Southern California has a lot going for it as a tech hub. It produces more tech PhDs per year than any other region in the country. The California Institute of Technology—Caltech—generates more patents than any other university in the US, and the University of California at Los Angeles (UCLA) more startups. In fact, our analysis indicates that Santa Monica and West Hollywood have an entrepreneurial density on par with many Silicon Valley cities, including Palo Alto and Menlo Park. SpaceX and Snap (Snapchat) are among the heavy hitters calling Southern California home.

The ingredients are in place for SoCal to emerge as the next major global tech ecosystem.

The Boston Consulting Group, in partnership with the Alliance for Southern California Innovation, took a fresh look at Southern California as a magnet for a new generation of tech innovators. We found a growing, surprisingly potent and robust region on the cusp of greater things. Especially encouraging is the strength of the area’s eight entrepreneurial hubs, or nodes, which provide a firm base on which to build. In contrast, we found that Silicon Valley is losing some of its shine owing to exorbitant costs, an “echo chamber” effect that is squelching innovation, and other problems—all of which create an opportunity for a region only a short plane ride away. In February, the Wall Street Journal reported that Peter Thiel, the famed investor, is leaving San Francisco for Los Angeles. As a source close to Thiel explained in an interview with Bloomberg, SoCal “offers a more varied ecosystem with diverse influences more likely to lead to innovation.”

Silicon Valley is losing some of its shine owing to exorbitant costs, an “echo chamber” effect that is squelching innovation, and other problems.

A lot has to happen before SoCal truly mirrors and complements Silicon Valley. The region must overcome numerous challenges before it can “jump the chasm” and take its place among the world’s top tech centers. There’s no shortage of urban rivals. New York City brands itself as Silicon Alley, Chicago as Silicon Prairie, and Austin as Silicon Hills. Well-developed tech centers exist in Boston and Seattle, along with emerging startup scenes in cities such as Detroit, Pittsburgh, and New Orleans (Silicon Bayou) and strong digital centers in China, India, Israel, and other countries.

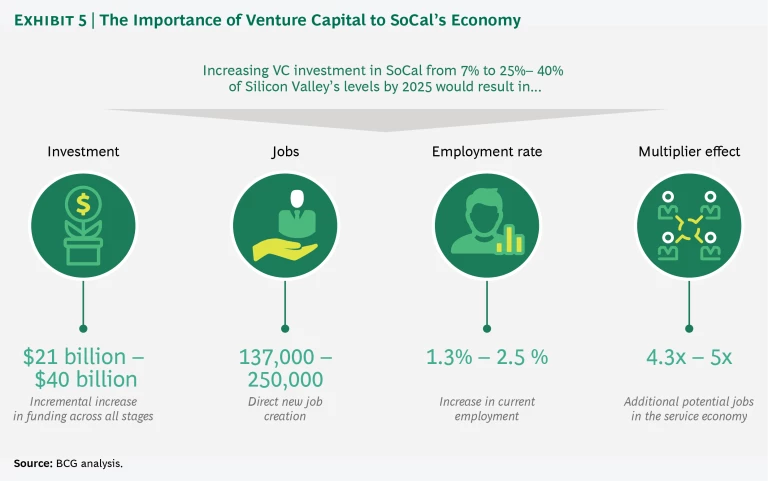

The competition, in other words, is stiff. But the potential rewards are great. If educators, executives, investors, government officials, and other stakeholders can muster the will and vision to work together, they can tap a multibillion-dollar opportunity. To take just one example: narrowing the venture capital gap between SoCal and the Bay Area would translate into 137,000 to 250,000 new, high-paying jobs, along with an influx of hundreds of thousands of service jobs.

