Digital technologies are changing the world—and dramatically improving the way industrial organizations operate. In the past, the complexity of companies’ interconnected value chains led management to make compromises, in many cases without a true understanding of their potential impact on the bottom line. Digital technologies—particularly predictive analytics and other artificial intelligence (AI) applications that run on cloud-based digital and data platforms—can help industrial manufacturers master that complexity, rethink their value chains, and, thus, avoid having to make such compromises.

These new solutions, which are more easily implemented than traditional IT applications, are modular, so they can be built incrementally. Although in most cases they’re decoupled from legacy IT systems, they can leverage existing operational data. This capability means that organizations can start generating new insights and extracting value from their data within a few months: they use an agile approach that is based on small pilot tests to identify winning solutions and learn through experience—then scale up fast.

Still, to make the gains sustainable, companies need to put the right supporting structure in place. Our experience shows that the development of the right algorithms and the deployment of new technological tools represent only about 30% of the total effort required. The remaining 70% lies in creating the right organizational environment and changing business processes. Specifically, we see three crucial elements: new capabilities, revamped organization structures and processes that capitalize on data, and sprint-based execution focused on value creation.

To make the gains sustainable, companies need to put the right supporting structure in place.

By transforming complex value chains through digital, industrial companies have the opportunity to improve EBITDA by 2 to 4 percentage points and reduce inventory by up to ten days. Furthermore, these initiatives help companies connect far more directly with their customers, dramatically improving their service levels.

Complexity Leads to Compromises and Lost Value

Industrial organizations, such as chemical, steel manufacturing, and mining companies, have highly intricate value chains, which are becoming even more complex. Such companies must contend with diverse and volatile customer bases, complicated and/or interconnected product portfolios, and large and global production footprints. In addition, many of them face external pressures from, for example, increasing competition and regulatory requirements.

Complexity leads to operational compromises: companies’ data is siloed and inaccessible, and leaders are hampered by their limited understanding of the ways decisions affect the bottom line and customer experience. Managers optimize production plants at the local level rather than in accordance with company-wide standards. Companies cannot capitalize on the demand for higher-market products and services because they cannot achieve the correspondingly higher service levels required. Production plans are based on inaccurate forecasts, and companies can neither respond swiftly to last-minute deviations from the plan nor mitigate risk. And an incomplete system view leads to bottlenecks throughout. The end result is a significant loss of value.

The Digital Value Chain

New digital technologies use five levers to enable companies to break away from these traditional compromises and to significantly improve their value chain performance:

- Integrating insights and data throughout the value chain to generate a single, system-wide view

- Managing vast amounts of data at the most granular level to help business leaders master complexity and understand root causes

- Improving planning accuracy through predictive analytics and simulations that allow companies to anticipate problems

- Understanding the full impact of decisions so that managers can focus on them rather than on technical actions

- Making data accessible to generate insights in real time—when they are most useful to the business units

For example, predictive algorithms based on machine learning can be used to analyze historical demand and the external factors that have influenced it, allowing companies to generate better plans and adapt to meet market demands. (See the sidebar “Using Predictive Analytics to Improve Demand Forecasting.”) With the organization’s already available data, these tools can track the flow of materials throughout the value chain, allowing management to make decisions on the basis of real-time information, efficiently balancing service levels, inventory, and profitability. By simulating supply chain performance and the impact of decisions across the value chain, the tools can identify the probability and impact of risks, such as production bottlenecks, and suggest ways to avoid them.

Using Predictive Analytics to Improve Demand Forecasting

Using Predictive Analytics to Improve Demand Forecasting

Demand forecasting is a common application of predictive analytics. AI techniques can significantly enhance the accuracy and richness of demand forecasts in two ways. First, the underlying algorithms learn from such factors as seasonality and trends. Second, AI techniques can make correlations with external factors that are affecting customer markets. AI-generated models learn from historical data and are back-tested to ensure accuracy. The algorithms adjust over time on the basis of real-world results, continuously improving their accuracy. The models can be set up in as little as 8 to 12 weeks, and they are ultimately integrated into daily processes and decision making.

