There’s a continuing digital disconnect in corporate marketing departments—and a widening digital divide as well. CMOs and others with marketing responsibility should take note.

Many companies have refocused their marketing functions on a digital or an omnichannel approach. But too many appear to be spending more on digital without building up the capabilities that produce bang for the digital buck. In late 2016, in collaboration with Google Digital Academy, BCG surveyed some 2,200 marketers at 141 advertisers, and 2,900 employees at 126 advertising agencies, on their organizations’ digital-marketing capabilities and learning and development efforts. (See the sidebar below.) The results were surprising—and not in a positive sense.

ABOUT THIS REPORT

With the rapid growth in digital spending and the increasing impact of digital channels on consumers, it’s more important than ever for marketing organizations to understand where and how they can most effectively influence consumer behavior.

In 2016, Google again commissioned BCG to assess the current state of digital skills in marketing organizations. The findings outlined here were discussed with Google executives, but BCG is responsible for the analysis and conclusions.

We surveyed some 2,200 marketers (including digital specialists, brand managers, customer marketers, and public relations practitioners) at 141 advertisers in 41 countries (Australia, Austria, Belarus, Belgium, Brazil, Bulgaria, Canada, Chile, Colombia, Denmark, Finland, France, Germany, Greece, Hungary, India, Indonesia, Italy, Ivory Coast, Japan, Latvia, Luxembourg, Mexico, Morocco, the Netherlands, Norway, Poland, Romania, Russia, Singapore, Slovakia, South Africa, South Korea, Spain, Sweden, Switzerland, Turkey, the United Kingdom, the United States, Venezuela, and Vietnam) on their organizations’ digital-marketing capabilities and learning and development efforts to understand how they rate their marketing organizations against digital-marketing best practices. Participating companies were from the retail, consumer products, financial services, and technology, media, and telecommunications industries, as well as from public-sector, education, and not-for-profit organizations. Our research also included 2,900 employees at 126 advertising agencies in 28 countries.

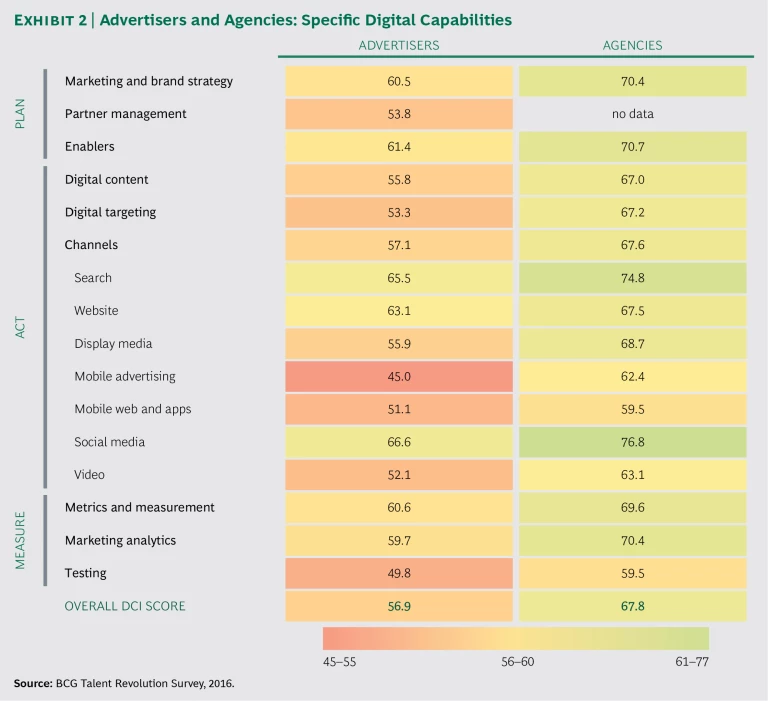

We asked marketers to assess their organizations’ capabilities across a digital-marketing framework comprising nine categories of skills. (See the exhibit below.) The first three categories are related to planning: marketing and brand strategy, partner management, and critical organization enablers. The next three involve execution: digital targeting, digital-content development and distribution, and expertise in seven digital channels (search, websites, display media, mobile advertising, mobile web and applications, social media, and video). The final three skill categories relate to measurement: metrics and measurement, marketing analytics, and testing.

