on local or regional markets, where they often have a leading position. They generally work through distributors in those markets.

Not surprisingly, our research found that each kind of company has its own concerns about BIM. Many distributors, recognizing the threat to their strong advisory position, are working to preserve their power in the marketplace. With an eye on emerging regulations, they’re striving to aggregate the BIM object libraries from various standards and formats in order to become trusted navigators for contractors. For some of them, embracing BIM is not such a big technical step.

Light-side manufacturers as a whole are showing a bit less interest in BIM. Many of them are aligning their product and innovation strategies with the new technology, especially in reaction to emerging standards and regulations. But most aren’t actively pursuing the possibilities afforded by BIM.

Heavy-side manufacturers appear to be the least concerned with BIM, probably because their business model relies on local competitiveness and they don’t see BIM as a threat or an opportunity in that regard. They’re generally still focused on developing basic digital capabilities and converting their object libraries to meet regulations. But a few are moving aggressively into BIM and creating value as a result. The larger and more complex its projects, the more likely a materials player is to embrace BIM.

To take advantage of BIM, it’s important for materials companies to make the move to at least level two. They should build up comprehensive object libraries that mesh with those of other BIM players. Equally important is their willingness to collaborate creatively with other companies.

A favorable local value chain can accelerate BIM investments. If other companies in the local E&C industry have developed BIM capabilities, or if sophisticated project management companies have emerged, it’s easier for materials companies to move quickly. Or they may feel pressure to invest in BIM from local and national regulations, and from new materials rivals such as digital-native distributors or lower-cost international manufacturers.

But materials companies don’t need to wait for the rest of the value chain or for competitors before taking action. They can shape the marketplace in their favor by joining policy working groups that support government and industry decisions, even in countries where BIM has not yet arrived.

A key issue for policymakers is whether to allow architects and engineers to specify a brand of building materials for a public project. BIM makes it easier for them to do so. If governments allow the practice, materials companies will need to market their libraries more actively to architects and engineers. Another major policy decision involves whether to require BIM-driven calculations on the total value of ownership (TVO) for public projects. Such a step would transform how decision makers choose objects, favoring higher-value-added building materials, which tend to lower the TVO.

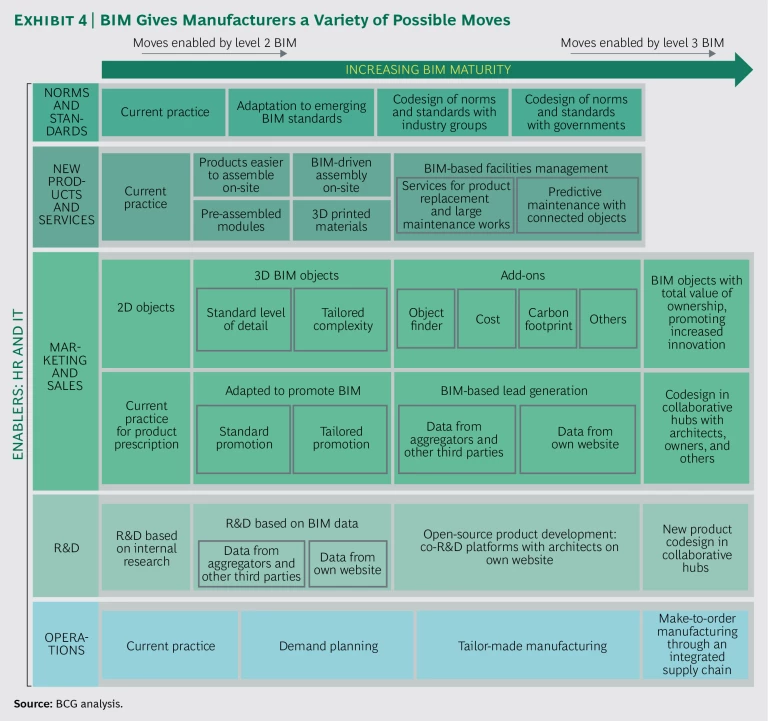

As materials companies move into BIM, they can seize opportunities in three areas: boosting demand for existing products, developing new offerings, and moving into BIM-based facilities management. (For a comprehensive, functional account of the activities enabled by BIM, see Exhibit 4.)

