You could more easily find a yachtsman willing to sail into a sustained 40-mile-an-hour headwind than a retail bank trying to stick with a nondigital strategy.

Banks know where the prevailing economic and technological forces are pushing them these days. But they are moving at very different speeds and focusing on different milestones.

BCG’s latest bank study shows that the economic benefits are increasing for traditional retail banks that have implemented the most effective digital strategies. Between their more developed digital strategies and (in many cases) regional advantages, the top-performing banks now have cost-income ratios that are 19% better than those of median banks. That differential has been growing for the past two years.

On the other hand, the pressure to embrace a more digital mode of operation has eliminated the differences in certain service areas. For instance, most banks have implemented online and mobile self-service capabilities. Likewise, most banks have added enough automation to their call centers that they can provide acceptable customer service with a smaller operations staff and at a lower cost. Once big advantages, these capabilities now represent mere table stakes.

This year’s data, part of BCG’s annual benchmarking of banks across more than 100 key performance indicators, underscores the extent to which banking is a local business affected by each market’s regulations, competitive dynamics, and consumer behaviors. For instance, retail banks in North America have structural advantages—including high fee and commission ratios—that give them profit margins that wouldn’t be possible elsewhere. Banks in the Netherlands, Belgium, and Australia—countries where most customers interact with their banks primarily through digital channels and rarely set foot in a physical bank—can embrace digital delivery more aggressively than banks in less-connected countries can.

But BCG’s Retail Banking Excellence Benchmark (REBEX by BCG) also uncovers sizable differences between local banks. Against local competitors, banks are in a position to control their own destinies.

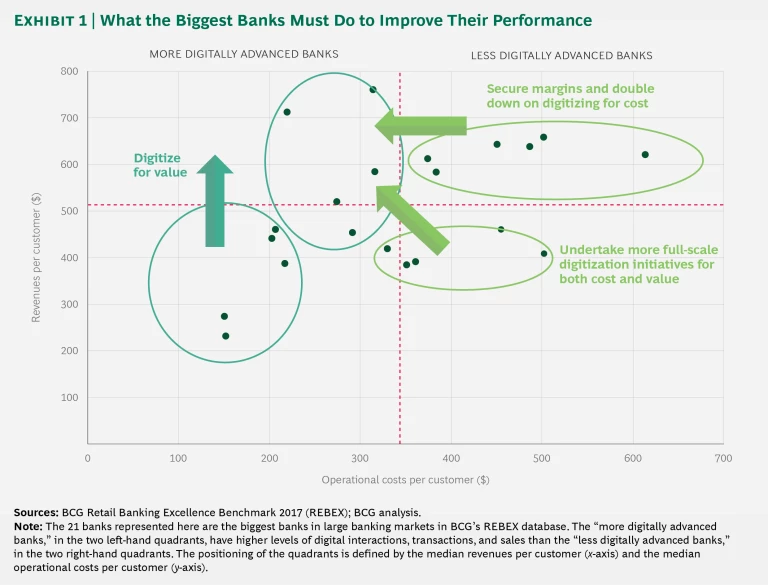

Looking at the universe of banks in six major geographic regions—North America, Asia-Pacific, Western Europe, Latin America, Eastern Europe, and the Middle East/Africa—we observe that banks are about midway through their transformation journeys. Many banks have made progress in digitizing for cost, although they still need to move from pilots to large-scale initiatives to reap the benefits of their digital investments. Banks are less far along in digitizing for value. (See Exhibit 1.) The goal of this more ambitious phase is to find ways to serve the customer better—and in doing so, to earn more revenue per customer and increase retention. The best way to accomplish this is through a reinvention of the customer engagement model.

To make further progress in digitizing for value, retail banks around the world must address two emerging imperatives: personalization and continuous delivery.

The personalization imperative has several dimensions:

- Personalization is quickly becoming a primary mechanism for increasing both customer satisfaction and economic value in banking. Customer retention is higher at banks that understand customers’ financial needs and interact with customers in ways that reflect their preferences.