Companies that have applied predictive analytics have improved the accuracy of their overall demand forecasts by up to 20 percentage points, leading to reductions in inventory levels, increased sales of high-margin products, and better overall customer service. Exhibits 1 and 2 illustrate the differences between a traditional demand-forecasting approach and one that is powered by predictive analytics.

An Agile Approach to Value

Perhaps the most significant aspect of these new technologies is that they can be deployed in an agile way using targeted modular solutions rather than traditional methodologies for large IT implementations. Companies can implement a data and analytics layer next to existing IT systems and begin consolidating and making sense of data that is spread across different legacy systems. (See the sidebar “The Power of Digital and Data Platforms.”) Because these digital tools can be put in place relatively quickly and inexpensively and scaled up incrementally, companies can begin to apply them through small pilot tests that focus on a single business unit, asset, or regional market, thus proving the concept and beginning to generate value within months. This approach sets business needs ahead of the technology, rather than the other way around.

The Power of Digital and Data Platforms

The Power of Digital and Data Platforms

At many companies, the biggest problem is not a lack of data. It’s the inability to effectively manage and generate insights from the data that already exists. For example, we worked with a company that had more than 9 petabytes of data spread across multiple data warehouses and other storage systems, yet it was using only 0.5% of it for reporting and analytics. Cloud-based digital and data platforms provide the foundation on which companies can quickly build scalable analytics solutions that create value. These platforms enable fast access to the large amounts of raw data that companies already have; they allow data scientists to combine that data with data sources, both structured and unstructured, and they do all this at a fraction of the cost of traditional data warehouse solutions.

In most cases, a digital and data platform comprises three components:

- The Data Layer. This is a data lake that gathers structured and unstructured raw data directly from sources—such as warehouses, factories, and inbound and outbound trucks—along the value chain, depositing it into a central repository.

- The Analytics Layer. This set of algorithms can run powerful data analyses, applying AI and other types of analytics techniques.

- The Visualization Layer. With this process, distilled information and insights are delivered to employees and managers in a user-friendly format, typically through cloud-based responsive mobile software.

In addition to the technology, a digital and data platform requires changes in the way IT commonly works. Use cases are deployed incrementally through sprints with far greater flexibility, more interaction with business units and support functions, and continuous iterations. The results can be dramatic. For example, one of our clients was able to develop a new data and digital platform to support its first set of analytics use cases within four months, and at a fraction of the cost of a traditional data warehouse—tens of thousands of dollars, instead of millions. Another client deployed its brand-new data platform within months, simultaneously conducting a multiyear rollout of a new SAP-based enterprise resource planning system.

Companies need to start with a clear understanding of the pain points and value gaps in their value chain and then design solutions for specific use cases, such as demand forecasting, inventory management, quality management, and order fulfillment.

Such targeted solutions can be deployed in a modular manner, with a clear focus on value creation, and then linked together through a digital integrated control tower that enables end-to-end transparency and integrated planning for all solutions across the entire value chain.

Furthermore, rather than trying to design an ideal solution at the outset, companies should start by developing minimum viable products (MVPs)—basic prototypes that they can deploy quickly, begin using, and refine over time. This provides an opportunity for delivering value quickly in today’s context of fast-changing technologies.

Three Critical Components

The digital technologies available to today’s industrial companies offer significant short-term opportunities. However, to achieve sustainable gains, companies must focus not only on technology and algorithms but also on creating the right organizational environment and changing business processes, which constitute 70% of the total effort. On the basis of our experience, we have identified three critical components that form a foundation for digital technology.

To achieve sustainable gains, companies must focus not only on technology and algorithms but also on creating the right organizational environment and changing business processes.

