In the digital era, winners go big. Amazon accounts for nearly half of all online retail sales in the United States. YouTube has more than 1 billion users worldwide. Netflix can boast a customer base comprising 44% of all video-on-demand subscribers. Clearly, telecom operators want to be digital winners, too. But so far, they’re not going very big.

Make no mistake : telcos are benefiting from digital initiatives. Automation is improving efficiency and customer experiences. New offerings are helping operators stand out from the competition. New business models—in areas such as content, advertising, and data and analytics—are opening the door to additional revenues. Yet many telcos are seeing less benefit than they probably could.

This year’s telco IT benchmarking study (TeBIT)—a survey of European operators’ IT spending and performance that was completed in August 2018—reveals that digital initiatives are having a very limited impact on the top line so far. No participating telco generated more than a few percentage points of its mobile or fixed revenues via digital channels. And although participants are now seeing about a fourth of their revenues come from areas outside their traditional fixed and mobile businesses, ICT services—not digital offerings—account for the bulk of those revenues.

When it comes to internal processes, the story is similar. Fully digital operations—such as remote incident management and zero-touch provisioning—are the exception, not the norm.

To be sure, telcos have the right vision. In the 2015 TeBIT study, the participants that were most active in the digital space suffered the smallest revenue declines. Last year, participants that invested in AI and robotics saw ROIs of 160% to 300%. (See TeBIT 2017 Executive Report , BCG report, October 2017.) And in TeBIT 2018, we find telcos markedly increasing their IT investment spending, with digital initiatives getting high priority. One could argue, then, that telcos just need more time to realize the full potential of digital transformation.

But this year’s TeBIT study suggests that while telcos have the right vision, they may not be on the right track to achieve it. Specifically, they are underusing or altogether lacking a key tool for navigating the journey: KPIs that measure the extent of digitization in their end-to-end processes.

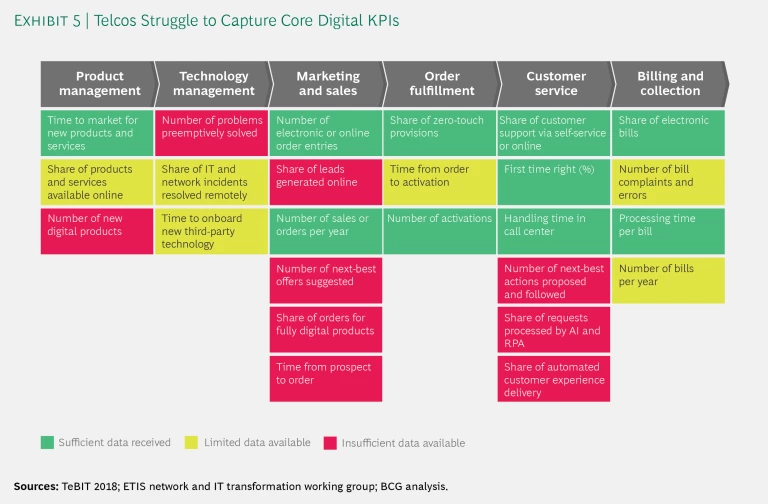

Working with European operators within ETIS—The Community for Telecom Professionals, we explored and refined a set of digital KPIs, including metrics such as time to market for new products and services, number of problems preemptively identified and solved, and percentage of zero-touch provisions. To our surprise, most TeBIT participants struggled to capture and report many of these metrics.

Digital KPIs are essential for focusing efforts, evaluating investments, setting ambition levels, monitoring progress, and making adjustments as needed. Many of the telcos’ new competitors—the digital natives founded around digital technologies and business models—already work like this. They constantly track the performance of their digital initiatives and use that visibility to fine-tune their strategies, goals, and investments.

Last year, we saw telcos making what appeared to be unfocused investments in AI and robotics. Some operators were seeing benefits from their initiatives, but few were using well-defined strategies and end-to-end implementations. This year, the KPIs that we received from participants, along with their IT spending patterns, strongly suggest that a lack of focus is endemic to digital transformation in general.

Without a full set of digital KPIs—and meticulous attention to them—telcos can still transform, but they will find it hard to transform well, fully unleashing the power of digital and seeing it have an optimum impact on their business.

Financial resources are finite. Talent can be hard to find. TeBIT’s digital KPIs can give operators the visibility they need to prioritize their initiatives, capability building, and investments—to know when and where to step on the gas.

Pump Up the Volume on IT Investment

Most TeBIT participants managed to increase their revenues in 2017, but the bigger headline may be the increase in ARPU by 2.7% across all telcos. The story is particularly compelling in emerging markets, where ARPU rose by 6.4% even as telcos struggled with customer churn. (See "The Business Environment.") Many factors—including economic cycles—can influence ARPU, but digital transformation can be an especially powerful lever. As previous TeBIT studies have shown, well-planned and well-executed investments can significantly boost profitability.

The Business Environment

The Business Environment

Market challenges continue to pack a punch, but Europe’s telecom operators are starting to strike back. Most ETIS members saw positive business results in 2017, with growth in revenues or EBITDA margin. (See the exhibit.) Yet room for improvement remains: only 23% of telcos saw increases in both of these metrics.