The Keys to Silicon Valley’s Success

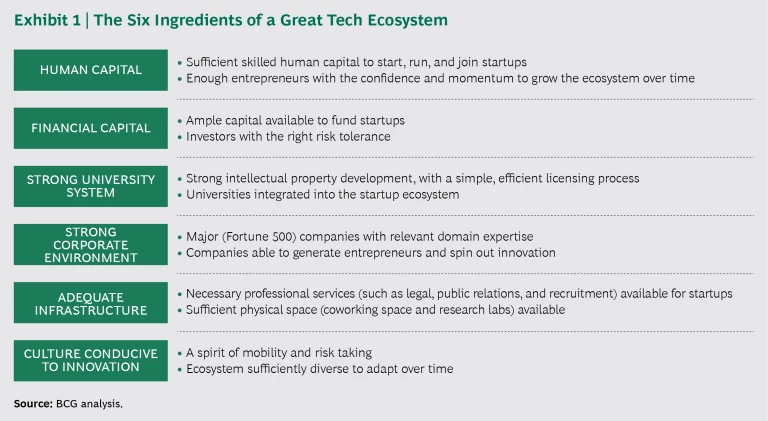

What does it take to foster a nurturing environment—and a magnet—for the next generation of tech innovators? To answer that question, we looked north to Silicon Valley and the San Francisco Bay Area. We sifted through the many studies that have been done to find out why it was Silicon Valley, and not Route 128 outside of Boston, say, or any other metropolitan center with major research universities, that established primacy. We also enlisted the help of Larry Sonsini, a founder of the Wilson Sonsini Goodrich & Rosati law firm, based in Palo Alto, and an influential advisor to the area’s startups over several decades. We identified six ingredients critical to the secret sauce that sustains Silicon Valley: sufficient human capital, sufficient financial capital, a strong university system, a strong corporate environment, adequate physical and professional infrastructure, and a culture conducive to innovation. (See Exhibit 1.)

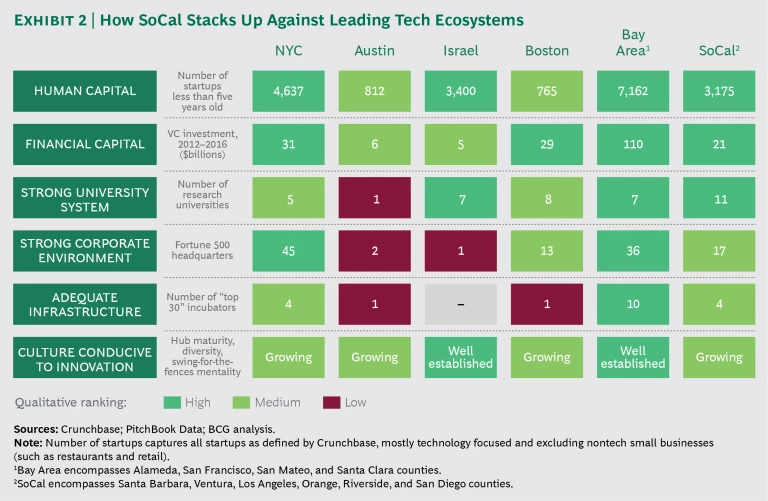

We then conducted 100-plus interviews with entrepreneurs, venture capitalists, and key players in major tech hubs (or nodes), including the Bay Area, as well as a quantitative analysis of each node according to the six categories that we identified. The other tech nodes, aside from SoCal and the Bay Area, were New York City, Austin, Boston, and Israel.

The San Francisco Bay Area, of course, scored at or near the top in every category. In many instances, it exceeded other tech nodes by a multiple, if not an order of magnitude. That’s hardly surprising; the innovation engine that is Silicon Valley is without parallel in modern business history, and now San Francisco has become an extension of the Valley, if not the region’s new center of gravity. Leading thinkers from across the globe migrate to the Bay Area to work with the world’s best and brightest. Engineering-intensive startups founded elsewhere feel pressure, whether explicit or implicit, to move to the Bay Area, especially when ready to scale. Another critical ingredient is the area’s concentration of venture capitalists, many with offices on a two-mile stretch of Sand Hill Road in Menlo Park. The network effects are substantial, given the volume and density of startups. Many of those we spoke with brought up another virtue of a community thick with so many tech companies: employees who, following an IPO or acquisition, start new ventures of their own—the “feedstock” of the startup ecosystem.

Other areas scored high in two or three categories. (See Exhibit 2.) New York City, for instance (like the Bay Area), is home to far more major corporations than Southern California. SoCal ranked fourth, behind New York, Boston, and of course the Bay Area, in terms of the dollar amount of venture capital locally invested between 2012 and 2016. The risk-taking, swing-for-the-fences attitude that embodies the tech scene in the Bay Area has taken hold in Israel but not quite yet in Southern California, even as we see progress there and in the other regions we examined. Yet SoCal arguably ranks second overall on the grid shown in Exhibit 2 and compares favorably with Silicon Valley. If not quite there yet, the region at least has the main ingredients in place that gave rise to Silicon Valley starting in the early 1960s.

