We know that climbing a mountain is no easy task. It requires intense preparation and training before the ascent begins. Successful mountaineers must pace themselves and climb with partners they trust, linked together for safety and mutual success. And they don’t give up when they reach the first peak; they persist until they reach the final summit.

While supplier management may lack the adrenaline rush of climbing Mount Everest, we find many parallels when large businesses address their vast corps of suppliers. These businesses can have thousands of supplier relationships built up over the years, many gained through mergers and acquisitions and others through an expansive bidding process that allows individual managers to engage new suppliers at will. When companies attempt to tackle the issue, they often succeed in reducing supplier numbers and partnering with a few top suppliers but then stop before going further. In no time, the corps of suppliers is expanding once again and costs are as high as ever.

To succeed in the long run, companies should take a step back to reassess the difficulty of the ascent, planning carefully for the next attempt. They need to select the very best approaches and incorporate them into a comprehensive whole. And they should make strategic allies of their top suppliers. By pushing through to the summit, companies can finally reduce their costs and create—and maintain—a compact group of high-performing strategic suppliers.

A Daunting Challenge

Companies across the globe have attempted supplier management solutions on repeat, sometimes for decades. Most of these solutions are well known—including reducing the number of suppliers, creating supplier classes, partnering, and providing supplier training and support—and each has distinct advantages. Yet companies implementing these strategies often fall short of their goals or end up back where they started. Even after launching themselves at the same challenge over and over, many still face high supplier costs and a large, unstructured corps of suppliers. Not surprisingly, 97% of chief procurement officers we surveyed are convinced that they’ve exhausted the effectiveness of their current supplier management strategies.

The primary reason is that they implement a few solutions (such as supplier performance management or supplier rationalization), make good early progress, and then move to an easier path that allows them to stop pushing for change.

As a result, their achievements are not sustainable. They gradually increase their supplier base again as they entertain new competitive bidders. Members of the supplier group eventually begin to lose interest in conducting business with the organization because they are not treated as strategic partners—even when they’ve been promised a larger share of the business—and the relationship suffers.

Even after launching themselves at the same problem over and over, many companies still face high supplier costs and a large, unstructured corps of suppliers.

The Importance of Supplier Management

Supplier management is one of the most important issues many large companies face. In fact, it was highlighted as a major procurement focus, along with big data and digital, in a 2017 BCG survey of leading chief procurement officers in Asia-Pacific and Europe.

Companies find that close supplier relationships are more important today than ever, with the burden of new regulatory requirements, such as recently revised tax laws in India, falling squarely on both parties. A global automotive OEM has even experienced a positive correlation between its supplier trust score—which measures suppliers’ perceptions of their collaborative customer relationships—and EBIT, according to an article in Supply Chain Management Review. This correlation exists because suppliers that are taken into confidence tend to pass both monetary and non-monetary benefits on to the business.

Companies that optimize their supplier base can reap benefits that include:

- A manageable supplier base, leading to enhanced efficiency

- Faster time to market

- The ability to tap into the innovation skills of capable suppliers

- Reduced transactions and thus greater procurement team productivity

- Cost reductions of 2% to 3% beyond other cost-saving measures

A Four-Pronged Attack

To reach the summit of supplier management, companies must begin by diagnosing what has gone wrong in the past and identifying the issues that they face going forward. They can do so by running a benchmarking exercise across their organization to look at any KPIs that may need support, such as the number of suppliers handled by each procurement professional and the cycle from purchase requisition to purchase order. In addition, they can perform a survey of their procurement professionals on supplier performance and analyze important supplier performance metrics, such as on-time delivery and quality.

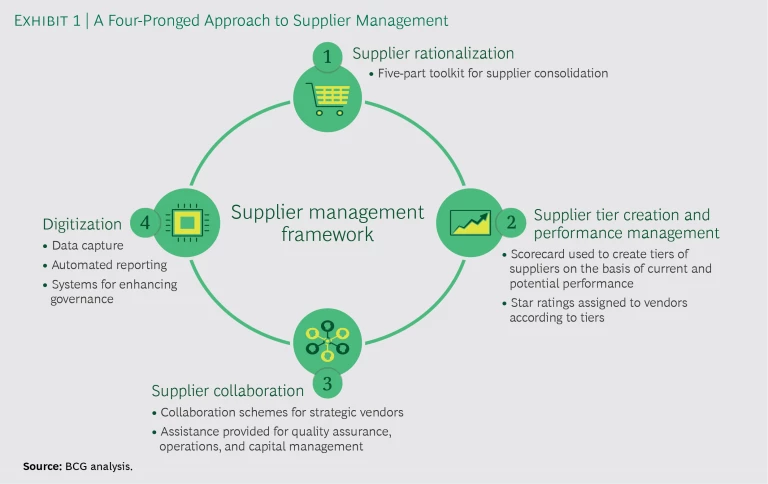

Businesses should then pursue a comprehensive approach to their supplier management process—rationalizing their supplier base, establishing robust supplier performance management with multiple tiers of suppliers, creating supplier collaboration programs, and digitizing the entire supplier management process. (See Exhibit 1.)