Similarly, the performance of TeBIT participants reveals a comeback that continues to be a work in progress. On average, telcos in emerging markets saw a rise of 3.4% in revenue but a drop of 2.6% in users. Meanwhile, participants in mature markets kept their user base stable overall, but saw a slight drop (0.5%) in revenue—evidence that price pressure is still taking a toll.

Telcos can pull a number of levers to boost efficiency, spark revenues, and better differentiate themselves in the market. And they are doing so—for example, by moving beyond their core business and into areas such as ICT and data and analytics. These efforts have not been in vain: overall, TeBIT participants experienced a 1.2% increase in revenues in 2017. That’s not a big bump, but it is a bump, and it comes after years of declining or stable revenues across TeBIT participants.

It’s vital to keep the momentum going—and that means investing more in the right places, including digital. Of all the levers that telcos can pull, only digital transformation can simultaneously improve efficiency and customer experiences. That twin boost can power more operators into the plus column on revenue, EBIDTA margin, and users. In short, it can get telcos on the path to significant and sustainable success.

Digital initiatives enable telcos to compete more on customer experience and less on price tag. That’s a relatively new concept for telecom services, which until recently were a commodity like electricity or gasoline. When buying such products, people generally don’t care about the brand as long as the price is low. But digital enables operators to escape price pressure and low margins. Because customers get more from the telco—innovative products, services, and support—they typically are willing to pay more. The telco, in turn, can differentiate itself. These dynamics can raise ARPU and decrease churn—and the latter is no small accomplishment, given that about half of all TeBIT participants lost users in 2017.

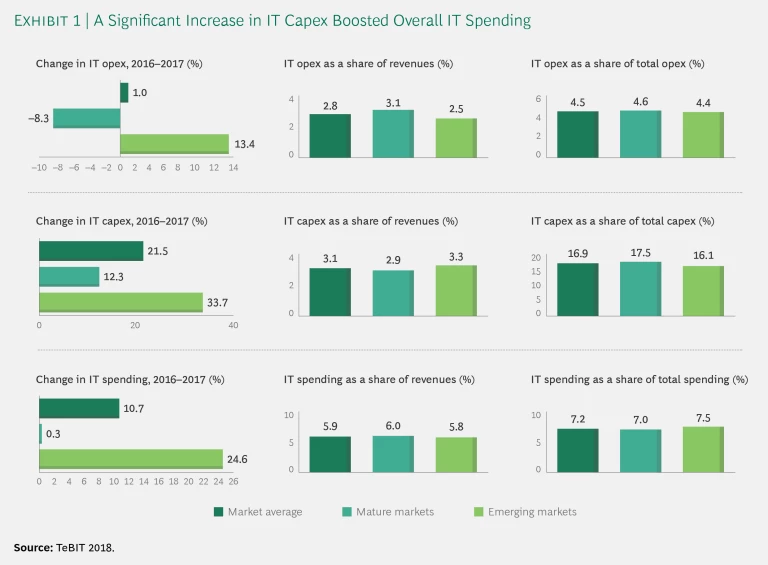

It stands to reason, then, that maintaining the upward trajectory of ARPU and ensuring a downward trajectory for churn will require telcos to invest more in digital. The TeBIT data reveals that this is happening. IT capex rose by 33.7% in emerging markets and by 12.3% in mature markets. (See Exhibit 1.) Focal points for that spending included digital initiatives around data management and analytics, as well as front-end development.

IT capex rose not only in absolute terms, but also, it seems, in standing within telco executive suites. In 2016, IT capex comprised, on average, 13.6% of total capex. In 2017, the corresponding figure was 16.9%. This reinforces the notion that telcos see digital transformation as increasingly important and are aligning their budgets with that view.

We also noted some interesting dynamics on the IT opex front. Overall, participants in mature markets saw their IT opex drop by 8.3%, although about a quarter of these telcos experienced a rise in IT opex. On the other hand, among emerging-market participants, IT opex rose for every telco—on average, by 13.4%.

What caused these variations? One explanation is that digital transformation requires new capabilities, and there are different ways to obtain them: training existing employees; hiring additional employees; replacing talent; working with external partners. Different approaches carry different price tags. Emerging-market participants had a significantly larger increase in IT FTE headcount than mature-market players did—a sign that operators in emerging markets are building up their digital capabilities by investing in new internal talent.

Although it’s good news that telcos are investing in digital initiatives and capabilities, a familiar question remains: are they investing enough? Previous TeBIT reports have answered with a resounding no, stressing the need for telcos to double down on their digital bets in areas such as data and analytics, artificial intelligence, and automation. With IT capex up markedly this year, the story has changed—but not enough. On average, IT spending accounted for 5.9% of revenues. That’s up from past years, and almost every TeBIT participant saw a rise in 2017. But outside the telco business, many technology-focused companies prioritize IT spending even more. The banking industry, for example, had an IT cost-to-income ratio of 11.4% in 2017.

The telecom industry continues to face challenges. Digital transformation can help tackle them. Telcos understand this and have turned up the dial on investment. Now they need to turn it up higher.

