Digital technologies continue to transform the world of business in the most wide-ranging and fundamental ways—notably in product development, the ways of working, the pace of business, customer demands, and employee expectations. And now more than ever, factors such as transparency, collaboration, and individual initiative are essential. It’s only logical that for organizational transformation to succeed, change management should address these new realities.

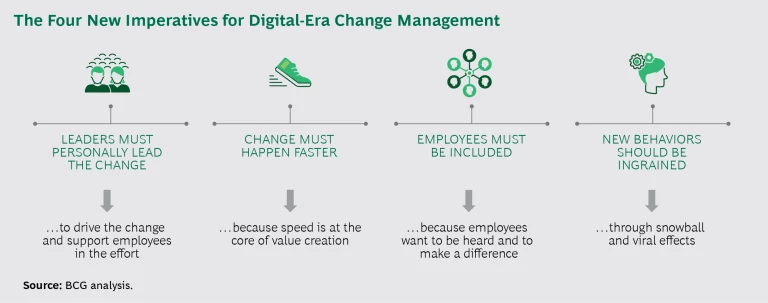

The time-tested fundamentals of change management—practices focusing on leadership, employee engagement, governance, and executional rigor—remain relevant and powerful. But they are not enough. We’ve identified four new imperatives for change management in the digital era: leaders must personally lead and commit to the change, change must happen faster, employees must be included (as active agents), and new behaviors should be ingrained in the workforce. (See the exhibit.) To satisfy these imperatives, companies can exploit some of the very same technologies that are triggering the transformation. Digital tools, with their reach and scalability, unlock opportunities to create powerful, new, and inviting ways for change to take root.

Few organizations have responded to these imperatives comprehensively. One that has is the Central and Eastern Europe (CEE) division of UniCredit Group. UniCredit CEE, which spans 11 of the bank’s 14 core markets, is a market leader in those countries and accounts for more than 20% of the group’s total revenues. UniCredit CEE has proved to be an ideal testing ground for novel digital and IT solutions, largely because its territory encompasses markets that are less established and show greater openness to new types of services. In the past four years, the unit has seeded a number of practices and programs—some, but not all, digitally enabled—that have transcended borders and cultures and caught on with near-viral speed.

UniCredit CEE’s innovative approaches—applicable to almost any organization—can be especially useful for large international organizations, where rapid change is a particular challenge. These approaches prove that often the most successful mechanisms for getting change to stick aren’t imposed or formally implemented but instead take root organically.

Leaders Must Personally Lead the Change

In recent years, transformation has shifted from being intermittent to being “always on.” And for most organizations, the need for greater agility and the intensified focus on the customer require employees to take more initiative and assume increased responsibility. Leadership today is thus not only about having a vision and setting a strategy; it’s also about creating alignment, serving as a role model, and establishing the right conditions for the change at hand. It’s no surprise that servant leadership, a leadership model that promotes mentoring and putting the needs of others (including customers) first, has gained more adherents in the agile age.

Leaders can no longer direct change from behind the scenes. They themselves must change while leading change from center stage. In doing so, leaders motivate and energize their people, fueling engagement and confidence that their efforts will bring positive results. When leaders truly embody the values and adopt the new ways, rather than merely decree them, they ensure that the change has meaning and purpose.

Consider two ways in which UniCredit CEE’s leaders are catalyzing change.

Open-Door Management Committee Meetings. Since 2015, UniCredit CEE’s management committee has welcomed employees into the inner sanctum by livestreaming its quarterly meetings. Employees can interact (via Slido, an audience interaction tool for meetings and conferences); post questions to UniCredit Group’s top management, CEE division head Carlo Vivaldi, and management committee members; and respond to instant polls. So far, 2,000 to 3,000 employees have accessed each broadcast in real time. The meetings are also videotaped for later viewing. Employees are even asked to rank senior managers’ presentations on content, helpfulness, and clarity.

According to Vivaldi, “By opening these discussions up to everyone, employees can learn about the most important issues related to their division—straight from the source, in real time, without the risk of misinterpretation.” This practice, Vivaldi notes, has also raised the bar for senior managers; they come better prepared and ready to be challenged. They view the open meetings as a plus, too; the immediate two-way communication fosters consensus building, direction setting, and alignment at all levels.

