This is the third in a series of multimedia offerings that highlight insights derived from a recent BCG survey of digital maturity in manufacturing operations. Here, we examine the organizational and technical enablers of a digital operations program. The first article, “ The How-To Guide to Digital Operations ,” discussed what sets apart the leaders, presented a framework for digitizing operations, and explained the importance of an upfront digital vision. The second article, “ Putting Value First in Digital Operations ,” examined the imperative to build a portfolio of use cases that address a company’s specific operational pain points.

It’s an increasingly common scenario: A company has a vision for digitizing its operations. It starts to identify and test use cases that will deliver value. But then, it gets stuck. Although the program may see some promising early results, it fails to get the traction needed to deliver value over the long term. Lacking a significant bottom-line impact, the program loses credibility within the business units and functions.

How can companies realize their vision and sustain the value of digital operations at scale?

How can companies realize their vision and sustain the value of digital operations at scale? In our experience, the key is to set up and enable a digital operations organization that promotes scale, speed, and impact. This means not only establishing the right organizational structure and reporting lines, but also attracting and retaining digital talent and building a scalable “data and digital platform.”

We have identified a set of best practices relating to each category of actions. These insights are based on our experience supporting digital operations transformations and an extensive survey of executives across a wide range of industries. (See “About the Survey.”)

About the Survey

About the Survey

In October 2018, BCG conducted an online survey of executives from large manufacturing companies in order to understand their progress in adopting digital technology in operations. We defined manufacturing operations to include product engineering and design, supply chain management, production, and distribution and field service. The survey’s participants consisted of 250 executives and managers from global companies representing a broad array of manufacturing industries: aerospace and defense, automotive, chemicals, consumer and retail, machinery, metals and mining, and pharmaceuticals.

Setting Up the Organization for Success

When designing an organization to support digital operations at scale, you will want to consider five key dimensions. Here we discuss what distinguishes the companies that are leaders in implementing a digital operations program, as identified by our survey. These leaders comprise the top decile among respondents in a self-assessment of their program across 13 dimensions of maturity.

Reporting Line. Where does the team driving digital adoption fit into the broader organization? What is the level and scope of the team’s role? Leading companies in our survey are approximately 50% more likely than other companies to require that the digital team reports no more than two levels below CEO—to the COO, chief digital officer, or other senior executive.

Organizational Structure. How does your company wish to organize its digital team? Around use cases or technologies? Leading companies are about 50% more likely than other companies to organize around use cases that solve pain points, rather than on the basis of the underlying technologies. They also mimic the structure of the business units that are applying the solutions. If certain technologies or data infrastructure are common across solutions, they build technology centers of excellence to support the solution teams.

Functional Integration. Another crucial decision is: Which functional capabilities should you embed in the digital team—engineering and product development, supply chain, IT, analytics, manufacturing, and after-sales service? Leading companies are about 2.5 times more likely than other companies to integrate digital operations into one group that has end-to-end responsibility for capturing the full value across functions. To promote success, they break down the typical silos and embed multiple functional capabilities into the digital team. They form cross-functional “agile squads” (even if reporting lines differ across team members) to build the solutions that they will ultimately transfer back to the business. They also co-locate solution teams whenever possible.

Business Interface. How should the digital team engage with the business units? Leading companies are twice as likely as others to bring members of the business units into the digital team as “product owners,” with ultimate accountability for, and ownership of, solutions. These companies also ensure that all members of a digital team apply a product-oriented mindset to developing and managing solutions. And they designate “champions” of digital operations within the business units to serve as the primary contact and drive the development of ideas.

Leading companies are twice as likely as others to bring members of the business units into the digital team as “product owners.”

Governance and Funding. Finally, how does your company want to fund initiatives and track progress—at the enterprise level or at the business-unit level? And does it want to set targets for impact from the top down or bottom up? Leading companies are approximately four times more likely than others to give responsibility to a central group for implementation and financial results. They set aggressive bottom-up targets and make detailed cost estimates, which they use to continuously track and compare the value delivered and cost incurred. Best practices include creating a governance committee with representatives from the digital team and the business units—which makes decisions on whether to start, keep, or kill projects. At many leading companies, the digital operations group provides funding for early-stage development of solutions. Once the company develops a minimum viable product, the digital group and business co-invest to build the solutions. The business funds the scaling of the solution after it validates the case for investment and payback time.