A Trickle—Not Yet a Flood—from the Digital Tap

To maximize the payoff from digital transformation, companies must achieve three things: the right level of investment, the right capabilities, and the right focus. The key is to zero in on the most promising initiatives and give them the resources they require. That may sound straightforward, but telcos must meet multiple challenges to get there. IT investment budgets go only so far. Digital capabilities remain a work in progress. And knowing where to focus is hard when dozens of ideas seem promising.

Not surprisingly, the TeBIT data suggests that telcos are only scratching the surface of digital’s potential. Consider one key marker of progress along the digital journey: the share of revenue generated through digital channels, and from digital products and services. For every participant in this year’s study, these digital revenues accounted for just a single-digit or low double-digit share of overall revenue.

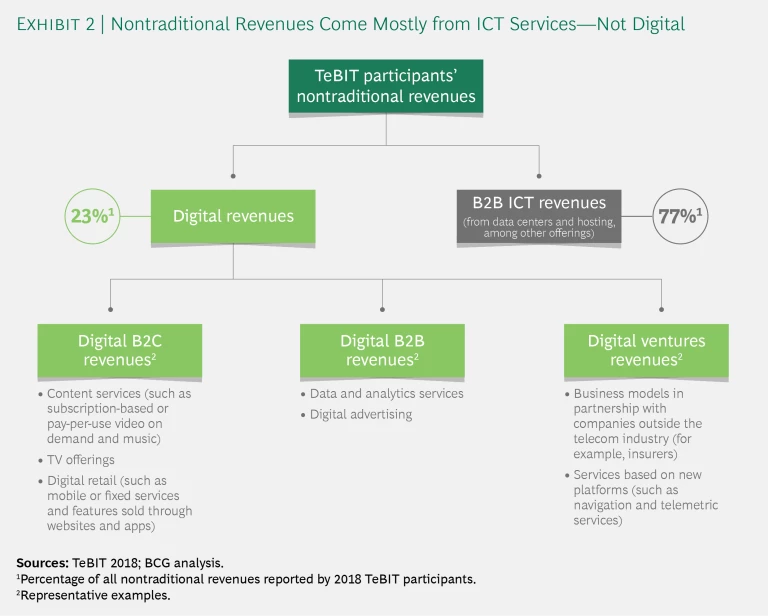

The breakdown of digital revenues is even more revealing. Mobile and fixed revenues generated through digital channels accounted for no more than a few percentage points of total revenues. The numbers improve slightly for digital services and products, such as content. These brought in, on average, 4% of total revenues, with one telco topping out at 13%. In contrast, ICT services accounted for 19% of overall revenues. For one TeBIT participant, the figure was a brow-raising 34%.

Clearly, B2B ICT—comprising services such as data centers and hosting—has become a particularly important lever for growth. According to the TeBIT data, it accounts for 77% of participants’ nontraditional revenues, on average. (See Exhibit 2.) And at one telco, the figure stands at 99%. Nevertheless, it’s clear that digital could contribute significantly more to telcos’ top line. As previous TeBIT studies have demonstrated, the benefits of digital transformation are multifaceted. Revenue upticks can be direct, through the sale of new products and services, or indirect, as when improvement in the customer experience lowers churn.

In this year’s study, three models for approaching digital revenues emerged. Some telcos are concentrating on the consumer market, with up to 90% of their digital revenues coming from content, value-added services, and other B2C digital offerings. Others are taking a more evenly divided approach, with around half of their digital revenues coming from the B2C side and the other half from B2B offerings such as data analytics and targeted advertising. Still others are pursuing a venture model, seeking their digital revenues via new platforms and business models. A telco in this third group might fund a startup or enter into a partnership that lets it play a key role in an all-new venture. For example, it might combine its data analytics with a partner’s market research.

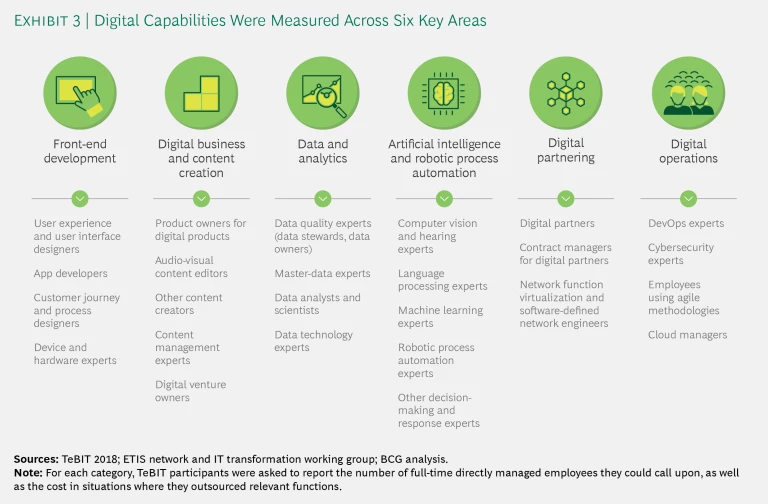

These varied approaches make sense, given that telcos operate under different circumstances, with different markets, customers, and strengths. But regardless of their approach, telcos will need to develop new capabilities in order to develop their digital initiatives. To gain insight into how operators are building those capabilities—where they are focusing and what challenges they might be facing—this year’s TeBIT study took a deep dive into the digital workforce of each participant. We observed that telcos seemed to stress some digital capabilities (such as data and analytics) more than others (such as artificial intelligence). (See Exhibit 3.)

