This article is a chapter from the BCG report, The Most Innovative Companies 2018: Innovators Go All In On Digital.

Explore the Full Report

- Innovation in 2018

- How Digital Transforms Innovation Strategy

- A Digital Overhaul for Innovation Operations

- Organizing for Digital Innovation

- The Most Innovative Companies Over Time

At leading innovators, R&D and new-product development have become digital endeavors. Eleven of the fifty companies named in BCG’s 2018 ranking of the most innovative companies—including seven of the top ten—are digital natives and thus digital innovators by definition. Most, if not all, of the others on the list have built digital technologies into their innovation programs. The trend is pervasive across industries, penetrating what were heretofore the most stolid and conservative businesses.

Like other aspects of digitally driven change, the shift to digital innovation is difficult. It requires executing big changes in strategy, operations, and organization, which affect the entire enterprise. Little surprise, then, that an innovation digital divide has opened up—and threatens to widen—between leaders and laggards. While 79% of strong innovators reported that they have properly digitized innovation processes, only 29% of weak innovators made the same claim. More than one-third of survey respondents said that digitized processes aren’t really doing much for their company—a sign that they haven’t yet found a way to embrace the new possibilities.

In this year’s report on the most innovative companies, we examine the state of digital innovation and what it takes for companies to refocus their innovation programs around this aspect of the digital imperative. Our three companion articles analyze digital’s impact on innovation strategy, operations, and organization.

The 50 Most Innovative Companies

Exhibit 1 ranks the 50 most innovative companies for 2018. The companies at the top of the list changed only slightly from those in our last report. (See The Most Innovative Companies 2016: Getting Past “Not Invented Here,” BCG report, January 2017.) Two digital natives pushed their way into the top 10 this year: Alibaba Group, which joined the top 50 for the first time, and Uber. Among the top 20, Tencent is also new to the list, and Airbnb, SpaceX, Cisco Systems, Orange, and Marriott moved up—some significantly. Overall, 12 companies either joined the list or returned to it.

While North America remains the most highly represented region, with 27 companies, Europe strengthened its showing substantially with 16 entrants, up from 10 in 2016. The travel and transportation sector has expanded its presence as some companies—including Uber, Airbnb, and SpaceX—demonstrate the disruptive potential of digital technologies and digital business models wielded in combination.

Digital Innovation Takes Over

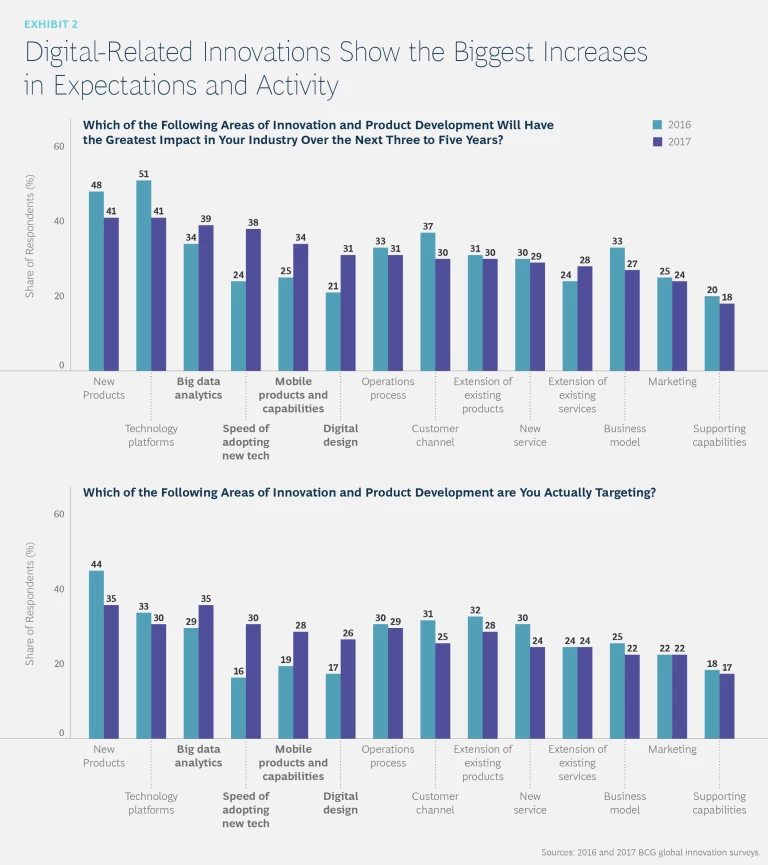

Since 2014, only four types of innovation—all related to digital—have grown in importance and are being pursued by more companies: big data analytics, the fast adoption of new technologies, mobile products and capabilities, and digital design. (See Exhibit 2.)

Big data analytics has risen from eighth in importance to third; it is now, along with new products, the most pursued type of innovation. More than half of respondents said that their companies use data analytics for a variety of purposes connected with innovation, including identifying new areas for exploration, providing input for idea generation, revealing market trends, informing innovation investment decisions, and setting portfolio priorities. Energy, media and entertainment, financial services, and the public sector all saw large increases in terms of the number of companies or organizations pursuing big data in innovation. Recent BCG research has shown that companies across all sectors are still struggling with their data analytics capabilities, and that one capability in particular—the ability to prioritize—is especially concerning, because it is so fundamental to success. (See Are You Set Up to Achieve Your Big Data Vision?, BCG Focus, June 2017.)

