Digital disruption is coming to the agriculture business. Data—as well as the ability to process, analyze, and exchange it—is transforming the entire agriculture value chain. Growers are using data to optimize agricultural practices by maximizing yield and reducing the need for agricultural inputs and natural resources. New digital tools will enhance transparency into the way that crops are grown, livestock is produced, and food is processed and distributed—and will help satisfy consumers’ and regulators’ demand for more information about the food we eat.

So far, the agricultural-input suppliers that provide seeds, fertilizers, and chemical crop protection to farmers have not yet fully embraced the use of digitization to enhance their interactions with customers. Growers remain largely dependent on their own experience and agronomic advice from third-party advisors in deciding what, when, and how to plant, with little or no direct input from suppliers. As a result, they can’t fully benefit from the data that suppliers maintain on the performance and value of their products. But that’s about to change.

Agricultural-input suppliers still haven’t fully embraced the use of digitization to enhance their interactions with growers.

A variety of technology-oriented companies are already moving into the agriculture market space with digitally enabled business models designed to provide greater transparency into performance and prices and respond faster to growers’ needs. To compete, agricultural-input companies must develop new go-to-market strategies that maximize their use of data to gain insight into their markets and customers and provide them with fully customized products and services. Suppliers need to act fast because the rapidly increasing use of data will quickly sort out the winners from the losers in the agricultural-input supply business, as it has in so many other industries.

Three Forces Disrupt the Industry

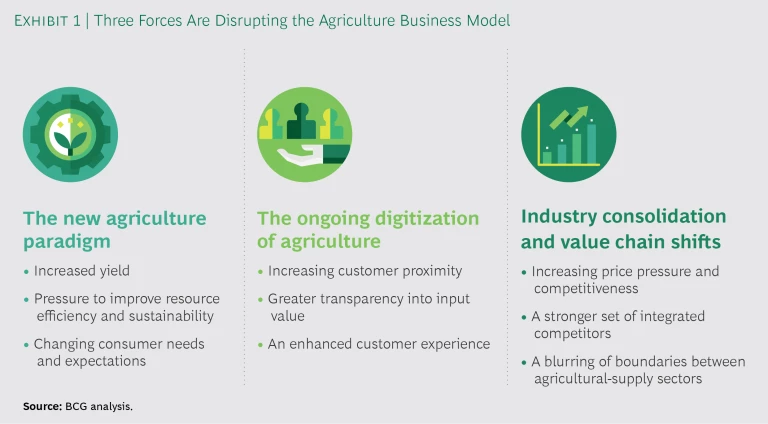

Three interrelated factors are transforming the environment in which agricultural-input suppliers conduct business: the changing agriculture paradigm, increasing industry consolidation with value chain shifts, and digitization. (See Exhibit 1.)

The New Agriculture Paradigm

The agriculture value chain used to be straightforward. Farmers grew crops to provide basic commodities for food processors, which then marketed and sold their products to retailers and consumers. It was essentially a supply-based model—the growers’ primary goal was to maximize their crop yields and then look for markets for their crops. Now, a new demand-based paradigm is taking over, forcing farmers to balance the desire to boost yield with two other, increasingly critical factors.

First, growers are facing rising pressure from regulators and society at large to use the land, water, energy, fertilizers, and crop protection chemicals that go into agricultural production in a more sustainable and environmentally conscious way. They must work to minimize the environmental impact of their farming practices, reduce pollution and soil degradation, and improve biodiversity.

Second, consumers around the world—particularly in North America and Western Europe—are demanding healthier, safer, more nutritious food. Farmers must now meet stricter quality and transparency targets for enhanced nutritional value and taste as well as lower levels of crop protection residue.

Industry Consolidation and Value Chain Shifts

Companies in the agriculture industry are combining forces to develop fully integrated operations and thereby build scale, improve flexibility and variability in their operations, and lower costs. Many large-scale mergers have occurred, particularly in the seed and crop protection sectors. Newly combined companies such as Corteva (the agriculture division of DowDuPont), ChemChina and Syngenta, Bayer and Monsanto, and BASF (which bought parts of Bayer’s Crop Science division) will likely control an even larger share of the business in the future.

This trend is raising the competitive bar for all agricultural-input suppliers, putting pressure on prices and forcing these companies to become more sophisticated in their internal operations and relations with customers. In turn, independent distributors of agricultural inputs are getting squeezed between the big input suppliers and the ever-more-educated and digitally enabled growers. As a result, they will continue exploring new revenue opportunities both up- and downstream in the agriculture value chain.

