“You’re digital or you’re dead.” Across industries, those words have evolved from prophecy to mantra to no-brainer. But the need to live and breathe digital is greatest in the technology, media, and telecommunications industries. TMT companies are leading the charge in creating a global economy that is increasingly centered around digital technologies and business models, and TMT companies are reaping the rewards of that transition.

The 2018 TMT Value Creators Report

- Digital Natives Lead the Battle for Value Creation

- Technology: The Engine of Digital Transformation

- Media’s Unassailable Castles and New Business Models

- Telecommunications: Breaking Through the Bottlenecks

- Unlock Value Creation Through Digital Enablers

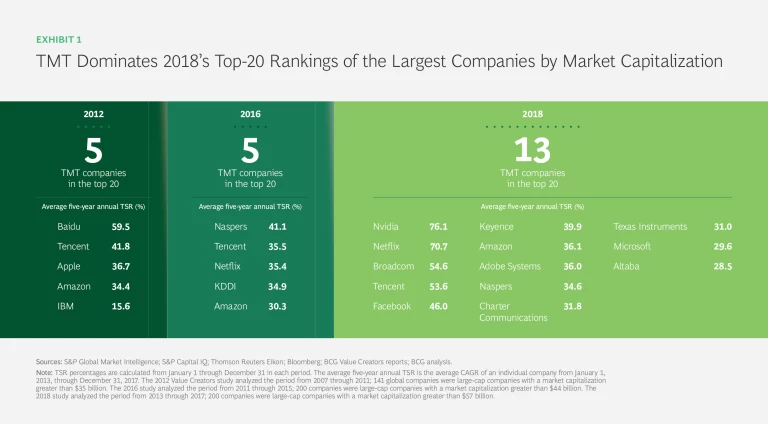

The overall 2018 BCG Value Creators study analyzed more than 2,000 companies across 33 industries. Of the 200 largest companies, TMT players claim 13 of the top 20 spots in terms of TSR. (See Exhibit 1.) And in BCG’s 2018 ranking of the 20 most innovative companies, 17 are TMT companies or digital natives, or both. (Digital natives are companies that were started using an internet- or mobile-based business model or that switched to one early in their life cycle.) (See The Most Innovative Companies 2018: Innovators Go All In on Digital , BCG report, January 2018.)

But TMT companies are not leading or reaping the rewards equally. Digital natives are increasingly generating a larger share of the TMT sector’s value creation, with the largest digital natives producing the most. This is ratcheting up the pressure on more traditional companies—those that weren’t born with digital in their DNA—to transform.

Transformations can take different paths, however; traditional companies need to create one that’s right for their organization. They can enter new, high-growth areas, such as cloud computing, artificial intelligence (AI), robotic process automation, or data and analytics. They can change their operating models to innovate faster, reduce costs, and improve the customer experience. They can even change their business models to evolve with new trends and opportunities. The list goes on. For most companies, though, the right path is pursuing a combination of options.

Yet transformations are hard. Indeed, we’ve found that only about one-third of companies navigate major change successfully. (See “ Creating Value from Disruption (While Others Disappear) ,” BCG article, September 2017.) Businesses must not only define a strategy that best suits them but also rigorously execute it to ensure success.

Outsized Companies Are Creating Outsized Value

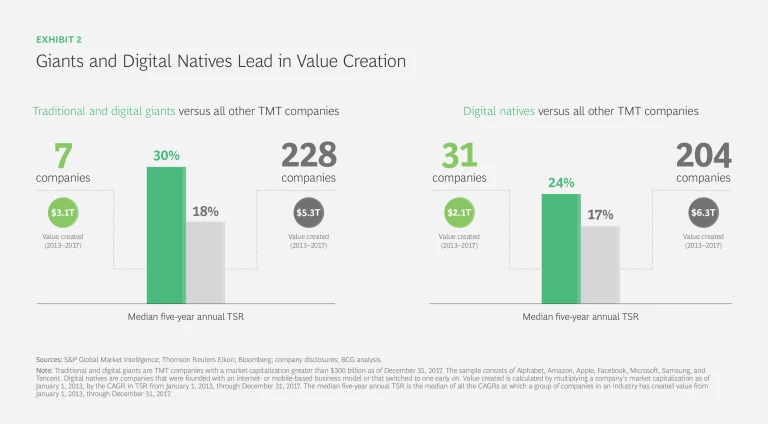

To determine which companies are generating the most value, we analyzed the TSR of 235 TMT companies over a five-year period from 2013 through 2017. The results provide stark evidence that traditional and digital giants—those companies with a market capitalization in excess of $300 billion—as well as digital natives are increasingly generating a larger share of the TMT sector’s value creation.

