The well-documented crash of cryptocurrencies in 2018 obscured a parallel softening in the market value, entrepreneurial activity, and deal sizes for startups and early-stage companies pursuing blockchain , the underlying technology that authenticates cryptocurrency transactions, among many other uses. Consider the following:

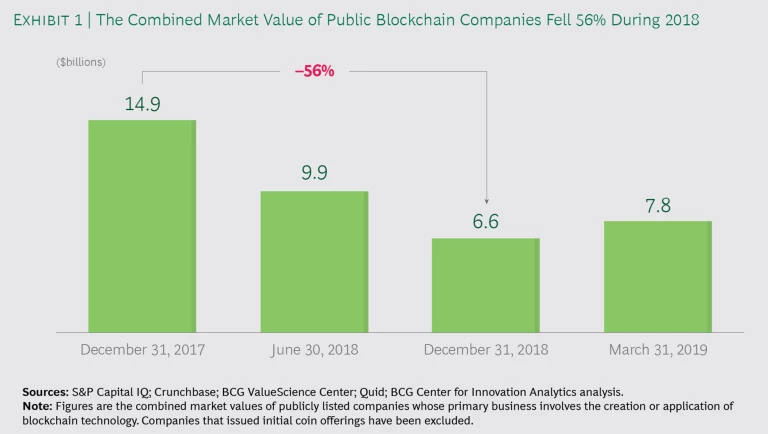

- The market value of publicly traded blockchain companies—those involving blockchain infrastructure, services, and applications but not cryptocurrencies—dropped by 56% in 2018 before rebounding slightly in early 2019. (See Exhibit 1.)

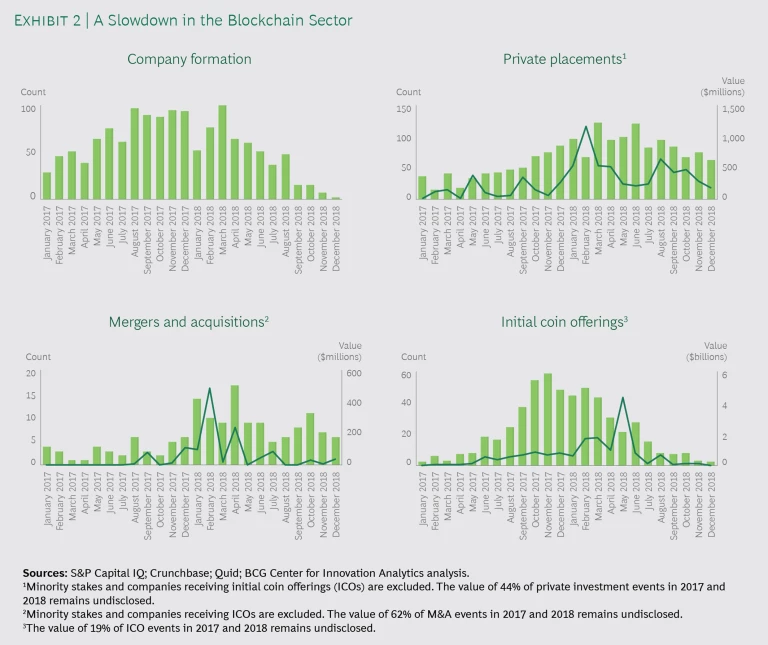

- Plunging valuations appear to be discouraging fresh investment in blockchain companies. Though year-over-year investments rose by a factor of four, activity in 2018 was concentrated in the first quarter, when it soared to $2.2 billion. Investments fell by half to $1.1 billion in the fourth quarter of 2018.

- Without the ability to raise fresh funds from traditional sources, owners of blockchain and bitcoin startups appear to have resorted to selling at lower prices. M&A volume tumbled from more than $500 million in the first quarter to less than $100 million in the fourth quarter of 2018, and the average deal size declined from $12 million to $3 million.

- The slowdown has had a detrimental effect on entrepreneurs’ enthusiasm. After rising at an annual rate of 45% from 2013 through 2017—and by 163% in 2017 alone—the number of blockchain company launches fell by 34% in 2018. (See Exhibit 2.)

- Some companies have turned to nontraditional funding sources such as initial coin offerings (ICOs), but the ICO market plunged from $6.9 billion in the first quarter of 2018 to $118 million in the first quarter of 2019, according to TokenData. This form of financing has come under scrutiny from regulators concerned about whether ICOs violate securities law and help finance illegal activities.

These findings emerged from an analysis by Boston Consulting Group and Quid, a data analytics and visualization firm, that drew on a broad range of data sets to shed light on the blockchain sector. The early returns suggest that fewer investors and entrepreneurs are betting on the sector, though a lag can occur in the reporting of company formations and to a lesser degree venture funding.

Importantly, these findings capture only what is revealed in public filings and other documents and do not take into account internal investment in blockchain applications by established companies in such areas as cybersecurity and supply chain management, a topic we will explore in a later article. Public data on these enterprise blockchains and distributed ledgers is harder to obtain, but anecdotal evidence suggests many tech companies, banks, and others remain optimistic. By and large, established enterprises are exploring invitation-only “permissioned” blockchains, which avoid some of the drawbacks of public blockchains that anyone can join.

