Advanced analytics have been slower to make a major impact in health care than in other industries, where new uses for data have been transformative. This is starting to change, however. Consider the following:

- One payer saved more than $350 million in administrative costs alone by using advanced analytics to transform care management and develop richer member segmentation and targeting.

- Another reduced sales and marketing administrative costs 30% to 60% with a data-driven sales force effectiveness program that used AI and advanced analytics-enabled tools to automate marketing, prioritize leads, and better understand clients’ needs.

- A mutual insurance company reduced administrative costs for underwriting functions 26% by using advanced analytics and artificial intelligence (AI) to help triage claims, automate tasks on standard claims, and improve risk-scoring algorithms.

Top health care executives are buying into the power of advanced analytics. “I really think of our future as a medicines and data science company, centered on innovation and access,” Vas Narasimhan, CEO of Novartis, told the Financial Times. “It’s essential that we use the combined power of data analytics and care teams to help people understand how lifestyle can impact health…” said Humana CEO Bruce Broussard. Plenty of companies are making significant investments in capabilities and solutions: we have found that leading payers are committing up to 10% of administrative budgets.

Still, examples of the successful use of advanced analytics in health care, particularly among payers, are more episodic than extensive. The biggest reason is that much of today’s analytics activity is driven by, and held within, a siloed department or function. It is often focused on a particular technology or technology solution, such as machine learning or natural-language processing, rather than on strategic opportunities or the needs of customers (both providers and patients). In addition, outputs are not shared across the organization. Advanced-analytics initiatives without a connection to changes in organization-wide strategy and operating model create little scalable value. Think about a payer that hires data scientists for its care management group but does not use their capabilities to support its pharmacy function. Most payers are making, or assessing, their analytics investments in a piecemeal fashion, trying to discover what analytics can do rather than taking a more purposeful approach that starts with asking where the power of analytics would be most valuable.

To gain competitive advantage, boost performance, and realize real value from data and analytics, payers should take a more strategic tack, determining first which business problems are most pressing and then how advanced analytics can best solve them. In this way, payers can develop capabilities that have lasting impact and deliver rapid business value. Here’s how they can go about it.

Start at the End

Companies should start by defining the end result they desire, such as reduced waste in specialty drugs or better, more timely support for the chronically ill. They should think big from the get-go—for example, aiming for a 2% to 3% impact on the bottom line. Ambitions that start small are more likely to stay small.

Companies should think big from the get-go—ambitions that start small are likely to stay small.

Payers should focus on the most critical problems they face and the use cases that are consistent with the enterprise strategy—for example, enabling providers to take on risk in value-based care programs if the strategy is to pass on risk to providers. They should also prioritize initiatives that can generate quick return. Programs that are self-funded and show early wins generate enthusiasm within the organization. Payers can then employ survey input, expert interviews, and benchmarking to identify a list of specific transformative use cases and prioritize each one on the basis of business potential and feasibility considerations (such as cost and time to implement).

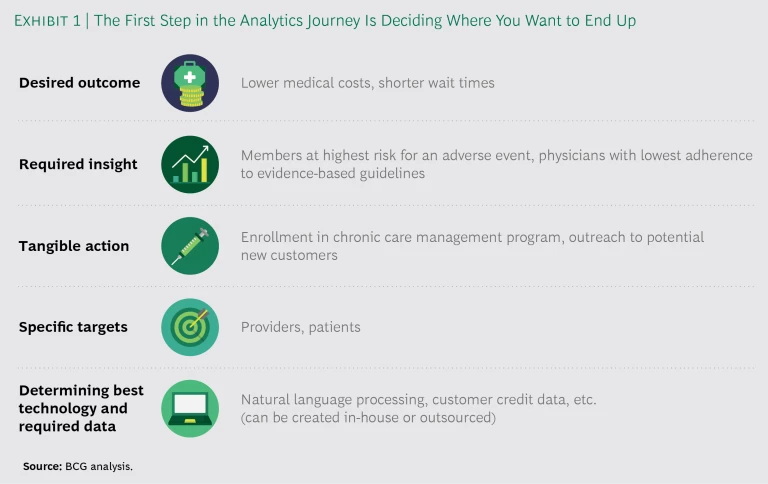

Defining the desired outcomes will also dictate how to approach the other steps of the analytics journey, from identifying the required insights through enabling the technology. (See Exhibit 1.) There’s no shortage of opportunities for impact, from member acquisition to medical management to administrative management. Examples of specific use cases in which we have seen advanced analytics have a significant effect include rationalizing product proliferation by eliminating underperforming plans, identifying consumers likely to develop expensive conditions and intervening to reduce risks, and improving customer service with simple AI algorithms. Other areas where advanced analytics can move the needle include personalization and customization for customers, continuous evaluation and improvement of processes, and greater efficiency in service delivery and operations.