Silicon Valley Woes

The good news for SoCal and any region with tech ambitions is that the Bay Area has in some ways been too successful. Our research revealed a saturation level causing unprecedented challenges, starting with exorbitant housing prices and runaway operating costs that accelerate a startup’s “burn rate”—its monthly spending. Consider this sampling of headlines from 2017:

“In Costly Bay Area, Even Six-Figure Salaries are Considered ‘Low Income’”

- (San Jose) Mercury News

“83% of Renters Want to Move Away from the Bay Area”

- Washington Post

“A 2:15 Alarm, 2 Trains and a Bus Get Her to Work by 7 A.M.”

- New York Times

Everywhere we found signs of a community choking on its own success. A 2015 study by Redpoint Ventures , a top-tier venture firm on Sand Hill Road, suggested that the cost of operating a startup in Silicon Valley doubled between 2009 and 2014—an inflation rate of roughly 14% annually. One venture capitalist we interviewed is connected to a burgeoning artificial intelligence network in Toronto. There, the same investment lasts 33 months, compared with 14 months in the Bay Area. Many spoke of a downside to the network effect: an echo chamber that causes more and more startups to target the same market segments and attack the same customer pain points. Clients in the San Francisco Bay Area consistently express worries about attracting and keeping top talent. To save costs and help with employee morale, many are actively looking to shift at least some positions to locales outside the Bay Area, if they have not done so already. One of those is a senior executive at a Fortune 100 tech company, who complained of the growing expense of hiring engineers and the employee poaching that is a “daily” occurrence.

A majority of our interviewees indicated that the time is ripe to offer a viable alternative a short plane ride away. SoCal needs to recognize—as if it were a startup attacking a pain point—that in problems such as these lie important opportunities.

Sizing Up SoCal’s Assets

Southern California’s strength as a region begins with its obvious assets: warm weather, year-round sunshine, the coastline and its beaches. Los Angeles has long been the city of dreams, welcoming those seeking fame and fortune. The roots of technology are deep there and date back to the image and sound technologies that helped create the motion-picture industry and give SoCal its Hollywood sheen. Recently, Los Angeles was named a finalist in Amazon’s search for a second headquarters. And, as mentioned above, there’s Peter Thiel’s decision to move to LA, along with the 50 or so people who work for him at Thiel Capital and the Thiel Foundation, which devotes a large portion of its funding to financing scientific research.

A large number of high-profile Bay Area-originated tech firms have offices in SoCal, including Google, Facebook, Yahoo, Netflix, and Salesforce. YouTube operates studio space in a part of the region that some call Silicon Beach, a coastal strip stretching from Playa del Rey and Venice to Santa Monica. There, an estimated 395 new companies sprouted up between 2014 and 2016 alone. Most of them are located within a few blocks of the beach. “There’s a creative energy to Venice. A better quality of life,” the CEO of one venture-backed startup told USA Today in a 2012 article running under the headline, “Silicon Beach Emerges as Tech Hotbed.” The CEO continued: “You can go surfing in the morning, code by day…and the weather’s better than Palo Alto.” In recent years, the tech world has grown enamored of the elusive unicorn, a young technology company worth at least $1 billion. Southern California is home to at least three “decacorns”—young enterprises worth at least $10 billion: Snap, SpaceX, and Kite Pharma (recently acquired by Gilead).

A strong university system is one of the six ingredients we identified in the formula that created and continues to nourish Silicon Valley. Here SoCal is without peer. The region has more major research universities than anywhere else in the country. With that comes a constant supply of raw brain power, which relates to a second critical ingredient: sufficient skilled human capital to populate the startups that are being established. Not only is Caltech in Pasadena, but it is the top US university in patents issued, according to a 2017 Milken Institute study , and four other Southern California universities rank in the top 20. In the same study, UCLA took the top spot for startup creation and three other SoCal schools ranked in the top 22.

SoCal has more major research universities than anywhere else in the country and sufficient skilled human capital to populate the startups that are being established.

As noted earlier, SoCal’s universities rank first in the US in tech PhDs awarded each year—about 600—and they are second only to New York State’s universities in tech graduates (more than 13,000 annually). More than 80 Nobel Prize winners call SoCal home. The Bay Area may have three renowned universities (Stanford, UC–Berkeley, and UC–San Francisco), but Southern California can counter not only with Caltech, but with UCLA, UC–Irvine, UC–Riverside, UC–Santa Barbara (UCSB), UC–San Diego (UCSD), the University of San Diego, the University of Southern California (USC), and the Claremont Colleges, among others.