The Business Case and the Barriers for Blockchain

The trading of cryptocurrencies always had a get-rich-quick patina. A reckoning was almost inevitable, given the rapid rise in the value of these currencies in 2017.

The trading of cryptocurrencies always had a get-rich-quick patina—a reckoning was almost inevitable.

But the underlying blockchain technology was viewed differently; it always had a more solid business case. Many skeptics of cryptocurrency were nonetheless bullish on blockchain. As a secure public ledger, blockchain had the potential to knock out the middleman in any activity in which counterparties need to trust one another—everything from land registries and supply chains to securities trading. Banks, venture funds, and private equity firms funneled billions into blockchain startups.

In metaphorical terms, cryptocurrency was Napster—the popular and now-shuttered music-sharing service—while blockchain was peer-to-peer (P2P) networking. Just as P2P networking has survived in such areas as distributed computing and mesh networks, blockchain has found its own way into the economy via applications distinct from cryptocurrencies.

Smart money has been betting on the survival of blockchain. Investors dropped over $10 billion in venture funding into more than 6,500 companies, with most of the activity coming in 2016 or later—that’s when 63% of all blockchain companies were founded, 82% of all blockchain patents were issued, and 88% of all scientific publications on blockchain were published.

The 2018 slowdown in blockchain company formation and venture activity may call into question the early optimism, at least as it applies to public blockchains. Some of the bearish attitude toward blockchain reflects guilt by association with the excesses and illegalities of the bitcoin world.

But technical and practical drawbacks may also be holding blockchain back.

An Inherent Inefficiency. The mathematical gymnastics that most public blockchains go through to verify transactions are slow and energy intensive. Even the fastest fully functional public blockchain is too sluggish for activities such as payment processing at scale, while it’s estimated that bitcoin mining consumes as much energy in a year as Denmark. This inefficiency may also be affecting these blockchains’ ability to serve as a trusted public business platform. Faster, more efficient blockchain authentication methods, such as “proof of stake” and other algorithms, exist but are mostly in development and early commercialization stages.

The permissioned systems under development by enterprises are faster because, among other reasons, the participants already trust one another to varying degrees. But they still require that participants, who are often competitors, agree on common standards and governance—no easy task.

The Lack of a Leading Public-Blockchain Platform. In the beginning, the original Bitcoin blockchain looked to have a first mover’s advantage. But several competing blockchains, such as Ethereum and Hyperledger, have since emerged. As a result, none of them has achieved the scale and network advantages of becoming a platform, as Amazon has in retail.

Trust has emerged as a barrier to implementation for public-blockchain platforms. Ironically, distributed ledgers are often described inaccurately as “trustless” systems. In reality, Thinking Outside the Blocks where blockchain meets the real world. A transaction posted on a ledger is only as trustworthy as the party that posted it, and this peripheral trust has been hard to generate in practice.

Instead of developing into a single global platform, blockchain appears to be moving in the opposite direction. Within individual industries—such as banking and air travel—enterprise blockchains or blockchain-adjacent technologies, such as Hyperledger Fabric and R3 Corda, have emerged to track and verify transactions and provide traceability and transparency in complex business ecosystems.

But it’s been challenging to conduct the complex diplomacy among customers, suppliers, and competitors that is necessary to bring these uses to life. We call this the blockchain paradox .

A Go-Slow Approach. Big banks and tech companies have jumped into blockchain with varying degrees of enthusiasm and commitment, but the sector is still relatively small. Data provider IDC, for example, projects that companies will spend $2.9 billion on blockchain solutions in 2019, a year-over-year jump of 89%, but an order of magnitude smaller than the $210 billion in projected spending for cloud services and infrastructure. Job sites show a large increase in postings, though this growth comes from a small base. Our analysis indicates that accounting and consulting firms dominate the online postings. Of the top five companies doing the most hiring, IBM is the only tech firm. SAP and Oracle are sixth and ninth, respectively.

A big push by one of the major tech companies could change the dynamics and outlook for the field, and it’s too early to count them out.

A big push by one of these companies could change the dynamics and outlook for the field—and it’s too early to count them out. The patenting data suggests that at least some are positioning themselves in this space. IBM, Alibaba, and Intel were all in the top ten for blockchain patenting activity in both 2017 and 2018.

Blockchain is still early in its life; it’s a teenager at best. The developments of 2018 suggest that its promise may be fulfilled within certain enterprises and industries rather than in the public realm where it was born. Blockchain has clear promise—to provide better transparency and tracking in enterprise applications or as a medium of exchange in failing economies such as Venezuela. But these uses may be more limited than foreseen by many of the original projections.

Other technologies have taken longer to flourish than the early proponents predicted—notably artificial intelligence—and some have morphed into something else entirely. Spotify, the company that won the online music wars, does not rely on the P2P model of lax IP enforcement envisioned by Napster. But the streaming service has figured out a lawful way to connect consumers with music that they love, which was the central conceit of Napster. Blockchain’s ultimate legacy may be to encourage industries to modernize inefficient trading and verification systems in ways that bear little resemblance to its original vision.