The electronic era dealt a huge and disruptive blow to the global paper industry. Beginning in the early 2000s, Europe’s €30 billion graphic paper industry—including magazine, newsprint, and printing paper—began to feel the effects of eroding demand. The recession at the turn of the millennium and the global financial crisis in 2008 further accelerated the market’s decline.

Read more about the Nordic Comeback Kids

Read more about the Nordic Comeback Kids

- Overview

- Danske Bank: Rediscovering the Customer

- Husqvarna: Honing a Competitive Edge

- BillerudKorsnäs and Metsä Board: Two Paper Companies, Two Routes to Reinvention

- UPM-Kymmene: Evolving Beyond Declining Product Categories

- Nokia: Reprogramming for Growth

- Royal Unibrew: Crafting a Turnaround from a Winning M&A Move

Billerud (of Sweden) and Metsä Board (of Finland) are companies whose forestry roots date back 150 years; but poor market conditions and the companies’ own high exposure cost them dearly. In 2008, packaging paper accounted for 68% of Billerud’s sales, and printing paper was responsible for more than 80% of Metsä Board’s revenues. From 2001 through 2008, operating profits for both companies had nosedived, and their debt-to-equity ratios had soared. The two landed at the bottom of their peer group: Metsä Board had lost 90% of its market value, and Billerud had lost 70%, while their peers, on average, had lost 50%.

Leaders at both companies knew that dramatic changes were in order. Packaging was one of the few growing segments in the industry, fueled by rising global prosperity, changes in patterns of consumption, and the steady growth of online shopping. At the same time, demand for recycled raw materials and recycled packaging was increasing, thanks to consumers’ heightened environmental awareness. Both Billerud and Metsä Board recognized that their survival depended on shifting their production from paper to packaging—primarily consumer board, paperboard, and corrugated products. But despite having the same ultimate goal in mind, the companies took completely different turnaround paths to reach it.

BillerudKorsnäs: Strategic Repositioning with M&A

Billerud’s leaders saw great promise in packaging, especially renewable packaging. But in 2008, that segment accounted for barely one-third of the company’s sales: corrugated products, at 29%, and consumer board, at 3%. Given that limited base, organic growth would take too long and be too risky. The company’s best bet for achieving the scale and competence needed to strategically reposition itself, leaders determined, was through M&A.

Billerud set the stage for its transformation with a series of small acquisitions. In 2011, it bought Paccess Packaging, primarily to gain a foothold in new customer segments in the North American and European markets and to expand its supplier base in Asia. In 2012, it acquired UPM-KYMMENE: Evolving Beyond Declining Product Categories to further expand its capacity and to increase the company’s overall sales by approximately 20%.

The company’s pivotal M&A move came in November 2012, when it acquired Korsnäs and became BillerudKorsnäs. Korsnäs’s product strength—packaging materials for consumer goods—positioned the new entity to establish itself as a leader in primary fiber-based packaging products. Almost overnight, BillerudKorsnäs nearly doubled its revenues while beefing up its core competencies. The combined entity now had the scale and the resources to capitalize on two fast-growing subsegments: liquid packaging board (chiefly for packaging milk and juices) and carton board. The successful postmerger integration unlocked SEK 530 million in synergies annually (a 3% margin improvement), by consolidating purchasing, procurement, and logistics, as well as through process improvements. Immediately following the acquisition, the company also lightened its debt load and strengthened its capital structure to bring its net gearing ratio, or debt-to-shareholder equity ratio, to less than 80%.

In one year, BillerudKorsnäs managed to flip the focus of its business, reducing the share of paper in its revenues to 37% and increasing the share of consumer board more than tenfold, to 36%—a healthy balance that the company has maintained to this day.

Metsä Board: Strategic Repositioning Through Portfolio Restructuring

Unlike BillerudKorsnäs, Metsä Board determined that an organic path was the right way to shift the business to a focus on packaging products. Leaders decided to restructure the company’s portfolio by shedding unprofitable businesses and making strategic investments.