We measured capabilities in six areas: front-end development; digital business and content creation; data and analytics; artificial intelligence and robotic process automation; digital partnering; and digital operations. For each area, we asked telcos to specify how many full-time directly managed employees they could call on. For example, for front-end development, we asked about the number of user experience and user interface designers, and the number of app developers, among others.

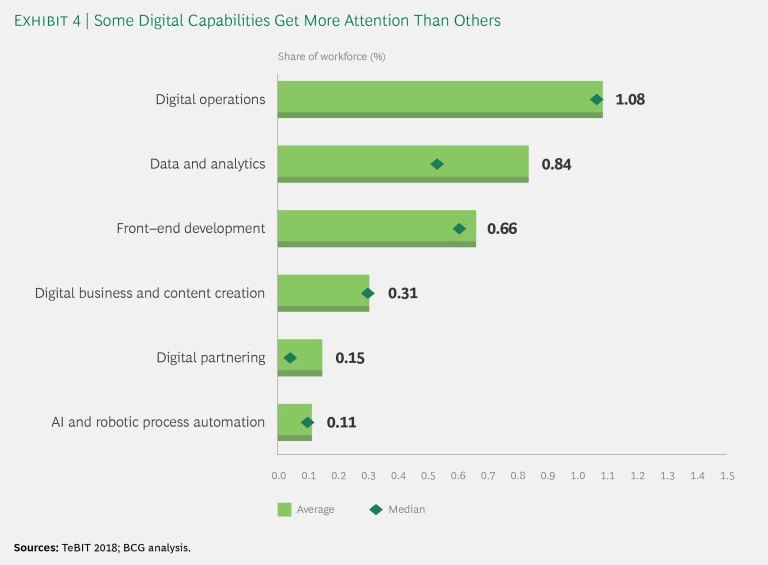

The distribution of this digital workforce varied widely from one telco to another, supporting the notion that telcos have not yet settled on a textbook strategy for developing capabilities. (See Exhibit 4.) Participants in emerging markets tend to stress front-end development and digital operations, while telcos in mature markets seem to emphasize data and analytics. For example, data scientists account for 1.75% of the total workforce in mature markets, but only 0.23% in emerging markets.

Overall, TeBIT’s workforce data suggests that operators in emerging markets are more actively developing internal digital capabilities. This isn’t unexpected. Across IT, emerging-market telcos rely more on internal staff, while operators in mature markets are likelier to leverage outsourcing. According to this year’s TeBIT data, internal headcount costs in emerging markets accounted for 50% of IT opex, on average. In mature markets, the corresponding figure was 25.5%.

As telcos are discovering, the challenge of attracting a new generation of digital talent complicates efforts to build internal capabilities. In a world of fast-moving startups, telcos must overcome the widespread impression that they are unexciting places to work. Savvy operators are taking steps to recast their image—and get the word out. (See "It's Not Just the Tools.") But telcos also need to align their capabilities with their goals. That’s where focus comes in: knowing where you want to go and how you can get there. As we’ll see in the next chapter, establishing that focus has been difficult. But telcos can change that.

It’s Not Just the Tools

It’s Not Just the Tools

“Moving from the analog world to the digital world means more than putting a new face on an old process. It means reengineering that process.”

Digital transformations—at least the most successful ones—aren’t just about new technologies. They also require new capabilities, new processes, new ways of working, new metrics, and even a new image to woo talent. That’s a long and perhaps ominous-looking list, but some telcos are steadily checking the boxes. BCG and ETIS spoke with Alexander Stock, IT director at A1, for insight on the approaches and lessons that operators should consider.

Telcos have often wrestled with a tradeoff between cost reduction and investment. On one hand, they need to spark savings and operate more efficiently. On the other, they have to pursue and fund enhancements—particularly, digital transformation. How does A1 deal with this challenge?

Frankly, I don’t see this as a tradeoff anymore. The beauty of digital transformation is that when you do it well—in the right places, at the right speed—you get efficiency along with enhancements. Consider our work with chatbots. Here digital technologies are improving the user experience: customers get fast, accurate support through a simple-to-use interface. But within A1, we’re getting greater efficiency and we’re addressing costs. These benefits don’t come exclusively from automation. They also come because we reengineer our processes as we deploy digital technologies. When your transformation efforts are well planned and aligned, enhancements and efficiencies go together.

Many telcos are looking to new types of services—in digital and ICT, for example—to help them compensate for slow growth or even declines in their traditional fixed and mobile businesses. This seems to be the case for A1, too. What are your focus areas, and what role does technology play in developing your businesses models?