The Ongoing Digitization of Agriculture

The digital revolution is finally transforming the agriculture industry. Suppliers are already deploying a variety of digital tools to produce, gather, and analyze large amounts of data. And they are using that data to improve agricultural productivity and efficiency, build closer relationships with customers, enhance the customer experience by providing optimized solutions and services as well as transparency into pricing, and improve internal processes. But no supplier has completely cracked the code yet.

The increased interest in data-enabled farming and related services is also blurring the boundaries between agricultural-supply sectors such as seeds, crop protection, fertilizers, equipment, and distribution. New entrants from the technology industry as well as nimble startups are already looking to change the competitive landscape—although no clear winner is likely to emerge in the near future. (See the sidebar.)

Virtual Farming

Virtual Farming

Already, intermediaries are moving into the agricultural-input supply business. One example is Farmers Business Network (FBN), a data-driven online procurement and analytics marketplace. FBN offers members direct access to products from major suppliers and the ability to conduct their own analysis of climate data, soil conditions, input needs, prices, and yields.

Launched in 2014, FBN has thousands of members who anonymously share their data on soil conditions, weather, yields, and other factors, allowing them to compare input prices and performance. Members can also receive financing offers through FBN and find markets for their crops on its direct-selling platform. The company promises, for example, to connect growers offering specialty crops with buyers looking for that particular crop. In theory, growers can maximize prices for their crops while buyers gain transparency into the sources of the products they purchase.

According to FBN, this degree of transparency has the potential to help members boost yields and save money. While its potential for disruption is high, the system is not yet fully mature. But FBN can draw on fresh resources from recent venture capital investments to further improve and extend its offerings—and perhaps even expand into the production of agricultural supplies in the long term.

Get Close to Your Customers or Get Out

The forces affecting the business of agriculture are already transforming how farmers conduct their seasonal activities. At every step of their seasonal journey—from preseason planning to planting to mid-season crop evaluation to harvesting and planning for the next season—growers are taking advantage of better data on weather, climate, location technology, soil and crop conditions, pricing, distribution, and retailer and customer demands. In response, agricultural-input suppliers are rethinking how to support farmers’ efforts to balance yield, resource management, and consumer expectations. (See Exhibit 2.)

By understanding growers’ new needs and expectations, agricultural-input suppliers can serve them far more effectively and profitably than in the past. They must gather detailed data on their customers and analyze it to produce meaningful and valuable business insights. Then they must use these insights to develop more-customer-centric products and customize product offerings to the needs of individual farms. And to maintain their customers’ trust, they must ensure the security and privacy of the data they gather. Agricultural-input suppliers that don’t get these things right or that move too slowly face considerable risks.

By understanding growers’ new needs and expectations, agricultural-input suppliers can serve them far more effectively and profitably than in the past.

First, faster-moving, digitally sophisticated rivals and third-party providers could step in between suppliers and their customers, outcompeting the more traditional players.

Second, better data on—and improved transparency into—the effectiveness of particular products will raise the bar for all agricultural-input products. While products that truly deliver better outcomes will thrive in the right settings, others may increasingly fall prey to generics or less innovative seeds and crop protection products, limiting the price premiums on branded products and services. To limit this risk and maintain their price premiums, suppliers must carefully analyze farm and sales data to identify areas where they can differentiate themselves from competitors.

It’s too soon to tell whether increased data transparency could trigger a shift toward an outcome- or value-based business model. But suppliers that can offer proven results will be in the best position to capture the financial benefits of their higher-value products.

How to Pioneer the Change

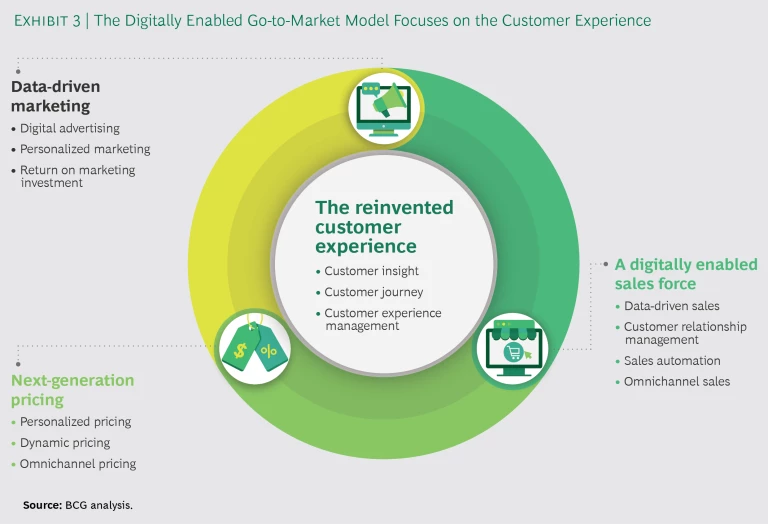

Equipped with a better understanding of the evolving needs and the changing customer journey of growers, suppliers must build efficient, digitally enabled go-to-market organizations. To do so, they need to rethink three key aspects of their customer-facing activities—marketing, sales, and pricing—and then integrate all three into a comprehensive end-to-end program. (See Exhibit 3.)

