This is the fifth article in a series exploring customer insight (CI) functions in consumer-facing industries.

Leaders at consumer-facing companies spend tens of millions of dollars every year on customer insights (CI) and commercial analytics (CA) , and for good reason. Consumer companies are under relentless pressure to deliver topline growth, and CI and CA are critical weapons in that effort. (See “ The Introverted Corporation ,” BCG article, April 2016.) The reason: those functions shed light on everything from the health of the brand to the factors that drive consumer purchase decisions.

But senior executives, and ultimately company shareholders, are often unclear on what concrete benefits are being derived from CI and CA. That’s because more than half of companies within industries such as consumer services, consumer packaged goods, and health and wellness do not regularly measure the return on investment from their CI and CA efforts.

The Customer Insight Series

The Customer Insight Series

Let that sink in: more than half of the consumer-facing companies we surveyed are not measuring the payoff from sizable investments that are central to elevating and preserving their brands and competitive positions. Consumer-focused companies must address this gap by measuring ROI for both CI and CA. This will not only the help the company understand where to direct its marketing firepower, but it will also ultimately increase the value that CI and CA deliver to the business. BCG research shows that ROI measurement—which increases transparency and discipline—can accelerate the maturity of these functions and enhance their ability to experiment and innovate. And companies with more mature CI functions often perform well on observable metrics such as customer loyalty and growth rates.

More than half of consumer-facing companies surveyed don’t measure the payoff from investments that are central to their brand.

Measuring ROI Is the Exception, Not the Rule

As part of BCG’s ongoing research into the customer insights and commercial analytics landscape, we conducted a benchmarking study in late 2017 in partnership with the Global Research Business Network (GRBN). The study involved 200 respondents from both regional and global companies across a variety of industries including consumer-packaged goods, consumer health and wellness, retail, and travel and tourism.

This recent work builds on BCG’s previous research which identified four stages of development for customer insights functions. The way CI operates, including the degree to which outsourcing is used, varies across these maturity levels. The spectrum of customer insights maturity runs from stage 1, which is essentially traditional market research, through stage 4, in which CI is a source of competitive advantage. (It is worth noting that the customer insights function often includes commercial analytics activities or is closely linked to commercial analytics, and our 2017 research found that CA has a similar maturity evolution as CI.) (See “ Why Companies Can’t Turn Customer Insights Into Growth ,” BCG article, August 2016.)

How Measurement of ROI Varies Across Companies. Our late 2017 research revealed that the degree to which ROI on CI projects is measured, how it is measured, and who does that analysis varies by maturity level as well:

- Stage 1 ROI. At this level the CI function is not firmly established, and often has a fluid budget and limited, variable headcount. Significant CI activities are outsourced, which helps control expenses by minimizing fixed costs and incurring CI expenses only as needed. In this stage there tends to be little to no measurement of ROI.

- Stage 2 ROI. CI projects at this stage are often done without clear business objectives defined upfront. As a result, metrics to evaluate success are not defined in advance and impact is difficult to assess. ROI measurement is either done intermittently and/or is qualitative in nature. In this stage measurement is typically done by a member of the CI team.

- Stage 3 ROI. CI projects are based on clear business objectives and defined metrics of success. However, while the metrics are linked to the objectives, in many cases those metrics are not clear predictors of success. Those metrics are typically used to do ROI measurement, particularly of nonroutine, strategic “ad-hoc” CI projects. ROI measurement is often done by a member of the CI or CA team and reported to the head of CI. Less commonly, that measurement is handled by the finance department, or a group such as a testing team that is not part of CI.

- Stage 4 ROI. CI projects have clear objectives with metrics that are solid predictors of achieving those objectives. There is consistent quantitative measurement of ROI for both nonroutine as well as ongoing, regular projects. CI and CA team members are not grading their own homework. Instead, either external parties do that measurement, or a structured method for measuring ROI is designed, based in part on input from outside partners.