ICT is certainly a strong focus area for us. And if you look at our numbers, we have grown significantly faster than the market over the past couple of years. How do we support this from a technology perspective? The idea is to create an environment that stresses automation and flexibility. Those two things are especially important when serving business customers. You need to be modular when it comes to your products and services, and have building blocks that can be assembled as customers require. You need to automate processes that traditionally have been highly manual and have taken a lot of time. To that last point, we’re focusing on things like the sales pipeline, order delivery, and order management. We want to get much more digitized in these areas so that we can be faster and more efficient in serving our business customers.

How does A1 prioritize initiatives to build digital capabilities, develop new products, or improve the customer experience?

One thing we have done is to centralize our portfolio planning. It’s no longer done in silos by individual business units. Now it’s done in a centralized, agile manner where the business units and IT sit together and prioritize initiatives based on value generation, on value-based KPIs, on what we see as the most important next thing to do. We also combine development paths with transformation paths. For instance, we will have a strategy and roadmap on what we want to achieve from a technological perspective, but we also have specific market goals. The idea is to match these in the best possible manner as we transform and develop.

What are your current investment priorities from a technology perspective? And what do you see as the key challenges to success?

I would say there are two priorities. One is the customer interaction—all the points, from sales to service, where we interact with the customer. The other is digitizing and automating our processes. One of the biggest challenges we face involves understanding what works well and what doesn’t and reacting—immediately—to those insights. If you look at the IT industry, and the Amazons and Googles and Facebooks, you’ll see that they are much better and faster than telcos in learning and responding to customer demands. We need to work not in monthly release cycles but really on the spot, trying things out and removing them or building on them based on the results we measure. This is what we are working on and investing in at the moment. We want to be able to understand and address customer needs in a very quick and flexible manner.

That’s a great point about learning and responding. Digital KPIs could help telcos there, but we found that many TeBIT participants struggled to collect the relevant data. In A1’s case, it seems that the data was largely available. Tell us a bit about how you manage and monitor digital KPIs.

We monitor a number of KPIs, including online sales rate, online conversion rate, and upselling and cross-selling online. For example, after a customer buys a mobile phone online, is he going back to our site and buying insurance? That’s something we’ll track. But what’s really interesting—and important—is how we use these KPIs. Like many of our competitors, we have been transforming to a more agile way of working. So we are now building scrum teams based on focus areas we think we should address. We’ll give digital KPIs—say, the online conversion rate—to these scrums and ask the teams to address them. This all goes back to my point about being able to understand and react quickly.

Digital transformation requires a host of new capabilities, from front-end user-experience design to data analytics. To what extent are you building these capabilities internally? Where do you rely on partners?

This raises perhaps the biggest challenge we face: attracting new people with new skills. The generation now coming out of the universities doesn’t typically view telcos as the most attractive career choice. It can take a very long time to fill new positions. We try to build internally the key know-how we need. But of course, we also need partners. One area where we are getting support is in agile methodologies. Building a scrum team sounds simple; but in fact, agile requires new job functions, like a scrum master or product owner. It requires new career paths and, indeed, a new HR structure. All of this has to be developed, and our partners are helping us do this. The other area where we get support is in digital capabilities. Here partners are helping us to establish a two-level center of excellence. It’s two-level because you can’t just focus on the technological aspects of digital transformation. Moving from the analog world to the digital world means more than putting a new face on an old process. It means reengineering that process. If you’re creating digital products, you need to think about how sales and support—indeed, all of your processes—best fit around them. Maybe you need digital delivery now or online, self-serve support. A lot of pieces need to change or be developed, and we’ll seek external help with the transformation.

Going back to the challenge around talent, how do you tackle that? Are there steps you take to attract the people you need and build a sustainable digital workforce?

Talent management has certainly become a key topic for us in the past couple of years, getting increased attention in terms of strategy and investment. About a year ago we initiated a program with one of the local universities, in which students divide their time between studying at school and working with us—effectively a 50-50 breakdown. Working with universities has a twofold advantage: it helps the schools understand the kinds of skills we need, and it helps students understand how A1 works and what we have to offer. The idea, of course, is that these students will become full-time employees once they graduate. Another thing we are doing to attract talent is building a modern working environment. We’re refurbishing our headquarters, getting rid of the long halls and closed offices. Image, we’ve found, is important. We’re also getting our management personnel into the universities, holding programs, giving speeches, and so on, to get on the radar of students—and get on it early.

The agile transformation you’re undergoing should help, as well.

Certainly—I think that’s part of the image. Young people want to work differently. They want to have the flexibility to work half a day in a coffee shop and a day with their people somewhere. They want to be self-managed, working in an agile way, on interesting projects, with modern technology. All of the digital topics help in that respect. People want to work with chatbots and cognitive analytics—not COBOL.

There’s a lot of upside to moving to agile approaches, but do you see challenges, as well, especially when it comes to retraining your existing workforce?

