This is an excerpt from The 2018 BCG Local Dynamos: Emerging-Market Companies Up Their Game .

It’s an enviable track record: Indian company Relaxo Footwears has seen a nearly 12-fold increase in revenues in 12 years, while its margins continue to exceed those of formidable multinational corporation (MNC) rivals. The key to that success is providing great consumer value at competitive pricing.

The 2018 BCG Local Dynamos

The 2018 BCG Local Dynamos

- Emerging-Market Companies Up Their Game

- How the Local Dynamos Win at Home

- What’s Powering Local Dynamos: The Infographic

Relaxo’s success—and those of other emerging-market players—bears watching. These savvy local companies understand their home markets and have built business models and capabilities to capitalize on the powerful forces shaping their regions. They have experimented and innovated, honing winning strategies on the basis of their deep understanding of local preferences and dynamics. And their success comes as emerging markets , despite a slowdown in recent years, continue to represent an attractive opportunity for both local and global companies. Much of this growth has been fueled by a rising class of consumers, buyers with increasing expectations of product and service quality and ever-expanding online access to such offerings.

To shed light on some of the biggest success stories, we have compiled a list of 50 companies, a group we dub local dynamos. Local dynamos are high-performing private companies in emerging markets that focus on their home front. Though few of these companies are widely known outside their home market, they are outperforming both local state-owned companies, which have built-in advantages, and large multinationals, which have an edge when it comes to access to resources and scale. Our list of companies, of course, is by no means exhaustive. The objective is to highlight a robust representative sample of these organizations, assessing the innovations and business practices that allow them to succeed. (See “In Search of Dynamos.”)

IN SEARCH OF DYNAMOS

IN SEARCH OF DYNAMOS

Finding the 50 local dynamos for this year’s list was a multistep process. We started with a clean slate, looking for an entirely new list of companies to spotlight. The first step was to identify companies that matched four quantitative criteria:

- A focus primarily on the company’s home country, with the bulk of revenues coming from that market

- Strong and stable revenue growth—a compound annual growth rate that, at a minimum, exceeded inflation

- A minimum revenue size of $100 million

- No base that gave the company a significant advantage. (This means that we did not include government-owned companies, companies with a monopoly in their market, or companies with large inherited assets, such as land holdings.)

Companies also needed to meet some qualitative criteria. They had to be agile and employ an innovative business model—factors reflected by the product or service they offer, the customer segment they target, or the way they carve out a competitive advantage.

This is our most recent report spotlighting local dynamos. (See 2014 BCG Local Dynamos , BCG report, July 2014.) Certainly the world has changed since our last analysis four years ago—most notably, global competition has experienced significant shifts. Smartphones and other digital tools are increasing global connectedness at breakneck speed, despite the rise of economic nationalism in many quarters. (See “ Going Beyond the Rhetoric ,” BCG article, April 2017.) Not only do these forces impact both global trade and individual country markets, but they also have profound repercussions for local dynamos. Economic nationalism within a company’s home country, for example, can give the organization a boost in selling to local customers. And the proliferation of digital tools can help local dynamos—as well as their MNC rivals—expand their roster of products and services with limited upfront investment and operate in more cost-effective ways.

In this fast-changing environment, local dynamos often exhibit a number of winning characteristics :

- Identifying and meeting increasing customer expectations about quality earlier than many rivals

- Harnessing new technology aggressively—often developing digital-first business models

- Building digital ecosystems that expand their reach and capabilities

- Moving from a slate of traditional product offerings to a portfolio of products and services

- Increasingly attracting and retaining strong local talent

Relaxo’s story reflects a number of these success factors. The footwear market in India has long been dominated by unbranded, low-priced offerings, with MNC footwear competitors focused on the smaller, premium end of the market. Relaxo, however, has zeroed in on the underserved market in the middle. The company moved beyond its traditional offering of low-priced slippers to build a profitable portfolio cutting across multiple footwear categories, including sport shoes. Relaxo concentrated steadily on great product quality, rationalized its portfolio, and invested in creating new brands. It has built a dominant position in the economy footwear segment, where MNCs, due to their higher costs structures, do not participate. In the premium sport shoe category, Relaxo’s products are priced 30% to 50% below MNC offerings—a compelling value for consumers. In addition, unlike most local competitors, Relaxo has expanded its reach by rapidly signing up large-scale distributors, which has allowed the company to profitably service the thousands of small retailers that dominate the market. At the same time, Relaxo has expanded into new channels, including its own chain of more than 300 retail stores and e-commerce marketplaces. Furthermore, Relaxo continues to up its game, investing in digital solutions to improve effectiveness and efficiency, especially in its front-end sales operation.