Always-On Leadership Development. At UniCredit CEE, developing the leadership pipeline is an ongoing effort—one that has been designed to build a bench of agile-minded leaders. CEE’s extended succession-planning program helps assess the readiness of candidates for top-management roles throughout the system. (Succession criteria are based on a set of five fundamental behaviors, cross-functional and cross-border experience, and specific business requirements.) It also helps to identify candidates’ development needs proactively, in order to accelerate their growth.

As a result of the program, the percentage of business line or competency line leaders with cross-functional experience more than tripled (from 12% to 45%) from 2014 through 2017. During that same period, the number of leaders with cross-country experience rose 17 percentage points (from 45% to 62%). A cross-country successor pool, launched in 2016, promotes the most talented middle managers by giving them the chance to present themselves to country and business leaders (and the thousands of employees watching) with a five-minute “elevator pitch” at CEE management committee meetings. In 2017, more than 80% of senior-management openings were staffed from successor pools (individual domestic pools as well as the cross-country pool).

Vivaldi and his team make a point of meeting one-on-one with members of the successor pools and other important people during their country visits, to engage with and challenge them and in the process demonstrate leadership behavior they should emulate.

Change Must Happen Faster

Customers today want more—and they want it faster. “What is most difficult about change today,” observes Vivaldi, “is altering how the organization works, adapting people to the speed of change outside of the organization.” Faster delivery, whether of internal or external projects, translates into greater value.

Agile as Accelerator. Agile continues to be used to develop and revise Mobile First, CEE’s mobile app offered in six markets; its use cut the app’s time to market by more than half. Locally, agile has accelerated a number of digital initiatives, among them SME Boost. This project, devoted to redesigning the service model for small and medium enterprises in Turkey, involved 200 people on multiple cross-functional teams. (See "Speeding Up Delivery.")

Speeding Up Delivery

Speeding Up Delivery

Agile has accelerated delivery times for UniCredit’s internal as well as external projects. Multiple cross-country projects have been rolled out simultaneously within six months (versus two to three years previously), with substantial productivity gains. For instance, the number of CEE mobile-banking releases has doubled in less than one year. Consider a few local examples:

- In Turkey, the time to market for a product’s first release was more than halved, while associated IT costs decreased by 20%.

- In Croatia, the time it took to apply for a new cash loan was cut from two hours to 30 minutes. Loan approval time fell from four days to 1 minute.

- In Russia, mobile-banking features were rolled out 35% faster.

With so many cultures in UniCredit CEE’s region, Vivaldi chose to introduce agile development methods informally, encouraging departments and teams to experiment with agile on their own. His instincts proved right.

In mid-2016, a network of local agile managers and coaches began promoting agile awareness. This group, known as Agile CEE, offers agile training and fosters its introduction throughout UniCredit CEE. By January 2018, more than 5,000 people had enrolled in agile training, participated in an agile workshop, or attended an agile webinar. After running several pilot projects, the bank is now developing 30 to 40 local and cross-border projects with agile at any given moment (including projects falling within the bank’s groupwide transformation plan, known as Transform 2019).

Agile Training for Senior Leaders. Excited by the impact of agile at other organizations (in particular, large financial organizations), Vivaldi put himself and his senior team through an agile training program so that they could see firsthand its potential for collaboration, product development, innovation, and decision making. Leaders walked away with a greater appreciation of the agile ethos, seeing the possibilities even without formal adoption.

A Digital Task Assignment Platform as a Centerpiece of Agile and Organic Change. Imagine tapping employee potential and talent, regardless of location. That’s one outcome Vivaldi and his team had in mind when they launched Marketplace in 2017. This digital platform connects those seeking skills unavailable in the local office with employees based elsewhere who are looking for interesting new outlets for collaboration. Anyone can post an assignment; project seekers sign up, create a profile, and peruse the listings in pursuit of “extracurricular” opportunities.

Marketplace was internally developed using agile methods. “We set the framework, provided the ground rules to developers, and then let people use their own creativity to develop functionality, in whichever way made the most sense to them,” Vivaldi explains. Remote teams collaborated to develop a functional product in three months.

Within seven months of its launch, Marketplace had more than 2,400 active users. As of spring 2018, about 470 assignments (such as automating reports, creating training materials, and performing economic analysis of special products) had been posted, and 31% of them had been completed. The site has had more than 11,000 unique visitors, and the visitor numbers are growing every month. Even executives are surprised at how quickly Marketplace has taken off.

New functionality is being developed constantly to boost Marketplace’s appeal: a mobile version, real-time interaction, and gamification features (such as rankings and badges) are already part of the 2.0 version.