I think we are making good progress in moving to agile, but I also think that it is a very difficult process and it will take a lot of time. As with many other areas, the difficulty is in the details. When you really want to transform to an agile way of working, all of your top-line KPIs need to change. At the moment we are still cost focused and revenue focused; but when you go to agile methodologies, you need to be value focused. As for the workforce, we will not be completely agile tomorrow. Right now, I would say half of my staff has been retrained and is working in scrum teams. But I also don’t think that we need to be completely agile tomorrow. We still have main-frame and legacy systems in our stack, and we will have them in the coming years. The big next step is to extend agile beyond IT and to follow the scrum approach end-to-end, with the product owner coming from the business side. It’s going to take time to get agile into all the corners of the company—but the effort will be worth it.

Wanted: A Boom with a View

Digital leaders, regardless of their particular industry, are data-driven organizations. They measure everything relentlessly: how processes perform, how customers behave, how different sales channels compare. And no wonder. Undertaking a digital transformation without keeping a sharp eye on the right metrics is like flying into space without instruments and a window. You can’t evaluate your progress, see what’s working well and what’s not, and adjust your goals and direction accordingly. For telcos, a clear view of the digital journey is critical. And yet, the TeBIT study finds, many telcos don’t have one.

Back in 2015, the TeBIT study found a positive correlation between the extent of a telco’s digital initiatives and its revenue performance. As we said in the title of that year’s report, “Digital Delivers.” It’s reasonable to conclude that the more digital a telco is, the more benefits it can realize. This year, to test that proposition, we took a close look at what we call digital KPIs—metrics that measure the digitization of a telco’s end-to-end processes, from product management to billing and collection.

An ETIS working group considered and refined a comprehensive set of relevant KPIs. Among the 25 metrics it identified were share of network and IT incidents resolved remotely (rather than by technicians in the field), share of provisioning accomplished without human intervention, and proportion of customers who received their bills electronically.

To a large extent, we found, participating telcos were flying with an obstructed view. In many instances, they did not have these KPIs at hand—or they didn’t have them at all. This made it hard to gauge exactly how digital the TeBIT participants were. More important, it makes the outcome of their transformations somewhat random. Without measuring KPIs and implementing a feedback loop of corrective actions, telcos are spending money on digital initiatives without clearly seeing where they are, where they need to go, and how to get them there.

The challenge related to KPIs helps explain the dynamic we saw this year: increased IT capex—much of it focused on digital—but a relatively low proportion of digital revenue. It may also explain why few participants have published their digital goals. Telcos need full transparency in order to have coherent ambitions and clear routes to achieve them.

The TeBIT analysis suggests that most telcos are nowhere near full transparency. For some KPIs—such as number of IT problems preemptively solved, number of next-best offers suggested, and percentage of customer service requests processed by AI and robotic process automation—data was so lacking that we couldn’t calculate overall averages. (See Exhibit 5.) For other metrics—such as share of products and services available online and time from order to activation—more data was available, but still so little that averages were of limited significance. Indeed, for only 10 of the 25 KPIs did we receive sufficient data to calculate statistically relevant averages across participants.

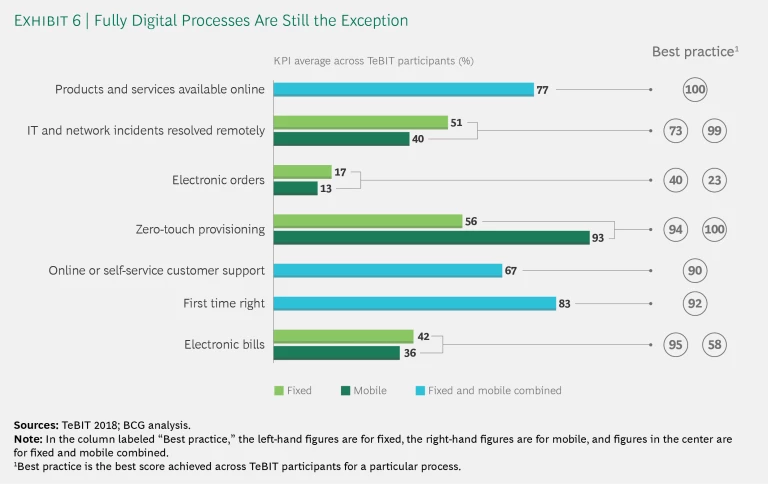

The averages that we did calculate reveal that the level of process digitization and automation remains comparatively low. (See Exhibit 6.) Overall, participants remotely solved just 51% of network and IT incidents on the fixed-business side and 40% on the mobile side. Only 42% of fixed-network customers and 36% of mobile customers receive bills electronically. And the share of electronic orders was just 17% for fixed and 13% for mobile.

Of course, from a more optimistic perspective, those figures indicate lots of potential for more efficient digital investment across core activities. Telcos have plenty of room to spend money in a more focused way to achieve a bigger impact. Rigorous attention to digital KPIs can give operators the transparency they need to identify their ambitions and track their progress toward their goals. (See "Follow the Data.") Telcos are already generating value from digital transformation—but imagine how much more value they could create with KPIs that help them monitor and adjust their journey. The savviest players will turn today’s small steps into tomorrow’s giant leaps.

Follow the Data

Follow the Data

“You really have to work more like a startup. You have to experiment, try new things, and constantly monitor how they are working out.”