The success of the local dynamos serves as a powerful example for any organization that aims to compete in emerging markets—whether it is an MNC, a company from an emerging economy that is becoming a worldwide leader (what we call a global challenger), or a local business. (See 2018 Global Challengers: Digital Leapfrogs , BCG report, May 2018.) All these players should study the playbooks of the local dynamos to gain insight about what it takes to compete and win in some of the fastest-growing markets in the world.

The Resilience of Emerging Markets

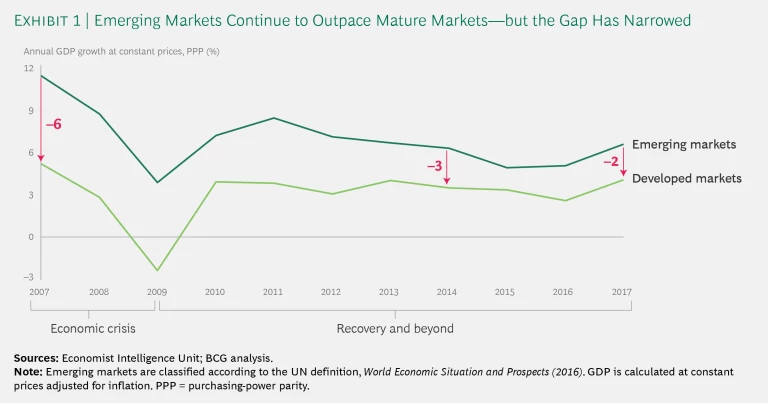

Economic growth in emerging markets has slowed in recent years, but it continues to exceed that of developed

Divergent Stories Across Countries

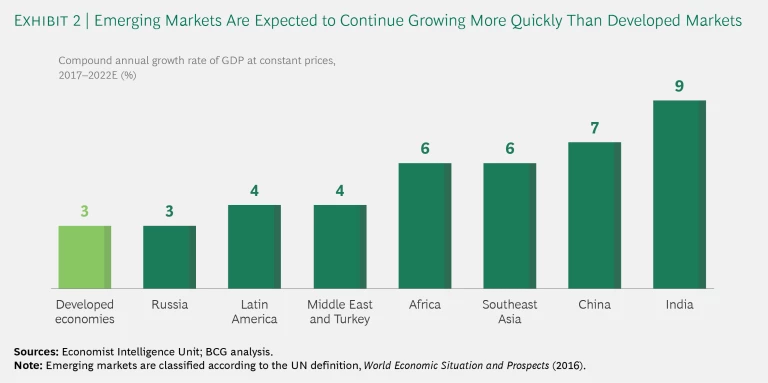

The story is hardly uniform across the emerging-market landscape, of course. Some emerging economies perform much better than others: in recent years, for example, China and India have been leading the pack in terms of economic growth. Russia and countries in Latin America, on the other hand, have posted growth rates that trail even those of developed economies. That weakness stems in large part from the end of the commodity boom that had contributed mightily to the growth of both regions.

At the same time, differences also exist at the regional and sector levels. A country with weak overall GDP growth may have regions or industries that are growing robustly and offer attractive business opportunities. Conversely, some regions and sectors may be struggling in countries that are posting strong economic growth overall.

For example, significant opportunities do still exist within Latin America and Russia. In Brazil, for instance, the overall economy contracted from 2013 through 2015, but the impact was not uniform across the country. An analysis of actual consumer expenditures in Brazil —more than 5 billion transactions annually from 2011 through 2015—by BCG and Cielo found that some regions, including the agribusiness and export zone in the center of the country and the northeast interior, fared relatively well. Meanwhile, a recent BCG survey of 4,000 Russian consumers found reason for optimism in certain consumer categories. Although consumers reported cutting back on nonessentials, such as alcohol and ready-to-eat foods, nearly half intend to spend more in categories, such as fresh foods and education, that contribute to the health and well-being of their families.

While unforeseen events can quickly alter the outlook for individual countries, in general it is likely that emerging markets overall will continue to outpace developed economies and will account for a significant portion of global economic growth. (See Exhibit 2.)