Marketers rated their teams’ current capabilities and performance in each skill and in each of the seven digital channels on a scale from one to six. We then turned the responses into an index, with 100 equaling best practice.

The disconnect: Advertisers ascribe high importance to such capabilities as digital- content development and to fast-rising digital channels such as mobile advertising. Despite this, we found that not much has changed since 2015, when we conducted an initial survey of 1,100 marketers at 57 companies. (See The Talent Revolution in Digital Marketing, BCG Focus, September 2015.)

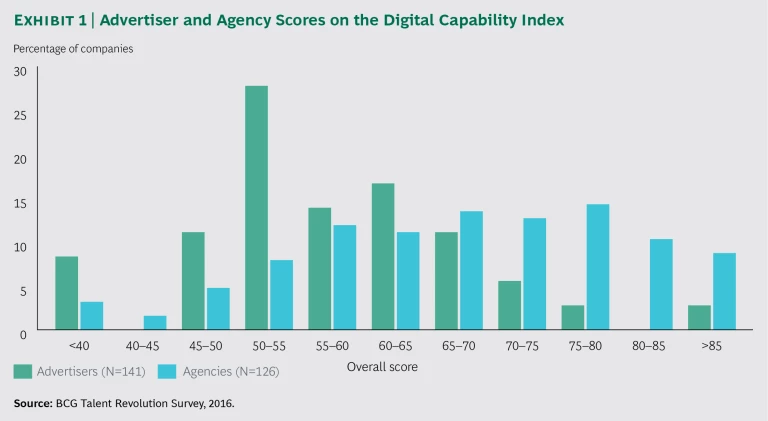

Our latest survey found that on our Digital Capabilities Index (DCI), a 100-point scale (with 100 indicating best practice), the average score was 57—exactly the same as it was 18 months ago. (See Exhibit 1.) Two-thirds of advertisers scored 60 or lower, but the actual numbers are less important than the lack of any demonstrable improvement. The results were consistent across all the countries surveyed.

The divide: Agencies are in better—while not great—shape, with an average score of 68. About two-thirds of agency respondents ranked their organization’s digital skills at 65 or higher, far from a best-practice 100, and there were some noticeable weaknesses in the mobile and video channels, among other areas. Perhaps more important, the differences between advertisers and agencies in certain key areas, such as digital targeting and mobile and video, are considerably wider than in the overall scores. For example, in mobile advertising, agencies scored 62 while advertisers scored 45. In digital targeting, agencies scored 67, advertisers 53. (See Exhibit 2.)

The current situation presents both sides of the digital-marketing partnership with questions about how they should work together going forward. Advertisers, in particular, need to build up their digital capabilities in order to improve their own performance and guide their agencies’ work effectively.

Big Money and Fast-Paced Change

Spending on digital channels continues to rise. At the end of 2016, global spending on digital advertising was set to top $180 billion, according to Magna Global, which projects double-digit growth through 2020. Digital channels now represent a third of all advertising spending worldwide; this year, they will overtake TV, driven by the strong growth of social media and video. Advertisers are buying more digital services from agencies: digital’s share of agency revenue passed 40% in 2015. And agencies are responding to the demand. According to Advertising Age, in December 2015, US agency employment reached its highest point since the dot-com bubble of the late 1990s—almost 200,000 people.

Digital and mobile channels and advanced marketing techniques, such as digital targeting and data analytics, are reshaping consumers’ purchase pathway for companies in all industries, from travel and hospitality to consumer products and retail to financial services. Different channels increasingly require different content, and the more advanced marketers are using technology to actively shape consumers’ cross-channel experience of their brands and products. (See, for example, Travel Innovated: Who Will Own the Customer?, BCG Focus, January 2016; How Digital Delivery Puts the Restaurant Value Chain Up for Grabs, BCG Focus, January 2017; The Winner-Take-All Digital World for CPG, BCG Focus, March 2016; and “Digitizing Customer Journeys and the New Insurance IT Model,” BCG article, August 2016.) The risk for many advertisers is that they keep falling further behind, as we emphasized in 2015, since digital technologies and the complexity of their application are advancing at dizzying speed. While many companies are struggling to develop digital content and employ social media, digital marketing is already moving toward new capabilities. The most significant may be personalization, marketing to individual consumers at scale. (See, for example, “It’s High Time Airlines Got Personal,” BCG article, August 2016.)