In the digital space, opportunities are boundless. For telcos, that brings great promise—for new revenue streams, new ways to serve customers, new paths to success. But it also brings challenges. What projects are most worthy of attention and funding? What is the best way to see what is working and what is not? Is it better to build or buy the necessary capabilities? How can we work faster? Uldis Tatarcuks, the CTO at Lattelecom, describes how his company keeps its digital agenda on course—and the roles that customers and data play in steering the way.

The fixed side of the telco business tends to struggle more with churn than the mobile side. As a fixed-only player, how does Lattelecom approach this challenge?

We’re not the typical fixed-only provider in that we have a strong presence in the mobile space. We have a lot of over-the-top applications that put us on mobile screens: our own television solution, a customer self-service app, even a specific application for electricity service. Customers can communicate with us, manage their accounts and features, and even get services from us from mobile devices. In that regard, we are similar to Netflix. We can reach customers and do business with them via mobile without actually owning a mobile network ourselves.

That’s a unique model.

Unique for telcos, perhaps, but many companies worldwide are using this model. Netflix is a big example. So is Facebook. We are just following the trend, leveraging technological capabilities to the greatest extent possible.

One can actually see this in the TeBIT data. It shows that Lattelecom generates a significant portion of its revenues from areas outside traditional fixed and mobile businesses. What are your focus areas, and what role does technology play in developing such business models?

We don’t expect to see huge growth in our core business lines, like fixed voice and broadband access—maybe a few percent a year. So to grow, we need to add other types of services that resonate with customers. For us, the current focus areas include over-the-top television, smart home solutions, and electricity, as well as data centers and cloud services. But we are investigating all areas. As for technology, its main role is to give customers the best user experience. Our electricity offering, for example, is fully digital. Customers can quickly connect or disconnect, change plans, and access any data they need. That kind of simplicity and convenience—enabled by technology—becomes a differentiator. Customers stick with us not just because we provide reasonable prices but also because our services are very easy to use.

You noted that Lattelecom has built a mobile presence via apps. Is there an advantage to having a collection of apps—say, one for each service—rather than one mega-app that covers everything?

This is a question we are asking ourselves and investigating. Right now, we have a central application through which customers can manage communications with us for all services they purchase. But we also have some separate applications, such as the app for our electricity service and an OTT app for content. We need to understand more—through usage patterns and behavior—which approach customers prefer. My guess is that we will probably have even more applications in the future, as customers are adopting increasingly segmented lifestyles. With separate solutions, you can align better with specific needs and preferences. So I expect that as we head deeper into the digital world, we’ll have a list of applications.

And as you head deeper into that world, what is your approach to finding and seizing new digital opportunities?

Our main focus is on identifying functionalities that customers would like to use. Focus groups and usage patterns and statistics are helpful here, shedding light on what might be of interest. Then we try to deliver a minimum viable product just to get that feature or function moving and to check whether our perception of what customers want is correct. If it isn’t, then we drop the project. If it is, then we continue developing the solution, moving quickly through second, third, and fourth releases, and so on.

You talked about services, but do you create content, as well?

Yes, we do have our own content. We are producing two TV channels ourselves and also giving our content an on-demand functionality, as many customers prefer that style of viewing. So we are killing two rabbits with one shot: providing unique content but also delivering it in the ways that users want.

Lattelecom is also looking at the smart home market. Have you launched anything in that space?

We’ve launched a few pilot projects. For example, customers can monitor their heating system or the CO2 environment in their home. We definitely think the smart home space is going to grow. Electricity prices are rising all the time, and customers are very willing to investigate opportunities for savings. We need to be, in effect, a good consultant to our customers, providing tools that show them how to run their homes better. Our approach is to add one small thing that is useful to the customer—like monitoring CO2—and grow from there. From our perspective, it’s very important to work like this, as it lets you be a lot faster and a lot more flexible than if you embark on a grand project to release something in a year. We’re going much, much faster than that.

Of course, all of this requires investment. Invariably, there will be a lot of different projects—enhancements, cost reduction initiatives, and so on—competing for a slice of the capex pie. How do you tackle this challenge within Lattelecom’s IT organization?

You really have to work more like a startup. You have to experiment, try new things, and constantly monitor how they are working out. Typically, if there is a business case for a project, we’ll get money for a three-month period. Say €10,000 to €30,000. Then we continually check to see if the project is reaching its goals. Only the projects that are succeeding will get additional funding. This lets us experiment, quickly kill the projects that aren’t succeeding, and focus our efforts—and our funding—on the initiatives that are working out much, much better.

What is your approach to building up digital capabilities—for example, in front-end design and digital content development? Do you build them internally, or do you rely on external sources?

We decided to keep all the critical capabilities internal. That’s why we started to hire app developers, user experience developers, user interface designers, and so on. Having them inside our organization has enabled us to move significantly faster than we moved two years ago. But we need to build up still, and we are actively looking to hire more digital talent.

That talent is in great demand, and other telco operators have told us that they are struggling to build the internal resources they need for their digital agenda. Is this a challenge for Lattelecom, as well? How do you attract talent?

