Venture philanthropists (VPs) are naturally eager to measure how their investments contribute to social change, but these funds often track generic metrics such as how many lives their investments affect. This data provides little insight into a much more important question: How have people’s lives improved? By focusing on overly simplistic metrics, VPs are missing an opportunity to add enormous value for social businesses.

In recent years, leading VPs have begun to embrace a new paradigm in which data is used as an essential tool to deliver greater social impact. While data collection has typically been viewed as a burden done for the sake of reporting, many VPs are now taking a much more proactive role in catalyzing social change through impact management. As one investor put it, “We are in the business of driving social performance and changing lives, not reporting.”

Since 2012, BCG has been working with Nobel Peace Prize winner Professor Muhammad Yunus—one of the pioneers of the social-business concept—and his network of organizations, including Yunus Social Business (YSB). Through this collaboration, we have developed a methodology to help VPs maximize the social impact of their investments. This methodology pushes well beyond the standard bean-counting approach that focuses on reporting. Instead, VPs use powerful data to gain a holistic view of their investments, which allows them to create more resilient and sustainable social businesses and make a meaningful difference in more people’s lives. VPs use this approach to manage impact at two levels: first to understand and optimize the fund’s impact on the social business to build stronger and more resilient companies, and second, to gain a comprehensive understanding of how the social businesses can optimize services and products to deliver better outcomes for beneficiaries.

While most funds track standard business metrics, such as sales figures and financials, few monitor the development and maturation of their social businesses in a structured way—and even fewer report on it. For VPs to strengthen the social businesses they invest in, a new approach is needed.

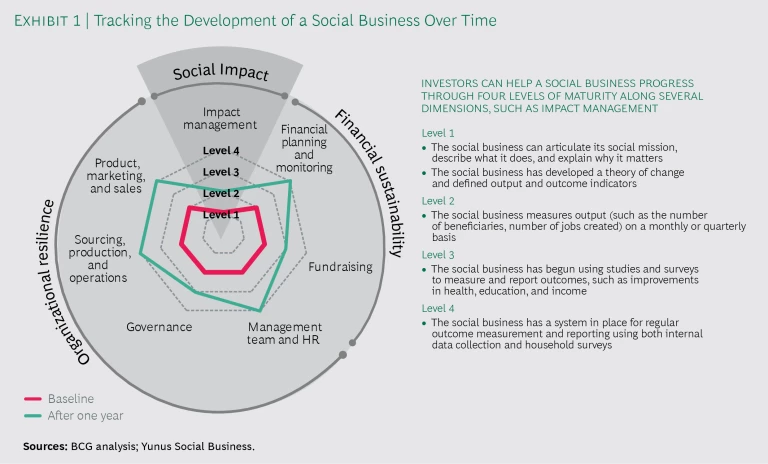

A social business needs to deliver results in three core areas: social impact, financial sustainability, and organizational resilience.

A social business needs to deliver results in three core areas: social impact, financial sustainability, and organizational resilience. To mature in these areas, businesses need more than philanthropic capital. They need targeted nonfinancial support, such as strategy consulting, training, and access to networks. Nonfinancial contributions are crucial in helping social businesses build internal capabilities and deliver greater impact. VPs can maximize the value of nonfinancial support in the following ways:

- Target areas for nonfinancial support. VPs must first identify the specific types of support that will help their portfolio companies become more sustainable and resilient. Support will vary depending on the fund’s focus and each business’s unique needs. A VP investing in early-stage social businesses will focus on the ability to create social impact and recover cost, while a fund supporting businesses in the scale-up phase might emphasize organizational resilience, such as the efficiency of core processes and systems.

- Track the development of the social business’s capabilities. Once specific outcomes have been identified, the next step is to track progress toward them. By establishing a baseline for the business’s capabilities at the time of the investment, VPs get a clearer look at the maturity and development of the social business over time. (Exhibit 1 shows the framework YSB uses to build capacity within its social businesses and illustrates the four levels businesses would move through as their impact management matures.) We recommend that VPs include these baseline and maturity assessments in their fund’s regular portfolio review. Investment managers can also use these assessments as a powerful tool in day-to-day interactions with social businesses. For example, when one of its social businesses experienced some difficulty with financial reporting, YSB connected it with a seasoned accountant who helped set up robust financial systems and easy-to-use accounting tools. This not only improved reporting but also allowed the social business to gain insight into its finances in real time.