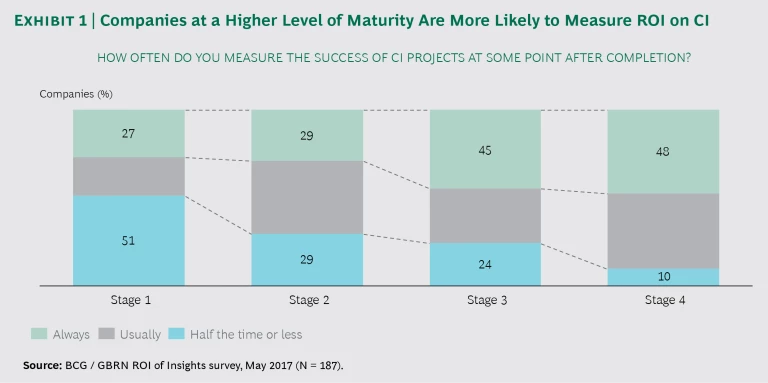

Even among companies with a similar overall CI maturity level, the approach to measuring ROI can differ significantly. Only about one quarter of stage 2 companies measure ROI at all. In stage 3 and 4, the proportion of companies that always measure ROI is closer to 50%. (See Exhibit 1.)

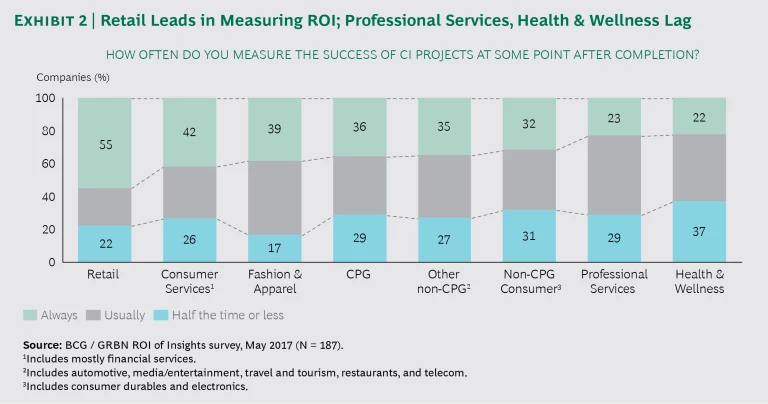

And there is also significant variation by industry. Not surprisingly, retail companies that have access to reliable and timely sales data measure ROI more consistently than the average: 55% of retail respondents always measure ROI of CI in some form and another 23% usually try to measure it. At the other end of the spectrum, only about 22% of consumer health and wellness companies report frequent, consistent measurement of CI ROI. (See Exhibit 2.)

The Benefits of Measuring ROI. There are significant benefits for the CI function from measuring ROI.

First, as a practical matter ROI measurement can help CI teams set priorities more effectively.

Second, it can greatly enhance CI’s standing within the organization and the resources available to it. Companies that don’t measure ROI actually tend to underestimate the value of CI. According to our research, companies that measure the ROI of CI have a higher satisfaction level with CI’s contribution to the business—about 30 to 40 percentage points higher—than companies that do not. It’s hardly surprising then that ROI measurement can lead to a higher CI (or CA) budget, and greater control by CI over how that budget is spent.

Companies that measure the ROI of CI have a higher satisfaction level with CI’s contribution to the business.

Third, measurement of CI tends to give the function a better seat at the table when it comes to the corporation itself. (See “ Building a Better Customer Insight Capability ,” BCG article, November, 2016.) For example, in stage 4 companies, where ROI measurement is common, CI information and insight is frequently used to make critical corporate capital spending decisions.

How to Measure Return on Investment

Certainly there are challenges to measuring the ROI of CI and CA projects effectively. For one thing, it may be difficult to clearly define what the business objective of a particular CI project is—and which metrics are best used to measure progress toward that objective. In addition, there are challenges related to how the impact of a specific CI program can be isolated and how companies should determine the appropriate time frame for gauging impact. But while these challenges are real, companies can address each one. BCG has identified four steps that companies can take in order to ensure they are effectively assessing the return on CI investments.