One global metals and mining conglomerate implemented this four-pronged framework through a comprehensive supplier management program, generating powerful and long-lasting results. The company reduced its large supplier base by approximately 50%, cut the number of supplier transactions by almost 50% in affected categories, and, with far fewer supplier transactions, increased productivity by close to 15%.

Supplier Rationalization

The first step in any supplier management exercise is to reduce the pool of suppliers to a manageable number, typically through the use of specific tools. This step is of the utmost importance, as organizations can’t manage performance or build strategic partnerships with an unwieldy set of suppliers. In addition to obvious quick fixes such as eliminating suppliers that have low turnover or a small share of the business, we recommend a five-point optimization toolkit. In our view, the following approach will yield the optimal supplier base:

- Consolidate supplier categories. Companies should streamline their procurement with a single large service provider where possible rather than deal with many suppliers. For example, they might procure an automotive assembly rather than the individual components. Alternatively, they might deal only with suppliers that have high turnover, eliminating traders and other intermediaries. And where local supplier quotas are in place—as we find in some parts of India—they may consolidate from ten local suppliers, for example, to just four or five.

- Combine repairs and maintenance (R&M) and operations and maintenance (O&M) services. Most companies allocate R&M to one set of suppliers and O&M to another. We recommend they consolidate—using one large service provider, where capable and qualified, to provide both services.

- Use specialist aggregators. Rather than relying on many small suppliers, companies can use third-party aggregators to acquire items of all kinds, including mechanical, electrical, and power-related spare parts; consumables, such as oil, bearings, and gears; facility management services; and travel arrangements, including flight and hotel bookings.

- Bundle materials and services under a single contract. Businesses often split civil contracts—for example, allocating erection and commissioning to one supplier and materials procurement to another. As an alternative, we recommend assigning turnkey contracts to suppliers that can provide both. Businesses can also use the same suppliers to provide services across different plants and even geographic areas, provided the suppliers are present and reliable in those locations.

- Try innovative approaches. Companies can also reduce the number of suppliers by using innovative tactics such as stopping the procurement of proprietary spare parts, instead purchasing generic parts (although caution must be used, as taking this step may render certain supplier warranties invalid). In addition, they can standardize the industrial lubricants used and have a supplier manage all the stock, ensuring a timely supply when needed. And they can consolidate their IT requirements with a single supplier each for hardware, software, applications, and licenses.

Robust Supplier Performance Management with Tiers

Once they have a smaller, more manageable pool of suppliers in hand, companies should undertake to build a rigorous performance management process. This process has four critical elements. With these elements in place, companies can rank each of their suppliers into tiers on the basis of current performance and long-term potential.

The Critical Elements. First, companies should designate core supplier categories. Our experience suggests seven key categories: raw materials; equipment; maintenance, repair, and operating supplies (MRO); operations services; administrative services; IT; and logistics.

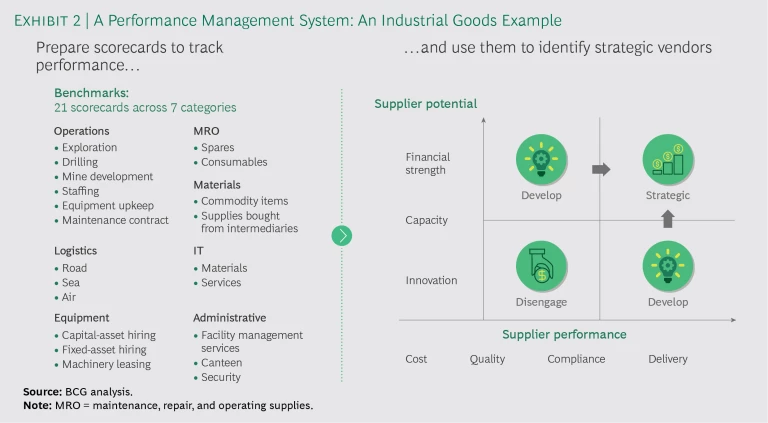

For each category, businesses need a number of scorecards to cover every type of spending. An industrial goods conglomerate, for instance, developed 21 scorecards in seven core categories. (See Exhibit 2.)

These scorecards should incorporate a crisp, easy-to-interpret design with five or six objective evaluation criteria and clear weights allocated to each. The criteria will vary by category: in the case of a contractor scorecard for operations, for example, criteria could include safety, execution, quality, resources (human, equipment, and other), and statutory compliance. In contrast, the criteria for a raw-materials supplier might include quality, cost, on-time delivery, and execution support.

Second, companies need automated data capture, preferably in real time—rather than manually updating the data monthly or quarterly. This gives them quantitative, objective KPIs for each of the criteria to ensure that there is no bias in the ratings.