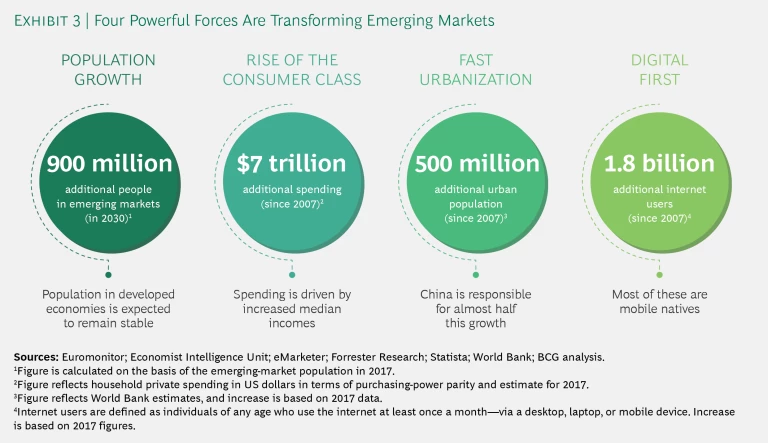

Four Powerful Trends in Emerging Markets

Within this setting, a number of developments are rapidly altering life—and the business landscape—in emerging markets. (See Exhibit 3.)

Population Growth. Global population has increased by 800 million people from 2007 through 2017, and it is expected to rise from 7.5 billion to 8.4 billion by 2030. What’s more, these increases have occurred, and are expected to continue doing so, almost entirely in emerging economies other than China.

Rise of the Consumer Class. Private consumption has been the primary driver of growth in emerging markets, accounting for at least 50% of GDP growth since 2010. From 2007 through 2017, that consumption jumped by an estimated $7 trillion per year. That private consumption has been fueled by the growing ranks of savvy consumers with purchasing habits consistent with the middle class within their country. In 2017, an estimated 1.5 billion people around the world earned more than $10,000 a year—more than double the number in 2007. Apparel company Mavi, for example, was quick to spot the growing popularity of jeans in Turkey and has built a fashionable and aspirational brand by linking up with such top fashion models and designers as Adriana Lima and Hussein Chalayan. The company has also bolstered its brand image by opening flagship stores in Berlin, Frankfurt, New York, and Vancouver.

Fast Urbanization. Since 2007, the population in emerging-market cities has surged by about 500 million. As economic prospects and jobs in urban centers improve, people are leaving rural areas in search of higher-paying positions. These growing population centers are attractive markets for companies across a variety of sectors, from consumer goods to health care. Private hospital company Siloam Hospitals, for example, is responding to the need for more health care resources in Indonesia’s expanding urban centers. Siloam grew from just 4 hospitals in 2010 to 31 hospitals across 22 cities by 2017, with plans to establish 50 hospitals in 34 cities by the end of 2019.

Digital First. Smartphone penetration and use in emerging markets exceeds that of developed markets. In 2017, there were roughly 2.4 billion internet users in emerging markets, an increase of 1.8 billion since 2007. Many of those users have always accessed the internet via a mobile device, and digital tools are tightly integrated into day-to-day life. Chinese consumers, for example, make annual mobile payments that are about 50 times those made by US consumers. And the explosive growth of digital technologies in emerging markets will continue: emerging markets are projected to account for 95% of new internet users—about 900 million people—through 2022.

This development creates a major opportunity for local companies that are digital natives—companies whose business models are primarily based on digital technologies. Capitec Bank, for example, has disrupted banking in South Africa by using digital technology to create low-cost, paperless banking services. This includes using biometrics to secure and verify accounts and leveraging artificial intelligence to make credit decisions.

The 2018 Local Dynamos

No country or region has a monopoly when it comes to cultivating winning local companies: the 50 that we identified this year are emerging-market powerhouses spread across various regions, including Africa, Asia, Latin America, and the Middle East. (See Exhibit 4.) Local dynamos also exist in a broad assortment of sectors and have developed diverse business models to succeed in their respective fields.