The more integrated an area’s high-powered universities are with the local startup ecosystem, the more robust the startup scene. USC’s Institute for Creative Technologies and UCLA’s Silicon Beach Innovation Lab both aim to better link the university with local startups. Other schools have similar centers that focus on real-world technology challenges. UCSD, for example, has a renowned life sciences research program, and San Diego is also home to the Sanford Consortium for Regenerative Medicine, the Sanford Burnham Prebys Medical Discovery Institute, the Scripps Research Institute, and the Salk Institute. UCSB is known for its leadership in materials science and Pasadena has NASA’s Jet Propulsion Laboratory.

A strong corporate environment is another important ingredient. Southern California is home to 17 Fortune 500 companies, compared with 13 in Boston and 2 in Austin (and 1 in Israel). Significantly, some of these—such as Qualcomm, the world’s largest maker of smartphone chips—offer relevant domain expertise. Employees at a Qualcomm or a Disney, or at a medium-size enterprise such as Harbor Medtech—a health tech company in Irvine working on regenerative medicine—help feed the stock of entrepreneurs dreaming up related businesses. The region’s greatest strength has always been content creation, and it’s also long been home to video game designers (Electronic Arts is still a large employer in the area, along with newer entrants like Scopely and Riot Games). The local defense and aerospace industries are not as strong as they once were, but new enterprises (including Elon Musk’s SpaceX and Richard Branson’s Virgin Galactic) have sprung up in their place and are pioneering the next generation of space travel. Orange County is a thriving hub for medical-device companies and any number of SoCal startups are working on virtual- and augmented-reality technologies.

SoCal is home to 17 Fortune 500 companies, some of which offer relevant domain expertise and help feed the stock of entrepreneurs dreaming up related businesses.

A More Diverse, Less Expensive Region

SoCal’s diversity is another great advantage in the competition for tech startups. AnnaLee Saxenian, a foremost authority on the Bay Area’s “regional advantage,” has noted that a high-skilled immigrant population is critical to its success as a tech mecca. There’s also the draw of a multicultural, polyglot environment for the younger workers whom startups need to recruit. Angelenos hail from 140 countries and speak 224 languages. Thirty-five percent of the city’s residents are foreign-born, more than any other US city; San Diego ranks 12th in the number of immigrants living within its borders and Orange County 15th. By comparison, Santa Clara County in Silicon Valley ranks 7th and San Francisco 26th.

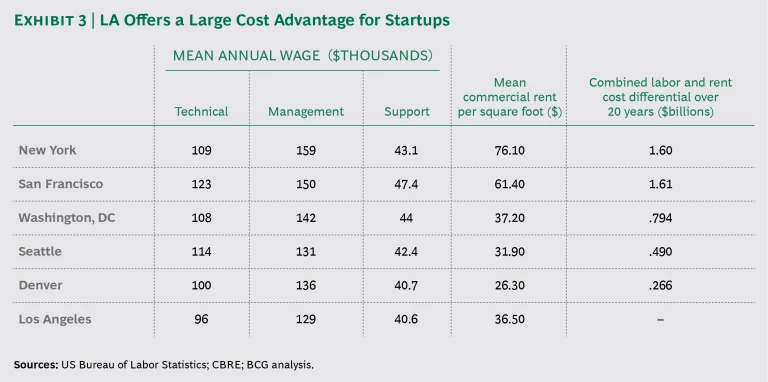

Rents and home prices are significantly lower in SoCal—a big selling point for those seeking to start a company and for the employees they’ll need to hire. (See Exhibit 3.) The median sale price of a home in San Francisco is more than twice that of a home in Los Angeles. Employees working at a startup in Manhattan Beach, say, can pay around $700,000 for a home in nearby Torrance or Inglewood. A programmer, marketing manager, or salesperson in Silicon Valley would pay at least twice that amount for a home anywhere close to work. The median rent across all properties in San Francisco is $3,219 a month—more than 50% higher than the $2,107 per month that the average renter pays in Los Angeles.

