Original equipment manufacturers (OEMs) of large industrial products have extremely profitable aftermarket businesses. The equipment they sell is often costly and complex, such as for airliners or power plants, and any downtime is expensive. By ensuring that their customers get the right parts at the right place and the right time, OEMs charge—and customers pay—sizable premiums.

But the world is changing. OEMs are shifting away from selling aftermarket parts and instead are guaranteeing operational time and the total cost of ownership for their equipment. These “power by the hour” arrangements are not new; they have been prevalent in some industrial sectors (like turbines) for years, but they are becoming increasingly popular in industries such as defense, where OEMs are shifting to performance-based contracts that emphasize reliability and lower costs for customers. Arrangements like these make sense in that they align the incentives between OEMs and their frontline customers, yet they also transfer much of the risk of downtime from the customer to the manufacturer.

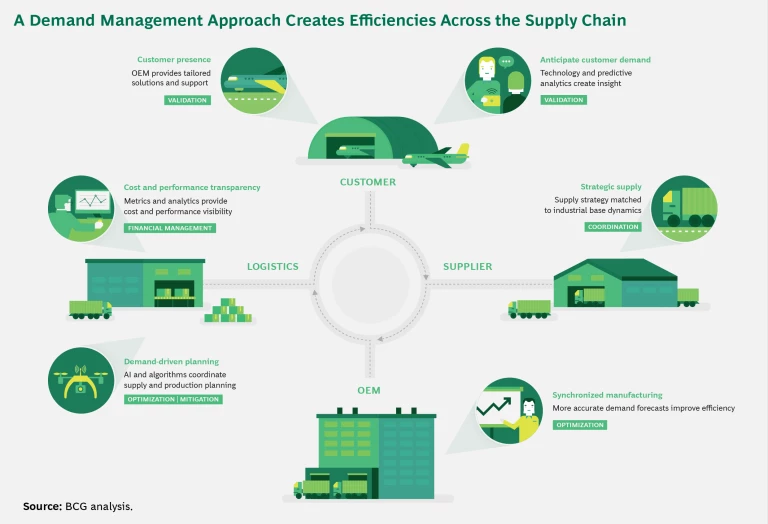

This demand management approach is dramatically different from the traditional OEM business model, and it requires that OEMs stop focusing on the supply of parts—a reactive and transactional stance—and instead proactively anticipate demand. Shifting to this model isn’t easy, but there are clear gains for those that get it right. In our experience, OEMs that implement best-in-class demand management systems can reduce costs—in maintenance, parts consumption, and overhead—by up to 25%. Contractors that serve customers in austere operating locations, where the delivery of replacement parts is difficult, may find it helpful as well.

From Supplying Parts to Managing Demand

Frontline customers are often wary of moving away from the traditional supply-based system, which is what they know best. Some of their reluctance is the result of previous demand-based schemes that were implemented in a half-hearted and small-scale manner, often leading to downed equipment. Moreover, many customers themselves struggle to accurately predict their future demand for replacement parts. Front-line planners tend to forecast demand without factoring in any constraints, and the procurement function applies a “believability factor” to those projections. As a result, customers generally want as many spare parts as they can keep on hand, with budget and inventory costs the limiting factors. This approach has favored OEMs because it maximizes the sale of aftermarket parts.

When the manufacturer takes on the responsibility of keeping equipment operational, managing demand becomes critical.

In contrast, when the manufacturer takes on the responsibility of keeping equipment operational, managing the demand side of the equation becomes critical. Now the manufacturer is not only selling aftermarket parts, it is selling outcomes on the basis of an agreed-upon price. When done right, these arrangements can be far more lucrative for the OEM than the traditional supply-based approach.

Holistic Demand Management: Five Interconnected Activities

For OEMs, demand management requires five distinct activities, each involving an increasing degree of maturity and sophistication. The first two activities—validation and coordination—are already in place at many OEMs. The remaining three—optimization, mitigation, and financial management—require more effort and interaction between the OEM and the engineering, planning, maintenance, and finance functions of its customers. All five activities overlap and create efficiencies and transparency across the supply chain—customers, suppliers, OEMs, and logistics providers—with financial savings accruing to the OEM. (See the exhibit.)

Validation

The first step in managing demand is validating that demand. Is the part correct, and is the quantity reasonable? If two parts are required, is the customer ordering a spare for the toolbox and thereby increasing material costs by one-third? This kind of redundancy is the traditional fix for failing to manage demand accurately, and many frontline maintainers use it to guarantee that the company meets its deadlines.

Validation may also require detailed equipment configuration records and an understanding of product variations and compatibility. For example, equipment can be configured as designed, as built, or as maintained, and the differences are often significant. If those differences are not documented, a customer may order the wrong part without realizing it. Another means of validation is to send engineers into the field to work side-by-side with customer maintenance teams, allowing the OEM to better understand and influence demand.

New technologies such as machine learning and artificial intelligence are making the validation process far more accurate and proactive. These tools can apply predictive maintenance algorithms to determine the likelihood that a part will fail, alert the OEM, and even order the needed part—all autonomously.

Coordination

The second critical demand management activity is coordination along the entire value chain, from the customer’s maintenance function to the OEM that provides the part to the supplier that provides the OEM with the necessary subcomponents. As noted above, the tendency of some customers is to keep an excess of spare parts on hand, leading to large and inconsistent orders. An OEM may receive a massive order for two years’ worth of a particular part and then nothing for the next 24 months. Or it may get separate orders from individual units, rather than an aggregate order from the company as a whole.