For instance, John Deere has set up a central team to drive the digitization of its operations. Using a workshop-based approach, the team works closely with factories to identify pain points. It quickly implements and evaluates small-scale, proof-of-concept solutions to the factory’s problems, then delivers the most promising solutions through a scalable technical infrastructure. Progress, investment decisions, and business impact are governed by a steering committee that includes leaders from the business units, manufacturing, and IT.

John Deere has set up a central team to drive the digitization of its operations.

Strengthening Talent and Skill Sets

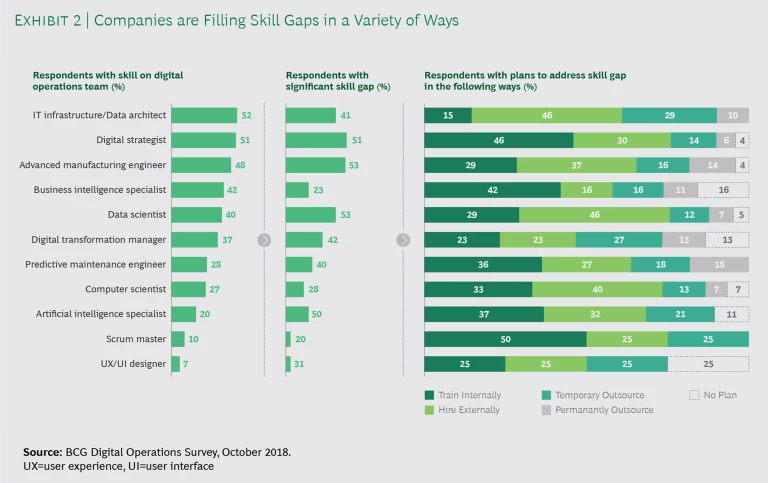

Digitizing operations requires a new set of skills that don’t exist within most organizations today. About half of survey respondents said that successful operations teams need infrastructure and data architects, digital strategists, and advanced manufacturing engineers. Many respondents also pointed to the need for business intelligence (BI) specialists, data scientists, digital transformation managers, and computer scientists (hardware and software engineers)—all of whom are essential for both the testing and the scaling of digital solutions. But because talent is scarce and the work environment at manufacturing companies is often unattractive to digital specialists, many companies solely rely on outsourcing for such capabilities—which is not a very sustainable strategy for digitizing operations.

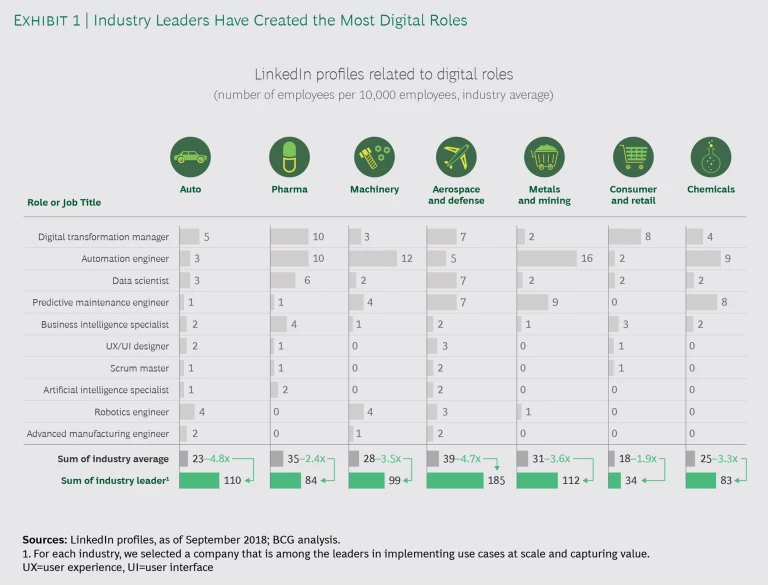

To take a deeper look at talent issues, we assessed the presence of digital operations roles in each manufacturing industry in our study. For a set of companies in each industry, we compared the number of LinkedIn profiles related to digital roles with the total number of LinkedIn profiles for company employees.

We found that, across industries, companies on average employ very few people in digital roles. For each industry, we selected a leading company in implementing use cases at scale and capturing value. The industry leader in each case has significantly more people in digital roles than the industry average—an indication of its commitment to invest heavily in a digital operations program. (See Exhibit 1.) We found digital roles most prevalent, on average, in the aerospace and defense (A&D) and pharmaceuticals industries. A&D’s leadership reflects the industry’s historical investments in lean management and Industry 4.0 initiatives. Pharma’s strength in data science and BI highlights the industry’s historical focus on R&D and sales.