One key step in the process that should not be overlooked is the last: integrating the resulting insights into business processes in ways that change how the company operates. For example, if the goal is to identify high-potential ROI patients for care management, how the payer integrates its newly developed priority patient list into the care management enrollment process will be a critical factor in successfully meeting that goal.

Organize for Impact

Companies tend to get caught up in questions of talent (How many data scientists do we need? Where do we find them?), organization (Should we centralize the analytics operation or house it in the business units?), and investment (How much do we need to spend?). There are no hard and fast answers to any of these questions. What’s more important, by far, is that companies to focus on organizing for impact. The goal should be state-of-the-art analytics capabilities that will generate insights that translate into value-creating care management actions. Invest in what we call integrators—people with both technical and business knowledge—match the structure to your organizational maturity, and invest in the areas aligned with your strategy.

Talent

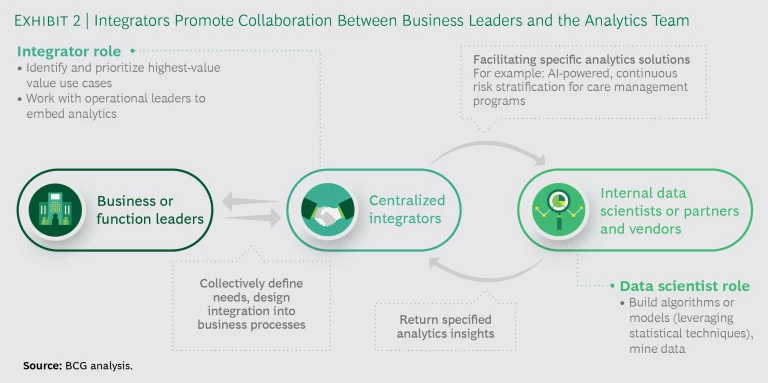

Most companies focus first on technical talent—data scientists and software engineers, for example. In our experience, smart companies look initially to hire or develop integrators—people whose understanding of the drivers of business value and working knowledge of analytics will help them lead the effort to turn data insights into operational results. These individuals are able to work with business leaders and technical personnel (whether internal or outsourced) to identify and prioritize the highest-value use cases, develop the necessary data assets, and incorporate analytics into business processes. (See Exhibit 2.) Integrators must have a good understanding of statistics and analytics. They may have previous experience in the payer industry, but the more important requirement is strong problem-solving skills.

The analytics team will also need technical experts who can handle a variety of specialized tasks, including training integrators, assessing vendors, and leading technical integrations with vendors. These data scientists, engineers, and business development specialists can also help identify and structure partnerships, joint ventures, and acquisitions.

One startup health plan recruits people who come from different backgrounds, many of whom have no experience in health care. It trains all its employees in coding by leveraging the skills of a few data scientists to teach analytically minded employees who then train their colleagues. At the same time, other employees teach the ins and outs of Medicare to new recruits with little health care background. The goal is to develop employees who understand both business processes and coding and can staff project teams made up of diversified operations and technical expertise.

Organizational Models

Companies tend to organize their analytics programs using one of three models, each with its plusses and minuses:

- Virtual. This model involves a small central management group with team members located in business units or functions. Governance, such as budgeting and reporting lines, is kept simple, and analytics teams are embedded in the business, so it is easier to implement findings. Disadvantages include lack of scale and sharing of best practices, as well as the absence of an insulated culture for analytics talent.

- Hub and Spoke. The analytics function is independent and works with associated units located in the businesses. This model takes advantage of scale while allowing for specialization of analytics capabilities in the business units. Governance can be difficult, however, particularly in delineating responsibilities between the hub and the spokes.