Then there’s the cost of doing business in the Bay Area. In Los Angeles, the mean commercial rent is $36.50 per square foot, compared with $64.40 in San Francisco—more than 75% higher. Employee salaries are also significantly higher. The mean annual wage of a tech worker is $95,617 in Los Angeles, compared with $123,158 in San Francisco. The average manager also costs more up north: just under $150,000 a year in San Francisco compared with $128,530 in LA. We calculated the combined labor and rent cost differential over 20 years for a startup that has scaled to 5,000 employees by its tenth year and found that it would save $1.6 billion by setting up shop in Los Angeles rather than in San Francisco or New York. The savings would be $250 to $500 million compared with Denver and Seattle.

The Bay Area, of course, is still a powerful draw. As a general partner at a top-tier venture capital firm in Silicon Valley pointed out, the cost of an engineer may be higher there but the area offers unmatched efficiency in terms of hiring and employee productivity: “Finding the right talent for the right position can be accomplished in days versus months, which can often more than offset the increased salary.” But as costs and the effects of saturation (including traffic congestion and high housing prices) rise, the risk-reward calculus of operating in Silicon Valley shifts in ways that favor other parts of the country.

SoCal at a Tipping Point?

Any observer of Silicon Valley can tell you that success builds on itself. First-time founders become serial entrepreneurs, whose past success makes it easier to raise funding. Some of those they’ve hired over the years venture off to start companies of their own. Others serve as the seasoned veterans whom young startups hire when seeking to grow. Academics studying this phenomenon talk about “entrepreneurial density”—the concentration of tech companies or tech workers per unit of space (per square mile, per city, per region). Few factors are as important in fostering collaboration, creativity, and innovation. A general manager of Box, a cloud content management company based in Silicon Valley, told us about a roundtable discussion with representatives from ten cities on the topic of why some regions succeed while others struggle. His conclusion based on those discussions: “Entrepreneurial density is a key driver for tech hub success.”

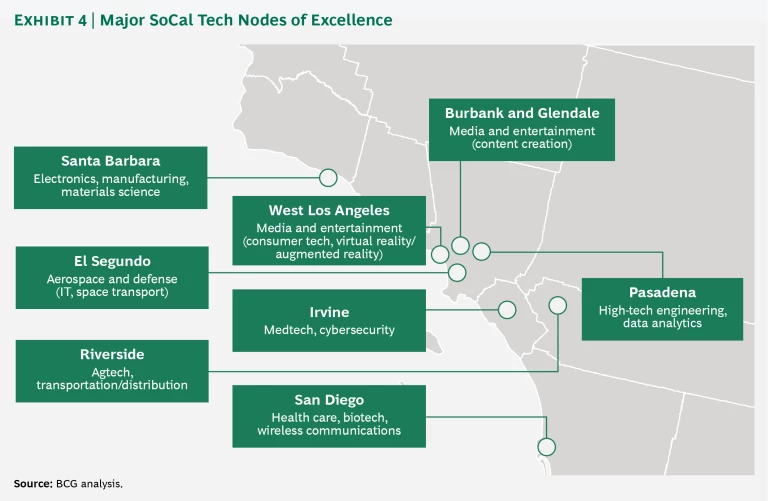

This insight is critical, and it offers both good and bad news for those seeking to accelerate the growth of the SoCal startup scene. On the positive side, our research shows that SoCal has at least eight nodes of excellence, each at a different stage of development (for example, San Diego is strong on most of the dimensions we identified, while Riverside’s strengths are nascent). Nodes have formed in Burbank and Glendale around content creation (media and entertainment). Another in Irvine is centered on medtech and cybersecurity. These and the other nodes serve as a foundation on which to build a world-class tech ecosystem. (See Exhibit 4.)

The downside for SoCal is essentially geography. In Silicon Valley, cities are clustered together in numbers that amplify the benefits. That proximity translates into traffic headaches for commuters on US 101, but it reinforces the creation and strengthening of information networks. SoCal has many of the same benefits, arguably to a competitive degree—but spread over a geographic area approximately eight times greater.

The absence of a center of gravity has historically bothered entrepreneurs, who fear that moving to SoCal will mean losing the concentration on tech that is part of life in the Bay Area. As one longtime Silicon Valley executive told us, “Entrepreneurs exist in SoCal, but something is keeping them from maximizing their potential.” He has offices in Southern California and though he sees its lures, he remains in Silicon Valley. “There’s a confidence I have that if I start a company here I’ll have access to capital and the support I need.”