The top seven TMT companies in terms of market capitalization—Apple, Alphabet, Microsoft, Amazon, Facebook, Tencent, and Samsung—generated $3.1 trillion of the $8.4 trillion in absolute value that TMT players created during those five

Digital giants, such as Amazon and Facebook, are not the only ones doing well. Digital natives as a whole seem to be outpacing traditional companies. Looking at digital natives that have a five-year TSR history (31 companies in all), we found that they had a median five-year annual TSR of 24%—7 percentage points higher than traditional companies. The average market capitalization of digital natives, meanwhile, grew by 56% over the past year, more than double the growth rate of traditional companies’ average market capitalization.

To be sure, digital natives benefit from an intrinsic advantage: they don’t have to manage a transformation. These companies have been built, from day one, around digital technologies and the business models they’ve inspired. But the most successful digital natives have also developed a set of critical capabilities. These companies have a fast, iterative approach to innovation. They focus on creating great customer experiences. They have simplified and automated internal processes. And they attract great talent. These are all important advantages in the digital era. And they are advantages that companies have to keep developing and building upon. Digital natives may be doing well overall, but there will invariably be a lot of fallout as markets mature.

The Value Creation Scorecard

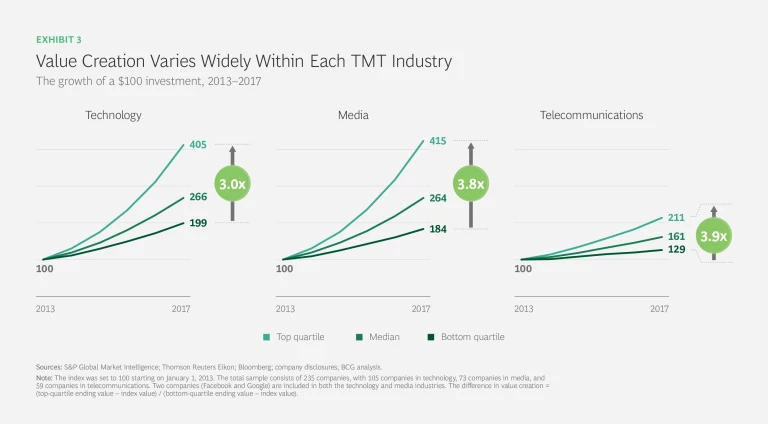

Of the 33 industries that we analyzed, those that make up the TMT sector are leading the way in creating value in a digital world. However, within the TMT sector, there are some noteworthy differences among the three industries.

- Technology is the star of the TMT show. Of the $8.4 trillion in value that the three industries created from 2013 through 2017, technology accounts for nearly 65%, or $5.5 trillion. The median five-year annual TSR for the tech companies analyzed is 21%, a significant increase from 14% for the period from 2011 through 2015. (See Unleashing Technology, Media, and Telecom with Digital Transformation , the 2016 TMT Value Creators report, October 2016.) This performance—driven by digital natives as well as by semiconductor companies benefiting from demand from new markets such as AI and the Internet of Things (IoT)—enabled the technology industry to rise to number 4 of the 33 industries. This ranking is up from number 11 for the period from 2011 through 2015.

- Media and telecommunications drop in the overall rankings. The media and telecommunications industries’ median five-year annual TSR have modest changes from the previous five-year period (2011 through 2015): media is up from 20% to 21%; telecommunications is down from 11% to 10%. But both industries drop in the overall rankings. Media is down two spots to number 5, and telecommunications is off 13 places to 30th. Notable, too, is a particularly wide gap between higher- and lower-performing players: in both industries, the value created by the top-quartile companies is almost four times greater than that generated by the bottom-quartile companies. (See Exhibit 3.)

A Playbook for Digital Transformation

By now, most traditional companies have started down the road to digital transformation. But the performance gaps we found—not only in media and telecommunications but also to a lesser extent in technology—suggest that some companies are moving faster and more successfully than others. What are the winners doing to get out ahead? Or perhaps more to the point, what can other companies do to join them?

For starters, high-performing companies have defined their strategy for the digital era, an effort that requires deciding how much emphasis to put on transforming their core business and how much attention to devote to newer, high-growth areas and business models. Some companies—particularly telcos such as NTT Docomo and Orange—have revitalized their core, providing customers with omnichannel experiences that are intuitive and personalized and that enable self-service. Others have also made bold moves. Microsoft has shifted from on-premises software to cloud-based offerings. Video game leaders such as Electronic Arts, Ubisoft Entertainment, and Take-Two Interactive Software have found a steadier source of revenue through in-game purchases that extend the value-creating lifetime of their hits.