Boosting Demand with Advanced Object Libraries and Add-Ons. The object library is where materials companies generally make their first BIM investments, because it requires relatively little organizational and strategic change and is mandatory in a growing number of countries. Most BIM object libraries for building materials still largely just restate information that is already available in catalogues and elsewhere. But BIM’s digital capabilities offer many ways for companies to improve how they promote their products. Here we discuss how light-side and heavy-side manufacturers can use object libraries and add-ons to advantage. For a look at how distributors of building materials can work with these tools, see “A Marketing Opportunity for Distributors.”

A MARKETING OPPORTUNITY FOR DISTRIBUTORS

Like manufacturers of building materials, distributors can take advantage of BIM to build better object libraries with their own add-ons. Their larger goal is to develop BIM-based value-adding activities for engineering and construction companies looking to improve their offerings for building owners. For that purpose, distributors should build up their BIM expertise and apply it to what they already know about customers’ needs.

The first step is to promote common BIM standards by which distributors can aggregate manufacturers’ libraries. They can then help each customer sort through the listings—either directly or using special add-ons that the distributor develops—and find the materials that best meet its needs. Meanwhile, distributors can digitize their logistics in conjunction with BIM in order to provide just-in-time product delivery.

For small projects, some distributors have used BIM to create easy-to-use 3D-modeling tools. These let customers design buildings and pick the right materials from the distribution network using criteria such as energy efficiency, without making a full investment in BIM.

Simply by making their libraries compatible with various software standards, materials companies can expand their potential customer base beyond local distributors and contractors, and become more competitive relative to peers. The greater opportunity lies in customizing the library so that it fully expresses the distinctive quality of the company’s materials or its service capabilities.

Building an effective BIM library involves three key decisions, all of which require a tradeoff between the convenience of outsourcing and the opportunity to demonstrate distinctive in-house capabilities. The first decision is the choice of software format (such as the formats developed by Autodesk, Dassault Systèmes, Graphisoft, and Trimble) and of BIM object standards (such as IFC, ISO 29481, or PPBIM). Aggregators can help companies make the library as compatible as possible with others, but it’s important to avoid formats and standards that could prevent differentiation.

The second is the make-or-buy decision regarding the design of the 3D objects. So far, most materials players are outsourcing the creation of their object libraries, but they may want to bring this in-house to gain the flexibility to demonstrate how they can respond to customers’ needs. Large companies might want to acquire a BIM software firm to boost their abilities here.

The third decision is where to display the library. Many companies are using reliable, unbiased websites such as nationalbimlibrary.com, bimobject.com, polantis.com, bimstore.co.uk, and datbim.com. But it’s important for companies to offer object libraries on their own websites as well. Many architecture, engineering, and contracting firms might discover a company’s materials on an aggregate library but then download the library directly from the manufacturer to ensure BIM object quality. Even more important, self-listing frees a company from aggregators’ limits on the ability to display special capabilities.

Once a materials player has preserved the flexibility to differentiate itself, where should it start? To highlight their offerings, some manufacturers might benefit from setting up advanced BIM object finders on their own websites that are more customized than they could be on any aggregator’s site. By hosting object finders, companies can monitor downloading at a more granular level and steer their sales and R&D efforts accordingly. Some specialists in insulation and aluminum facades have already done this. Indeed, manufacturers can do a great deal to beef up their libraries’ search-and-display options for a variety of customers.

Many BIM libraries provide more detail than customers require in the early phases of a project. If architects and engineers plug complex BIM objects directly into their models, they could end up with models that are difficult to modify as the owner’s preferences emerge. So they create their own simplified versions of the BIM objects. Companies that do this for them will gain an advantage. Accordingly, some materials manufacturers have proposed libraries that would automatically adapt to the concerns of each kind of industry participant.