- Centralized. The analytics function is organized under a top executive (typically the CFO, or CIO) with dedicated resources. This approach leverages scale, ensures that analytics is treated as a priority, and provides an insulated analytics culture. At the same time, though, the analytics function is disconnected from business units that require attention if they are to integrate insights and incorporate results into daily operations.

Our experience shows that while many payers have distributed their analytics capabilities throughout their organizations, the best practice for a company in the early stages of analytics strategy development is to ring-fence a centralized advanced-analytics team with the goals of leveraging scale and creating a culture of innovation. After the group is developed and running efficiently, a more distributed model, such as hub and spoke, may make sense, with an analytics center of excellence working closely with integrators and technical experts at the business unit level.

UnitedHealth Group has gone so far as to set up its analytics unit as a standalone operation, with its own P&L. OptumIQ supports United Health’s business units and also sells its services to outside health plans. The model has achieved significant scale benefits, and the service buyback model encourages investment in use cases with the highest ROI.

Investment

Many large payers currently devote about 2% of their administrative budgets to advanced analytics, while the most innovative payers are investing as much as 8% to 10%. One startup Medicare Advantage plan is spending 10% to 15% of its administrative budget on advanced analytics. Among the broader universe of financial services companies that we have benchmarked, analytics spending averages about 3% of SG&A, with an average absolute amount of about $250 million.

How much you spend is less important than where the spending is targeted. Successful companies take on specific use cases rather than large infrastructure development investments, and they focus on developing execution skills. In our experience, most payers need to increase spending, but they should do so only in support of a clearly defined, needs-backed analytics strategy.

The most innovative payers devote as much as 10% of their administrative budgets to advanced analytics.

Adopt a Transformational Mindset

Building an advanced-analytics function takes time and is best approached as a type of transformational journey that will ultimately change how the company works. It’s important to notch some early wins—use cases with near-term impact whose success will generate income increases or cost savings that will help fund the rest of the journey. Most companies will want to adopt some form of agile ways of working that involve cross-functional teams developing analytics tools and applications in short, iterative sprints. Each iteration is tested with the business users and their feedback is incorporated into the next version. Companies should also resist trying to do everything themselves. Building the necessary algorithms requires technical expertise that many payers do not have. They will need to outsource some of the analytics through a joint venture, partnership, or purchase, which can speed the development process and contribute to a successful result.

Putting It All Together

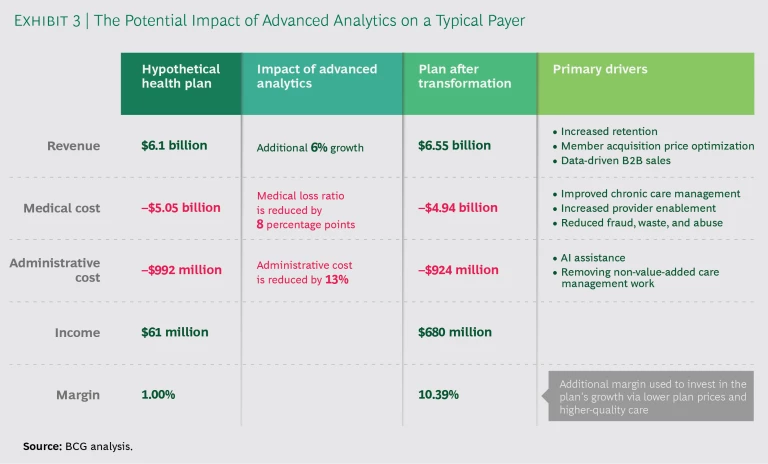

To demonstrate the potential advanced-analytics offers for health care, we recently modeled the impact of a successful transformation on a hypothetical regional payer. (See Exhibit 3.) For a company with about $6 billion in revenues, our analysis showed a 6% boost in sales from increased member retention, optimized member acquisition pricing, and data-driven B2B sales. Improving chronic care management and provider enablement, along with reducing fraud, waste, and abuse, improved the medical loss ratio by 8 percentage points. Applying AI to automate manual processes and removing care management work that didn’t add value cut administrative costs by 13 percentage points. The overall result was an increase in the company’s operating margin from 1% to more than 10% and an accompanying boost in operating income from about $61 million to $680 million, money that can be reinvested in the company’s growth through lower plan prices and higher-quality care.

These are achievable results for payers that embrace advanced analytics and follow the type of roadmap outlined above to build their capabilities. There is no reason not to start now.