The importance of speed in adopting new technologies has gone from near last place to fourth. Speed also used to be last in terms of the number of companies pursuing it as an innovation strategy; it is now tied for third. The percentage of companies targeting fast adoption increased significantly in manufacturing, insurance, metals and mining, and the public sector. Strong innovators understand that successful digital transformation requires excelling in three fundamental areas: speed, scale, and value. (See “Acting on the Digital Imperative,” BCG article, September 2016.)

About a third of all respondents said that mobile products and capabilities, along with digital design, will have a significant impact in their industries over the next three to five years. About a quarter said that their companies are actively targeting these areas. The use of mobile technology is growing significantly in chemicals, financial services, manufacturing, and health care. Digital design is receiving greater attention in consumer products, media and entertainment, manufacturing, insurance, health care, and the public sector.

A Digital Innovation Divide

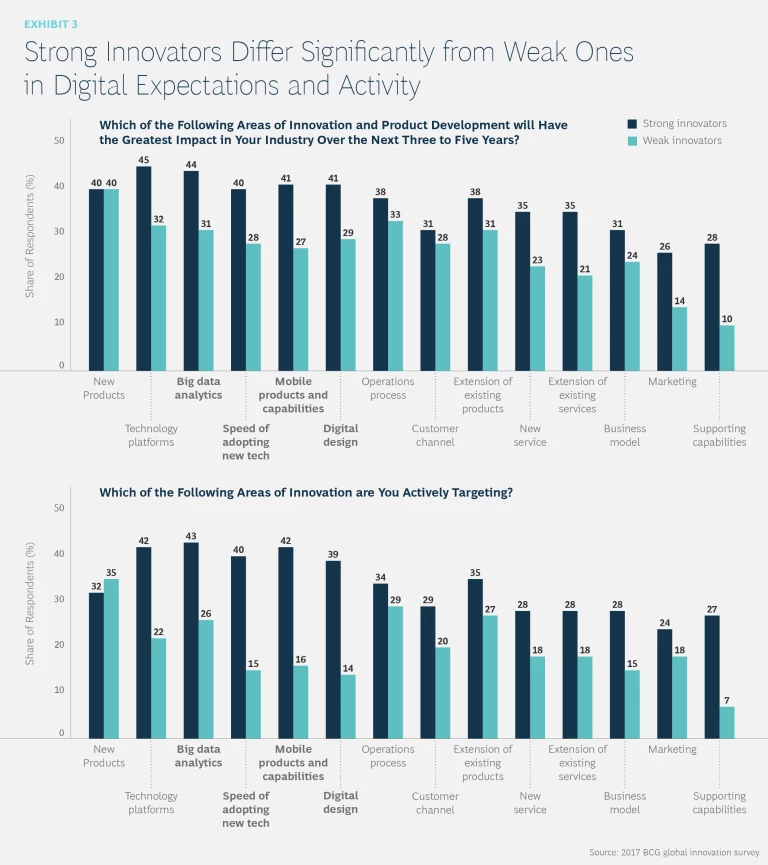

There are significant gaps in many areas between companies that describe themselves as strong in innovation and those that think they are weak, but the divide in the digital aspects of innovation is particularly striking. It indicates that companies with effective digital innovation programs are getting stronger while the weak are falling further behind. For example, strong innovators attach much greater importance than weak ones to the four types of digital-related innovation discussed above, as well as to technology platforms in general. There are even bigger chasms with regard to how aggressively companies are pursuing these innovation avenues. (See Exhibit 3.)

Strong innovators are far more likely to use big data and advanced analytics throughout the innovation process than weak innovators, which struggle to leverage data analytics effectively. Strong innovators also consistently use multiple sources of data, originating both internally and externally. Almost three-quarters of strong innovators, compared with less than 20% of weak innovators, reported that new projects or ideas for growth come from social media or data mining.

Strong innovators are more than twice as likely to use outsourcing to access the right capabilities, something that is frequently necessary for companies that do not have all the requisite digital skills in-house. They are also more likely to have properly digitized innovation processes. And it comes as no surprise that far more strong innovators than weak ones are satisfied with their return on investment (90% versus 24%).

Digital Change

In our work with companies that span the digital innovation continuum, we’ve found that organizations wanting to raise their digital game often face a variety of functional challenges. These businesses need to answer questions in three areas:

- Strategy. How do we apply technologies that expand the horizons of the possible in terms of new products, services, and business models? (See the companion article “How Digital Transforms Innovation Strategy.”)

- Operations and Processes. How do we apply digital technologies to drive innovation, leveraging new tools, platforms, and processes (such as agile) in order to turn insights into new products and services? (See the companion article “A Digital Overhaul for Innovation Operations.”)

- Organization. How do we transform ourselves into digitally capable organizations and cultures that can bring digital innovations to market and make them work? (See the companion article “Organizing for Digital Innovation.”)