- Improved data and rapidly improving digital technologies enable banks to meet customers’ heightened expectations of personalization. Banks should use these tools to get a clear sense of each customer’s financial and behavioral DNA and develop individualized offers on that basis.

- Banks that succeed with personalization will become better at acquiring, engaging, and retaining customers. This will add appreciably to their growth and profits.

The issue of continuous delivery, meanwhile, involves two key points:

- Bank convenience used to be a function of the number of physical retail outlets that a bank had in a given city or town. In the future, convenience will increasingly revolve around the concept of always-on banking. Payment services will be embedded in every aspect of the online shopping experience and will be available for peer-to-peer transactions in social networks.

- The number, type, and timing of these interactions are evolving quickly. To remain flexible, banks will have to build sophisticated routing platforms that ensure continuous delivery of the personalized experience. They can best do this through digitally empowered relationship managers, automated customer care centers, and self-service technologies.

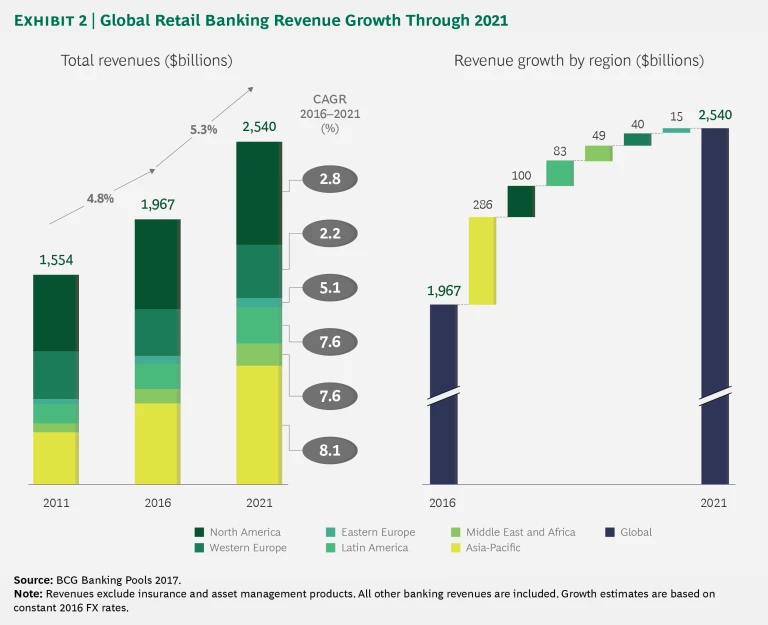

In most regions of the world, the bank transformation imperative (or as we have called it in the past, the imperative for “bionic transformation”—see last year’s report ) is coming at a time of improving conditions in the sector. BCG Banking Pools, our forecasting unit, forecasts a 5.3% annual rise in global retail bank revenues between now and the end of 2021, exceeding the fastest growth recorded in the past decade. (See Exhibit 2.) The gains will be greater in some regions than in others, however:

- Asian bank revenue will grow by about 8% annually for the next few years, helped by the trend toward financial inclusion and the rollout of digital banking services. By 2021, BCG predicts, Asia will surpass North America as the region with the highest retail banking revenues.

- Two other young banking regions, Latin America and the Middle East and Africa, will also experience above-average revenue growth. In Latin America, the main growth catalyst will be Brazil’s renewed economic vitality. In Africa, the catalyst will be financial inclusion.

- Revenues will grow at a considerably slower pace in the mature North American banking market than in these still-developing markets. But North American banks will likely get a lift from higher interest rates, which will help them improve their margins. The banks will also benefit from their customers’ growing interest in investment products.

- At the bottom, in terms of growth, will be European banks. Western European banks are facing some unfavorable regulations just as they start to recover from an environment of punishingly low interest rates. Their revenues, on average, will grow by only 2.2% on a compound annual basis over the next few years. Eastern European banks will fare better, except in Russia, the region’s largest market, where we expect the banking sector to continue to struggle with nonperforming loans and other challenges and to grow more slowly than nominal GDP.