Materials companies can also use object libraries to showcase their technical abilities by expanding the information that is available on each item. Libraries can be set to emphasize a product’s contribution to energy efficiency and other performance measures, as well as to meet various operational and maintenance requirements.

Add-ons offer further opportunities for differentiation. Several materials manufacturers are beefing up their libraries with software add-ons that make it easy for customers to assess the impact of various materials on a project. In markets that don’t require TVO calculations, a manufacturer can set up a TVO add-on so that building owners can still see which materials lower the cost of construction and facilities management. Contractors would welcome an add-on that promotes equipment that includes pre-optimized sequencing and so is especially easy to install. Architects and engineers, by contrast, might seek information on advanced technical properties in order to offer their customers innovative finishes and other features. Add-ons could also address country-based regulations on safety, energy efficiency, carbon footprint, and cost of ownership.

Some light-side manufacturers already offer add-ons that help customers find materials with thermal or fire resistance. Others are working on add-ons that showcase the time required to install their products. Meanwhile, some heavy-side counterparts have increased sales by offering add-ons promoting the technical robustness of their materials. Operability and maintenance are also of big interest to customers. As the industry moves into level three BIM, collaborators will be increasingly concerned with construction sequencing and costs, so add-ons in those areas could stand out.

As architects and other players gain more power to prescribe specific materials in construction, manufacturers can use add-ons to reach out to them. One light-side glass manufacturer developed a tool to provide a realistic view of a proposed building that featured its product.

The sky isn’t the limit. Materials companies have to work within the ecosystem of potential add-ons determined by the software companies that create the BIM platform. So manufacturers will need to align their add-on strategy with their chosen platform.

Investments in object libraries and add-ons could pay off handsomely over time. A richer, more accessible object library will help manufacturers sell more products to a wider set of buyers. Materials companies will have an easier time bypassing intermediaries and addressing users directly, giving those companies an opportunity to differentiate their offerings. Some light-side manufacturers have even used BIM to sell internationally.

Robust object libraries and add-ons boost the information that goes out to potential customers. But BIM also allows companies to track searches in real time of their libraries on their own websites. That information boosts lead generation, allowing a sales team to propose products that match a customer’s requirements. Already some manufacturers report that they have more leads on customers looking for specific products from object libraries than from other channels. Incoming information also improves R&D, since companies can analyze searches in aggregate to spot trends in customers’ needs and, in the case of particularly adept materials companies, to codesign products with architects and others. While searches from individual companies are the most valuable, searches from aggregators provide useful information, too.

Developing Higher-Value Offerings. BIM’s advantages extend far beyond richer object libraries. By providing real-time information on exactly what a project needs in each area, BIM allows materials companies to offer products and services that were technically impossible before. We believe the opportunities are vast, and we’ve already seen a variety of new offerings with strategic implications.

One opportunity is in component design. A common challenge in construction is that builders have to assemble many components onsite. This assembly work can slow down a project or introduce problems that need to be corrected later on if the components don’t match the requirements of the structure. With BIM, manufacturers can customize designs for a specific project so that builders can assemble components quickly and efficiently, with much less need for rework. Some materials companies are exploring partnerships to develop products that interface easily with one another. These partnerships could also offer design and logistics services that would save contractors substantial time and trouble.

A related opportunity is in robotics. Materials players could encourage manufacturers to use robotics for onsite assembly, especially for complex modules. After the London Olympics, the main stadium needed a new roof to enable its use for a wide range of events. To make this difficult job easier, the parts of the roof were prefabricated and assembled onsite by robots. The contractor drew on the BIM model, combined with satellites, to give the robots precise guidance. While some contractors will want to own robots, many will prefer to lease them. Materials players could then develop materials and services that work especially well with robots.