The fact that Los Angeles was awarded the 2028 Olympics will help. Its winning application promised that the region will spend $88 billion upgrading its transportation infrastructure. That will bring its disparate “pockets” effectively—if not physically—closer together. Add to that the virtuous cycle born of the successes the area has enjoyed in recent years. Decacorns like Snap and SpaceX are creating more entrepreneurial feedstock, which promises to fill in pockets of expertise. And in Silicon Beach, tech giants such as Google, Yahoo, and Facebook have expanded their footprint, increasing the density of tech employees and engineers in the area.

The west side of Los Angeles is one of SoCal’s most fully developed nodes. The area is home to roughly 2,000 tech companies—about 55 per square mile. Most focus on consumer apps linked to mobile, social, gaming, and media and entertainment. The area is home to Activision Blizzard, a gaming giant with $16 billion in annual revenues, and to Snap and Live Nation Entertainment. UCLA is nearby, and USC operates its innovation lab there. West LA’s “infrastructure” includes accelerators and incubators (for instance, Amplify.LA, MuckerLab, and BCG Digital Ventures). We believe the strength of the West LA node will serve as a critical catalyst for regional growth, especially as tech companies and talent look for opportunities beyond Silicon Valley.

The west side of Los Angeles is home to roughly 2,000 tech companies—about 55 per square mile.

One more sign that SoCal’s nodes are strengthening: fewer recent grads are leaving for jobs outside the region. Data from members of the Alliance for Southern California Innovation indicates a remarkable spike in SoCal tech graduates from leading institutions (those with bachelor’s, master’s, and doctoral degrees in a range of science-related majors) choosing to remain in the area after graduation, instead of migrating to the Bay Area or elsewhere. Whereas 31% of Caltech graduates remained in SoCal after graduation in 2012, 54% did so in 2017. A similar trend is apparent at UCSB and Harvey Mudd College. This tells us that SoCal is creating new jobs in demand centers that likely overlap with the region’s nodes. It’s the new grads who have the pulse of the local startup scene, and their presence tells us that they see the future right where they live.

SoCal’s Deficits

The area’s biggest deficit, at least from the perspective of the startup community, is a lack of venture capital. At the pre-seed stage, SoCal attracts funding levels roughly on par with Silicon Valley. Yet by the seed and early-stage rounds of funding—critical points in the life of any startup—SoCal trails Silicon Valley by a factor of four, based on 2012–2016 data provided by PitchBook, a financial analytics company based in Seattle. The gap grows even wider during the later stages of the venture-funding cycle. SoCal trails the Bay Area by a factor of seven in later-stage venture rounds. What this means is pressure on founders to migrate north to Silicon Valley when it’s time to scale.

The area’s biggest deficit, at least from the perspective of the startup community, is a lack of venture capital.

Today, most venture capitalists in Silicon Valley who have invested in a SoCal company make day trips to the area to visit their portfolio companies. Leaders in SoCal will know that they have succeeded when top-tier firms on Sand Hill Road see so many investment opportunities in SoCal that they open up satellite offices in the region, just as many have increasingly done in China or Israel. They must also make sure that their serial entrepreneurs (those with a successful startup track record who are therefore able to raise capital no matter what their locale) stay in the area because they see no reason to go elsewhere.

We see this shift as a three-step process. The region is already in the midst of the first: making sure that more of its tech grads and PhDs remain in SoCal because they’ve found work with an innovative company or because the environment is right for commercializing their ideas. Step two is making sure that more of SoCal’s seed venture companies stay put rather than move north when it’s time to scale up and grow big. This too is happening and can be promoted by stronger networking and better visibility for companies that show early promise. Step three is also in progress, if only within the strongest nodes: an entrepreneurial density so great that it serves as a strong magnet for startups and like-minded individuals, thereby putting pressure on venture capitalists to open an office down south rather than continuing to take commuter flights up and down the coast.

Critical Next Steps

Many stakeholders have a role to play in the growth of SoCal as an innovation hub. Universities can ease the tech transfer of intellectual property and invest in entrepreneurship programs and incubation space. Politicians can ensure infrastructure investments and a more favorable regulatory environment. Elected officials and others need to work more closely across municipal boundaries. Individual cities can aspire to create their own mini tech hubs—cheap alternatives to existing nodes—since embryonic startups will always be on the hunt for cheap rent.