Data-Driven Marketing

Every go-to-market strategy, whether old or new, depends on gaining the best possible understanding of customer needs and expectations. The digital revolution in marketing now enables companies to capture and effectively use this information to segment customers precisely and accurately, both as individuals and as a group, and then customize the marketing approach to each segment and to each customer.

The first step is to actively seek the most relevant customer information possible and use it to support the customer segmentation process. This information should be derived from various sources—not just from past experience, point-of-sale data, and farm-specific demand data but also from sources such as social media and online research about customer concerns, complaints, likes, and dislikes.

Digitally enabled sales leads that are based on customer information can significantly increase the success rate and productivity of the sales force.

Once captured, this information can be used to create a comprehensive marketing program. It should include content such as recommendations for crop protection products and when to apply them, seed choices depending on soil and environmental conditions, and additional agronomic advice that can be adapted and personalized to specific customers.

Digitally enabled sales leads that are based on customer information can significantly increase the success rate and productivity of the sales force.

A Digitally Enabled Sales Force

The customer information captured by the marketing function is instrumental in designing individualized sales experiences that maximize the impact on sales results. A properly designed sales journey requires the clear definition and integration of the sales force’s functions and roles to ensure a consistent message and higher customer satisfaction. The journey must be actively managed, assessed, and adapted to maximize value over time. And it must include both traditional and digital sales channels so that the go-to-market strategy is fully interlinked across channels and integrated into a single holistic approach.

Online sales channels with optimized connections to traditional offline sales channels can significantly enhance the interaction between the customer and the sales force, provided the channels are properly designed and include detailed knowledge about customer needs. Online channels, for instance, can provide detailed recommendations for seeds and crop protection application, tailored to the needs of specific customers. By tracking customers throughout the online sales journey and analyzing their responsiveness and value to the company, the sales force can make continual improvements to the sales experience.

The most forward-thinking companies will soon apply artificial intelligence (AI) to further support the sales force effort. AI-enabled deep analysis of customer needs will enable suppliers to further customize seed, fertilizer, and crop protection recommendations and even predict customers’ input needs by using data from prior years. This in turn will empower the sales force to maintain better contact with growers, increasing loyalty and value for both suppliers and their customers.

Next-Generation Pricing

Prices should no longer be determined at the corporate level. The key to pricing success lies in providing the sales force with flexible pricing tools that they can use to make the best offers at the most opportune time. Value-based pricing, for example, enables the sales force to determine prices using the actual value the product creates in the field.

Another example is simulation tools, which give the sales force a clearer understanding of the impact of pricing levels on volume and profitability. This in turn can give them the information they need to make real-time pricing decisions both online and in the field. By using pricing data combined with detailed information about individual customers, the sales force can strike the best balance between volume and price at each stage of the customer journey and track the effect of price on customer profitability over time.

Five Imperatives to Succeed in the World of Digital Agriculture

Digitization offers agricultural-input suppliers a significant opportunity to optimize their go-to-market programs and processes. The steps outlined above provide specific guidelines for leveraging digitally enabled tools to boost value and improve the customer experience. Winning in this new environment requires an organization that has fully digitized its core operations, giving it the ability to deliver on a new business model. As agricultural-input suppliers work to harness the power of digitization, they must follow five imperatives:

- Enhance customer proximity to truly understand customer needs and value.

- Nurture an innovation-driven and customer-centric culture throughout the organization.

- Digitize the core of the commercial organization including data-driven marketing, a digitally enabled sales force, and next-generation pricing.

- Create new customer-tailored and digitally enabled offerings to meet specific customer needs.

- Continually improve the go-to-market model to capitalize on new opportunities.

The key to success in the agricultural-inputs business, as in any business, lies in understanding the needs and expectations of customers, creating innovative products and services that best fulfill those needs, and taking them to market effectively. Every supplier understands that there is considerable value to be captured by leveraging data and digital tools to get closer to customers and to better meet their needs. The only question that remains is: Which companies can attain that goal first and which will be left behind?