- Evaluate the effectiveness of nonfinancial support. VPs may provide nonfinancial support in any number of areas, such as management, financial planning, and human resources. By recording support provided and tracking the business’s maturation over time, VPs can ensure that resources are being directed toward areas that generate meaningful results. For example, a social business in Haiti produces cleaning products to make hygiene and sanitary solutions accessible and affordable. YSB provided access to experts in distribution networks and supply chain systems, which helped the social business incorporate safety procedures into their supply chain and develop more cost-efficient logistics operations. By tracking outcomes, YSB was able to confirm that this expert support ultimately reduced costs for the business.

The insights gained from this structured approach enable social businesses to become stronger, more resilient, and fully capable of driving social change.

By following this structured approach across their portfolio, VPs can ensure that their support is targeted properly and is as effective as possible. It helps secure the VP’s investment, and the resulting insights enable social businesses to become stronger, more resilient, and fully capable of driving social change on a broad scale.

In addition, it’s critical for VPs to keep the lines of communication open with social businesses. Satisfaction surveys provide insight into how much the social businesses value the nonfinancial support they received, particularly in areas closely linked to the core objectives of social impact, financial sustainability, and organizational resilience. By soliciting this type of input, VPs can better understand the business’s needs and take action accordingly.

Enhancing Social Impact for Beneficiaries

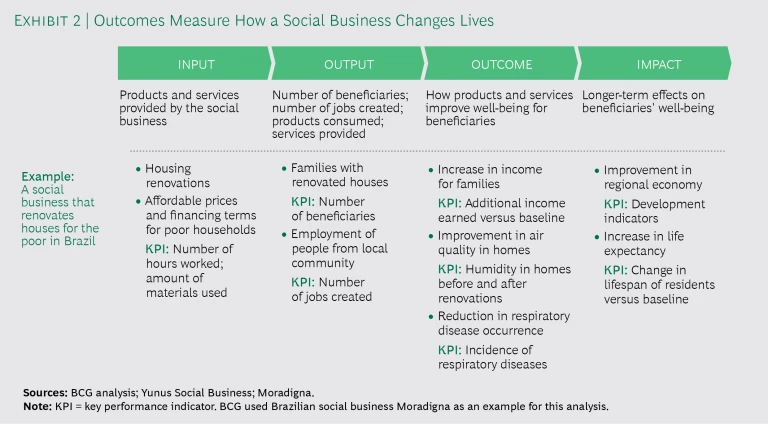

Much has been written about the importance of monitoring how well social businesses are delivering on their mission, but many VPs and social businesses have yet to advance beyond tracking output metrics such as “number of people served” or “number of jobs created.” This type of data offers little insight into how social businesses are changing people’s lives.

Instead of setting up complex monitoring frameworks, VPs should invest time and resources in helping social businesses understand what drives and inhibits their effectiveness. This requires an intimate understanding of beneficiaries’ needs, living conditions, and challenges:

- Understand beneficiaries’ needs and define the desired impact. Social businesses can benefit from the type of research that for-profit businesses use to better understand their customers. They can survey customers, employees, and other beneficiaries to learn who is being served and how the products and services are changing lives. With a realistic picture of the needs and problems at hand, VPs and social businesses can work together to map out a theory of change, a methodology used to articulate what a social business must achieve to be successful and how it will deliver to its target beneficiaries. Through this collaborative process, both entities can establish a common language, gain a clear vision of how the business strategy and operations link to the social mission, and define key performance indicators to measure output and outcomes.

- Track output to measure breadth of impact. Output data, such as the number of customers reached or number of jobs created, is usually the easiest type of information for social businesses to collect. This is true for Moradigna, a social business based in Brazil that renovates homes for people living in poor, unsanitary conditions and employs people who have not had access to the formal labor market. Measurable outputs for Moradigna are “number of people employed” and “number of homes renovated.” This data provides the company with fundamental information about the reach of its activities.

- Track outcomes to measure depth of impact. Although output makes for easy aggregation, it doesn’t provide the necessary insight into how a social business affects its customers and beneficiaries. Using Moradigna again as an example, output data showing that the business renovated 300 homes doesn’t tell us how the home renovations affected people’s well-being. But if we track outcomes, we can see that “humidity in homes decreased by X%” and “occurrence of respiratory disease was reduced by Y%.” (See Exhibit 2.) By collecting outcome data, the social business gets an opportunity to solicit feedback from beneficiaries, which can then be used to continuously improve the product or service. VPs can either directly or indirectly provide expertise and funding to generate data on outcomes. Armed with this information, social businesses and VPs can test key assumptions of their business models and drive their strategies forward to achieve the desired impact.

Venture philanthropists have a unique opportunity to shape the future of social businesses. As early investors, they are uniquely positioned to drive change that creates value for social businesses and people in need. With a bilateral approach to impact management—understanding how the fund can best support the social business as well as how the social business can best support beneficiaries—VPs can provide the kind of targeted support that leads to long-term success.