The company, part of the Metsä Group, laid the foundation for its turnaround with a two-year cost-savings initiative begun in 2004. The resulting profit improvement helped fund the journey. In 2006, Metsä Board launched a two-pronged divestment strategy: closing paper mills and selling its high-performing paper plants. Within one year, the company had reduced its mill capacity by 13%; within seven years, it had slashed capacity by 78%. A program of asset sales, begun in 2001 to alleviate debt incurred during the company’s late 1990s acquisition spree, generated €3 billion between 2005 and 2012. These divestments not only relieved the company’s onerous debt burden but also were critical in advancing its exit from the paper market. The divestment of Metsä Board’s graphic papers unit alone cut the company’s debt by €630 million and hastened its portfolio restructuring.

With its debt significantly reduced and its margins vastly improved, the company saw its debt-to-equity ratio fall dramatically. By 2011, Metsä Board had reduced the proportion of its sales from paper by almost half, from 84% to 47%. Meanwhile, its paperboard business grew from 16% to 53% of sales. By 2016, just five years later, the company was out of the paper business and squarely in the packaging business, earning 75% of its revenues from paperboard (the rest came from pulp sales).

By All Measures, a Springboard to Future Success for Both Companies

Now on solid ground, the two companies are poised for sustainable and profitable growth. BillerudKorsnäs has high hopes for its SEK 5.7 billion investment (one of the biggest in Sweden in recent years) in a new board machine. Metsä Board’s new financial strength has allowed it to make the necessary investments in capacity to realize its ambitions in the paperboard market—such as expanding the company’s flagship Husum mill, a project that began in 2014. This expansion has boosted the company’s capacity in boxboard and linerboard by 40%.

Across all metrics, both companies have delivered dramatic performance improvements. Between 2012 and 2016, BillerudKorsnäs more than doubled its revenues, to SEK 21.8 billion. The company’s operating profit jumped by 80% to SEK 2.0 billion, and its operating margin rose to 9% (from 5%). The company also slashed debt, restoring its debt-to-equity ratio to healthy levels.

Metsä Board, meanwhile, saw its profits explode during that same five-year period, as its EBITDA margin nearly quadrupled, to 13.4%. The company also slashed its debt from €2.4 billion in 2006 to €464 million in 2016.

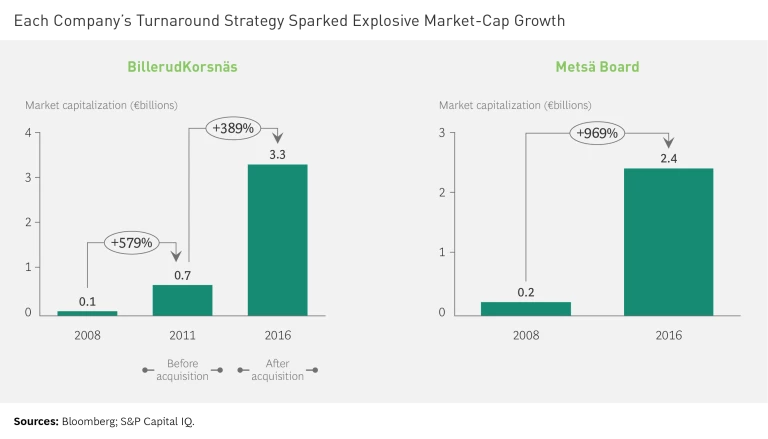

From 2008 (at the beginning of their turnarounds) to 2016, the two companies experienced explosive growth in market capitalization. BillerudKorsnäs’s market cap rose from €0.1 billion to €3.3 billion, while Metsä Board’s jumped from €0.2 billion to €2.4 billion. (See the exhibit.)

Though their approaches differed, both BillerudKorsnäs and Metsä Board strategically repositioned themselves to remain vibrant, value-creating enterprises in an industry rocked by change. Their roots may be a century-and-a-half old, but they have used careful pruning and seeding to reinvent themselves to bear fruit for the long term.