It’s particularly surprising that advertisers and agencies continue to give themselves low scores on testing (50 and 60, respectively), since testing, learning, and adjusting the campaign approach or design are among the most powerful capabilities enabled by digital technologies. The ability to see what is working and what is not, and to experiment almost in real time with adjustments and improvements, is essential to using digital channels effectively. This is especially true in fast-growing channels that are also evolving at a rapid pace, such as mobile web and apps, in which both advertisers and agencies—perhaps not surprisingly—also score poorly (51 and 60, respectively).

In another area of fast-rising importance—video—the data shows a specific disconnect. While a good number of agencies and some advertisers reported that they understand the role of video in the consumer journey, they are still mostly putting existing TV assets online and not investing in the digital capabilities that make online video a more effective medium than TV. Too few companies, for example, create more than one video per campaign, tailor their video creatively to fit consumers’ use of different devices and digital platforms, or make use of such tools as hotspots and sequential retargeting to keep consumers engaged with their brands. In other words, marketers are still using new and advanced tools in old-fashioned ways.

Advertiser Inertia

Given the pace of technological change and the growing influence of digital technologies throughout the marketing function, we expected advertisers to show material improvement in our 2016 survey—the kind that would indicate that they are moving in the right direction, if still getting up to speed. Instead, we found more inertia than action (although there certainly are exceptions). We see at least four reasons:

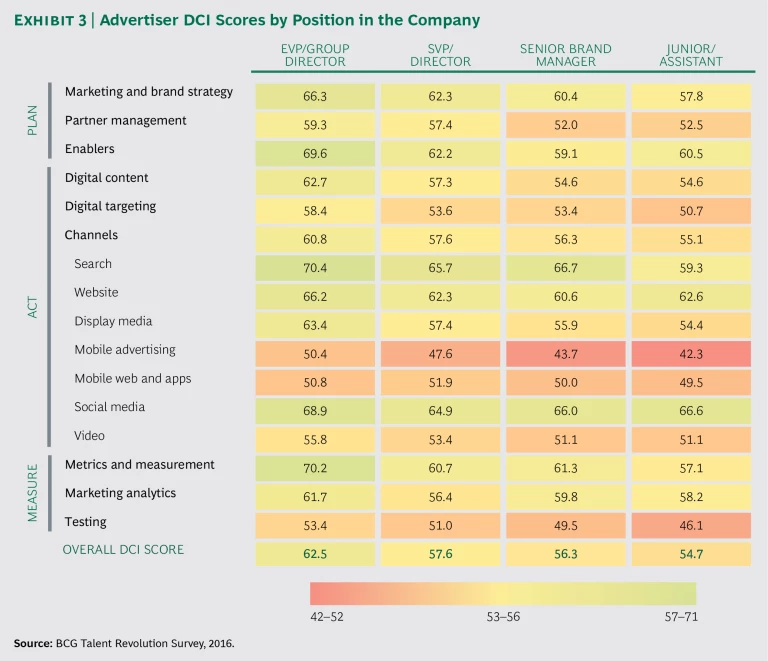

- Lack of Understanding. Our survey surfaced indications of a lack of understanding at senior levels of marketing management about the strength of companies’ digital capabilities. Across all three phases of the marketing function—planning, executing, and measuring—senior managers consistently rated their departments’ capabilities higher, and often significantly higher, than junior executives did. (See Exhibit 3.) For example, marketing and brand strategy capabilities were assigned a rating of 66 by the most senior managers, compared with 58 by junior managers, while digital-content capabilities were rated 63 versus 55, respectively, and metrics and measurement were rated 70 versus 57. It would appear that the ground-level view, if not more realistic, is at least more skeptical. It also bears remembering that junior executives are likely to be younger and, because they grew up in a digital world, more knowledgeable and sophisticated about how digital marketing works.

- Lack of Vision. Advertisers gave themselves a DCI rating of only 60 on their ability to build digital strategies and plans. They are especially weak in mapping the consumer journey, tailoring content to match the stages of that journey, using ROI metrics to adjust the marketing mix across channels for greater impact, and measuring the effects of their campaigns on actual business outcomes such as sales.

- Lack of Organizational Support. Advertisers recognize that they are weak in attracting and retaining critical digital talent (a DCI score of 56). They also do not see digital marketing receiving the support it needs from other functional areas of their organizations, such as finance, legal, and IT. And they fault marketing technology platforms for not enabling them to make the most of consumer data.