Additional analysis of LinkedIn job postings by manufacturing companies found that demand is highest for data scientists and BI and AI specialists. However, our survey found a shortfall with respect to other technical talent, as well. About 50% of survey respondents indicated they didn’t have enough advanced manufacturing engineers, AI specialists, data scientists, and digital strategists. To address near-term talent gaps and overcome the shortfall, digital leaders are using strategies such as training internally, hiring externally, and outsourcing on a permanent or temporary basis. (See Exhibit 2.)

Deploying a “Data and Digital Platform”

Many companies found their efforts to digitize operations hampered by legacy IT systems. Traditionally, companies have invested in heavily customized enterprise IT, including enterprise resource planning and mainframe systems. These systems are not designed to ingest and process the massive amounts of data that fuel digital use cases, and they aren’t easily adapted to support new data and digital use cases over time. To implement data-driven digital use cases at scale, companies need to modernize their IT architecture.

Many companies found their efforts to digitize operations hampered by legacy IT systems.

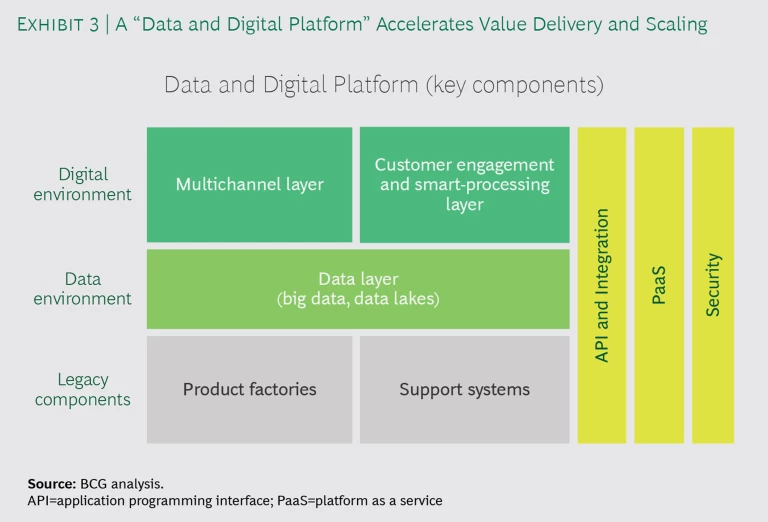

But the imperative to modernize does not mean companies must fully revamp their IT architecture (such as by fully replacing systems) to support the initial phases of digitization. Rather, companies should start small by implementing a “data and digital platform” (DDP). This allows the company to achieve rapid results and is scalable so that new digital processes can be added quickly.

A DDP supports scale in several ways. (See Exhibit 3.) The platform decouples the data environment from legacy systems, facilitating data sharing and usage. Data lakes and modern data technologies ensure that companies can take in and store large amounts of structured and unstructured data and process it in real time. A cloud-native platform delivers ubiquitous access to data. The DDP also provides an environment for developing digital, analytics, and data products faster (via “devops” and “dataops” capabilities). Additionally, by providing an interface among digital services, digitized processes, and the Internet of Things, the platform fosters an integrated approach in how companies use them. Application programming interfaces and microservices (which focus on specific pain points) increase the modularity of applications. The platform can be built using a non-proprietary or commercial “platform as a service” (PaaS).

A company migrates its legacy IT systems incrementally to the DDP to support scaling specific applications justified by the business case—such as demand forecasting, capacity planning, and advanced automation. Over time, the company gradually, but methodically, retires its legacy systems in favor of this single platform to serve its digital needs.

For example, as part of a large-scale digital transformation, an automotive OEM sought to industrialize and scale up data management. It built a DDP as a single source of truth for all data and analytics needs. The company was able to develop and launch new data and digital products rapidly, while it added functionality to the DDP.

As we have discussed in this series of articles, manufacturers recognize that they must digitize operations—but sustaining value has proven more challenging than most companies expected. Our study identified several factors that set the leaders apart: they establish a bold vision, prioritize and scale solutions that address business pain points, and set up a digital operations organization supported by a scalable DDP. Such a journey requires two to three years—companies that get it right are rewarded with transformational improvements in cost and performance.