Select the group to measure ROI. Companies need to create a team dedicated partially or in some cases entirely to measuring ROI. Currently, if that team exists, it is usually within CI or CA. Best practice, however, is to create objectivity for the process by putting some distance between the measurement process and the CI or CA function being assessed. In addition to increasing objectivity, the distance can offer more direct access to the data required to calculate ROI, such as point of sale information.

How this is best accomplished varies, and often depends on the CI function’s level of maturity. In those companies with a stage 1 CI function that actually measures ROI, external providers and partners typically develop the methodology and manage the process. This can help establish and accelerate the development of an ROI measurement process by drawing on expertise from outside the company’s walls.

While it is most common for stage 2 and 3 companies to rely on CI and CA to do the ROI measurement, some companies draw on members of the broader marketing organization, potentially from marketing effectiveness or the marketing analytics groups, to handle the task. And in companies with stage 4 CI functions, members from the business line functions, such as finance or a testing team, often drive the ROI measurement effort.

Identify the right metrics. Once the team responsible for measurement is in place, the next move is to identify the appropriate metrics for assessing return. In many cases the list of potential measures to consider is seemingly endless, including those measures related to consumer behavior and sentiment, finance, operations, and market share structure.

To zero in on the right measures for assessing the return of a CI or CA project or tool, companies need to start with answering a simple question: What is the business objective? Among the most common business objectives: revenue growth, marketing effectiveness, and consumer brand health.

Of course, those business objectives aren’t always entirely clear to CI or CA. In such cases, business line managers need to change how they brief CI and CA on their project goals and CI and CA team members need to be trained to ask probing questions to ensure they have clarity on the objectives. At the same time all groups who participate in or have a stake in the outcome of CI and CA work need to be educated on why such upfront alignment among all stakeholders and transparency is so important.

With the business objectives spelled out, specific metrics should be selected to reflect those objectives. The selection of the right metrics should be done at the beginning of the project—not on the back end. And these metrics should be leading indicators—measures that will be predictive of success against the stated business objectives.

To determine the right metrics, the company should zero in on the decisions or processes that will be directly impacted by the CI or CA project or tool. Consider the case of a CI project that is aimed at driving revenue growth by redesigning the customer experience. Certain measures related to the customer experience might best reflect progress toward the overall objective of improving revenue growth. These measures might include new customer acquisition, reactivation of lapsed customers, and increased productivity of consumer touch-points such as sales associate effectiveness.

Finally, the company should determine the relevant baseline (the starting point) and precise calculation for each metric. For some companies, that baseline selection is driven by an internal advisory group that includes representatives not only from the relevant CI and/or commercial analytics functions but also from finance, strategy, testing, analytics, academics, and external agencies or firms.

Establish the right time frame. The time frame in which to assess impact depends on which business decisions you’re looking to inform. These generally fall into three categories:

- Strategic and forward-looking. These decisions tend to involve ad hoc and predictive research or analytics, and significant allocation of budgets and resources to the CI or CA team. These decisions are typically made during the annual strategic planning process and/or fiscal budgeting cycle and include things such as benchmarking against competitors, customer segmentations, and market trend studies. The relevant timeframe tends to be long—often measured in years. In many cases this period should be limited to three years.

- Tactical and near-term. These decisions are made many times throughout the year, with the relevant time frame for measurement being measured in months. They are typically made based on longitudinal CI studies, such as brand trackers, and commercial analytics such as quarterly or monthly point of sale analyses. The measurement period is usually several months.

- Operational and continuous. In today’s digital world these decisions can occur daily or multiple times a day. They tend to involve continuous data and programs such as social media insights, product or packaging testing, marketing content testing and online clickstream patterns.

With the right time frames identified, the team measuring ROI can do their analysis based on the investments made in the specific projects or tools and the impact those investments had as reflected in the specific metrics selected. CI, CA, and business line leaders should agree on all these elements of measuring ROI—with the process for arriving at agreement driven by CI and CA leaders.