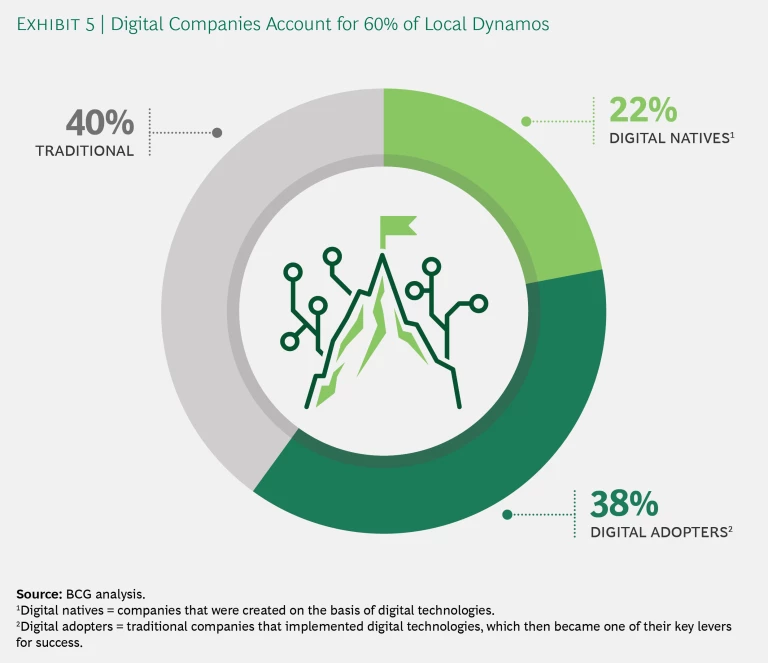

Overall, the companies on our list reflect an evolution in emerging-market economies away from low-cost manufacturers and toward more sophisticated, digitally enabled businesses. What’s more, this shift goes well beyond the internet and high-tech categories. Some 22% of the 2018 local dynamos are digital natives, and another 38% started out as traditional companies but have aggressively adopted digital technologies to enhance their competitiveness. (See Exhibit 5.)

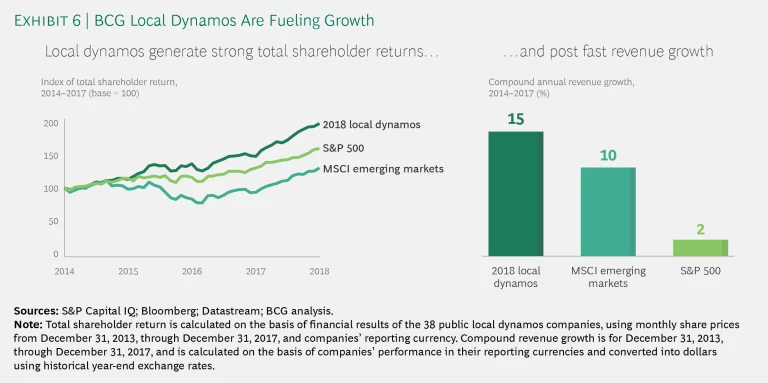

The local dynamos, as in previous years, have posted strong financial performance—particularly impressive in light of the more challenging external environment. An index comprising the 38 publicly traded dynamos generated total shareholder returns of 18% from 2014 through 2017, more than double the performance of the MSCI Emerging Markets (7%) and well above the S&P 500 (12%). A key driver of local dynamos’ strong returns was robust topline growth. From 2014 through 2017, that same group of local dynamos generated compound annual revenue growth of 15%, beating organizations on the MSCI Emerging Markets Index (10%) as well as the S&P 500 (2%). (See Exhibit 6.)

While our current group of dynamos has posted strong performance over the past four years, their objective, of course, is to build businesses with staying power. It is worth noting that a significant majority of the 2014 dynamos—some 82%—are still delivering great results. (See “Revisiting the Class of 2014.”) This is strong evidence that emerging-market companies with a laser-like focus on their home turf can prosper over the long term.

Revisiting the Class of 2014

Revisiting the Class of 2014

The 2014 local dynamos have racked up impressive performance over the past several years. (See the exhibit.)

Of the 50 companies on our 2014 list, 28 are still thriving in their home markets, and another 13 have become either global or regional players. Xiaomi, for example, is now an international player and has joined our global challengers list. And Air Arabia has expanded into the Middle East and North Africa. Four of the companies on our 2014 list have been acquired—some by MNCs. Among the deals: Walmart is taking a 77% stake in Indian e-commerce leader Flipkart, a reflection of Flipkart’s enviable leadership position in its home market. Just five of the 2014 companies are no longer performing well financially.

The local dynamo group generated a TSR of 26% from 2009 through 2017, outpacing both the MSCI Emerging Markets Index (11%) and the S&P 500 (15%).