Pre-assembled modules are another new offering made possible by BIM. BIM ensures a more exacting design and enables better site scheduling so that modules arrive only when needed. Pre-assembled modules generate less waste than those assembled at the building site, though they can be costly to transport because of their size. They have been used in several projects in Europe, such as in Sweden’s Karolinska University Hospital. They are also becoming popular in China, where weather often disrupts construction and where contractors struggle to attract workers to remote sites. For the Fondation Louis Vuitton art museum in Paris, the architects designed a steel structure with complex curvatures. As with the London stadium, the manufacturer drew on the BIM model to precisely guide the tools that shaped and cut the metal. Thanks to this tight control, the manufacturer could prepare structural modules in the factory and ship them directly to the building site.

Some projects are relying almost entirely on pre-assembled modules. For the Leadenhall Building in London, 83% of the construction work was performed offsite. The windows were constructed and assembled primarily in China, but they fit the building well thanks to BIM’s direction. As this demonstrates, BIM has the potential to unleash international sourcing, especially for complex tailor-made products.

Manufacturers are taking the lead with factory-assembled modules because they have the capacity to construct and move them. Distributors could also enter this space, drawing on materials from a mix of manufacturers to improve quality. But doing so would require a significant capital expenditure, which would be risky if demand for the modules was intermittent.

With 3D printing, materials companies may be able take customization to another level. The technology is still experimental, but specialized builders are encouraging its use for complex building parts and even entire structures. BIM, which can generate printer-ready object files that precisely match what is needed for the design, makes this technology practical.

By combining BIM and 3D printing, China’s WinSun Decoration Design Engineering Company has been building a series of inexpensive houses and apartment buildings, some of which are five stories tall. The company prints sections of each structure with layers of a paste made of glass, cement, steel, and hardening agents. But 3D printing is likely to be especially useful for creating entirely new kinds of components that are used in complex structures—components that are feasible only because of the technology. Just as 3D printing is generating honeycombed aircraft structures that are both lighter and stronger, it could offer new possibilities in building construction.

Materials companies can encourage these developments, and better position themselves in the value chain, by proposing materials for use in 3D printing. Some manufacturers have already developed cement that works as 3D printing “ink.” They can also assess the feasibility and opportunity for making their products with 3D printing. Heavy-side manufacturers could offer large printed modules, while their light-side counterparts could explore the possibilities not only for existing offerings but for new products.

Just-in-time data-driven logistics is essential to these new services. Materials companies will need this capability when 4D BIM enables the detailed sequencing of construction. This service could come from distributors or even new players that specialize in data-based logistics. Eventually, construction will be tightly integrated through collaborative hubs, leading to make-to-order optimized manufacturing.

Moving into BIM-Driven Facilities Management. The third option for building materials companies is to move beyond construction altogether into services. This is a major opportunity, as most of the overall building cost arises from operations, not construction. BIM offers a foundation for comprehensive facilities management, especially in light of the trend toward “smart” buildings. Using detailed BIM models, owners can connect a building’s basic information with data from sensors monitoring its operations, thus optimizing operations while meeting occupants’ needs and even offering new services. These sensors will be embedded in the building materials. Accordingly, we believe that all materials will eventually need to be “smart.”

The Edge building in Amsterdam, for example, installed sensors in 3,000 lighting fixtures to measure movement, temperature, humidity, and CO2 levels. In Sydney, the design startup ineni Realtime used BIM-based 3D modeling to give owners spatial awareness of the entire building. This comes in handy not just for security but also for maintenance and repair tasks. Technicians, for example, immediately know how tall a ladder to bring to a job.

Light-side manufacturers and distributors will have a particularly valuable opportunity in buildings. BIM can reveal the location of their products in the structure and help with replacement and big maintenance jobs.

Heavy-side manufacturers have an opportunity in sensor-connected infrastructure. With sensors in place, engineers can discover problems such as cracks in cement during and after construction. In the “smart cities” of the future , city managers can monitor traffic patterns and pollution trends and direct drivers accordingly.

To realize this opportunity, manufacturers need to develop building materials that incorporate sensors and other smart connections. They could then consider devising mechanisms that monetize the benefits of those materials over the life cycle of the building, with fees rising in proportion to the owner’s savings. Distributors could serve as expert intermediaries, offering operational services to help realize those benefits. All of this will require forming new kinds of relationships with end users and other customers. (See “Developing New Kinds of Leverage.”)