An OEM may receive a massive order for two years’ worth of a particular part and then nothing for the next 24 months.

Should material be bought to the operations floor in large batches or in the smaller amounts needed to fill monthly orders? In order to optimize the flow of materials, OEMs need transparency into how its parts are actually being consumed. Balancing volume discounts, lead times, storage and stock positioning, production flows and surges, and other factors reduces material waste and leads to the best overall pricing.

Optimization

The third activity is optimizing demand—ensuring that customers have the right volume of parts and material on hand. This starts with identifying and eliminating unnecessary redundancies, which often entails making decisions about whether to repair, overhaul, or replace a component. For example, if a major component inside a piece of equipment fails, the maintainer may decide to replace it entirely, even though many of the component’s other internal parts are still fine. Thus, a customer may replace an entire cooling system because of a single broken pump.

Conversely, should a technician who opts to open up a component in order to re-place a failed part replace all the other internal parts at the same time? The right answer often requires analyzing the component’s repair history and mean time between failures. Increased computing power and big data analysis techniques are improving the way companies make these decisions, leading to much better outcomes.

A related activity—and one that also relies on data and analytics—is dynamically repositioning parts. OEMs are increasingly using artificial intelligence and similar tools to better understand demand patterns and proactively move parts to the site or facility where they are most likely to be needed.

Consistency is another factor. Is the same maintenance action consuming the same amount of material across individuals, organizations, and locations? If not, why not? This type of analysis often produces startling results. For instance, it can be a leading indicator of problems in technician training that are producing negative outcomes in the field.

Finally, OEMs should reduce cannibalization of parts wherever possible. For example, stripping parts from one airframe in order to repair another should be done only in rare circumstances. In the military, “canns” are often the primary supply source. Cannibalization effectively doubles the maintenance man-hours needed to perform any operation—the same part must be pulled out and then installed elsewhere—and usually increases overall material consumption by approximately 30% or more, owing to damage or loss that occurs in the process. If cannibalization has to happen, it should be rigorously reported and documented so that it serves as a red flag indicating bigger problems in the supply chain.

OEMs are increasingly using artificial intelligence and similar tools to better understand demand patterns.

Mitigation

Demand mitigation involves strategies to reduce the overall demand for material, typically by improving operations and maintenance. For example, operations efficacy analysis looks at how equipment can be better used in order to improve reliability and thus minimize repairs. The way customers operate systems often dictates rates of failure and catastrophic events. In aviation, analyzing data such as the aggregated performance information for a company’s entire fleet of planes can help operators understand how changes in pilot practices can affect fuel and parts consumption and maintenance man-hours.

Operations efficiency analysis looks at how equipment can be better used in order to improve reliability and thus minimize repairs.

Similarly, maintenance efficacy analysis looks at the effect of individual practices on reliability and maintenance costs. Maintenance analytics data can be used to assess training needs and generate ideas for improved maintenance practices. It can also highlight the performance of individual maintainers in terms of both material consumption and mean time between failures. It’s important to note, however, that operators and maintainers may find this type of analysis intrusive and worry that the results will be used for such purposes as evaluating performance. Careful planning and thoughtful implementation—including the early and active involvement of operators and maintainers themselves—are therefore imperative.

Other mitigation strategies include the following:

- Reducing “No Fault Found” and “Could Not Duplicate” Situations. These occur when a maintainer removes a suspect component from operation and tests it but is unable to find a problem. With military equipment, NFF/CND rates average around 30% and can run as high as 80% for some components. They are often caused by ambiguities in technical manuals, inaccurate built-in tests, training deficiencies, or poor maintenance practices (such as “pluck and chuck” and “Easter egging”) that accept wholesale replacement of components rather than accurate troubleshooting. NFF rates can often be cut in half with proper training and technology.

- Collecting Real-Time Operational Data on Parts. Many components and parts have a planned replacement schedule based on worst-case environmental factors—temperatures, pressures, g-forces, and loads, for example—rather than real-world conditions. Replacing these assumptions with measurements and data collected from low-cost sensors can lead to major reductions in demand. (In many cases, companies have already collected huge amounts of data but haven’t synthesized it.)

- Value Engineering. When expensive components and systems show continued high failure rates, one potential solution is to re-engineer them. This may seem like a big step, but it can be more cost effective than continually repairing or replacing components.

- Employing Field Representatives. Technical reps can often improve training and troubleshooting or reduce no-fault-found situations and maintenance-induced failures. However, the return on investment must be analyzed accurately. Some organizations view the cost of such programs in isolation, but factoring in the resulting reduction in material costs will often change the ROI and show these services to be a real bargain.

Financial Management

At the highest level, financial management means determining the right price for an overall contract—a process that can be highly complex and can make or break the arrangement.

At a more granular level, maintainers and operators should not be given a blank check. Instead, they must consider the financial implications of their decisions. For example, replacing stained or scratched components just for the sake of appearance may not be justified. It’s also important to balance timing and price. Rather than striving to hit preassigned “uptime” goals no matter what, frontline managers should have the opportunity to delay component repairs or replacement when doing so will have a significant cost benefit.

Within the finance function, better management of accounts receivable and payable can reduce the cost of materials, even when the actual volume remains the same. In all cases, OEMs need to set up the right incentives, allowing service organizations to share in any savings they can generate through changes in behavior.

Implementing best-in-class demand management is a challenge, but a structured approach can help OEMs begin generating meaningful results in as little as six months and ultimately lead to savings of up to 25% in maintenance costs, parts consumption, and overhead. The advantages of this approach are clear. The only question is which OEMs will have the foresight to capitalize on the opportunity.