This is an excerpt from The Comeback Kids: Lessons from Successful Turnarounds .

I n the wake of the financial crisis of 2008, HSBC faced rising costs and regulatory challenges. From the 1990s to 2006, the bank made a series of acquisitions and grew its balance sheet fivefold. It ended up with operations—many of them standalone entities with their own processes and IT systems—in 88 countries. The result was a complex operating environment and few economies of scale.

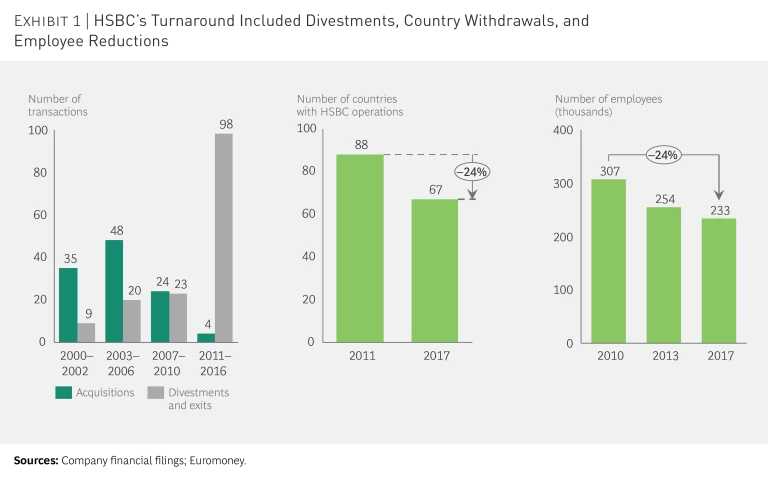

When Stuart Gulliver (who started at HSBC at age 21) took over as CEO in 2011, he immediately launched a turnaround, starting with rapid streamlining and simplification measures to fund the journey. The company reduced its head count by more than 20% and the number of countries where it operated from 88 to 67. (See Exhibit 1.) Despite this geographic contraction, HSBC still covers 90% of global trade and capital flows, more than just about any other bank in the world. In all, these measures saved $4.7 billion by the end of 2016 and are expected to amount to $6 billion in savings, mostly from middle- and back-office functions, by the end of the turnaround, in 2017. In terms of operations, HSBC improved its capital performance, reducing risk-weighted assets by nearly $300 billion.

HSBC also restructured the organization to eliminate excess management layers and give leaders the right level of accountability. The structure, introduced in 2011, consists of four global businesses—each run by an executive who reports directly to Gulliver—supported by a set of globally run support functions. That has led to significant efficiencies. “It is only now, running businesses as single global verticals, that you can negotiate your procurement in ways that derive full economies of scale,” Gulliver recently told Euromoney, a trade publication. “We used to have countless separate contracts with IT companies, with the people managing our properties, with every supplier, in fact.”

HSBC restructured the organization to eliminate excess management layers.

More important, the company is making a big bet on digital, investing $2.1 billion from 2015 to 2020. Digital initiatives include automating back-office functions, improving the customer journey with mobile platforms, and creating an intelligence unit to spot financial irregularities among customers. HSBC also announced a partnership with Google Cloud for analytics and machine-learning capabilities. And the bank has a dedicated innovation unit to help it stay attuned to the movements of fintech players and digital-only competitors.

The company is making a big bet on digital.

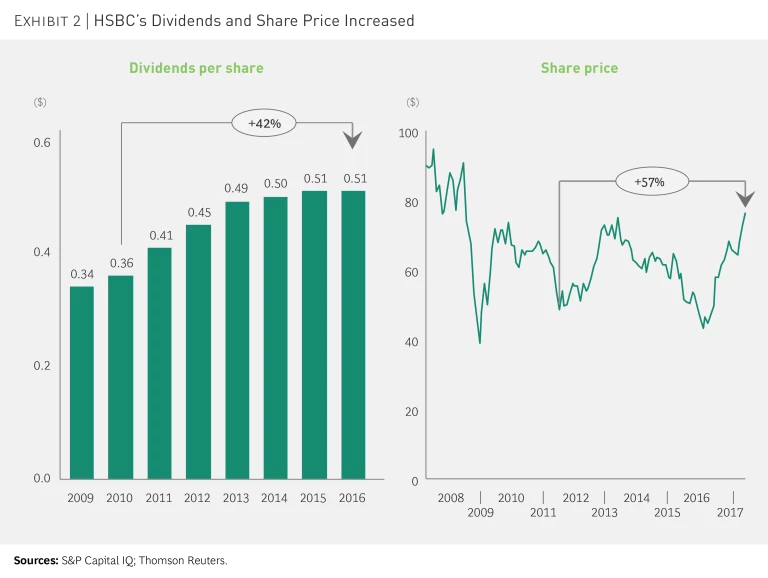

Overall, the turnaround has been extremely focused on creating shareholder value. HSBC is among the top financial services performers in terms of dividend payouts, with an increase of 42% since the turnaround began. (See Exhibit 2.)

In the past year, the company has also announced a return to shareholders of $5.5 billion in share buybacks. The turnaround, now nearly complete, has won praise from investors and analysts, and in 2017 Euromoney named HSBC the world’s best bank.