Next, businesses should disseminate the scorecards in a timely way, using a common portal or custom-developed apps, while providing transparency into the scoring process.

Finally, companies should use the scorecards as the basis for monthly or quarterly development discussions with suppliers. In fact, ensuring that these discussions take place in a robust and consistent way is the primary reason for capturing and sharing the scorecard information.

Ranking the Suppliers. With scorecards in hand, companies should then rank all suppliers within their category and spending type, basing the rank on the supplier’s current performance and its long-term potential. Current-performance metrics include such indicators as cost, quality, delivery, execution, and compliance, while potential-performance metrics include financial capabilities, an innovation quotient, and capacity.

For example, a supplier that has been associated with an organization for 30 years and is performing well might obtain a high current-performance rating. If that supplier is unwilling to invest capital to expand its business or isn’t agile enough to innovate, however, it should receive a low potential-performance rating. These two measures together will determine the supplier’s rank, or tier, in its core category.

One large European automotive conglomerate, for instance, uses parameters such as quality, cost, technology, and supply to evaluate its suppliers, then publishes the scorecards on a common portal. This transparency fosters healthy competition, makes it easy for the suppliers to compare and improve, and creates a platform for supplier discussions.

Supplier Collaboration Programs

Once they’ve ranked every supplier, companies can easily identify their top-tier, or star-rated, suppliers. Large businesses with mature supplier management processes can further divide their most strategic suppliers into three groups. One industrial goods conglomerate, for example, designated the top 5% of suppliers in both performance and potential as the five-star, or platinum, group; the next 5% were named the four-star, or gold, group; and the subsequent 10% were termed the three-star, or silver, group. (See Exhibit 3.)

To maintain buy-in and ensure the sustainability of the approach, companies should then develop a supplier collaboration program for each group. For example, some leading companies have created a program for their star-rated suppliers that includes quarterly meetings with the suppliers’ CEOs to ensure that they understand their supplier status and to offer support when needed. These suppliers are given the right of first refusal as well; if a potential supplier offers a lower price than that offered by a top-ranked supplier, these companies give the existing supplier the opportunity to price match. The companies also share detailed information about all star-rated suppliers on their supplier portals, hold annual award ceremonies to recognize the leaders, and publicize the results in newspapers, industry journals, and other media.

If a potential supplier offers a lower price than that offered by a top-ranked supplier, some companies give the existing supplier the opportunity to price match.

Heavy-equipment leader Boeing, for example, categorizes its suppliers into gold and silver tiers on its website, then gives a Performance Excellence Award to eligible suppliers—along with 13 Supplier of the Year awards to suppliers in different segments.

Programs for suppliers in lower ranks should be similar but less intense. For example, companies may meet with their four-star suppliers twice a year and three-star suppliers just once a year. In addition, they might offer an operational improvement program to the three-star and two-star groups that provides opportunities to move up a tier. One global consumer goods player runs a supplier management program with its strategic suppliers in which it provides both financial and operational assistance. In another example, multinational technology company Philips has started resolving supply issues by posting them on its website. Suppliers can offer solutions, and if a solution is feasible, Philips will award a contract to the supplier and the supplier can begin institutionalizing the solution within Philips.

Digitization

Companies often have a great deal of untapped potential when it comes to using digital technologies, particularly in certain regions. In the final step of the approach, therefore, companies should work to digitally enhance their supplier management. They can start by pinpointing all relevant data and aggregating it on a common platform using tools for data source mapping and data extraction. They can use additional tools to clean the data, standardize it, and synthesize it in the form of a digital dashboard. They can also install digital governance controls to curb any maverick buying and prevent the reproliferation of suppliers.

One of the world’s leading engineering and construction equipment companies has successfully used digital tools to evaluate and monitor supplier risks throughout the business. Among these tools is the digital control tower, which aggregates data across supplier locations, manufacturing units, and warehouses—including scheduled delivery times, product yields, and whether goods have been dispatched from the supplier location. Such control towers can feed information about the flow of materials and other operational data to a supply center; the center, in turn, can review supplier performance and evaluate supplier capabilities and risks.

Guiding Principles

As companies work to create and then sustain their new supplier management programs, they should keep in mind a few high-level objectives:

- Engagement and Sponsorship from Senior Leadership. Companies need a dedicated and empowered central supply-planning team with a mandate and clear support from the top. In addition, organizations should provide training for everyone in the relevant departments and establish a senior-leadership committee to review the new supplier management program monthly.

- A Performance-Oriented Culture. The corporate culture should support objective discussions with suppliers that include clearly stated goals and two-way feedback at every supplier level—although the amount of engagement will vary with the supplier’s ranking.

- Clear and Continual Communications. Companies should establish and maintain open communication channels with suppliers that cover all supplier selection criteria, expectations, and rewards arising from the new program.

By pursuing these objectives, following each step of the approach to completion, and keeping supplier management at the top of their priority list, companies can finally reach the summit—reducing their corps of suppliers, creating true supplier partnerships, and reaping lasting rewards.