It’s certainly tough to attract new digital talent to a legacy telco organization. So our approach is to demonstrate very visibly that we are not the organization they may think we are. For instance, we are very active participants in hackathons. We go out to universities. We tell students what we are doing. Very quickly, we saw that everyone was quite surprised to see what we are doing. They believed we were only broadband providers or only dealing in cable, with no interesting projects. So we put a lot of effort into clarifying exactly who we are and what kinds of exciting projects we are working on.

What role do KPIs play in your digital agenda? Do you have specific digital KPIs that you track?

Yes, we use KPIs to closely monitor how our digital projects and channels are performing. Are we getting more sales? What are the chatbot communications rates? At the beginning of a project, we set goals; and then we use KPIs to keep a focus on them. We’ve been doing this for a couple of years now. We believe that all companies will be increasingly data driven. You’re going to be more data driven next Monday than you were this week. So we collect data and analyze it and learn from it. And in this way, we can quickly make any changes we need to make.

To what extent are key digital KPIs tracked on a management level? Is there something like a KPI dashboard that you share weekly or daily?

We have a meeting with the CEO every week, bringing together the business departments and technical departments, and following up on the key data we’re tracking. What are our digital sales? How are our chatbots performing? This attention from the top management helps a lot, as we can make decisions based on how things are performing. We can set a plan for this week, and then next week we’ll see how it is working and make further decisions. This focus on data lets us drive our digital agenda in the right direction. It lets us get smarter.

Transforming the Transformation

Over the past several TeBIT reports, we’ve seen telcos’ strategies and investments evolve to strengthen the companies’ competitiveness in a changing but always challenging marketplace. Perhaps the biggest step telcos have taken is to pursue digital transformation, and that effort is starting to pay off: digital has improved efficiencies and the customer experience, and sparked innovation, differentiation, and even new revenues. Yet while every operator has a different recipe for transformation, this year’s TeBIT report says that most lack a key ingredient: a data-fueled focus on developing the initiatives and capabilities that generate the most value.

Digital KPIs are a powerful way to gain that focus, and fortunately telcos don’t need to develop them from scratch. Although the right digital initiatives will vary from one telco to another, having a common set of KPIs can be right for everyone. ETIS members, representing a cross section of European telecom companies, have refined just such a KPI set to describe the digital maturity of telcos’ end-to-end processes.

ETIS working groups are designed expressly to spark knowledge sharing within the telecom industry—and operators can start reaping the benefits of their efforts right now. With the KPIs used in this year’s benchmark, telcos can measure, learn, and react just as relentlessly and rapidly as the data-driven startups, upstarts, and giants that have

transformed industries, including the telecom business.

The reacting can start right away, too. Although we received insufficient data for some core KPIs, for others we collected enough responses to calculate statistically relevant averages. In these cases, the averages provide useful reference points, enabling telcos to set a baseline ambition level. For example, across TeBIT participants, an average of 56% of fixed-network provisions were zero touch—a figure that could serve as a minimum maturity level that operators should aim for.

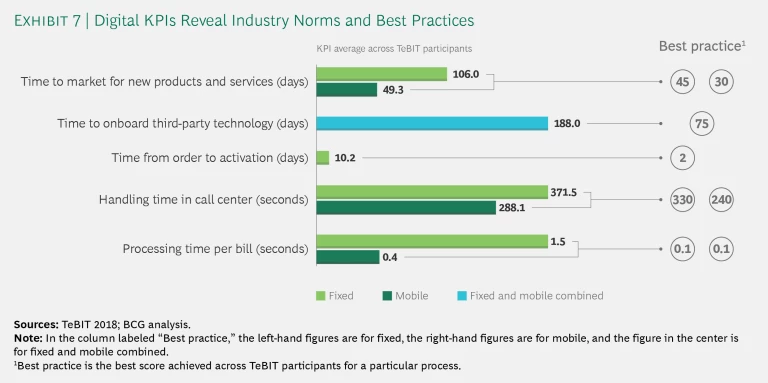

Meanwhile, the maximum levels we saw for various KPIs suggest the current best practice for those areas. For example, one TeBIT participant achieved 94% zero-touch provisions in its fixed business. This and other maximums, such as a 73% share for remote incident resolutions in fixed and a two-day time to activation in fixed, suggest aspirational goals that telcos could shoot for once they attain the baseline maturity level. (See Exhibit 7.)

As telcos step up their KPI monitoring, they will be better positioned to fine-tune their digital strategies and initiatives. But digital transformation also requires new skills and talent. Here telcos need to look at more than their metrics. They need to review and likely change the image they present to a new generation of digital talent. Two strategies can help. First, telcos can adopt many of the practices synonymous with fast-moving digital players, such as an agile way of working, greater encouragement for experimentation, and a more physically open workspace. Second, telcos can spread the word that they’re not the quiet, noninnovative backwaters that some people might imagine. There are many ways to do this, from sponsoring hackathons to partnering with local universities. Telcos should explore them all.

Although the times remain challenging for telecom companies, it’s also an era of promise and possibilities. Through new technologies and business models, telcos are starting to capture and deliver important benefits. By better tracking their digital transformations, they can turn the payoff into a windfall—and lead themselves, their customers, and the industry forward.