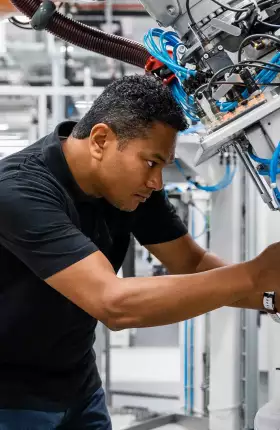

Developing New Capabilities. Companies that want to capitalize on new technologies quickly can turn to outside vendors. However, to create a sustainable competitive advantage, they must build up new internal capabilities. Some companies identify massive amounts of value in the initial proof-of-concept stage but fail to capture that value across the organization. Why? They did not have the right capabilities in place. Three core roles are fundamental for success in the digital world:

- Product Owners. These “CEOs” of a given use case can identify digital tools in order to meet the needs of individual business units and functions. They also oversee the teams working to develop those tools.

- Data Scientists and Data Engineers. These are the experts who execute analytics projects, gather and prepare the required data, construct analytical models, and maintain the actual algorithms.

- Scrum Masters and Agile Coaches. With their particular expertise, scrum masters and agile coaches can create the right structure and establish an appropriate pace at the beginning of and throughout a project, helping teams work in a more agile fashion.

Some of these roles can be filled through training initiatives for employees and managers already within the company, but success also requires attracting new talent.

Establishing the Right Organization Structure. Successful digital deployment requires strong leadership and guidance—especially at the beginning of the journey—and the creation of new digital functions, such as data analytics. These functions can sit in different positions, depending on the company’s organization structure, operational footprint, regional market coverage, and types of industrial processes. For example, most companies with regionally distributed leadership and different types of products, facilities, and processes likely have corresponding variation in business models, objectives, and reporting structures. In many cases, such companies apply a decentralized model in which each business unit has its own analytics function.

Conversely, a company with highly standardized processes, centralized leadership, and similar problems across facilities and business units would likely have a single analytics function for developing solutions.

Other companies could apply a hybrid model or one with a digital “excubator”—a floating division that builds up digital and analytics expertise and can then be deployed to individual units on a project-by-project basis.

Building New Processes. To capitalize on digital, companies must adapt their processes and change the way they make decisions. Furthermore, companies that aim to fundamentally improve performance must undergo the difficult process of changing cultures.

Departments can no longer function in silos: collaboration and transparency are crucial to capturing the full potential of a business through digital. Rather than focusing solely on their small slice of responsibility within the value chain, teams must become part of a more comprehensive solution in which data-driven insights lead to changes that improve operational and financial performance. In reality, this means that with new insights, companies can significantly cut steps from their planning processes, streamline decision making, and focus teams on what really matters—especially their customers.

Collaboration and transparency are crucial to capturing the full potential of a business through digital.

Data governance is crucial for ensuring that data is of the right quality and is available to the relevant business leaders. Data ownership typically sits with business units, so data officers and stewards need to be nominated to guarantee that all data is maintained properly.

Key Success Factors

Throughout the digitization of industrial value chains, several imperatives apply:

- Lead from the business rather than the technology. Business leaders have the clearest understanding of the problems they face, so they should be directly involved in designing digital solutions.

- Obtain top-level buy-in from day one. Senior executives need to lead the way.

- Plan to generate value quickly. Positive financial results build momentum and counter skepticism.

- Immerse the organization in the digital world. Emphasize new ways of working and make it crystal clear that there will be no going back to outdated analog processes.

- Enable agile decision making. Use data to inform changes.

In the past, industrial companies could direct their focus to operational excellence. Today, that’s neither possible nor adequate. Companies will rise and fall depending on how they handle—and capitalize on—data. Many industrial manufacturers have taken only initial steps toward transforming their value chains through digital. Although that means a longer path ahead, it also means a bigger potential advantage for first movers. Companies that recognize the digital opportunity and take deliberate action to capitalize on it will give themselves a sustainable advantage. Those that fail to capitalize on this opportunity risk falling behind.