Employees Must Be Included

Employees today value transparency, and they want their voices to be heard. They desire more collaborative work environments. Digital supports this kind of inclusiveness—in terms of more open communication, greater participation, and new methods of working—in powerful, self-propagating ways.

UniCredit CEE has answered the inclusiveness imperative with numerous approaches. By livestreaming its management committee meetings, the division has brought employees into the conversation while enhancing management’s appreciation for openness and consensus. A digital platform such as Marketplace enables cross-functional, cross-organization collaboration, fosters engagement, and creates a more inclusive workplace. It removes geographic barriers and organizational silos to expand opportunities for individuals and teams. And it draws people in of their own volition, with the same magnetic pull as social media and online interactions.

Marketplace not only broadens employees’ exposure to opportunities, it also allows them to use skills that may not be needed in their core job, without having to give up that position or relocate. Consider these success stories:

- CEE Agile needed to build a website to promote the bank’s new Remove initiative. (This program, aimed at saving time, solicits ideas on where and how to reduce complexity and waste anywhere in the bank.) A senior employee in the Croatia corporate office who has a passion for web design in his private life responded, creating exactly what the team wanted.

- A planning team in Serbia posted a request for help in automating a process. An IT colleague from a Romanian branch who had done a similar job there offered his services. The result: significant time savings for the Serbian bank.

- In Bosnia and Herzegovina, leaders posted an ad for a videographer to create a video explaining the functionality of a credit card for the bank’s new hires. A junior bank teller with one year of experience created a video; it was so well received that he’s been asked to create more.

Apart from the intrinsic satisfaction that employees gain from taking part in Marketplace, UniCredit now also offers participants tangible rewards: points that can be exchanged for such awards as books, courses, and even dinner with their local CEO.

While employees boost their visibility and employability, the bank gains a better picture of the talent in its employee pool in a way previously impossible. Says Vivaldi, “The interconnections that Marketplace forges are already leading to greater engagement, cost savings, and faster execution.”

New Behaviors Should Be Ingrained

For change to stick, it must not only penetrate the furthest reaches of the organization but must also ingrain new behaviors. One important way is through the sharing of best practices. At CEE, the philosophy is to start small, engage those who are receptive to change, and encourage the sharing of new ways. Here again, digital platforms and tools play a vital role.

Vivaldi purposely started CEE’s transformation with a talent-based project such as Marketplace. The project was narrow in scope, and though it was technically and practically challenging (in particular because it was cross-border), he figured that its innate appeal would attract users and help it to catch on quickly. As he observes, “The best way to ensure widespread adoption of any practice is by making sure it’s good. When it’s good, it will grow. If it’s not, it won’t take off.”

CEE’s Best Practice Sharing program, launched in 2016, identifies successful practices, both internal and external, that can be replicated throughout the group. The program relies on short, engaging videos to illustrate high-impact customer practices that can help the bank’s units meet the group’s Transform 2019 targets. Designed to foster continual improvement, the program focuses on the most strategically significant areas that can advance the bank furthest, such as digitalization and lending. By also involving senior management, CEE leaders signal the importance of the program and ensure that it receives the necessary visibility.

Participating managers must all agree to be part of the program. “This means not only that we openly share our best practices and get recognition for them,” says Vivaldi, “but that we also help interested colleagues replicate them and that we accept best practices from others. We must all be open to change.”

Here’s how it works. In lending, two central factors determine the customer experience: how swiftly customers receive loan approval and how quickly they obtain the loan money. Using these factors, participants identify the best-performing bank in the group. They examine how the bank designed its process so that other CEE banks can adopt the same practice. Similarly, participants also explore what not to do, studying subpar practices from the examples submitted.

Best Practice Sharing has already expanded beyond the CEE division. UniCredit’s Austria, Italy, and Germany divisions have all joined the team’s digitalization effort, making it a groupwide undertaking. In addition, the permanent team supporting Best Practice Sharing uses Idea Sharing, a dedicated platform for disseminating the best-practices videos throughout the group. (There’s a rule for posting content: it must be “entertaining.”)

In the fast-moving, disruptive digital era, change management needs a boost. The methods and tools companies use needn’t be part of a formal program either. Often, organic digitally inspired (or enabled) practices and processes can do the job more effectively. As UniCredit CEE’s Vivaldi notes, “Change that sticks works through the snowball effect: it takes off, and its success serves as an example, breeding more such efforts. That’s the only way to create sustainable change in an environment where everything changes so quickly.”