- Lack of Assessment. Measurement is a continuing area of weakness. Companies scored no higher than 61 on their ability to gain access to and derive insight from data, choose the right metrics and targets, and measure campaigns effectively. (See “Making Sense of the Marketing Measurement Mess,” BCG article, February 2017.)

Since our survey was a self-assessment, advertisers and agencies that are behind the curve may not be aware of how much they lag or why. But whatever the reasons for a company’s failure to make progress, lack of talent, in particular, hurts its ability to plan, execute, measure, and improve digital campaigns. As a result, many companies either mount subpar campaigns or rely on the support of their agencies to plan the work, do the work, and measure the results. So far, it appears that many are following the second course—outsourcing campaign development and execution, just as they have long outsourced creative development and media buying.

Those that outsource pay a big price—in more than just agency fees and commissions. Digital campaigns are different from their offline equivalents. They are continually modified and adjusted in real time based on real-time results. Marketers that are not actively involved in the test-learn-adapt process lose touch with both their campaigns and their digital consumers. They don’t know whether their strategies are being faithfully executed or how their budgets are being spent. They are hard-pressed to explain how or why success—or failure—occurred. And perhaps most critically, they don’t learn how to access and use the plethora of digital data that campaigns generate—the data that makes more advanced techniques, such as personalized outreach, possible.

Advertisers face another skills-related challenge. Unless they improve their performance and their learning and development, the digital divide is set to widen. These companies will find it increasingly difficult to attract technical talent as they compete for skills not only with agencies but, more significantly, with digital natives, tech startups, and other organizations. Since talent attracts talent, it will become harder and harder for advertisers that lack technical skills to fill the void.

Agency Opportunity

All of this spells opportunity for agencies, with the caveat that they need to raise their own game as well. That agencies gave their capabilities a higher rating than advertisers did makes sense (this is their core business, after all), but the fact that they assign themselves DCI scores in only the 60s and 70s in most areas of development and execution should be a cause for concern. Agencies do have an opportunity to increase billings by compensating for their clients’ weaknesses, but to add the most value, they need to improve their own skills in several key areas, starting with mobile and video. These channels are critical now, and their importance will only increase in importance. Testing is another area of weakness. The ability to test and adjust creative content and campaign formats and methods is one of the biggest advantages that digital technologies provide marketers. Yet both advertisers and agencies give themselves poor grades in how they test content, creative materials, targeting options, and offline content (such as TV commercials on YouTube). (See the appendix.)

The bigger opportunity for agencies lies in building long-term partnerships with their clients. These partnerships should be based on the development of joint skills enabling the design and execution of digital campaigns that can further continuing consumer relationships and engagement both online and offline. Such campaigns are the ultimate promise of digital marketing, but so far they are more the exception than the rule. The data suggests some reasons why.

Agencies scored relatively high in critical campaign design capabilities such as these:

- Building a deep understanding of consumers by connecting data from diverse sources

- Having a clear and up-to-date map of consumer journeys related to the client’s brand or product category

- Knowing which digital touch points are the most critical to specific marketing objectives

Agencies also believe they are good at developing digital-content strategies that tailor content to key moments in the consumer journey and at translating marketing objectives into a set of actionable metrics.

Advertisers, in contrast, scored themselves considerably lower on these campaign-building components. This suggests that agencies are doing an inadequate job of conferring their campaign skills on their clients. Moreover, agencies have not impressed their clients with the quality and extent of their capabilities. Advertisers consistently rate their agencies (and themselves) in the low- to mid-50s on the DCI for these attributes:

- Being at the cutting edge of marketing in a digital world (in both a media and creative context)

- Being clear on how agencies’ specific roles affect the overall success of the campaign

- Orchestrating agency partners so that they work as one team

Part of the reason for these low ratings may have to do with incentives. Advertisers gave themselves a rating of only 45 on whether “campaign outcomes are a critical component of how we reward our partners.”

Agencies have the lead, for now at least, in digital-marketing skills and capabilities. Smart agency heads will resist the temptation to use this advantage to maximize near-term agency revenues by taking over more and more of their clients’ campaign work. Instead, they will field multiskilled teams that work with clients to design and execute orchestrated campaigns that achieve measurable results, and in this way, build long-term digital-marketing partnerships that work.