The Alliance for Southern California Innovation can play a central role as facilitator, leveraging its sizable network (via its board and advisory council) to bring together key players in the SoCal ecosystem and ensure that entrepreneurs are fully supported as they seek to scale their businesses. Formed in 2017, the Alliance provides a resource at an opportune moment, with Silicon Valley oversaturated and SoCal at a tipping point. Its members include the area’s major research institutions, local business leaders, and world-class advisors. It falls on the Alliance and other organizations to focus on the gaps that stand in the way of further tech growth and ensure that promising SoCal founders are linked to the right types of capital and the right types of expertise. Southern California could then emerge as a tech hub that competes with Silicon Valley—an audacious but not a completely unreasonable goal. Our recommendations follow.

Recommendation 1: Attract More Venture Capital

We can’t emphasize enough the importance of venture capital to the health of a startup ecosystem. (See Exhibit 5.) We estimate that expanding SoCal’s venture capital investments from 7% to 25%–40% of the Bay Area’s total venture spending would result in between 137,000 and 250,000 new, high-paying jobs. Economists estimate that for every tech job, roughly four to five service jobs are created—a multiplier effect that greatly outpaces that of traditional manufacturing. Our interviews with top-tier venture capitalists confirm that “smart money will find good ideas”; increased investment will therefore come as the region increases its attractiveness to seasoned entrepreneurs looking to start their next venture.

Recommendation 2: Strengthen Existing Tech Nodes

The area’s stakeholders must identify gaps within each tech node and leverage their networks to ensure that the necessary ingredients are added: a more tightly integrated, supportive relationship with a nearby research institution, perhaps, or access to the professional services they need. More mature companies can partner with younger entrepreneurs and offer them access to the lab space and test equipment that they will need after graduating. Recruiting organizations, such as the Aerospace Corporation in El Segundo and LA BioMed in Torrance, with their significant assets and vertical expertise, can help firms grow from concept to enterprise and ultimately strengthen each node. As nodes grow in size and breadth, the disadvantages of the area’s geographic spread will diminish.

Recommendation 3: Foster Interconnectivity Among Existing Tech Nodes

The primary strength of Silicon Valley is its cohesiveness as a community. The Alliance is leveraging its relationships with universities and others across the region and playing a central role in fostering that same interconnectivity in Southern California. The Alliance and other interested parties should identify opportunities to bring nodes together around overlapping interests and host well-publicized events for innovators and investors from across the region. Area leaders also need to impress on local companies that it is in their own best interest to more frequently engage with startups in a more robust fashion. One way to bring that about is by sharing subject matter experts. Another is to establish rotational programs for junior employees.

Recommendation 4: Elevate the Collective Ambitions of SoCal Founders

Our interviewees consistently brought up the advantage of the Bay Area’s swing-for-the- fences mentality—the permission to fail in the name of a bold and audacious goal. That mentality is a big reason why so many venture firms are based there and why many serial entrepreneurs often prefer to remain. We recommend that the business community develop a “band of angels” similar to Silicon Valley’s comprising seasoned entrepreneurs who encourage this attitude. Such a group would build on existing networks of investors in the area and share their experiences with less seasoned founders. Much like Sam Altman’s Startup School in the Bay Area, such a group can democratize know-how and expertise.

Recommendation 5: Market the Region’s Commitment to Diversity and Inclusion

Southern California must do a better job promoting its diversity, which is a critical source of competitive advantage. Increasingly, diversity is an important motivator for individuals seeking to opt out of what some perceive as a “bro” culture at Silicon Valley startups. Maria Klawe, president of Harvey Mudd College, is leading a working group that is looking at how to build on this advantage; its recommendations are expected later in 2018.

Recommendation 6: Highlight SoCal’s Tech Capabilities Locally and Beyond

The robustness of the SoCal innovation economy was a surprise even to some of the stakeholders we interviewed. The area must do a better job at marketing the region’s strengths both at home and beyond. The Alliance is hosting a series of technology showcases in 2018 and a startup competition that should give exposure to some of the best ideas and brightest individuals in the SoCal ecosystem.

We don’t expect massive change overnight. Nor do we enter the debate on the “next Silicon Valley” lightly. But we do believe that the facts and data support significant strength and momentum for the Southern California innovation ecosystem at the same time that the Bay Area, for all its unquestioned strengths, is starting to falter under the weight of its own success. With the right influence applied strategically, stakeholders in Southern California have an opportunity to grow the startup economy in a very significant way.