For most companies, the key will be to strike the right balance between digitalizing the core business and identifying—and pursuing—new paths to growth. Within the core business, digital technologies can be applied throughout the value chain to improve the customer experience, simplify processes, and reduce costs. At the same time, companies can take advantage of technical developments and emerging customer needs to create new routes to revenue. Examples include telcos that are moving from 3G and 4G networks to 5G networks and software companies that have shifted their focus from products to solutions and services.

For companies whose existing portfolios are deep in slow-growing legacy products, the need to discover emerging, high-potential business opportunities is particularly acute. Many options exist across the disruptive technology landscape. Three areas are particularly fertile ground for opportunities:

- Artificial Intelligence. Momentum in AI continues, with applications and opportunities growing. Machine learning, in particular, is a hot spot, with heightened activity in areas as diverse as autonomous driving, medical engineering, and marketing. Yet many companies have yet to seize on AI’s potential. A recent study found that only one-quarter of responding companies had incorporated AI in some

manner.2 2 Reshaping Business with Artificial Intelligence: Closing the Gap Between Ambition and Action, MIT Sloan Management Review, September 2017. TMT companies can break down common barriers to adopting AI by sourcing high-quality data, reskilling their workforces, educating their leaders, and promoting an experimental approach to using AI technologies. - The Internet of Things. IoT continues to mature with an expanding array of applications, notably in areas such as transportation, industrial automation, and medical care. M&A activity is increasing as well: the number of IoT-related deals rose 60% from 2015 through 2016. Some TMT players are moving into specific IoT verticals: for example, GE Digital acquired logistics-focused ServiceMax for $900 mil- lion in 2016, and Intel acquired Mobileye—a company active in the autonomous driving space—for $15 billion in 2017. Meanwhile, concerns about IoT security have raised the profile of areas such as edge computing and blockchain. Already, players such as Cisco and Micron Technology have made IoT security a new focal point.

- Cybersecurity. Incidents of stolen intellectual property, lost customer data, crippling ransomware, and other forms of cybercrime continue to rise. Securing traditional IT is far from a solved problem, and new trends, such as the increasing adoption of hybrid cloud platforms, add to the challenge. AI, meanwhile, has emerged as a double-edged sword. Companies such as Illusive Networks are using machine learning to create solutions that defend against threats. But AI can also be used for malicious purposes, and companies will need to prepare for these new types of attacks.

As the cybersecurity landscape evolves, new areas are growing in importance and potential. One such area is agile security development: as companies deploy software faster and faster, they need more nimble security testing and scanning capabilities. Cyberresilience—the ability to deter and withstand cyberattacks—is also gaining prominence, as companies require increasingly robust incident management capabilities. In the future, the private sector—with TMT companies in the lead—will play a key role in fostering partnerships with public institutions and strengthening personal data protection.

As they shape their strategies, companies should view digital transformation through two lenses. First and foremost, there is the customer lens. This requires companies to ask how they can design great customer experiences. But at the same time, companies shouldn’t overlook the value lens. Digital transformations take time, and they don’t come cheap. So while companies are defining how to win in the medium term, they also need to run their business and fund their journey.

We’ve found that companies that hope to flourish in the digital era need to spend at least 10% of their market capitalization on transformation initiatives. And they need to spend that money well. Investors (and employees) generally aren’t convinced that a company is serious about—and seriously working toward—change until 20% of its revenue is coming from new business models. A value-based perspective ensures that a company hits all the necessary notes and helps it decide which initiatives to prioritize.

Creating a well-defined strategy is crucial, but so is the ability to execute it. High-performing companies do a great job managing both the “hard,” or technology, side of change and the “soft” side, which includes a company’s people, culture, and ways of working. High performers also have—without exception—a strong commitment from senior management.

The ability to manage large, complex, two-to three-year programs and hit financial targets is a huge differentiator between the winners and losers. So, too, is the ability to accelerate change in a disrupted landscape. Standout companies have developed an array of new but vital skills and capabilities—digital enablers—that let them do this. Nvidia, for example, has used a customer-centric approach to product design to create new growth opportunities in areas such as AI. Other companies have adopted agile methodologies to foster a faster, more flexible development process or are using sophisticated analytics capabilities to better understand customer behavior and preferences.

These digital enablers, explored later in this report, fall into four main categories: people and organization, data and analytics, technology, and ecosystems. Applied wisely, digital enablers can help a business survive and thrive in the digital era. It’s time to join that elite third: companies that not only define the digital transformation that’s right for them but also deliver on it.