DEVELOPING NEW KINDS OF LEVERAGE

As BIM brings more information and transparency to engineering and construction, companies will find themselves with less negotiating leverage. Product information will become highly standardized and accessible, enabling companies and customers to compare suppliers. Change orders during construction will be fewer and smaller, and better understood, so companies will no longer be able to depend on them to boost margins. Customers will be able to assess various offerings according to the total value of ownership.

But as BIM takes away, it can also give. Materials companies should have more data on market activity, allowing them to see how well the current supply matches demand. They could try out dynamic pricing that adjusts accordingly.

The bigger solution to the pricing squeeze, however, will be to invest in BIM-driven opportunities. Materials players that offer richer libraries, value-added construction activities, and facilities management will stand out.

How to Get BIM-Ready

To realize all these opportunities, building materials companies must take into account the holistic nature of BIM. The technological changes go far beyond BIM itself and well beyond what IT can handle. Leaders must make the adoption of BIM an enterprise-wide project guided by teams throughout the organization. Larger players may need teams for each function and for each business unit or country. Each function will have specific issues to address:

- Strategy needs to articulate the company’s desired positioning in each of the three big opportunities we have described: object libraries, higher-value offerings, and BIM-driven facilities management. How realistic is it to go after add-ons, modularization, or “smart” materials? And how big is the threat or opportunity represented by BIM-driven standardization and price transparency? From there, companies can develop a customized digitization plan that exploits BIM. That plan may include a variety of partnerships to bring in scale, expertise, and other capabilities.

- Human resources, which we believe will be the cornerstone of this transformation, needs to define the teams and governance structure for BIM. Should teams be established centrally, by business unit, or by country? How does BIM change the organization’s required capabilities, especially in marketing and sales, R&D, IT, and sourcing? What does the company need in order to manage the change and gain the needed skills?

- Marketing and sales must consider how the company can enrich and extend the object library. How can it ensure successful searches and promote added value with add-ons? As the industry moves toward higher levels of BIM use, the company will need to adjust its strategy to promote prescriptions of its branded materials and take advantage of new distribution mechanisms. Along the way, managers need to use the data from object library searches for better lead generation.

- Likewise, R&D should use data from library searches to better understand emerging needs in the marketplace and to recast its projects accordingly. Managers can also prepare to codesign products with architects, engineers, and owners.

- Operations staff members will need to understand how BIM affects the management of the supply chain. They’ll likely need to integrate their activities with those of architects, engineers, and contractors. Looking ahead, are they ready to move from “make-to-stock” toward “make-to-order”?

- For IT, a big challenge is building an effective object library. But IT will also be called on to provide resources and infrastructure to support the BIM transformation and, over time, to protect the intellectual property and operating data that will be increasingly available online.

Distributors will need to address most of the same questions, but they will want to pay special attention to continuing to offer valuable services in order to maintain their position as intermediaries. How might access to manufacturers’ product data change? They’ll want to decide how to position themselves against, or with, BIM online aggregators. They could also propose new services for facilities management.

Regardless of their direction, distributors will want to ensure common norms and standards among manufacturers. The more data from suppliers they can capture, the better. They’ll also want to shift their sourcing to BIM-ready manufacturers and invest in understanding the emerging universe of software add-ons. Also important will be encouraging architects and contractors to call for generic, rather than branded, materials, which will give distributors maximum freedom.

By embracing the possibilities of BIM, building materials companies can shore up their competitive position, engage in rich collaborations, and increase their capacity for innovation. They can boost their existing business while opening up possibilities in higher-value areas.

But getting there will require many companies to change their largely reactive stance. The more they can help chart the future in their industry, the better their long-term position in the marketplace.

Acknowledgments

The authors are grateful to BCG clients for their valuable inputs and insights. They thank their BCG Industrial Goods colleagues Andreas Renz, Christoph Rothballer, and Sven Witthöft for contributing their insights, and Maxence Vanheuverswyn, who helped write the report.