Share the information. Who actually gets the information on ROI is almost as important as measuring it in the first place. Typically the information is shared within CI itself. In companies with more mature CI—stage 3 and 4—the information is shared with the senior executive overseeing the function, often the CMO.

But in order for CI and CA to become more integrated with the business, leaders of both functions need to share this information with business line leaders, the CEO, and ultimately, in some form, the board. Such value-focused, active engagement with key stakeholders by CI and CA—including a certain level of “evangelism”—will go a long way toward helping both functions gain a meaningful seat at the table.

Steps for Getting Started on ROI Measurement

The value of measuring ROI is not debatable—but how to move ahead on this effort is not always clear. The steps required will differ according to the maturity level of a company’s CI and CA functions:

Nascent. For companies with functions that are in the earliest stages of development the goal should be to establish a foundation for ROI measurement. At this level companies should start by defining the value that each CI or CA project is designed to deliver. This can be quantitative or qualitative. And they should be sure that they are working with agencies that have a strong focus on ROI. That focus is reflected in agency actions such as clarifying business objectives for projects, defining specific metrics and targets, and the use of pay-for-performance agency fee structures.

Stage 1. Companies should clearly define the business objective of studies and projects at the outset. They should also define and track performance in certain qualitative metrics such as customer satisfaction or internal referral rates before and after the CI project. And they should assess their next significant CI project to determine the value it creates as a way to fine-tune their ROI methodology.

Stage 2/3. At this level companies should impose greater discipline on the ROI measurement process. This includes identifying quantitative metrics for cross-functional and strategic projects and using those metrics to determine the value delivered by each project after it is completed. CI and CA functions should conduct regular internal reviews of their performance on delivering ROI to the business, and use these reviews to inform CI and CA investment priorities, as well as to provide input into executive decisions related to CI and CA budget amounts and budget control. They should select external agency partners that outline upfront how their research will deliver value and host those partners and other suppliers several times a year to discuss CI and CA innovation and how they can work together to increase the amount of ROI that CI and CA deliver. In addition, the return on investment of CI and CA should be a critical KPI for those functions and compensation within both groups should be tied to performance of the business lines they support.

The return on investment of CI and CA should be a critical KPI for those functions and compensation within both groups should be tied to performance of the business lines they support.

Stage 4. Those companies at the most advanced levels should bring real rigor to the ROI measurement process and use that process to enhance the impact that CI and CA have on the top and bottom line of the business. They should establish quantitative performance criteria for all—or almost all—projects. They should identify or hire employees whose primary roles will be to track and improve CI and CA ROI, and they should involve external agency partners in the measurement process. Furthermore, the CEO and executive team should review ROI several times a year.

Certainly for many companies, particularly those at an early stage in CI and CA maturity, the move to measure ROI will require a new way of thinking and working. But the rewards of such a shift will be significant. For companies, CI and CA investments will be directed at the best projects and tools. And for CI and CA leaders, measuring ROI will reinforce the power of their operations and earn them a better seat at the table with top management.

About BCG’s Center for Customer Insight (CCI)

Boston Consulting Group’s Center for Customer Insight (CCI) applies a unique, integrated approach that combines quantitative and qualitative consumer research with a deep understanding of business strategy and competitive dynamics. The center works closely with BCG’s various practices to translate its insights into actionable strategies that lead to tangible economic impact for our clients. In the course of its work, the center has amassed a rich set of proprietary data on consumers from around the world, in both emerging and developed markets. The CCI is sponsored by BCG’s Marketing, Sales & Pricing practice and Global Advantage practice. For more information, please visit Center for Customer Insight .

The BCG Henderson Institute is Boston Consulting Group’s strategy think tank, dedicated to exploring and developing valuable new insights from business, technology, and science by embracing the powerful technology of ideas. The Institute engages leaders in provocative discussion and experimentation to expand the boundaries of business theory and practice and to translate innovative ideas from within and beyond business. For more ideas and inspiration from the Institute, please visit

Featured Insights

.